Is GOOD ENOUGH FX safe?

Business

License

Is Good Enough FX Safe or a Scam?

Introduction

Good Enough FX is a trading platform that has emerged in the forex market, claiming to provide a diverse array of financial instruments including major currency pairs and cryptocurrencies. As the forex market continues to grow, traders must exercise caution when selecting a broker. The presence of scams and unregulated entities makes it imperative for traders to thoroughly assess the legitimacy and safety of their chosen platforms. This article aims to investigate the safety of Good Enough FX by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its credibility and safety. Good Enough FX operates from the British Virgin Islands, but it lacks clear regulatory oversight. This absence of regulation poses significant risks for traders, as unregulated brokers are not held accountable to any governing body. Below, we summarize the core regulatory information for Good Enough FX:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | British Virgin Islands | Unregulated |

The lack of a regulatory framework raises serious concerns regarding the protection of client funds and the overall integrity of the trading environment. Well-regulated brokers are typically required to adhere to strict financial standards, including maintaining a minimum capital reserve and segregating client funds. The absence of these safeguards with Good Enough FX indicates a potentially high-risk trading environment. Furthermore, the platform's unclear compliance history and lack of transparency in its operations further exacerbate these concerns.

Company Background Investigation

Good Enough FX was established approximately 2-5 years ago, positioning itself as a new player in the forex industry. However, the companys ownership structure and management team remain largely undisclosed, raising questions about its transparency and accountability. A thorough background check on the management team is essential to assess their qualifications and experience in the trading sector. Unfortunately, the limited information available makes it difficult to evaluate the expertise of those at the helm of Good Enough FX.

In terms of transparency, Good Enough FX falls short. A reputable broker should provide clear and accessible information regarding its ownership, management, and operational practices. The lack of such information may deter potential clients who seek a trustworthy trading environment. Furthermore, the absence of a well-defined corporate structure can lead to skepticism regarding the platform's long-term viability and commitment to ethical trading practices.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for evaluating its overall value. Good Enough FX claims to provide competitive trading conditions, including access to various financial instruments and leverage options. However, the absence of clear information regarding its fee structure and trading costs raises concerns. Below is a comparison of key trading costs associated with Good Enough FX:

| Cost Type | Good Enough FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 0.5 - 1.5 pips |

| Commission Model | Not specified | $5 per 100,000 traded |

| Overnight Interest Range | Not specified | Varies |

The variability in spreads and lack of a defined commission model suggest that traders may face unpredictable costs when trading with Good Enough FX. Additionally, the potential for hidden fees or unfavorable trading conditions raises red flags for traders considering this platform. A transparent fee structure is crucial for ensuring that traders can accurately assess their potential profits and losses.

Client Fund Security

The safety of client funds is paramount in the forex trading environment. Good Enough FX's lack of regulatory oversight raises significant concerns regarding its fund security measures. A responsible broker should implement client fund segregation, ensuring that client assets are kept separate from the company's operational funds. Furthermore, investor protection mechanisms, such as negative balance protection, are essential for safeguarding traders against significant losses.

Unfortunately, Good Enough FX does not provide clear information about its fund security policies. The absence of details regarding client fund segregation and investor protection raises questions about the safety of traders' investments. Historical issues related to fund security or client disputes could indicate a pattern of negligence or mismanagement, further emphasizing the need for caution when considering this broker.

Customer Experience and Complaints

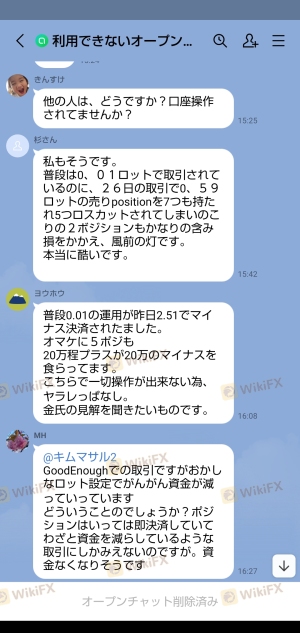

Analyzing customer feedback is crucial for understanding the overall experience of traders using a particular platform. Reviews of Good Enough FX reveal a mixed bag of experiences, with some users expressing dissatisfaction with the platform's customer service and withdrawal processes. Common complaints include difficulties in fund withdrawals, lack of timely support, and unclear communication regarding trading conditions.

Below is a summary of the primary complaint types associated with Good Enough FX:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Limited availability |

| Transparency Concerns | High | Unaddressed |

Several users have reported experiencing delays in withdrawing funds, which can be a significant red flag for potential clients. A broker's ability to facilitate smooth and timely withdrawals is a critical aspect of its trustworthiness. The lack of a proactive response from Good Enough FX regarding these complaints further exacerbates concerns about its reliability as a trading platform.

Platform and Execution

The performance and reliability of a trading platform are crucial for a smooth trading experience. Good Enough FX utilizes the MetaTrader 4 (MT4) platform, which is widely recognized and popular among traders. However, the overall performance of the platform, including order execution quality and slippage, is essential for evaluating its effectiveness.

Traders have reported mixed experiences with order execution on Good Enough FX. Some users have noted instances of slippage during high volatility periods, which can significantly impact trading outcomes. Additionally, concerns about potential order rejections or manipulation may arise if a broker does not maintain transparent practices regarding trade execution.

Risk Assessment

Engaging with Good Enough FX involves various risks, primarily due to its unregulated status and lack of transparency. Below is a risk assessment summary of key areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No regulatory oversight |

| Fund Security | High | Lack of client fund segregation |

| Customer Support | Medium | Limited responsiveness |

| Trading Conditions | High | Unclear fees and potential hidden costs |

To mitigate these risks, traders are advised to conduct thorough research before committing to Good Enough FX. Utilizing demo accounts to test the platform without financial exposure can also be a prudent approach for potential clients.

Conclusion and Recommendations

In conclusion, the investigation into Good Enough FX raises several concerns regarding its safety and legitimacy. The absence of regulatory oversight, unclear trading conditions, and mixed customer experiences suggest that traders should exercise extreme caution when considering this broker. While Good Enough FX may offer a variety of trading options, the potential risks associated with its unregulated status and lack of transparency cannot be overlooked.

For traders seeking a reliable and trustworthy forex broker, it is advisable to explore alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers such as IG, Forex.com, and Pepperstone provide robust regulatory frameworks, transparent fee structures, and positive user experiences, making them safer options for forex trading.

In summary, while Good Enough FX may present itself as a viable trading platform, the significant risks involved warrant careful consideration. Traders should prioritize their safety and security by opting for brokers that adhere to stringent regulatory standards and offer comprehensive support.

Is GOOD ENOUGH FX a scam, or is it legit?

The latest exposure and evaluation content of GOOD ENOUGH FX brokers.

GOOD ENOUGH FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GOOD ENOUGH FX latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.