Is GGFX safe?

Business

License

Is GGFX Safe or a Scam?

Introduction

GGFX is a forex broker that has emerged in the competitive landscape of online trading since its establishment in 2017. Positioned as a platform for retail traders, GGFX offers a wide array of trading instruments, including currencies, stocks, indices, and commodities. However, with the proliferation of online trading platforms, it is crucial for traders to carefully evaluate the legitimacy and reliability of their chosen brokers. This is particularly important given the potential risks associated with unregulated or poorly regulated trading environments, which can lead to significant financial losses.

In this article, we will conduct a thorough investigation into the safety and reliability of GGFX. Our evaluation will be based on a comprehensive review of regulatory compliance, company background, trading conditions, customer experiences, and platform performance. By analyzing these factors, we aim to provide a balanced perspective on whether GGFX is a safe trading option or if it raises red flags that warrant caution.

Regulatory and Legitimacy

When assessing the safety of any forex broker, regulatory compliance is a critical factor. Regulation serves as a safeguard for traders, ensuring that brokers adhere to established standards of conduct and financial practices. GGFX claims to be registered with the Financial Service Providers Register (FSPR) in New Zealand. However, its regulatory status has been flagged as a "suspicious clone," raising concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | 371806 | New Zealand | Suspicious Clone |

The designation of GGFX as a "suspicious clone" suggests that it may not be operating under legitimate regulatory oversight. This is a significant concern, as brokers lacking robust regulatory frameworks often expose their clients to higher risks, including fraud and mismanagement of funds. Furthermore, the historical compliance record of GGFX is not well-documented, which adds to the uncertainty surrounding its operations.

Company Background Investigation

GGFX was founded in 2017, and while it has been in operation for several years, detailed information regarding its ownership structure and company history is limited. The broker is reportedly operated by Golden Grand Global Holding Limited, which raises questions about transparency and accountability. The management team behind GGFX lacks publicly available profiles that detail their experience and qualifications in the financial sector, which further complicates the assessment of the company's credibility.

Transparency is a vital component of any financial institution's operations. Brokers that openly disclose their ownership, management, and operational practices tend to instill greater confidence among traders. However, GGFX's lack of detailed information about its management team and corporate structure may deter potential clients who prioritize transparency.

Trading Conditions Analysis

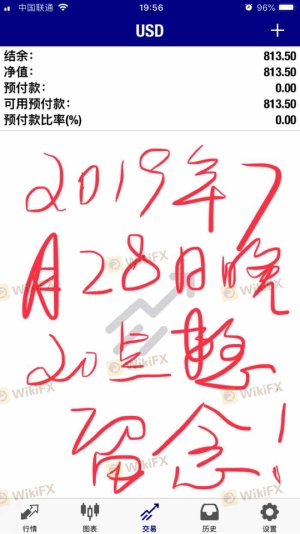

The trading conditions offered by GGFX are another critical aspect to consider when evaluating its safety. The broker provides a variety of account types, including standard, premium, and VIP accounts, with a minimum deposit requirement of just $100. While this low entry barrier may attract novice traders, it also raises questions about the overall quality of the trading experience.

Fee Structure: GGFX's fee structure includes spreads starting from 0.6 pips, but specific details regarding commissions and overnight interest rates are not clearly outlined. This lack of transparency can lead to unexpected costs for traders, making it difficult to accurately assess the total cost of trading.

| Fee Type | GGFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips | 1.0 pips |

| Commission Model | Not specified | Varies widely |

| Overnight Interest Range | Not specified | Varies widely |

The ambiguity surrounding GGFX's commission model and overnight interest rates is a potential red flag. Traders should be wary of brokers that do not provide clear and detailed information about their fees, as this can lead to hidden costs that erode profitability.

Customer Funds Security

The security of customer funds is paramount in the forex trading industry. GGFX claims to implement various safety measures to protect traders' funds, including segregated accounts. This practice is designed to ensure that client funds are kept separate from the broker's operational funds, providing an additional layer of security in the event of financial difficulties.

However, the absence of information regarding negative balance protection and investor compensation schemes raises concerns about the overall safety of funds held with GGFX. Historical incidents involving fund mismanagement or security breaches can significantly impact a broker's reputation and trustworthiness. Given the limited information available about GGFX's fund security measures, potential clients should exercise caution.

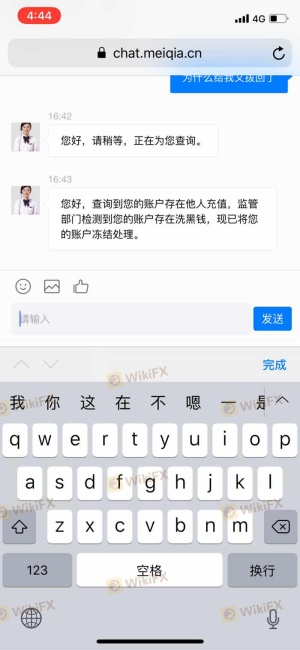

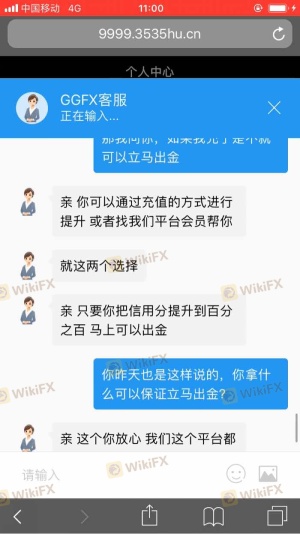

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability. A review of user experiences with GGFX reveals a pattern of complaints related to difficulties in withdrawing funds and inadequate customer support. Many users have reported being unable to access their funds, which is a significant concern when evaluating the safety of any trading platform.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No response |

| Customer Support Issues | Medium | Inconsistent |

Numerous complaints highlight the challenges traders face when attempting to withdraw their funds, with some users alleging that their accounts were frozen without explanation. Such issues are indicative of potential operational problems within GGFX and raise questions about the broker's commitment to customer service.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. GGFX offers access to popular trading platforms such as MetaTrader 4 and MetaTrader 5. These platforms are widely recognized for their user-friendly interfaces and advanced trading features. However, the overall performance and reliability of these platforms are crucial for successful trading execution.

Traders have reported mixed experiences with order execution quality on GGFX's platforms, with some users experiencing slippage and rejected orders. Slippage occurs when trades are executed at prices different from the expected price, which can negatively impact profitability. Additionally, any signs of platform manipulation should be carefully scrutinized, as they can indicate deeper issues with the broker's operations.

Risk Assessment

Using GGFX as a trading platform comes with inherent risks. The combination of regulatory uncertainties, customer complaints, and unclear trading conditions creates a complex risk landscape for potential traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Suspicious clone status raises concerns. |

| Fund Security | Medium | Limited information on fund protection measures. |

| Withdrawal Issues | High | Numerous complaints regarding fund access. |

| Trading Conditions | Medium | Lack of transparency in fees and commissions. |

To mitigate these risks, traders should conduct thorough research before committing funds to GGFX. Engaging in small trades initially and assessing the platform's performance can help gauge its reliability.

Conclusion and Recommendations

In conclusion, while GGFX presents itself as a forex broker with various trading options, there are numerous concerns that potential traders should consider. The suspicious clone status, lack of regulatory transparency, and a pattern of customer complaints about withdrawal issues raise significant red flags.

For traders seeking a reliable and safe trading environment, it may be prudent to consider alternative brokers with robust regulatory oversight and positive customer reviews. Brokers regulated by top-tier authorities such as the FCA or ASIC are generally more trustworthy and offer better protection for client funds.

In summary, is GGFX safe? The evidence suggests that potential traders should approach with caution and consider the risks involved.

Is GGFX a scam, or is it legit?

The latest exposure and evaluation content of GGFX brokers.

GGFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GGFX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.