Is GS-Forex safe?

Business

License

Is GS Forex Safe or Scam?

Introduction

GS Forex is a relatively new player in the foreign exchange market, established in 2019 and operating out of Vanuatu. As a broker, it aims to provide access to various financial instruments, including forex pairs, commodities, and indices, through popular trading platforms like MetaTrader 4 and 5. However, the growing number of online brokers necessitates a cautious approach for traders, as the risk of scams and unregulated firms continues to rise. This article aims to provide a comprehensive evaluation of GS Forex, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. The analysis is based on a review of various online sources, including regulatory databases, customer feedback, and expert evaluations.

Regulation and Legitimacy

The regulatory status of any forex broker is a crucial factor for traders when assessing safety. GS Forex claims to be regulated by the Vanuatu Financial Services Commission (VFSC). However, there are serious concerns regarding the legitimacy of this claim, as GS Forex has been flagged as a suspicious clone firm. This means that it may be falsely presenting itself as a legitimate entity, potentially putting clients' funds at risk.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | 700261 | Vanuatu | Suspicious Clone |

The VFSC is not considered a top-tier regulatory body, and its oversight may not provide sufficient protection for traders. Furthermore, the lack of transparency regarding GS Forex's compliance history raises additional red flags. Traders should be aware that engaging with an unregulated broker can lead to significant financial losses, as they lack the safeguards that regulated firms must adhere to.

Company Background Investigation

GS Forex is registered in Vanuatu and has been operational for a few years. However, details about its ownership structure and management team are scarce, leading to concerns about transparency. The absence of information regarding the company's founders and their professional backgrounds makes it difficult for potential clients to assess the credibility of the broker.

Moreover, the company's limited online presence and lack of verifiable information further exacerbate the uncertainty surrounding its legitimacy. A well-established broker typically provides clear information about its management team and operational history, which is crucial for building trust with clients. In contrast, GS Forex's vague disclosures may indicate a lack of accountability.

Trading Conditions Analysis

An analysis of GS Forex's trading conditions reveals a mixed picture. The broker offers various account types with different minimum deposit requirements and leverage options. However, the overall fee structure lacks transparency, with limited information available on spreads, commissions, and overnight interest rates.

| Fee Type | GS Forex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 1.2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.5% | 0.3% |

While GS Forex advertises competitive spreads, traders should be cautious of hidden fees that may not be disclosed upfront. The absence of clear information regarding commissions could lead to unexpected costs, affecting overall profitability.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker's credibility. GS Forex claims to implement measures to protect client funds, but the lack of regulatory oversight raises concerns about the effectiveness of these measures.

Key safety features that should be evaluated include fund segregation, investor protection schemes, and negative balance protection policies. However, due to the broker's questionable regulatory status, it is unclear whether GS Forex adheres to these best practices. Furthermore, any historical issues related to fund safety or disputes should be carefully considered before engaging with the broker.

Customer Experience and Complaints

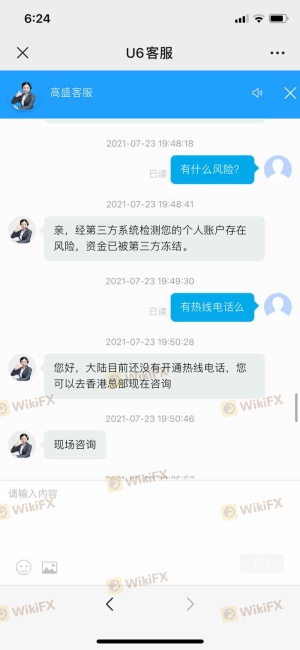

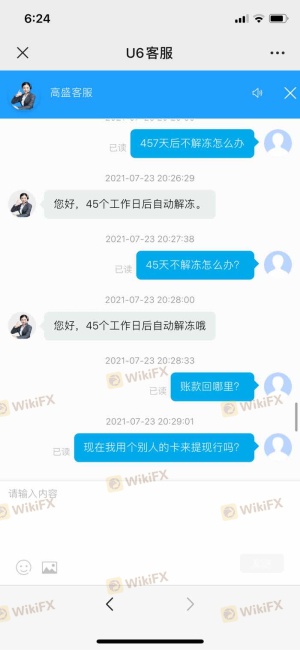

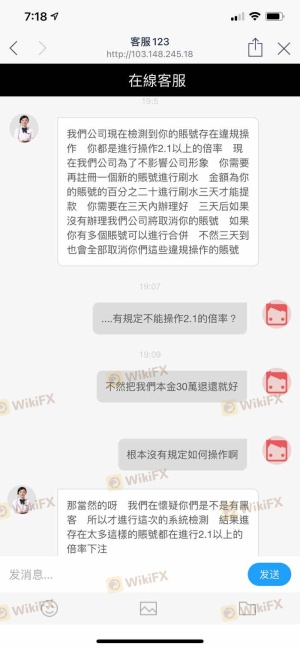

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews of GS Forex reveal a range of experiences, with many users expressing dissatisfaction regarding withdrawal processes and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Support | Medium | Limited Availability |

Common complaints include difficulties in withdrawing funds and unresponsive customer service. In some cases, clients reported being pressured to make additional deposits to access their funds, raising concerns about potential fraudulent practices.

Platform and Execution

The trading platforms offered by GS Forex, namely MetaTrader 4 and 5, are widely regarded as industry standards. However, the overall performance and reliability of these platforms can vary significantly based on the broker's infrastructure.

Traders should assess the order execution quality, slippage rates, and any signs of platform manipulation. Issues such as frequent re-quotes and delayed executions can hinder trading performance and lead to frustration among users.

Risk Assessment

Using GS Forex involves several risks that traders should be aware of. The absence of regulatory oversight, combined with limited transparency regarding fees and company background, poses significant concerns.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status and clone firm allegations. |

| Financial Risk | Medium | Potential hidden fees and unclear commission structures. |

| Operational Risk | Medium | Customer service issues and withdrawal difficulties. |

To mitigate these risks, traders are advised to conduct thorough research, read reviews from multiple sources, and consider engaging with regulated brokers that provide clear information about their operations.

Conclusion and Recommendations

In conclusion, while GS Forex presents itself as a legitimate trading platform, significant concerns regarding its regulatory status, company transparency, and customer experiences raise red flags. The broker's classification as a suspicious clone firm and the lack of clear information about its management and operational practices suggest that it may not be a safe choice for traders.

Traders looking for a reliable forex broker should prioritize those regulated by reputable financial authorities, as this provides essential protections and assurances. Alternatives to consider include brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback. In light of the findings, it is advisable for potential clients to proceed with caution and thoroughly evaluate their options before engaging with GS Forex.

Is GS-Forex a scam, or is it legit?

The latest exposure and evaluation content of GS-Forex brokers.

GS-Forex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GS-Forex latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.