Is Aberdeen Standard safe?

Pros

Cons

Is Aberdeen Standard Safe or Scam?

Introduction

Aberdeen Standard, a prominent player in the forex market, has garnered attention for its investment management services and diverse range of financial products. As traders seek opportunities in the volatile world of forex, it is crucial to assess the legitimacy and safety of the brokers they choose to work with. The forex market is rife with scams and unregulated entities that can jeopardize traders' investments. Therefore, traders must conduct thorough evaluations of brokers like Aberdeen Standard to ensure they are engaging with a reputable firm. This article investigates the safety and legitimacy of Aberdeen Standard, utilizing a combination of regulatory analysis, company background research, and customer feedback to provide a comprehensive review.

Regulation and Legitimacy

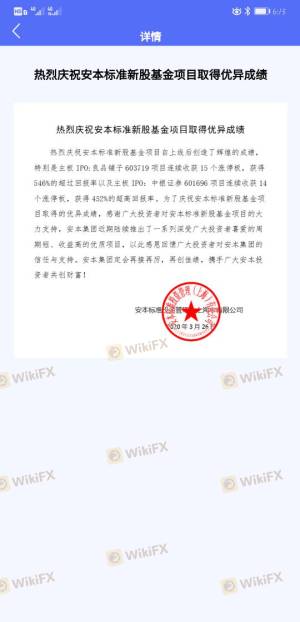

Aberdeen Standard's regulatory status is a fundamental aspect of its credibility. Regulation ensures that brokers adhere to certain standards, protecting traders from fraudulent activities and ensuring fair trading practices. Unfortunately, Aberdeen Standard has been flagged as a "clone" firm, meaning it has been associated with fraudulent entities that misuse its name and details to deceive clients. The Financial Conduct Authority (FCA) has issued warnings about clone firms impersonating Aberdeen Standard Investments, which raises concerns about the broker's legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Authorized |

The absence of a valid license from a reputable regulatory body like the FCA indicates a significant risk for potential clients. Moreover, the lack of oversight means that traders would not have access to the Financial Ombudsman Service or the Financial Services Compensation Scheme (FSCS) if issues arise. This lack of regulatory protection is a major red flag for anyone considering whether Aberdeen Standard is safe for trading.

Company Background Investigation

Aberdeen Standard was formed in 2017 through the merger of Aberdeen Asset Management and Standard Life. This merger created one of the largest investment firms in the UK, managing substantial assets across various sectors. However, the company's history is marred by significant outflows and challenges post-merger, as many investors withdrew their assets due to dissatisfaction with performance.

The management team at Aberdeen Standard comprises experienced professionals in the finance sector, which theoretically should lend credibility to the firm's operations. However, the opacity regarding the company's ownership structure and the lack of detailed disclosures can lead to skepticism among potential investors. Transparency in operations is crucial for building trust, and any deficiencies in this area raise questions about the overall safety of trading with Aberdeen Standard.

Trading Conditions Analysis

Aberdeen Standard's trading conditions are another critical factor to consider when evaluating its safety. The broker's fee structure must be transparent and competitive to attract and retain clients. However, reports suggest that the broker lacks clarity on its fees, which can lead to unexpected costs for traders.

| Fee Type | Aberdeen Standard | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Moderate |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Unclear | Low |

The high spreads on major currency pairs and the unclear commission model could indicate potential issues with cost transparency. Traders should be wary of brokers that do not clearly outline their fee structures, as hidden costs can significantly impact profitability.

Client Fund Security

The security of client funds is paramount in the forex trading landscape. Aberdeen Standard's approach to safeguarding client assets is a vital aspect of its overall safety profile. Reports indicate that the broker does not provide adequate information on fund segregation and investor protection measures. This lack of clarity raises concerns about the safety of funds deposited with the broker.

In the event of financial difficulties or insolvency, clients may find themselves at risk of losing their investments without any recourse. The absence of negative balance protection further exacerbates this risk, as clients could potentially owe more than their initial investment. These factors collectively suggest that Aberdeen Standard may not be safe for traders looking to secure their funds.

Customer Experience and Complaints

Customer feedback is a valuable source of information when assessing a broker's reliability. Reviews of Aberdeen Standard reveal a mixed bag of experiences, with many clients expressing dissatisfaction with the broker's services. Common complaints include issues with withdrawal processes, high fees, and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow and Unresponsive |

| High Fees | Moderate | Inadequate Explanation |

| Poor Customer Service | High | Limited Support |

For instance, some users have reported significant delays in processing withdrawal requests, leading to frustrations and financial losses. Additionally, the company's response to complaints appears to be lacking, further diminishing client trust. These patterns of complaints raise serious concerns about whether Aberdeen Standard is a safe option for traders.

Platform and Trade Execution

The trading platform's performance is another critical aspect of the trading experience. Users have reported mixed experiences with the platform's stability and execution quality. Instances of slippage and order rejections have been noted, which can significantly impact trading outcomes.

A reliable trading platform should provide fast execution, minimal slippage, and a user-friendly interface. However, if traders experience frequent issues with trade execution, it can lead to losses and frustration. This inconsistency raises questions about the broker's commitment to providing a trustworthy trading environment, leading to concerns about whether Aberdeen Standard is truly safe for trading activities.

Risk Assessment

When considering the overall risk of trading with Aberdeen Standard, several factors come into play. The lack of regulation, combined with customer complaints and unclear trading conditions, contributes to a higher risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Financial Security Risk | High | Lack of fund protection |

| Customer Service Risk | Medium | Poor response to complaints |

To mitigate these risks, traders should conduct thorough research before engaging with any broker. It is advisable to start with a demo account, limit initial investments, and consider using brokers with a proven track record and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that Aberdeen Standard may not be a safe choice for forex trading. The lack of regulatory oversight, combined with customer complaints and unclear trading conditions, presents significant risks for potential clients. While the firm has a notable history and experienced management, the operational transparency and customer service issues raise serious concerns.

For traders seeking reliable forex brokers, it is advisable to consider alternatives that are regulated by reputable authorities and have a proven track record of customer satisfaction. Brokers such as IG, OANDA, and Forex.com may present safer options for those looking to engage in forex trading with peace of mind. Always prioritize safety and regulatory compliance when choosing a broker to ensure a secure trading experience.

Is Aberdeen Standard a scam, or is it legit?

The latest exposure and evaluation content of Aberdeen Standard brokers.

Aberdeen Standard Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Aberdeen Standard latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.