GS-Forex 2025 Review: Everything You Need to Know

Summary

GS-Forex presents a mixed picture in the competitive forex brokerage landscape. Significant concerns overshadow its limited advantages, creating substantial risks for potential users. This gs-forex review reveals an overall negative assessment primarily due to substantial fraud risks that have been identified by industry monitors. The broker does offer some practical features, including multiple deposit and withdrawal options such as bank wire transfers, credit/debit cards, and e-wallets. It also provides the widely-used MT4 trading platform across all account types, which meets basic industry standards.

The platform targets traders interested in diversified asset classes. It provides access to forex, CFDs, stocks, options, and futures for comprehensive market exposure. However, user feedback paints a concerning picture, with only one positive review against 23 exposure reports and numerous complaints about customer service quality. The broker's lack of transparent regulatory information creates additional safety concerns for potential clients. The prevalence of fraud warnings makes it unsuitable for traders prioritizing security and reliability in their trading environment. While the variety of trading instruments and payment methods may initially appear attractive, the overwhelming negative user experiences and safety concerns significantly outweigh these limited benefits.

Important Notice

This comprehensive evaluation is based on available user feedback, industry reports, and publicly accessible information about GS-Forex's services and operations. The analysis draws from multiple sources including user review platforms, regulatory databases, and broker comparison websites to provide accurate assessment. Traders should note that information regarding cross-regional regulatory differences is not available in current documentation. Specific regulatory oversight details remain unclear, creating transparency concerns for potential users. This review aims to provide an objective assessment based on verifiable data and user experiences to help potential clients make informed decisions about their trading platform selection.

Rating Framework

Broker Overview

GS-Forex operates in the online trading sector. Specific establishment dates and detailed company background information are not readily available in current documentation, which raises transparency concerns. The broker positions itself as a multi-asset trading platform, offering services across various financial instruments including foreign exchange, contracts for difference, equity securities, options, and futures contracts. This broad approach suggests an attempt to cater to diverse trading preferences and investment strategies across multiple market segments.

The platform's primary business model revolves around providing access to global financial markets through the MT4 trading infrastructure. This remains one of the industry's most recognized platforms for retail and professional trading. GS-Forex supports trading across multiple asset categories, enabling clients to diversify their portfolios within a single platform environment. However, the absence of clear regulatory framework details raises significant questions about operational oversight and client protection measures that are essential for safe trading. This gs-forex review must emphasize that while the broker offers various trading opportunities, the lack of transparent regulatory backing and the presence of fraud warnings create substantial concerns for potential users seeking secure trading environments.

Regulatory Status: Current available information does not specify particular regulatory jurisdictions or oversight bodies governing GS-Forex operations. This represents a significant transparency concern for potential clients seeking regulated trading environments.

Payment Methods: The broker provides multiple funding options including traditional bank wire transfers, major credit and debit card processing, and various electronic wallet solutions. This offers reasonable flexibility for account funding and withdrawals across different user preferences.

Minimum Deposit Requirements: Specific minimum deposit thresholds are not detailed in available documentation. This leaves potential clients without clear entry-level investment requirements for account opening.

Promotional Offers: No specific bonus structures or promotional campaigns are mentioned in current broker information. This suggests either absence of such programs or limited marketing disclosure practices.

Available Assets: Trading opportunities span across foreign exchange pairs, contracts for difference on various underlying assets, direct stock trading, options contracts, and futures instruments. This provides comprehensive market access for diversified trading strategies.

Cost Structure: Detailed information regarding spreads, commission rates, overnight financing charges, and other trading costs remains unavailable in current documentation. This creates uncertainty about total trading expenses for potential clients.

Leverage Options: Specific leverage ratios and margin requirements are not specified in available materials. This leaves traders without crucial risk management information for position sizing.

Platform Access: MT4 platform availability across all account categories ensures consistent trading interface and functionality. This provides standardized access regardless of account type selection.

Geographic Restrictions: Information regarding regional limitations or restricted territories is not specified in current documentation. This creates uncertainty about service availability in different jurisdictions.

Customer Support Languages: Available language options for client support services are not detailed in accessible information. This gs-forex review highlights these information gaps as significant concerns for potential clients seeking comprehensive service details.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of GS-Forex's account conditions faces significant limitations due to insufficient publicly available information. Current documentation fails to specify the variety of account types offered, their distinctive features, or the specific requirements for each category, creating transparency issues. Without clear information about minimum deposit requirements, account opening procedures, or special account features such as Islamic accounts for Sharia-compliant trading, potential clients cannot adequately assess whether the broker's offerings align with their trading needs and financial capabilities.

The absence of detailed account condition information represents a transparency issue that affects user confidence significantly. Professional traders typically require comprehensive understanding of account structures, including any tiered benefits, fee schedules, or enhanced features available at different investment levels for proper evaluation. The lack of readily accessible information about account verification processes, documentation requirements, or approval timeframes further complicates the assessment for potential users. This gs-forex review cannot provide a meaningful rating for account conditions due to insufficient data. This highlights a significant deficiency in the broker's public information disclosure practices that affects client decision-making.

GS-Forex demonstrates reasonable capability in trading tools and resources through its MT4 platform implementation across all account types. The MetaTrader 4 platform provides essential trading functionality including technical analysis tools, automated trading capabilities through Expert Advisors, and comprehensive charting features that meet standard industry expectations for retail trading. The platform's widespread industry adoption ensures familiarity for experienced traders and adequate learning resources for newcomers to electronic trading environments.

The broker's asset diversity represents another positive aspect of their service offering. It offers access to multiple market categories including forex, CFDs, stocks, options, and futures for comprehensive trading opportunities. This variety enables portfolio diversification and allows traders to pursue different market opportunities within a single platform environment for convenience. However, the evaluation is limited by lack of information regarding proprietary research tools, market analysis resources, educational materials, or advanced trading features beyond the standard MT4 package. The absence of details about economic calendars, market commentary, or analytical resources suggests either limited additional tools or inadequate disclosure of available resources to potential clients.

Customer Service and Support Analysis

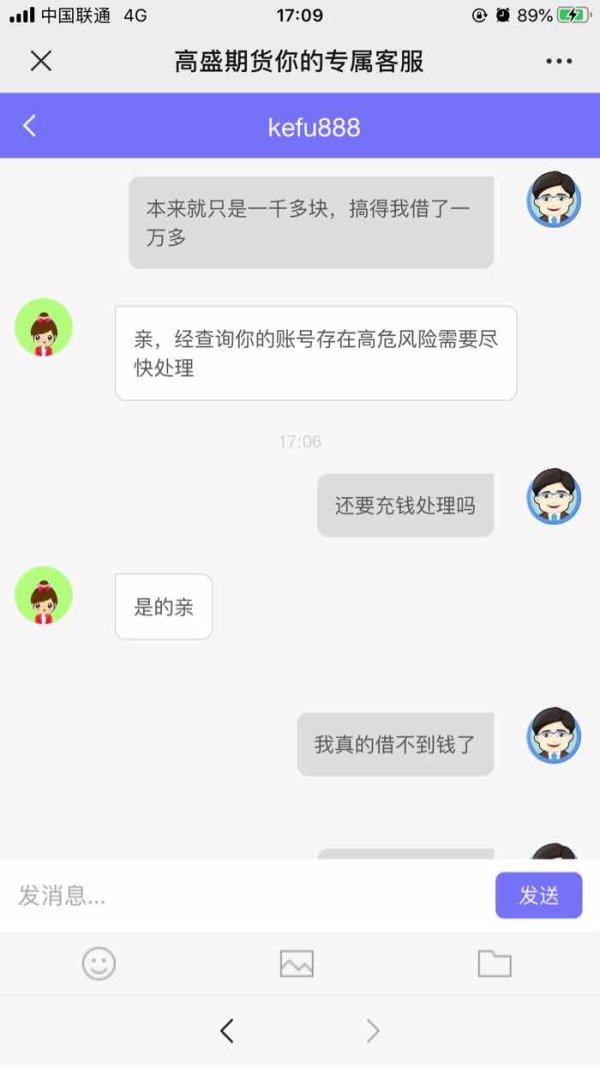

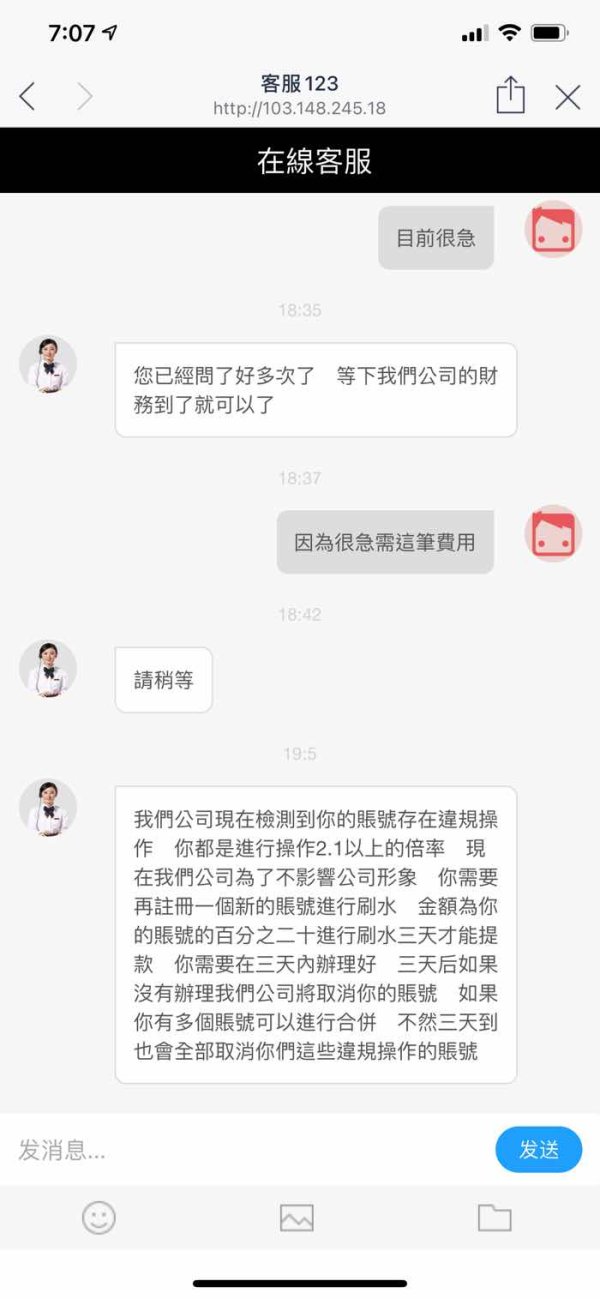

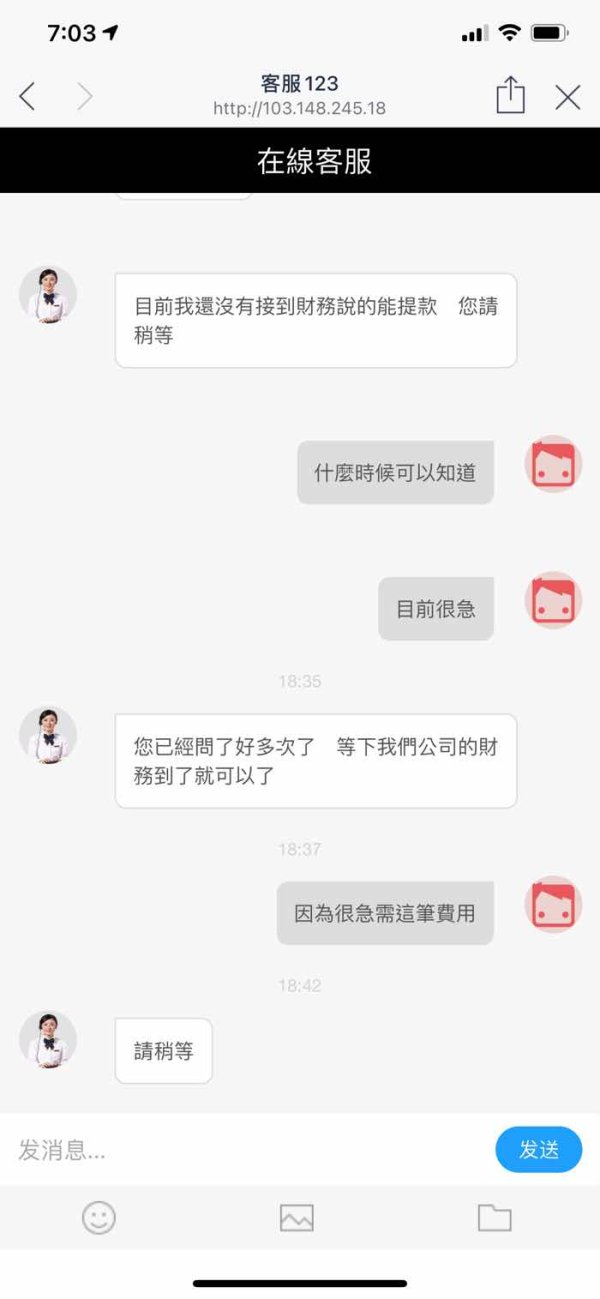

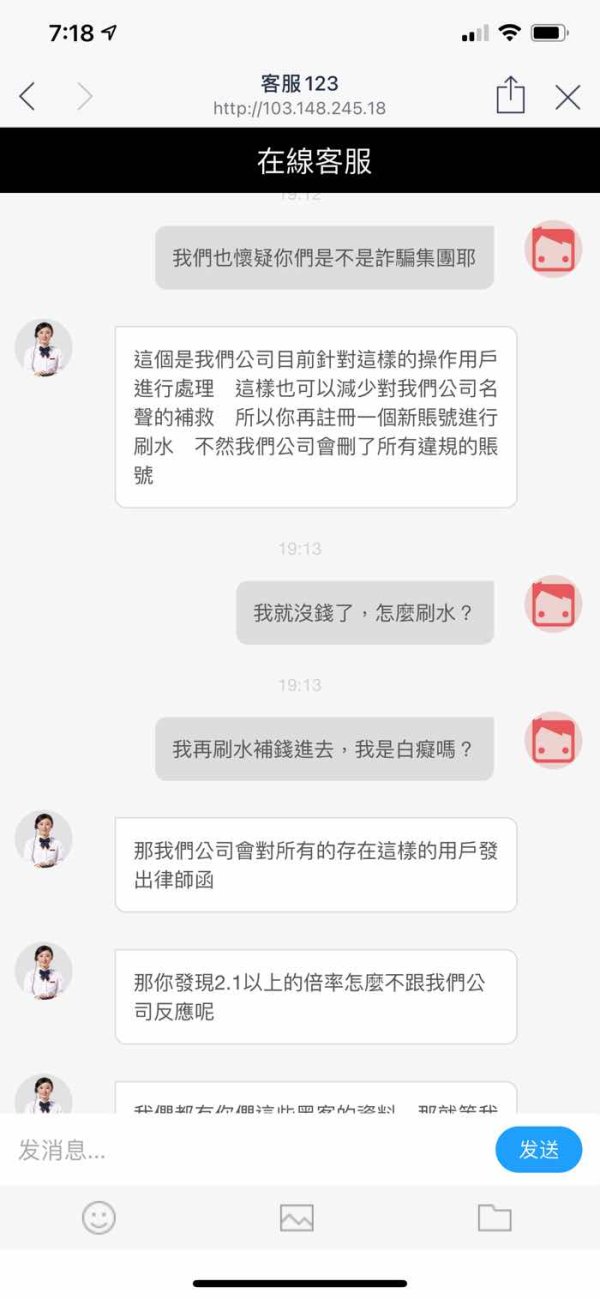

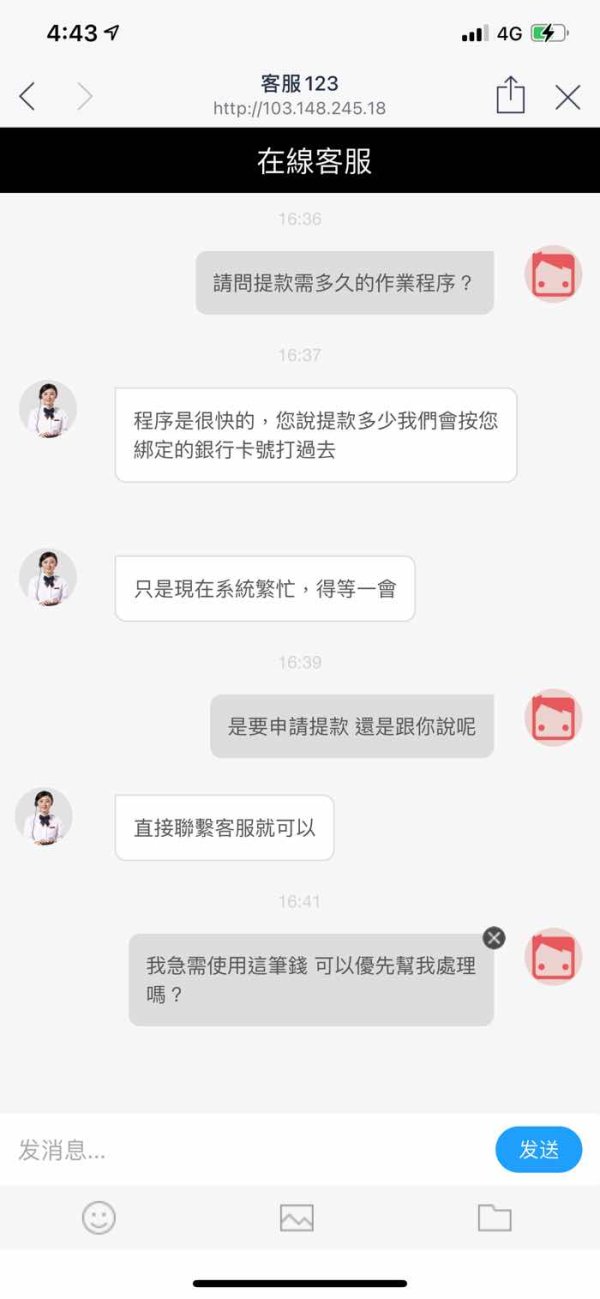

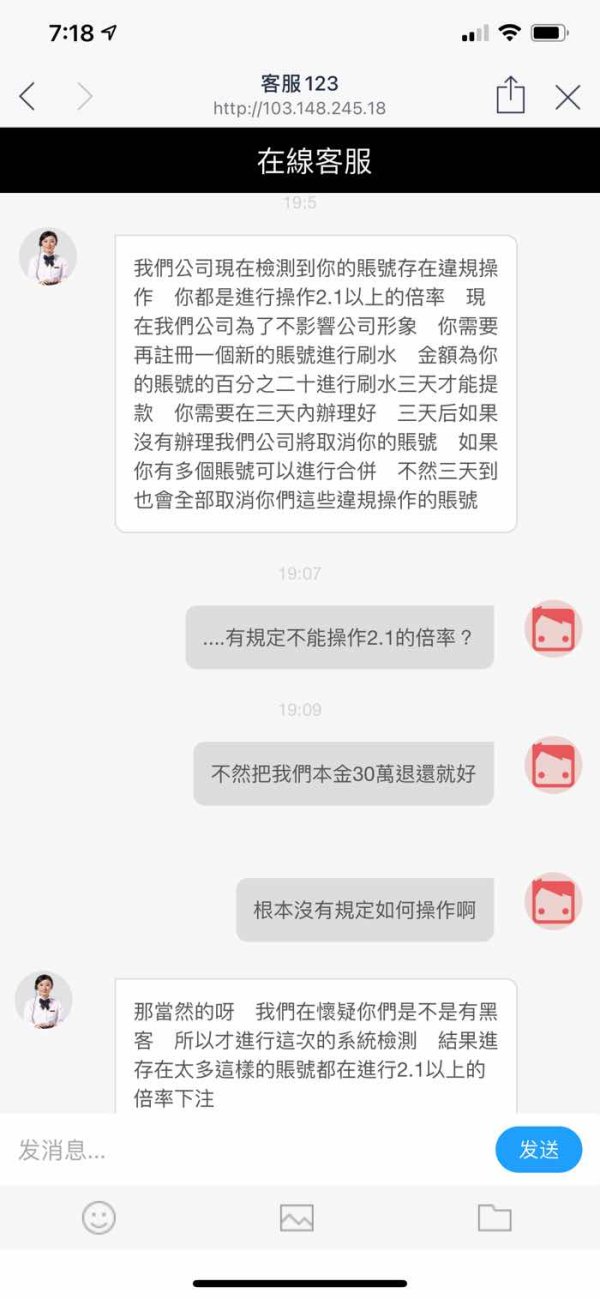

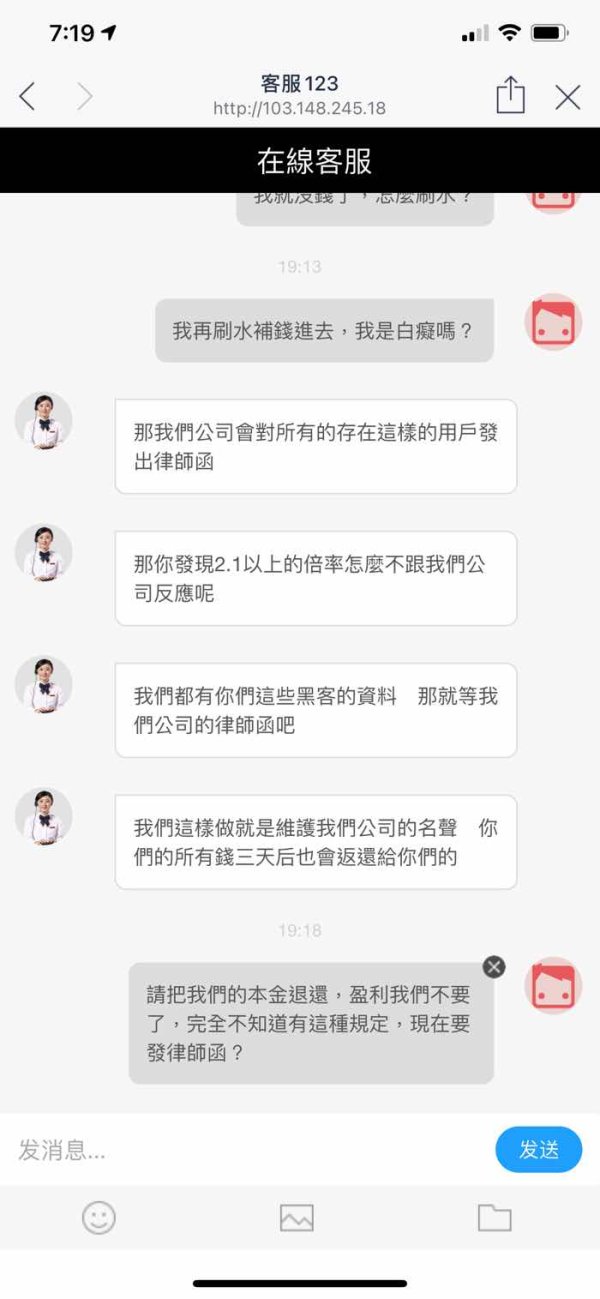

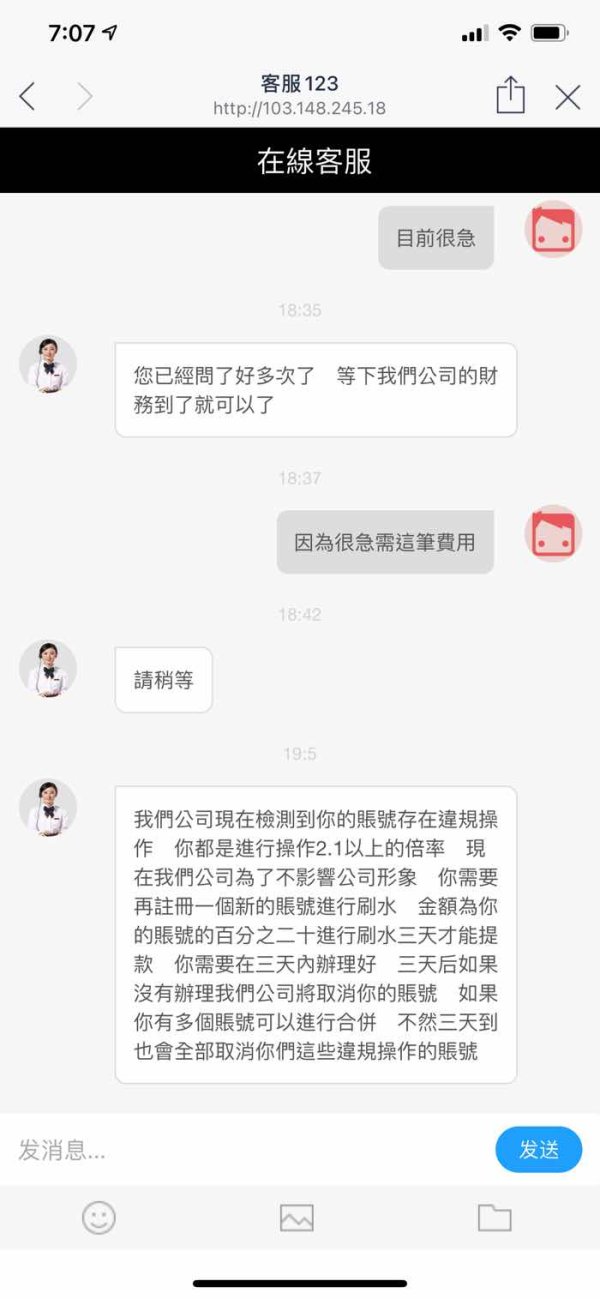

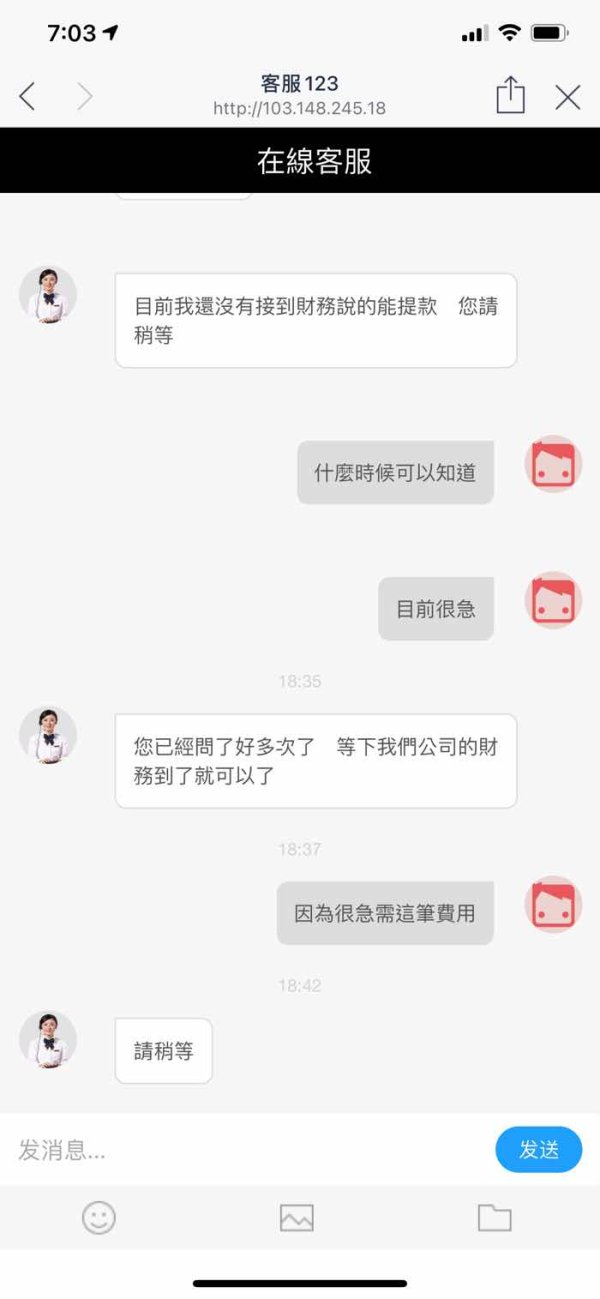

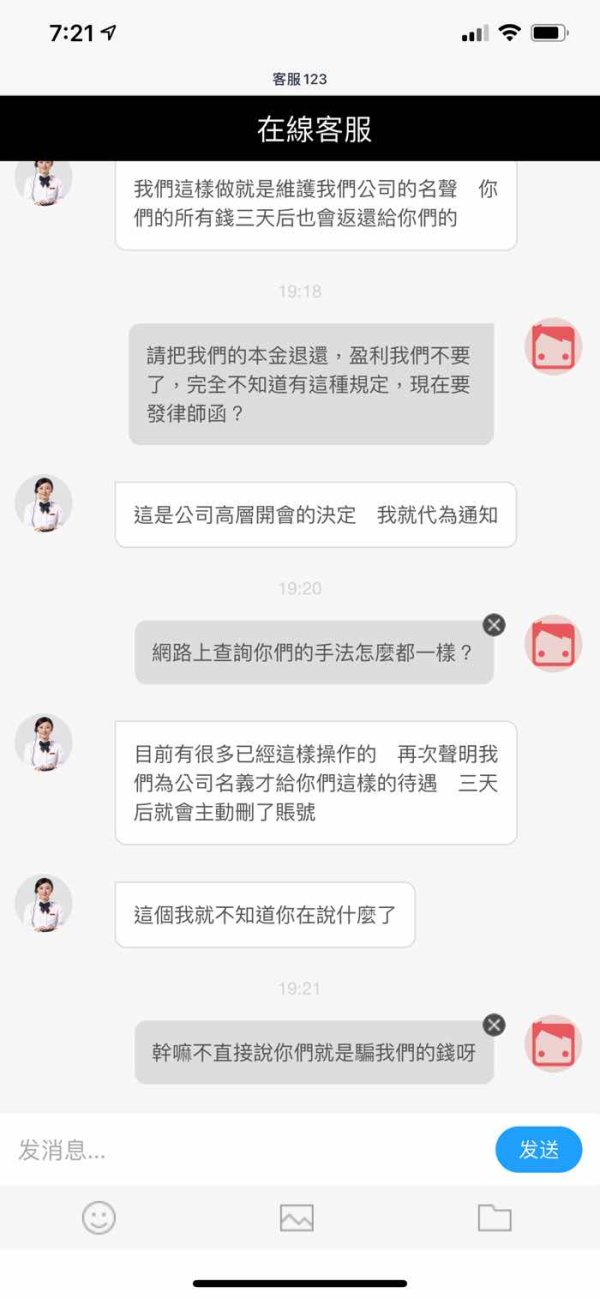

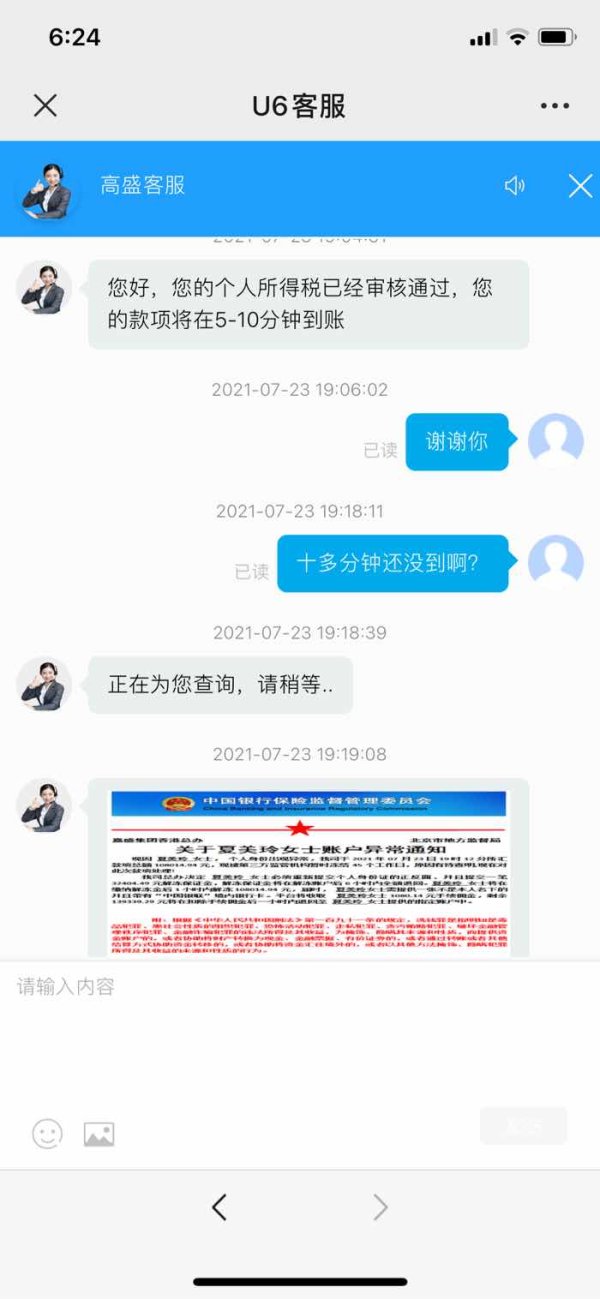

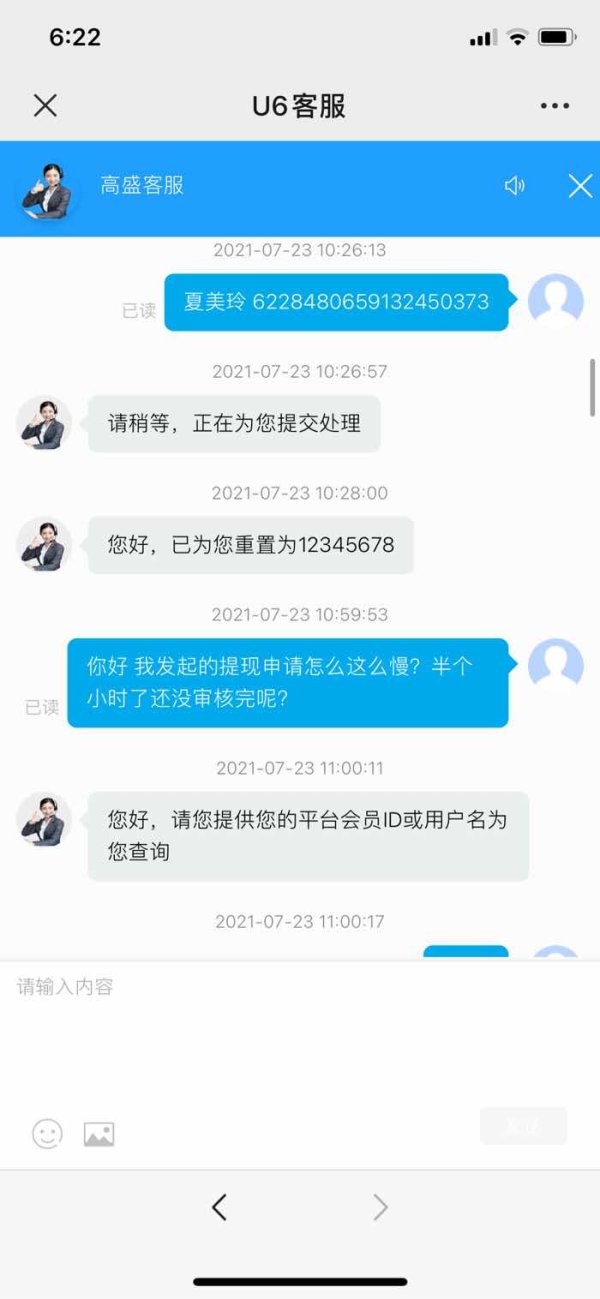

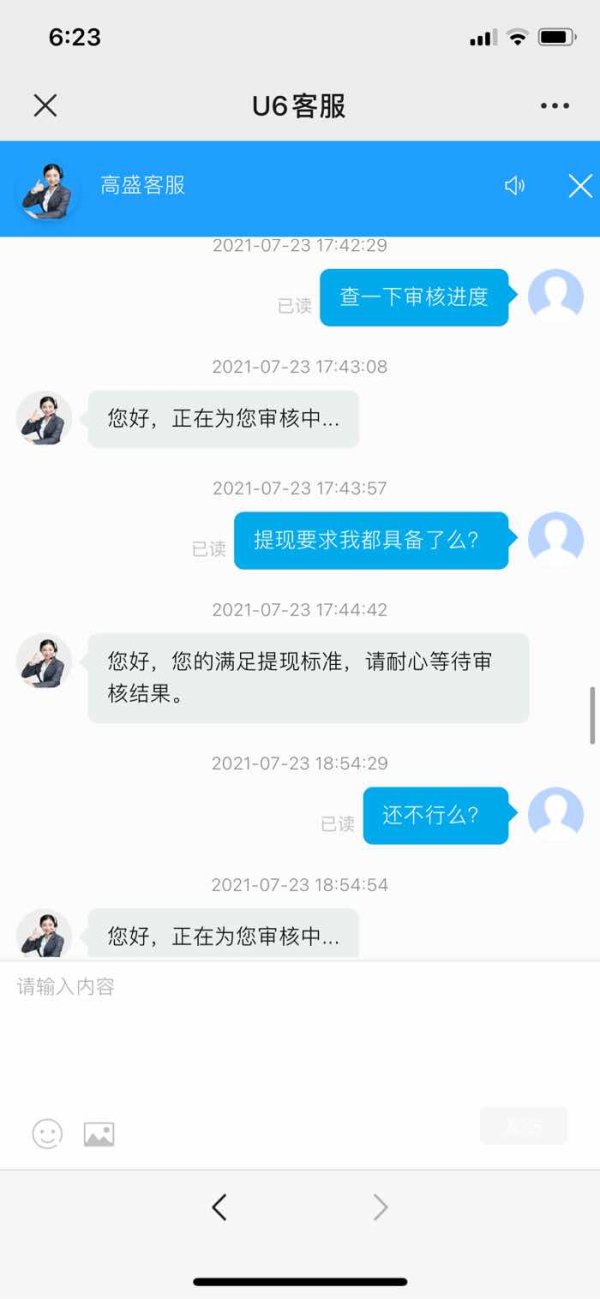

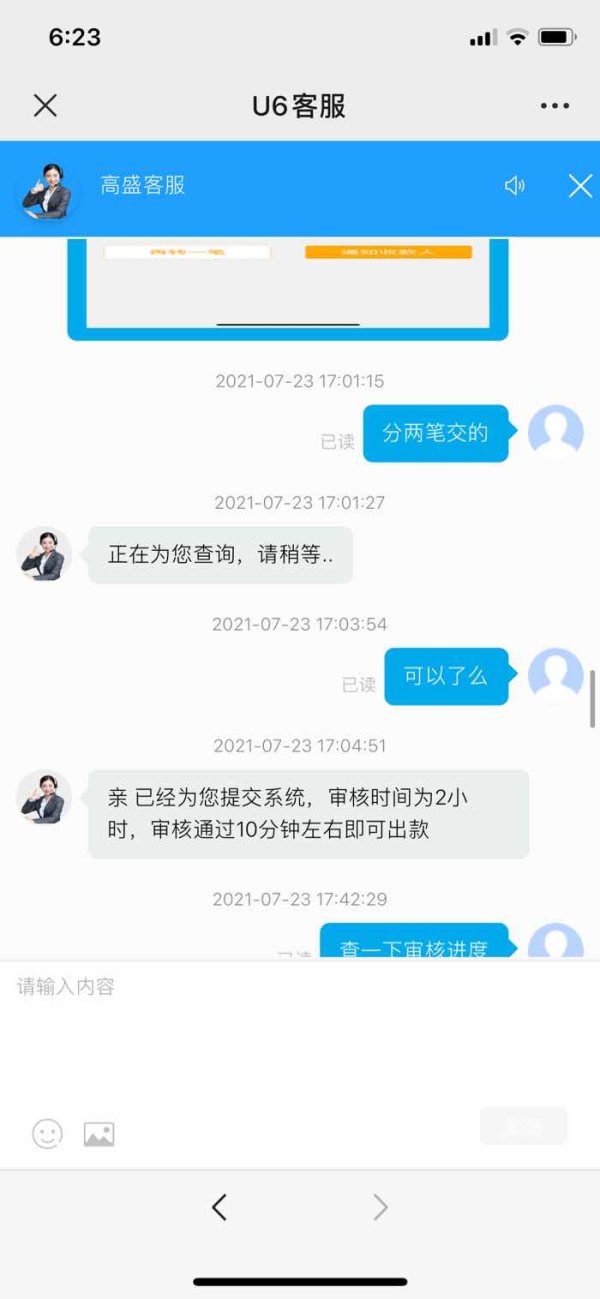

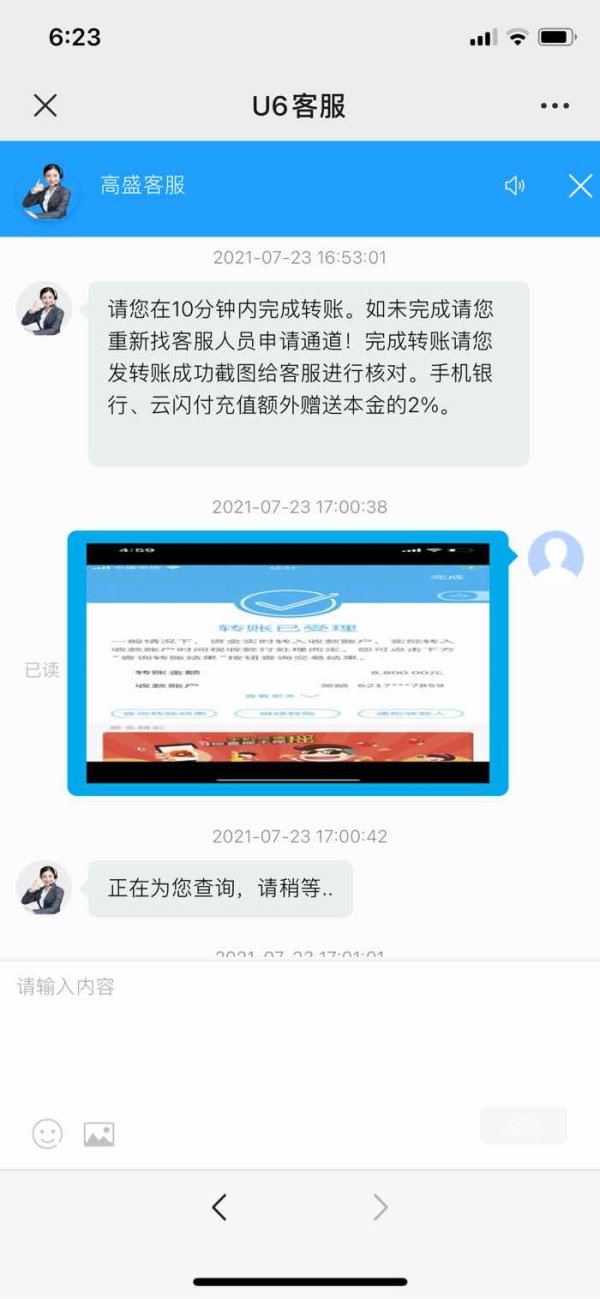

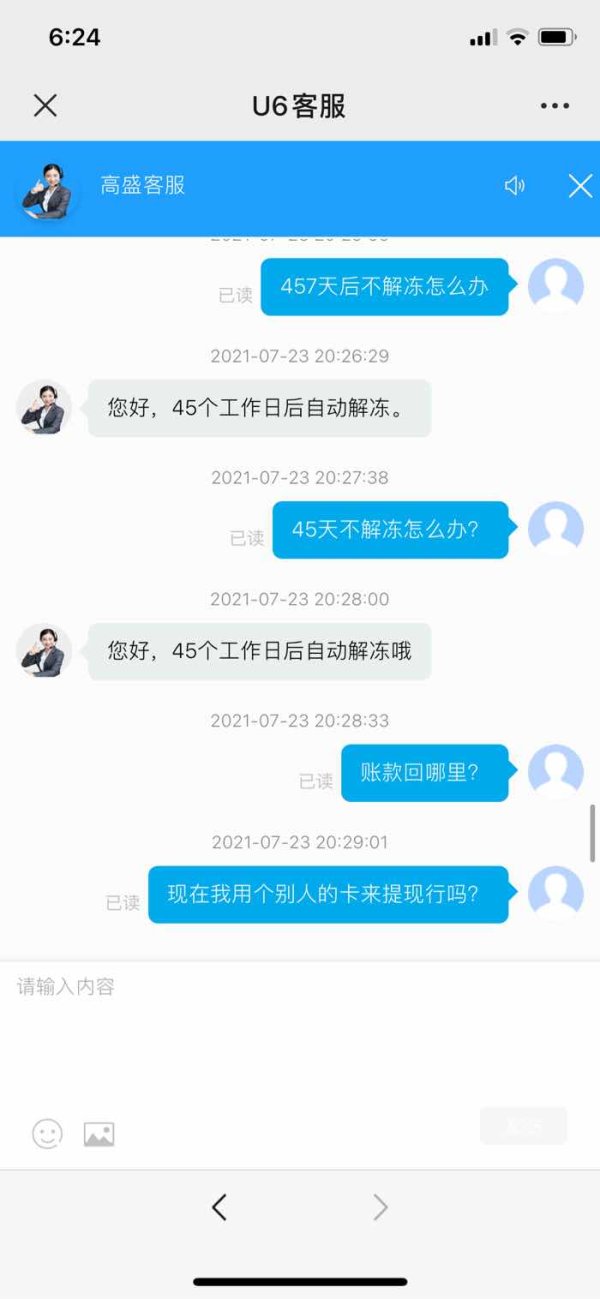

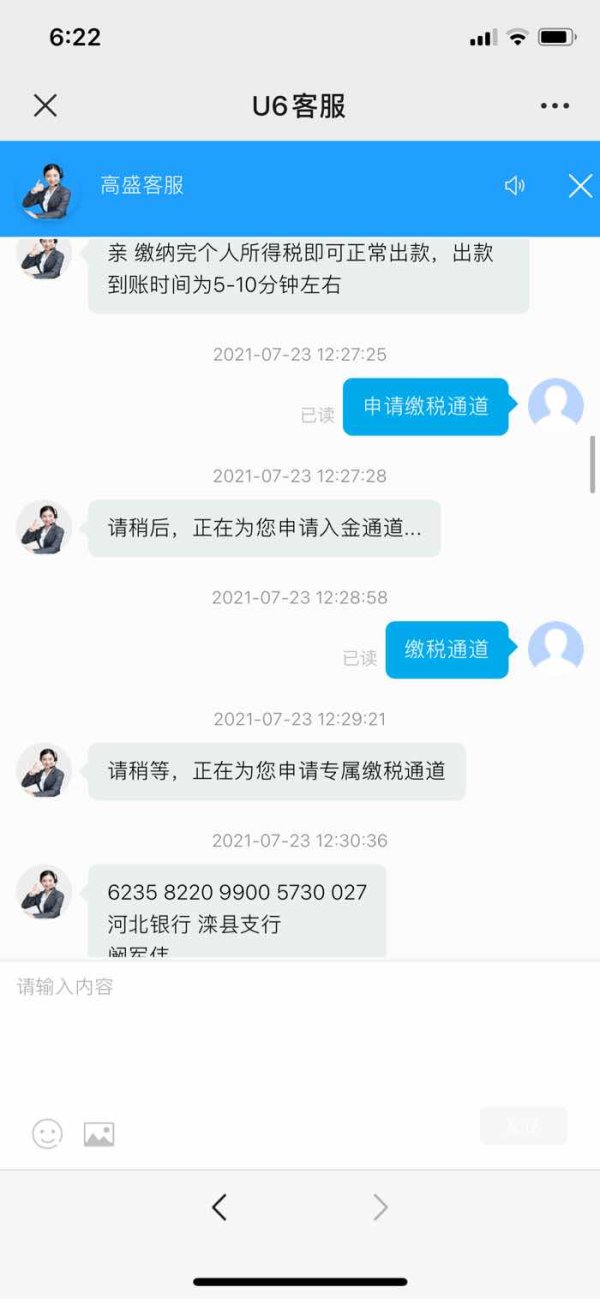

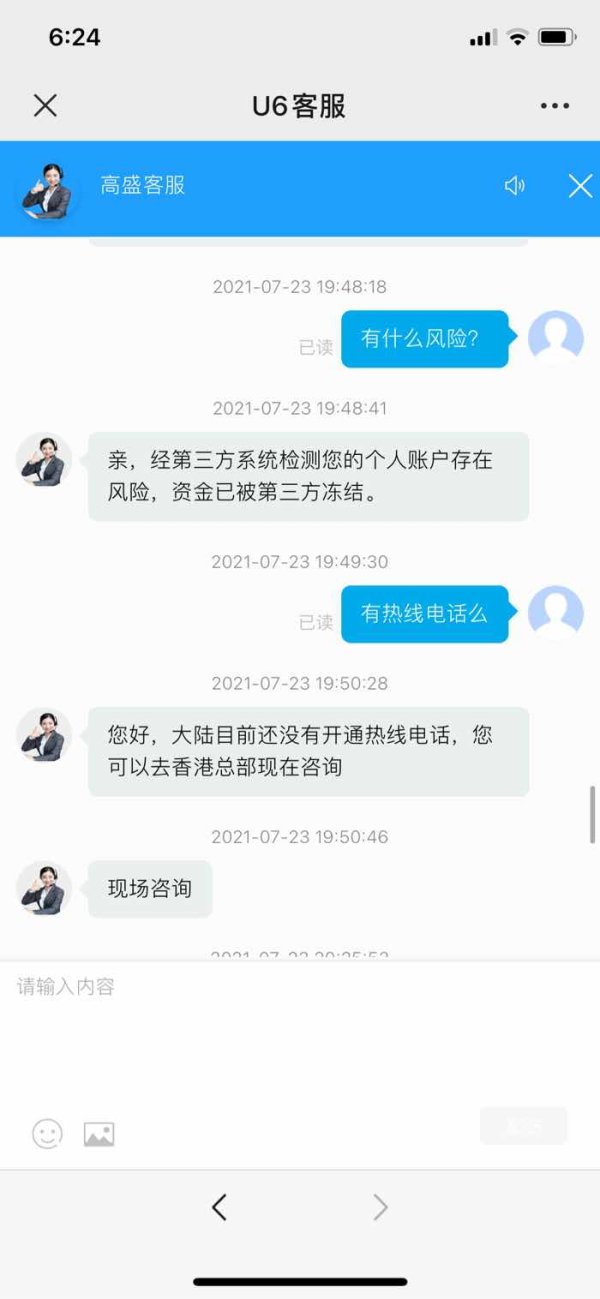

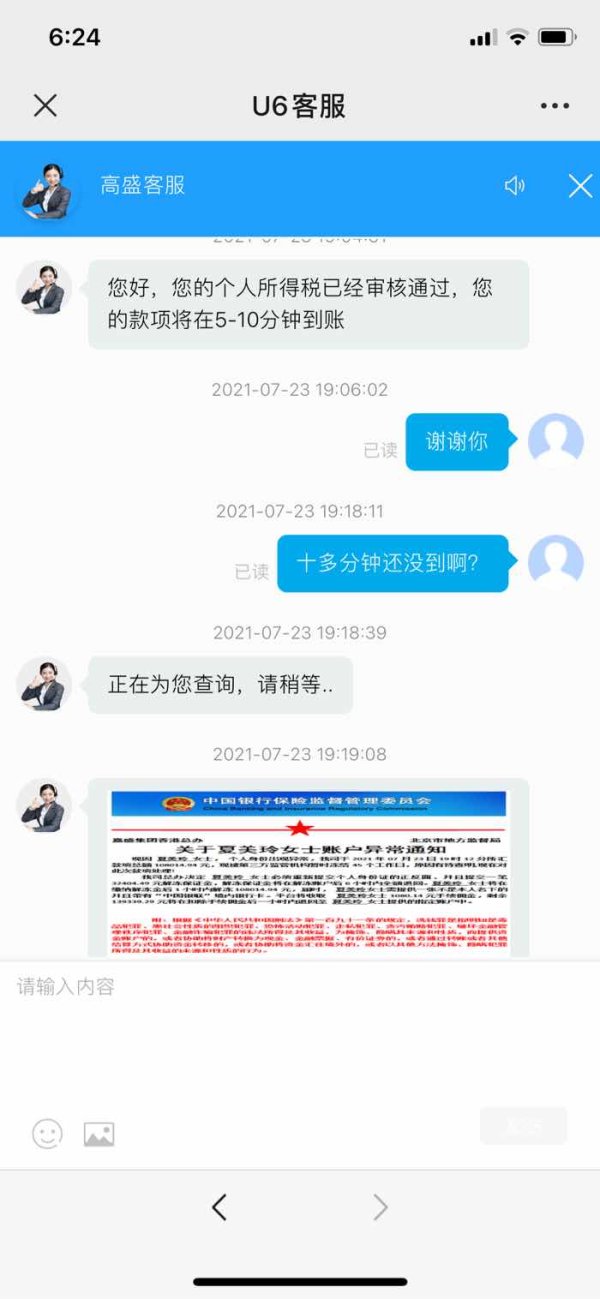

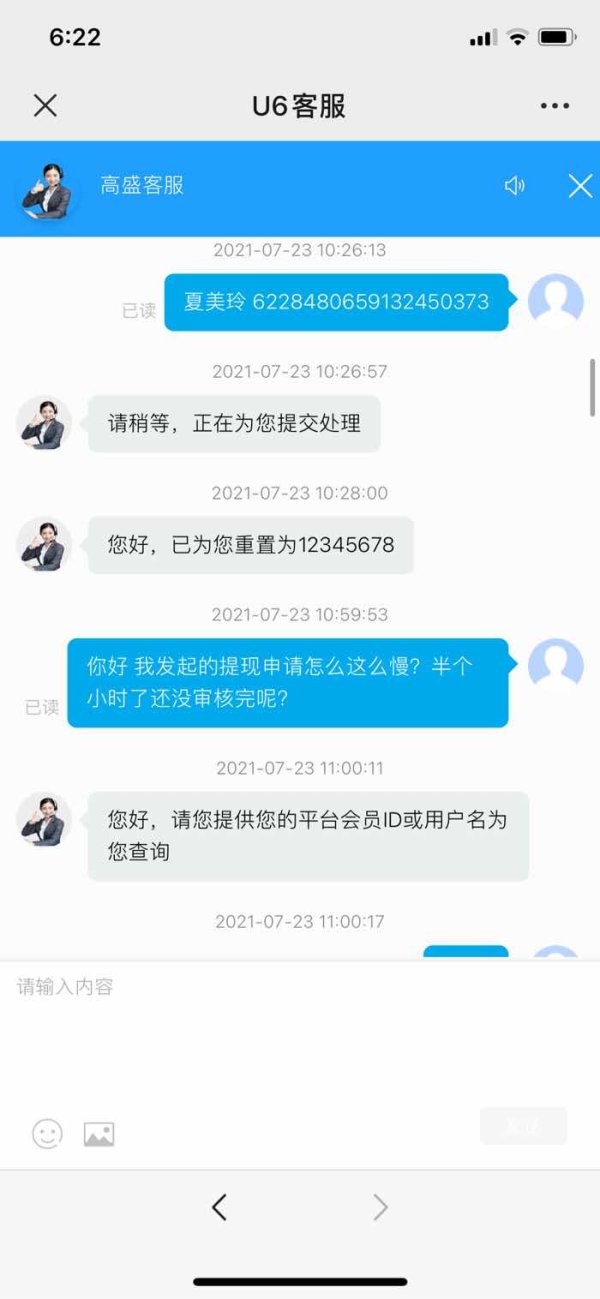

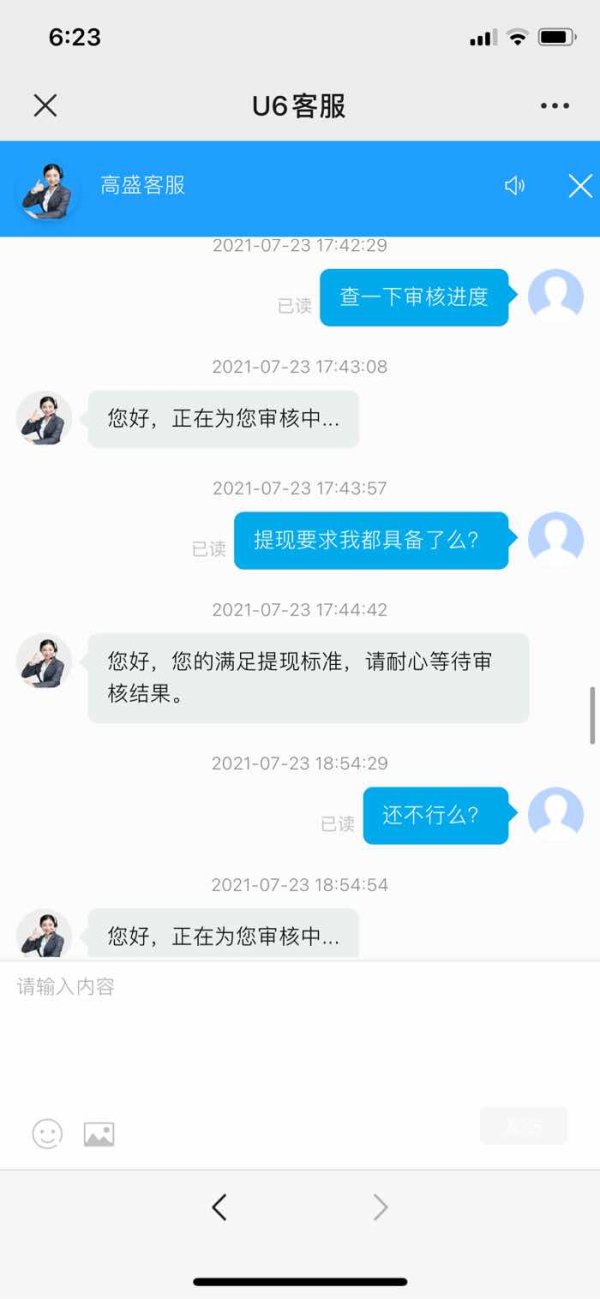

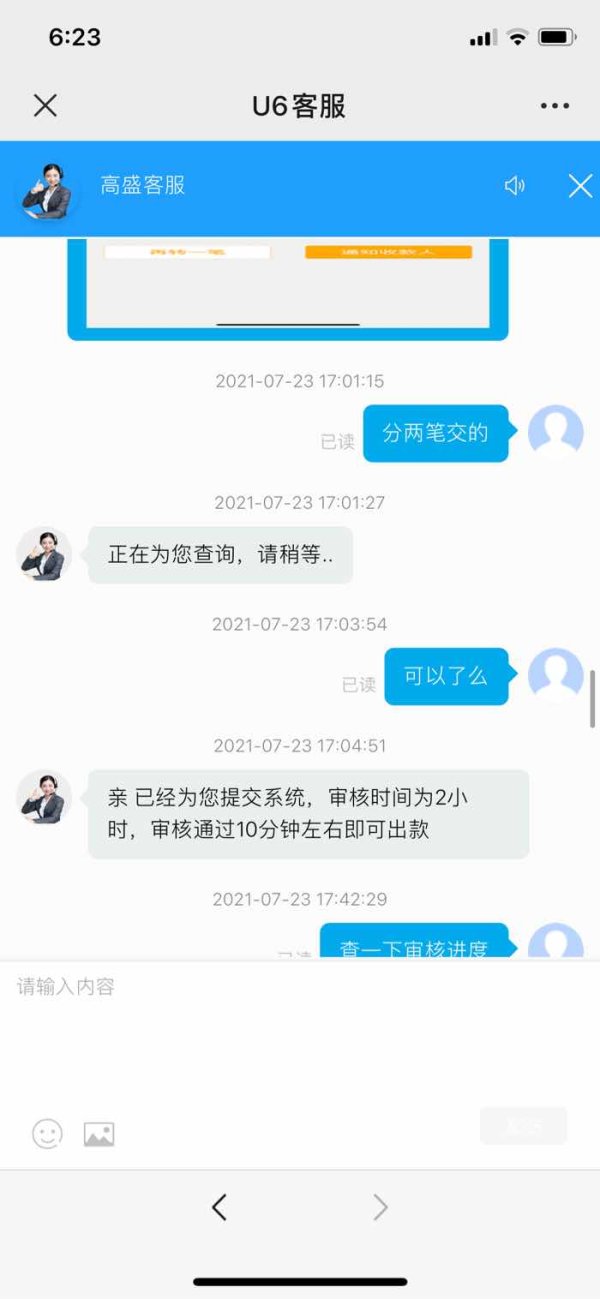

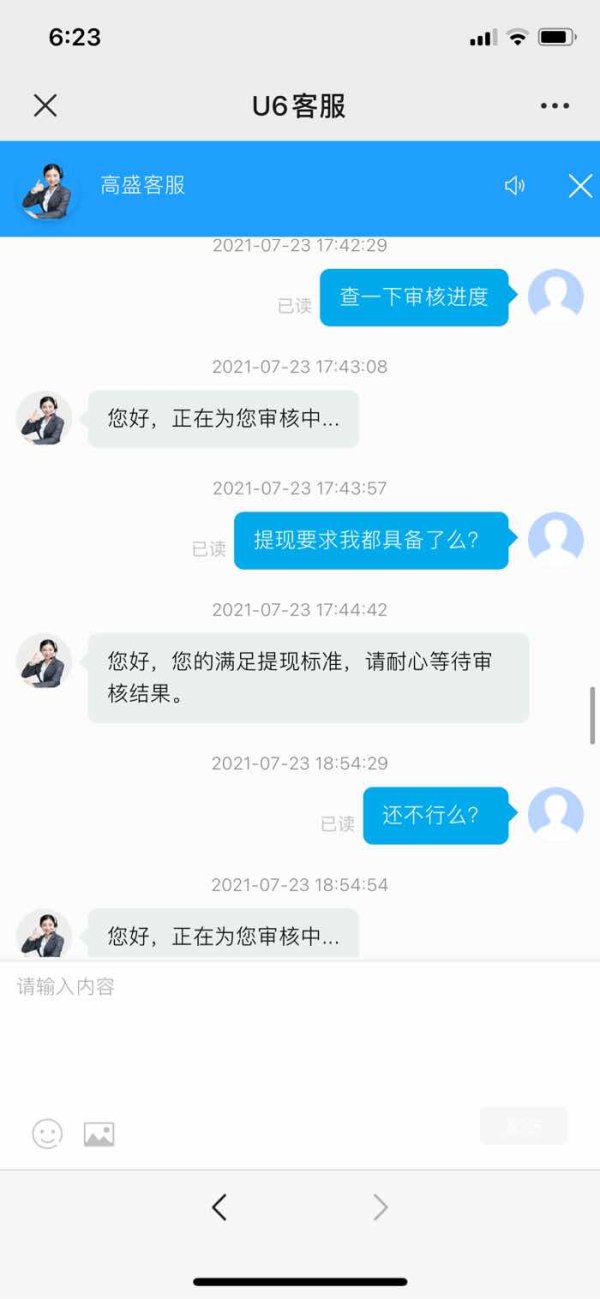

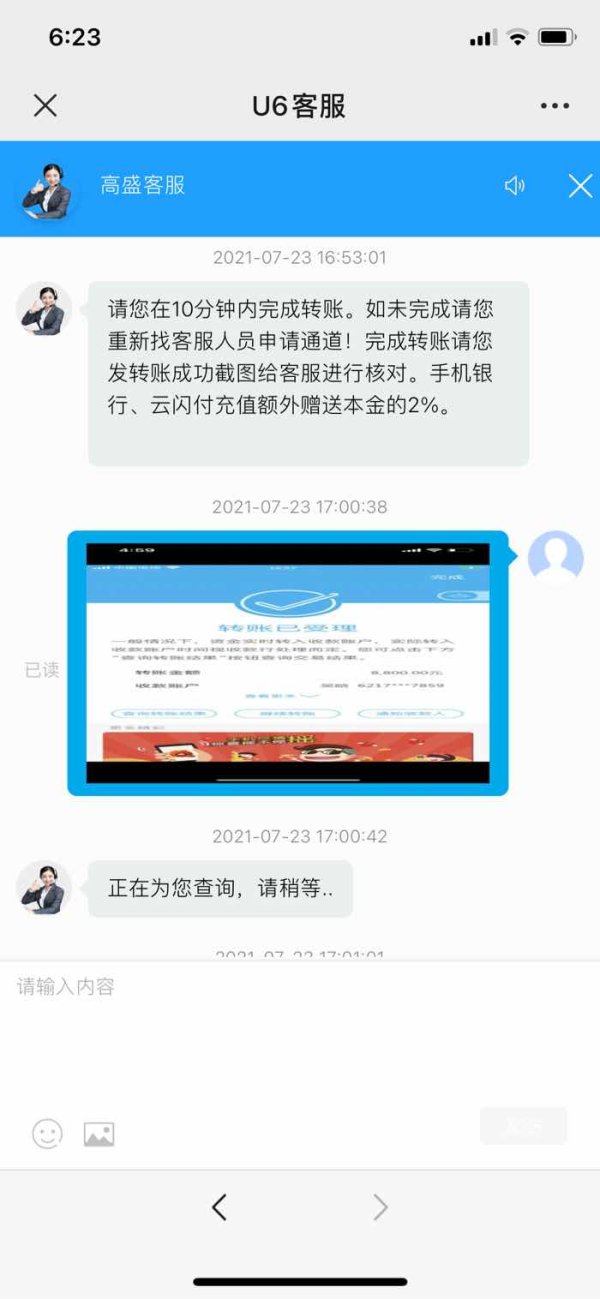

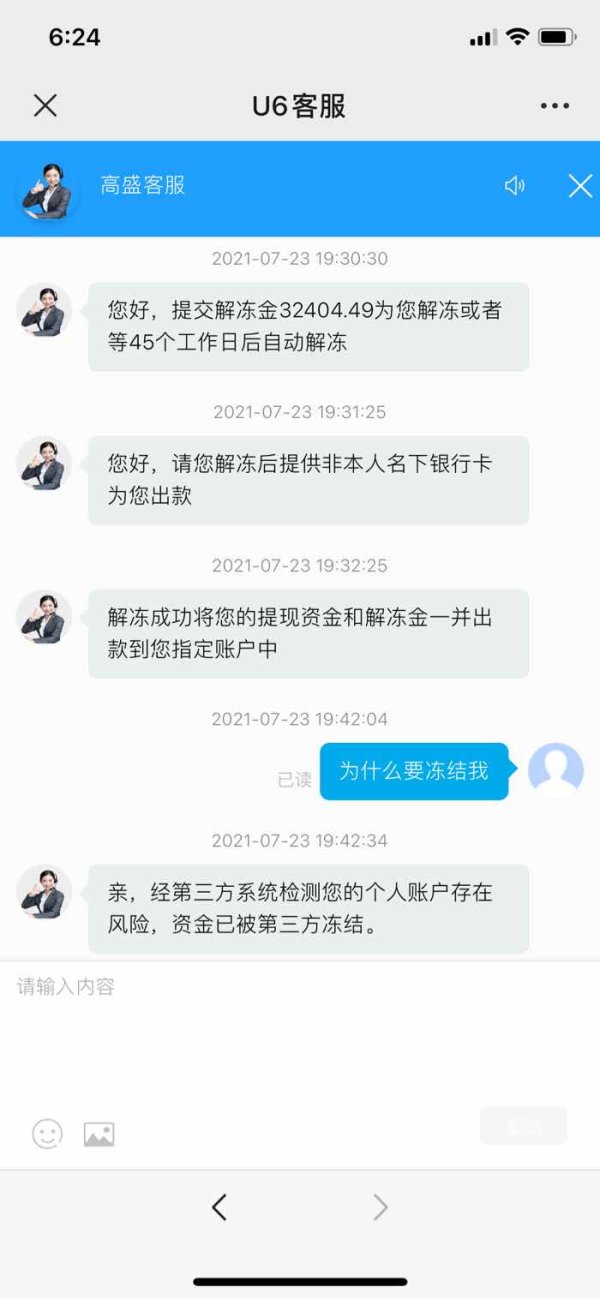

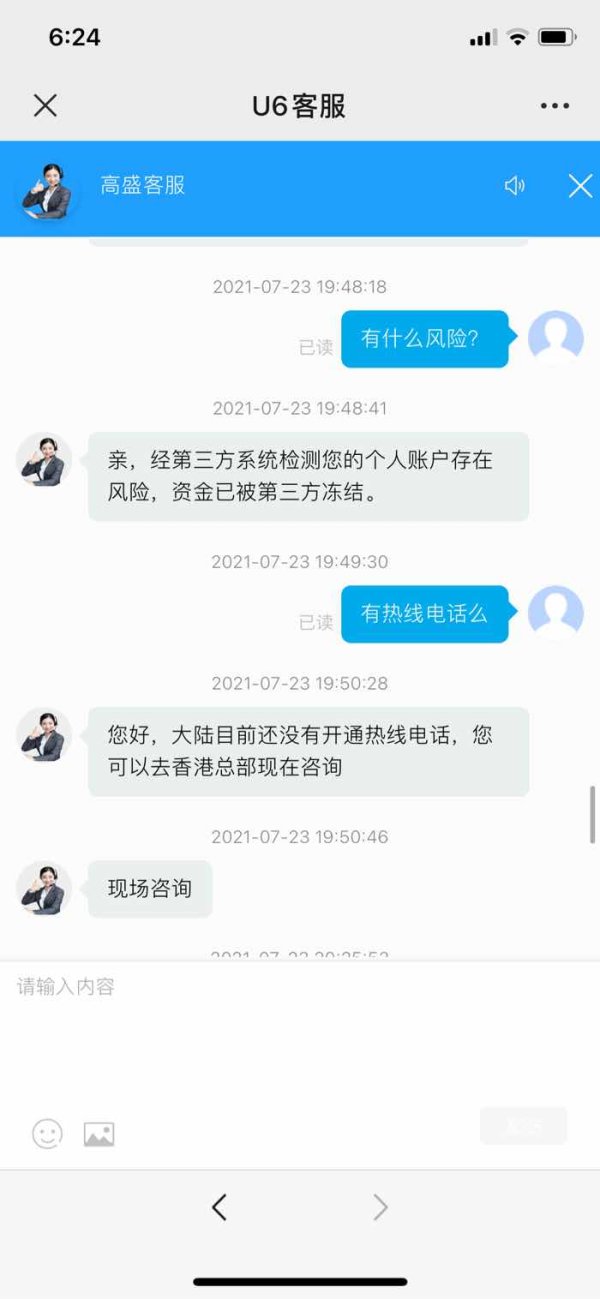

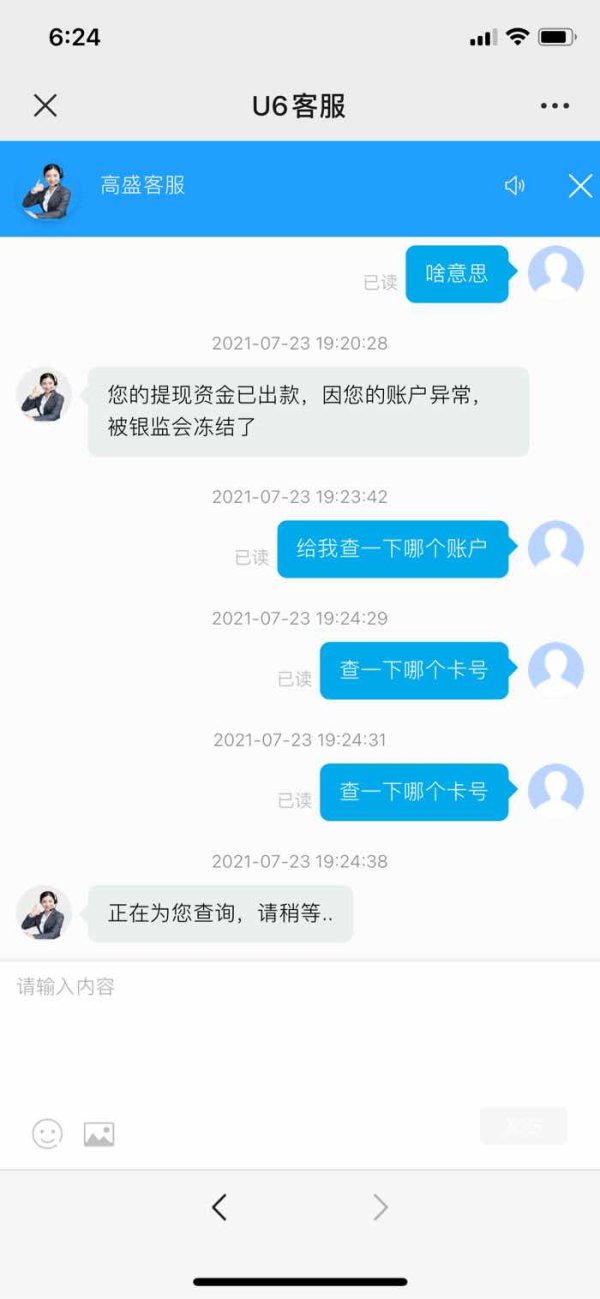

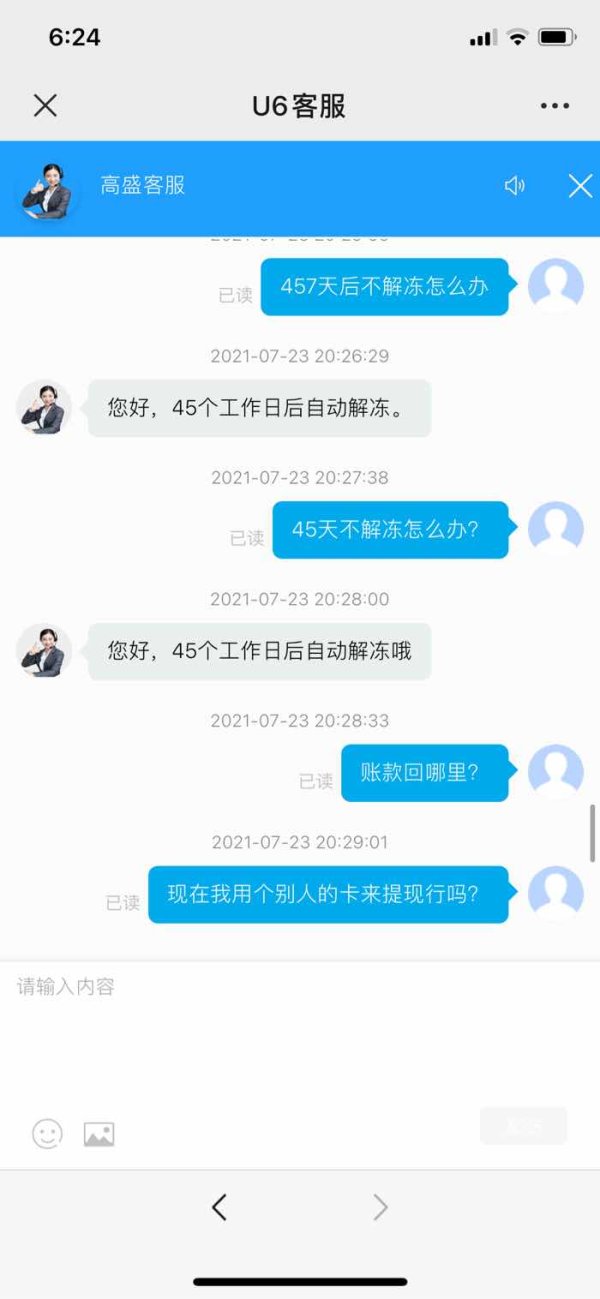

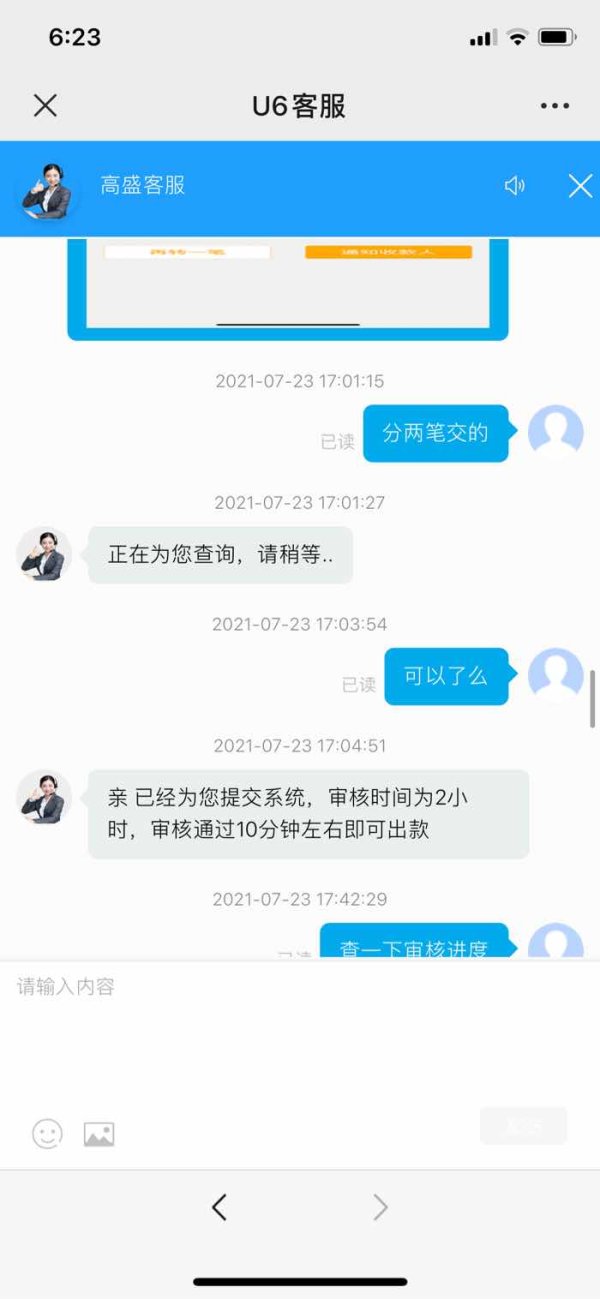

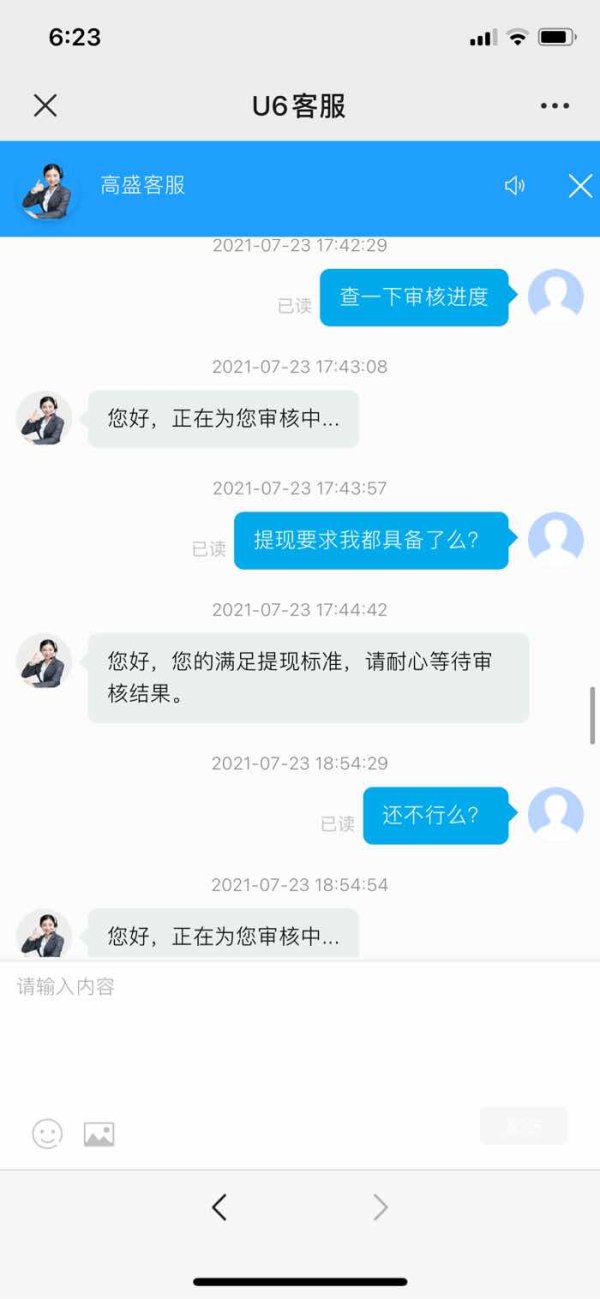

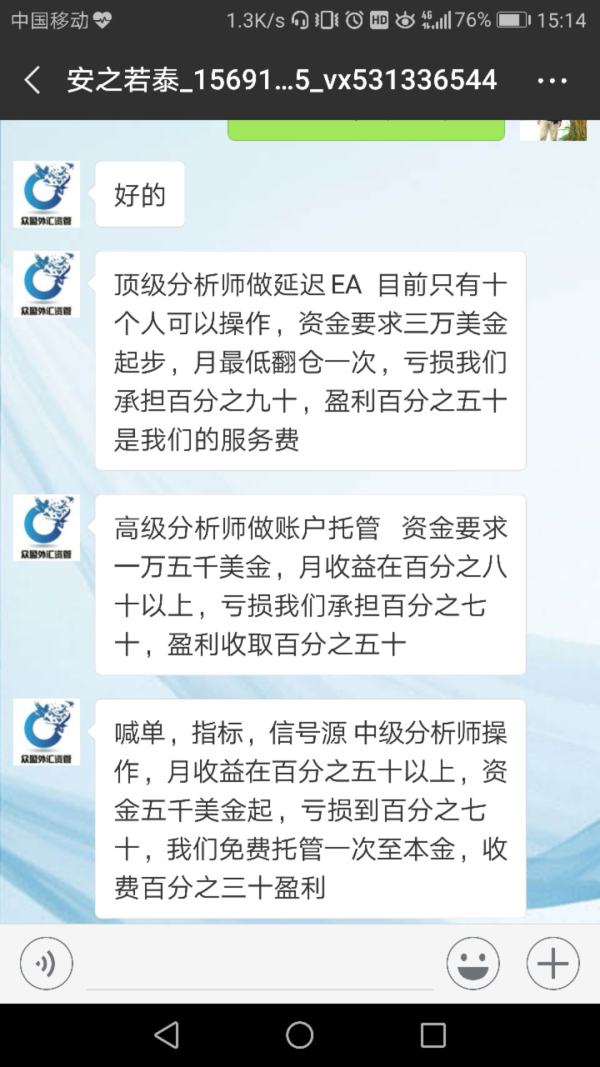

Customer service represents one of GS-Forex's most significant weaknesses based on available user feedback and industry reports. Multiple sources indicate substantial user dissatisfaction with service quality, complaint handling procedures, and overall support responsiveness across various client interactions. The predominance of negative feedback regarding customer service suggests systemic issues in support operations rather than isolated incidents or individual representative problems.

User reports consistently highlight inadequate complaint resolution processes throughout their service experience. This suggests that the broker may lack proper procedures for addressing client concerns or disputes in a timely and effective manner. This pattern of service deficiency creates particular concern given the absence of clear regulatory oversight that might otherwise provide external complaint resolution mechanisms for client protection. The lack of specified customer service channels, availability hours, or multilingual support capabilities further compounds these concerns for international clients. Professional trading environments require reliable, responsive customer support for technical issues, account queries, and urgent trading matters. This makes this area a critical deficiency for GS-Forex operations that affects overall client satisfaction significantly.

Trading Experience Analysis

The assessment of GS-Forex's trading experience faces limitations due to mixed and insufficient user feedback regarding platform performance, execution quality, and overall trading conditions. While the MT4 platform provides standard functionality expected in professional trading environments, specific user experiences regarding platform stability, order execution speed, or system reliability are not well-documented in available sources for comprehensive evaluation. The absence of detailed performance metrics or user testimonials about actual trading conditions makes comprehensive evaluation challenging for potential clients.

Available information does not address crucial trading experience factors such as slippage rates, requote frequency, platform downtime incidents, or execution speed during high-volatility periods. Mobile trading capabilities, which have become essential for modern traders, are not specifically detailed in current documentation for user assessment. The lack of information about liquidity providers, execution models, or trading environment specifics leaves potential users without crucial details about expected trading conditions. This gs-forex review emphasizes that while the broker offers market access through established platform technology, the absence of transparent trading condition information represents a significant limitation for informed decision-making. Traders require comprehensive information about execution quality and platform performance to make appropriate broker selection decisions.

Trust and Safety Analysis

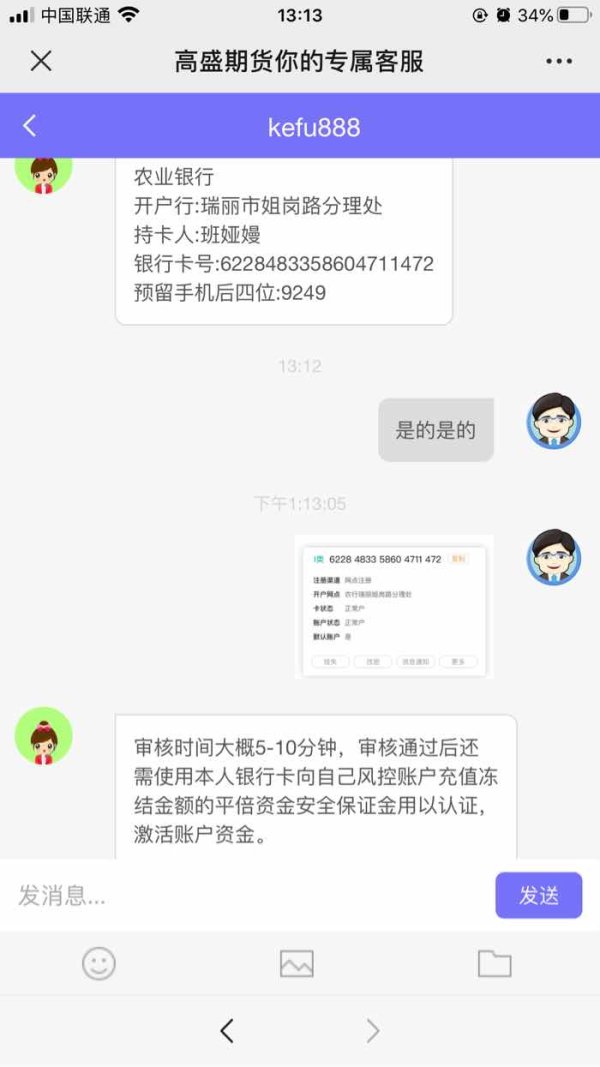

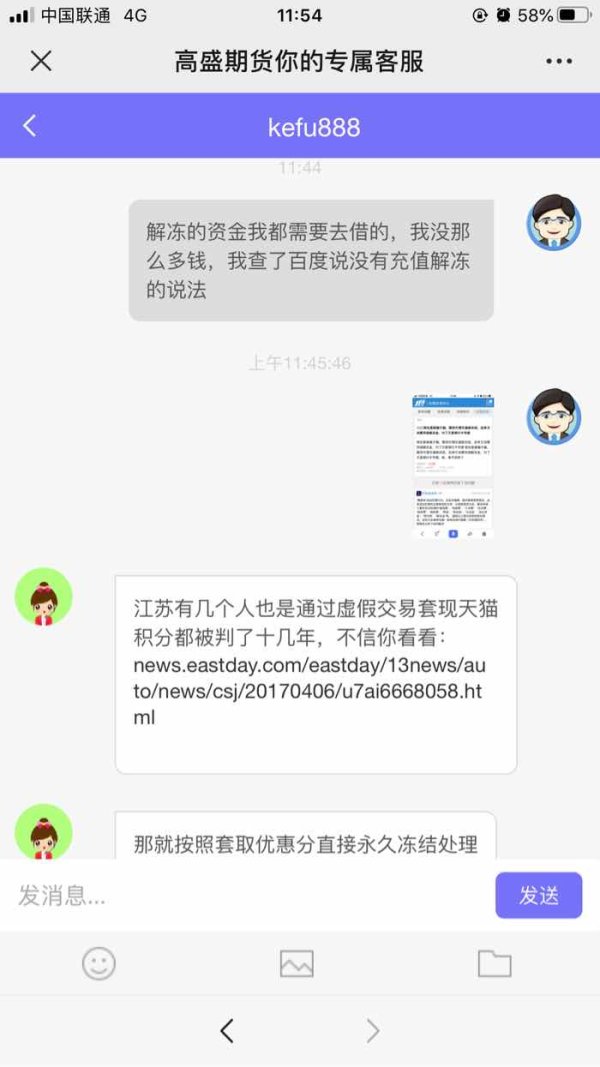

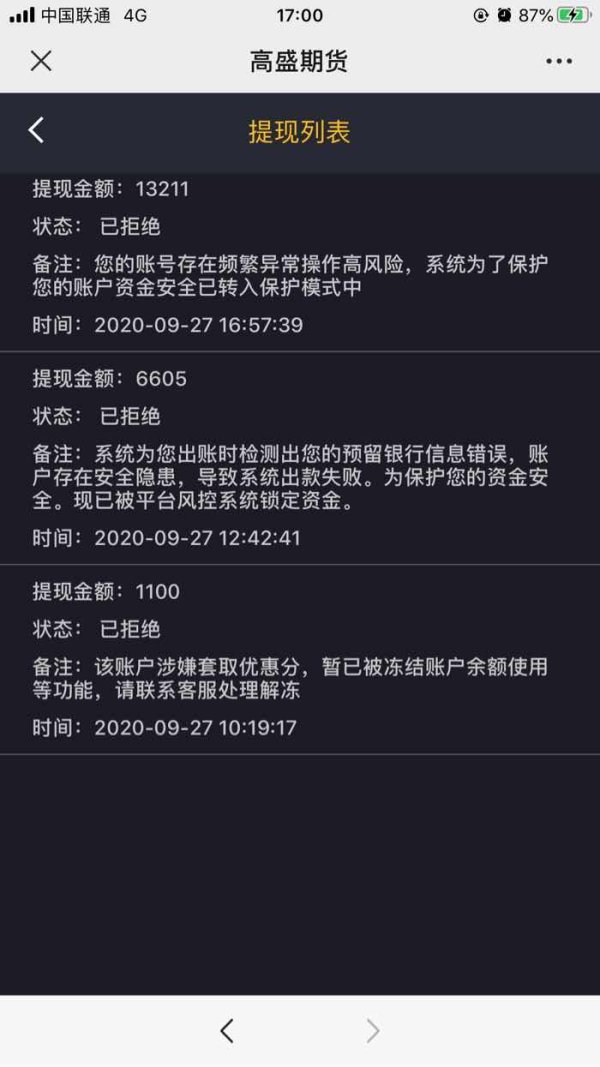

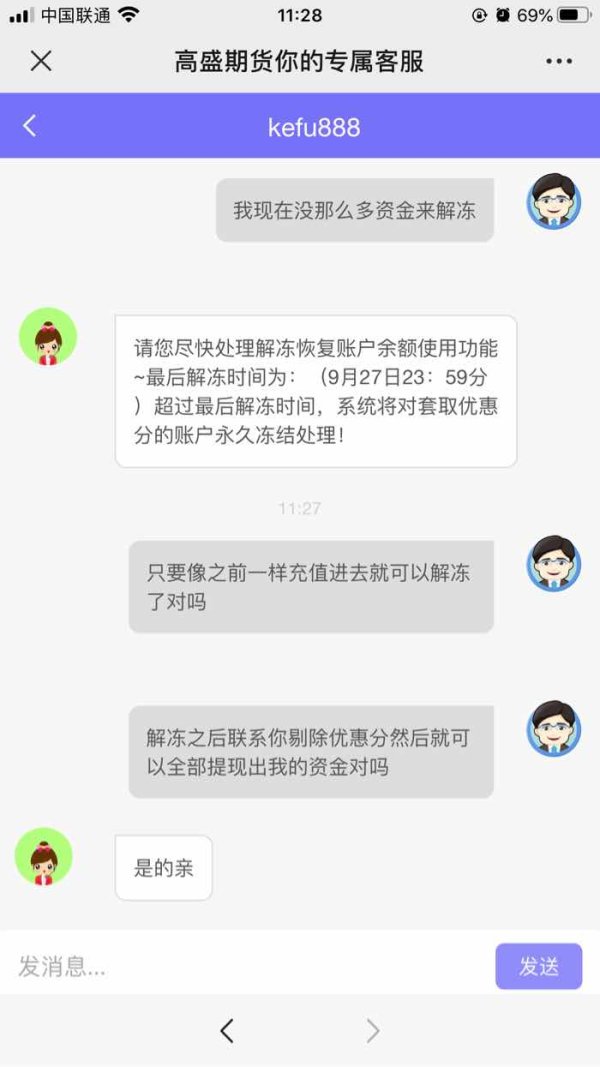

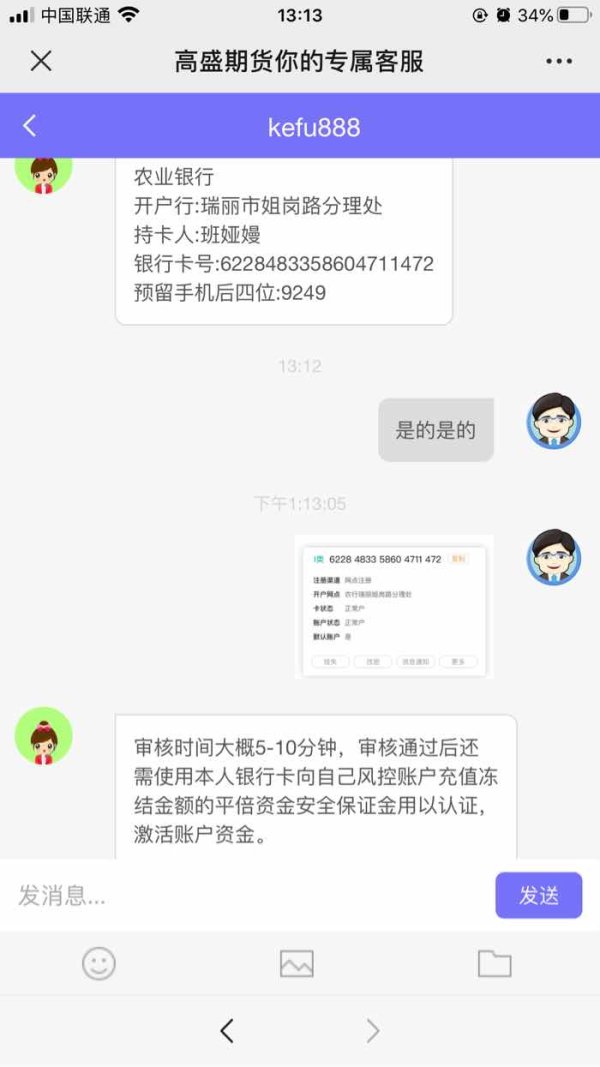

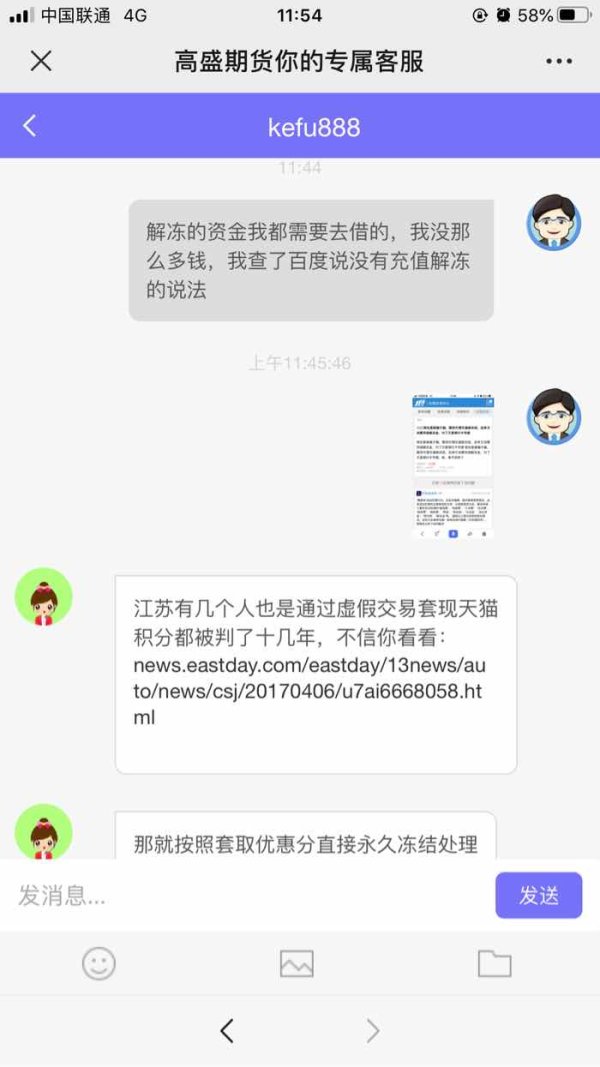

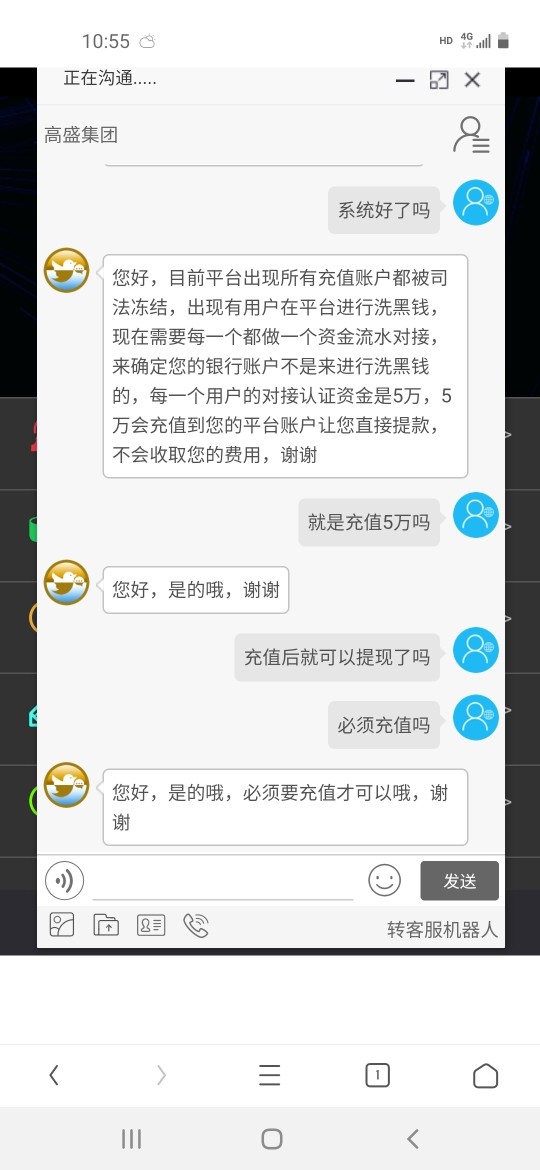

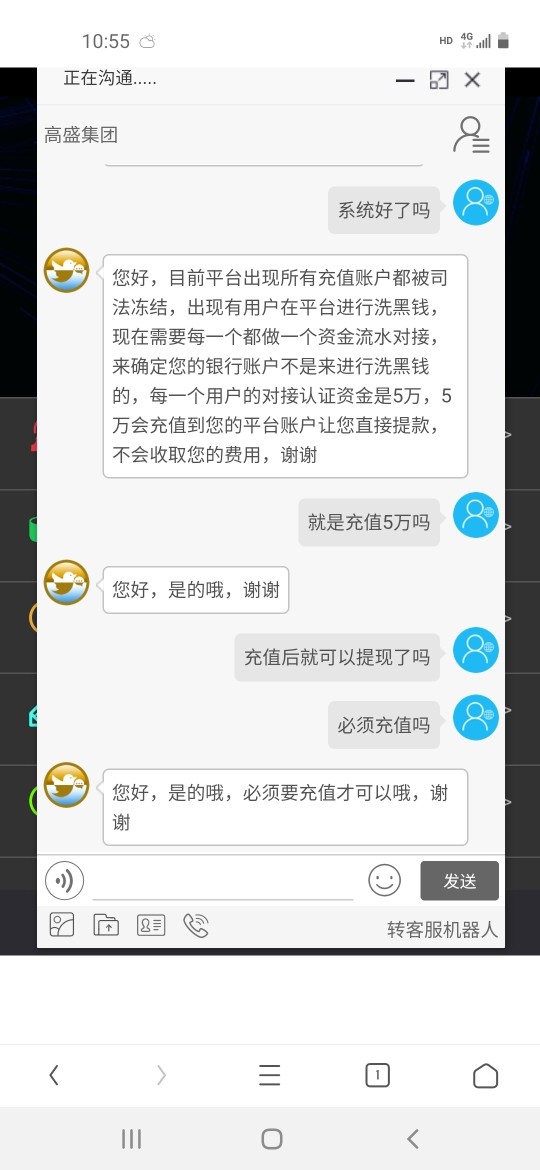

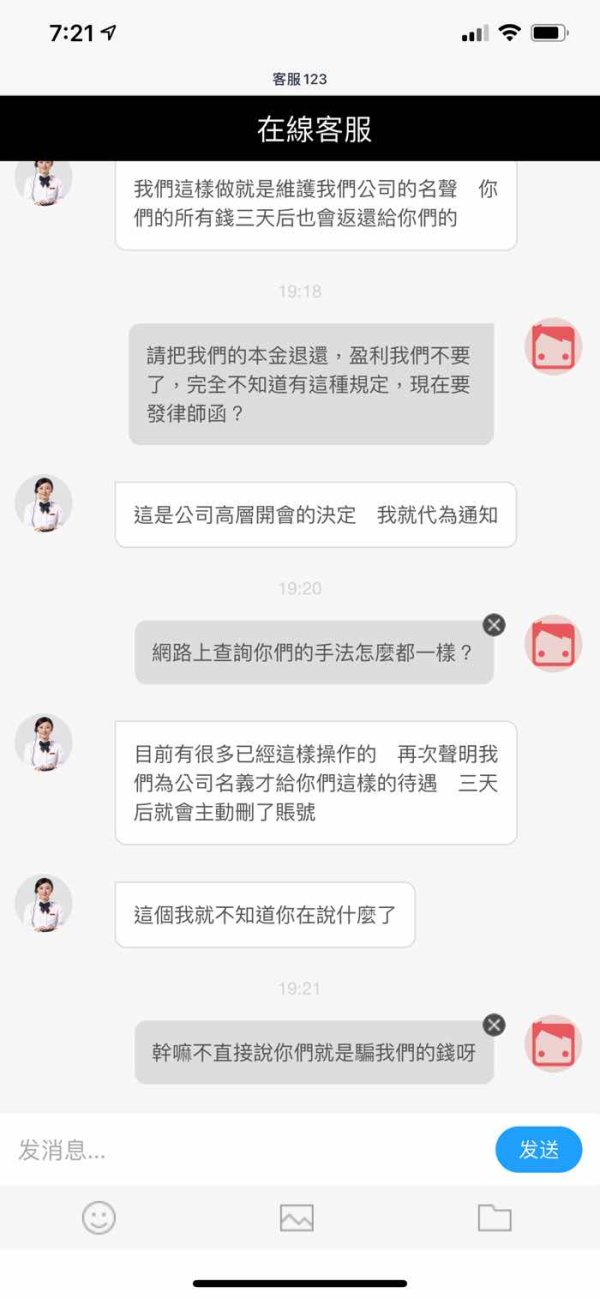

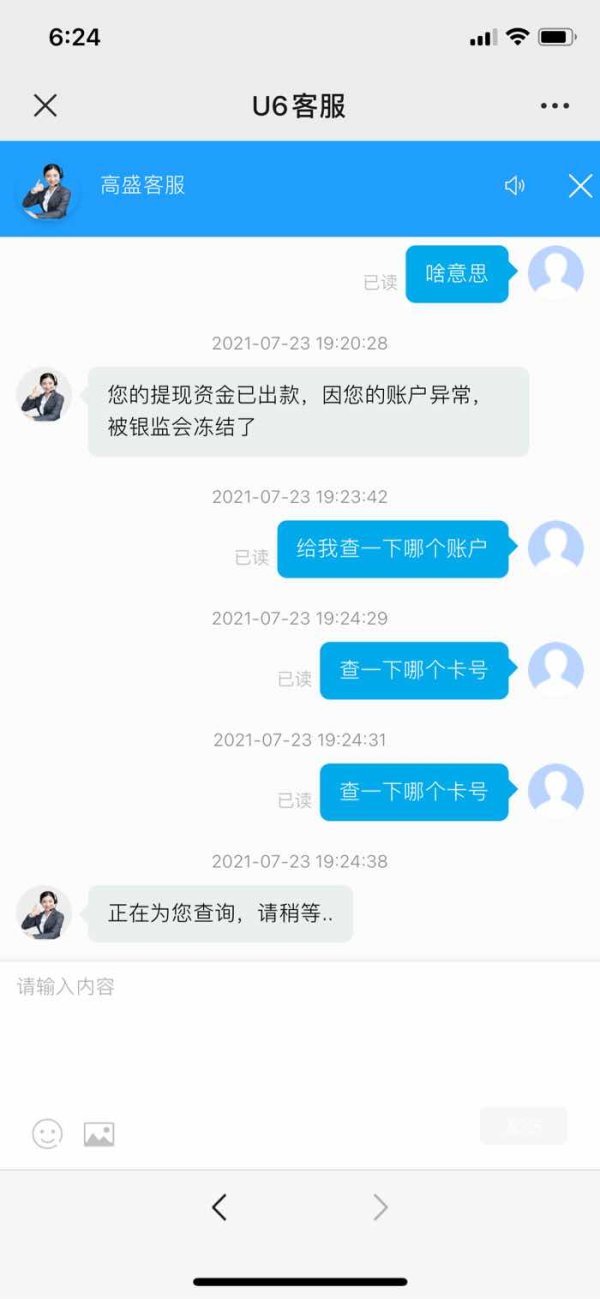

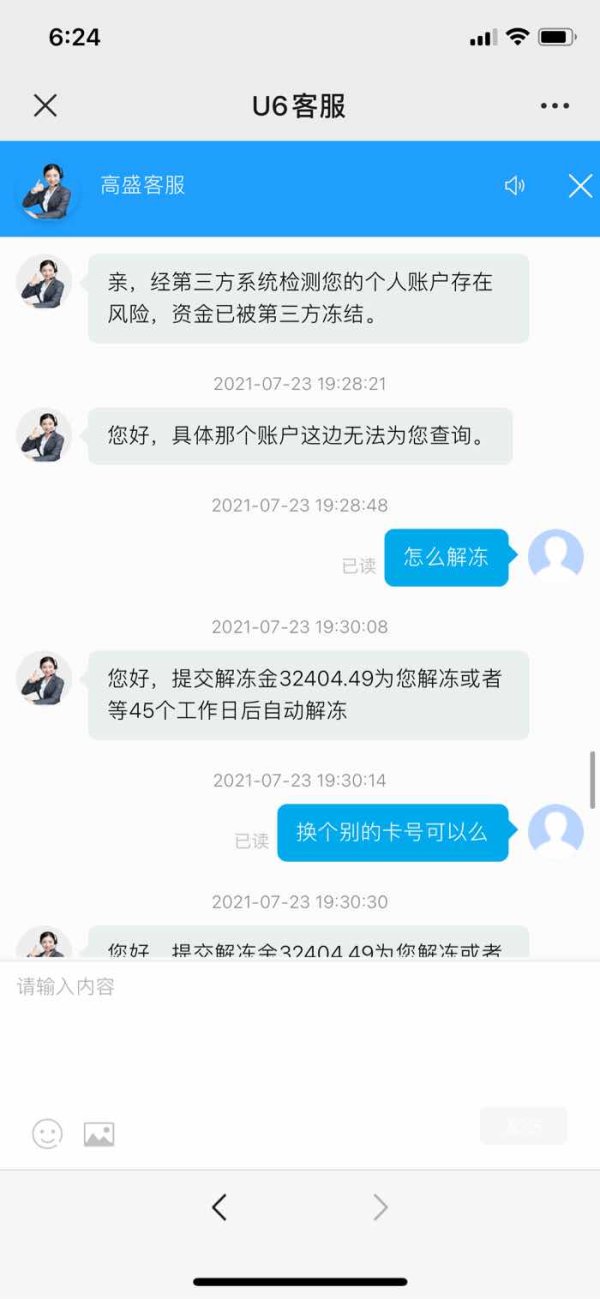

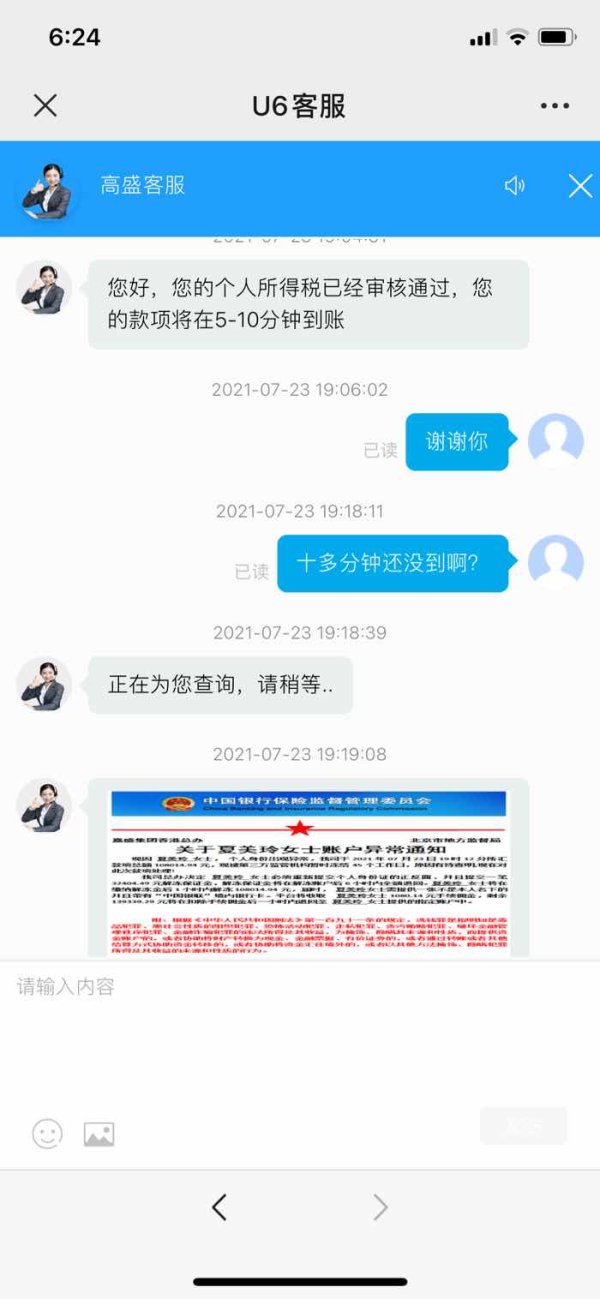

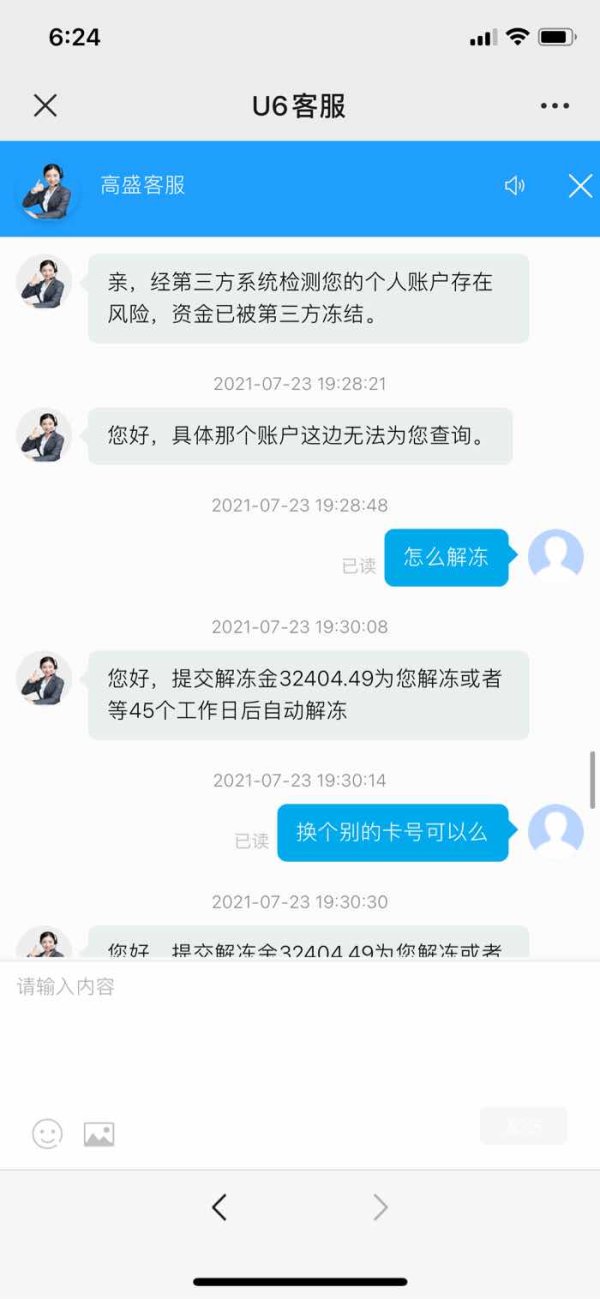

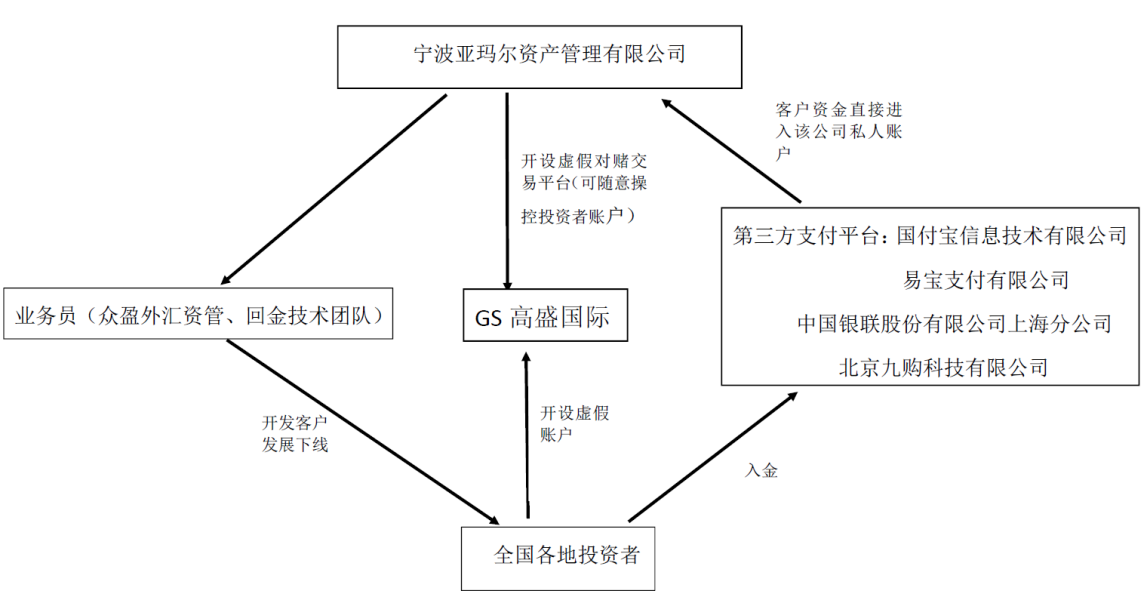

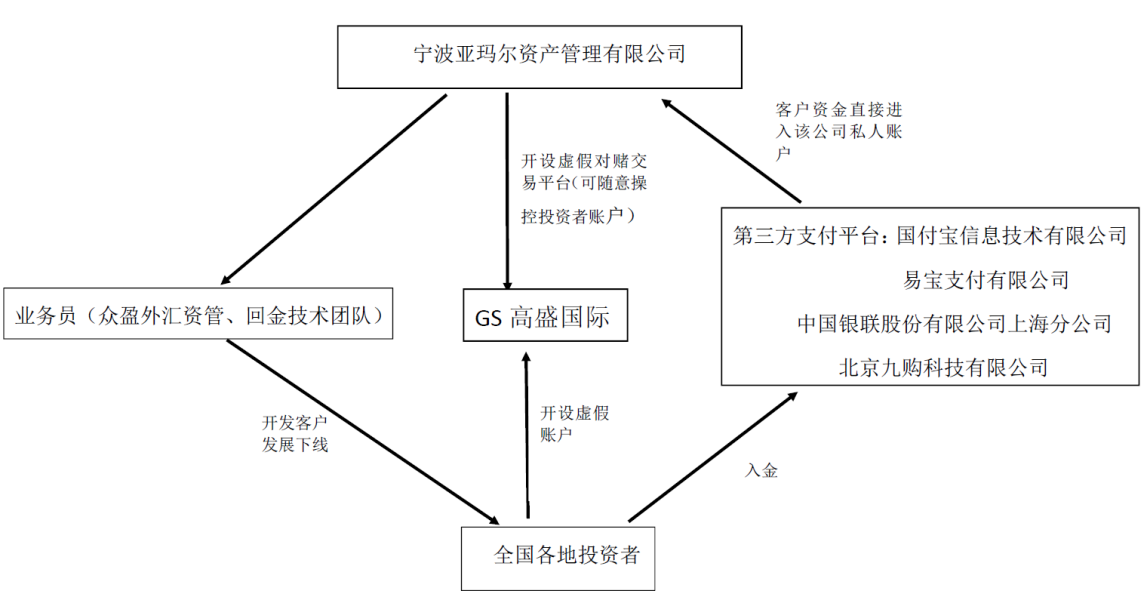

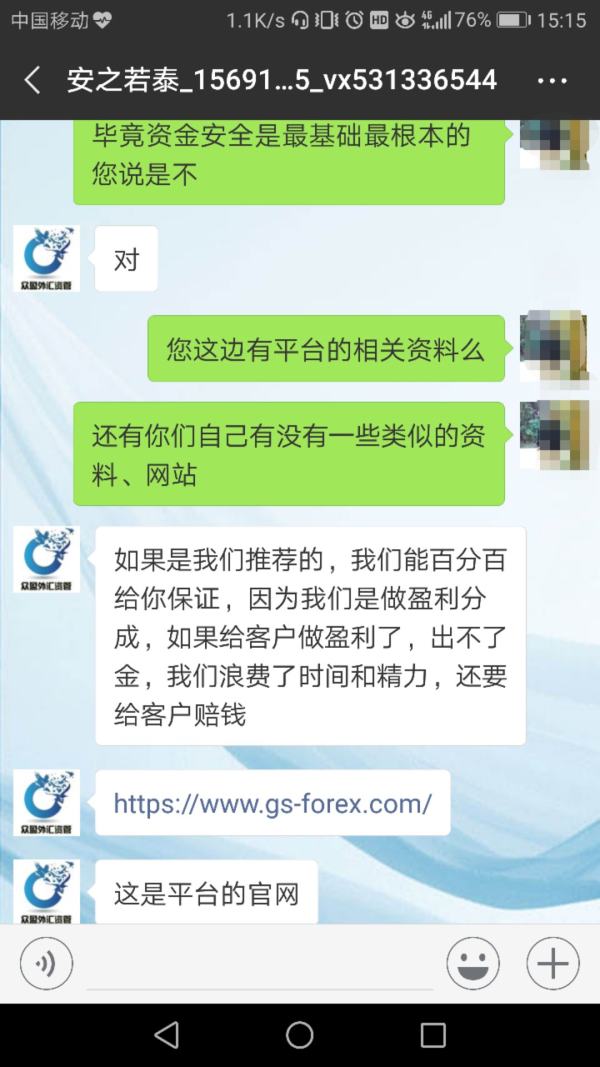

Trust and safety represent the most concerning aspects of GS-Forex operations, with multiple sources identifying significant fraud risks associated with the broker. Industry monitoring services have flagged the broker as potentially fraudulent, creating substantial safety concerns for potential clients considering their services. The absence of clear regulatory oversight information compounds these trust issues significantly. Legitimate brokers typically provide transparent details about their regulatory status and client protection measures for user confidence.

The lack of specified regulatory framework means clients have limited recourse options in case of disputes or operational issues. Professional trading environments require robust client fund protection measures, segregated account structures, and regulatory oversight to ensure operational integrity and client safety. Without clear regulatory backing or transparent safety measures, clients face elevated risks regarding fund security and operational reliability in their trading activities. The combination of fraud warnings and regulatory uncertainty creates an environment unsuitable for traders prioritizing capital protection and operational transparency. These safety concerns significantly outweigh any potential benefits offered by the broker's trading platform or asset selection for risk-conscious traders.

User Experience Analysis

Overall user experience with GS-Forex appears predominantly negative based on available feedback and review patterns from multiple sources. With only one positive review against 23 exposure reports, the user satisfaction metrics suggest widespread dissatisfaction with the broker's services across different client segments. The significant imbalance between positive and negative feedback indicates systemic issues affecting user experience rather than isolated problems or individual grievances.

The concentration of complaints around customer service quality suggests that user experience problems extend beyond technical platform issues to fundamental service delivery failures. Without detailed information about registration processes, account verification procedures, or fund management experiences, the assessment relies heavily on the pattern of negative feedback and fraud warnings from industry sources. The absence of positive user testimonials about platform usability, service quality, or overall satisfaction further reinforces concerns about the broker's operational standards. For traders seeking reliable, user-friendly trading environments with strong customer satisfaction records, the current user experience indicators suggest GS-Forex does not meet these requirements. This creates significant concerns for potential clients considering their services for trading activities.

Conclusion

This comprehensive evaluation reveals that GS-Forex presents significant risks that outweigh its limited advantages. While the broker offers multiple payment options and MT4 platform access across various asset classes, the overwhelming concerns about fraud risks, poor customer service, and lack of regulatory transparency make it unsuitable for traders prioritizing security and reliability. The broker is not recommended for users seeking high safety standards, transparent operations, or quality customer support in their trading environment. The main advantages include diverse payment methods and multi-asset trading capabilities for portfolio diversification. However, these are overshadowed by substantial disadvantages including fraud warnings, inadequate customer service, and absence of clear regulatory protection that create significant risks for potential clients.