Is Global exchange safe?

Pros

Cons

Is Global Exchange Safe or a Scam?

Introduction

In the ever-evolving landscape of the forex market, Global Exchange has emerged as a notable player, offering a range of trading services to both novice and seasoned traders. As with any financial service provider, it is crucial for traders to exercise caution and conduct thorough evaluations before engaging with a broker. This is especially true in the forex market, which is rife with opportunities but also fraught with risks, including potential scams. In this article, we will delve into a comprehensive assessment of Global Exchange, utilizing data from various reputable sources to determine whether it is a safe trading option or a potential scam.

Our investigation will focus on several key areas: regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and an overall risk assessment. By employing this structured approach, we aim to provide an objective analysis that highlights both the strengths and weaknesses of Global Exchange.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in assessing its safety. Regulation serves as a safeguard for traders, ensuring that brokers adhere to industry standards and practices. Unfortunately, Global Exchange operates without any notable regulatory oversight, which raises significant concerns regarding its legitimacy and the safety of client funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a regulatory body overseeing Global Exchange means that traders lack the protections typically afforded by regulated brokers. Regulatory authorities impose strict guidelines, including capital requirements, client fund segregation, and regular audits, all of which contribute to a safer trading environment. Without such oversight, there is an increased risk of malpractice, fraud, and mismanagement of funds. Historical compliance records also indicate that unregulated brokers often have a higher incidence of complaints and disputes, further complicating the trading experience.

Company Background Investigation

Understanding the background of Global Exchange is essential in evaluating its credibility. The company claims to have been operational for several years, but specific details regarding its history, ownership structure, and management team are sparse. A lack of transparency in these areas can be a red flag for potential investors.

The management team‘s background and experience are crucial in determining the company’s reliability. Unfortunately, there is limited information available about the individuals behind Global Exchange, which raises questions about their expertise and commitment to ethical trading practices. Furthermore, the company's transparency regarding its operations and financial health appears to be minimal, which could hinder traders' ability to make informed decisions.

Trading Conditions Analysis

When evaluating whether Global Exchange is safe, it is also essential to analyze its trading conditions. A broker's fee structure and trading costs can significantly impact a trader's profitability. Global Exchange offers a variety of account types, but the specifics regarding fees and spreads are often unclear, leading to potential confusion and unexpected costs for traders.

| Fee Type | Global Exchange | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Variable (typically high) | Lower than average |

| Commission Model | None specified | Varies widely |

| Overnight Interest Range | High | Moderate |

The lack of a clear commission structure and high spreads may indicate that traders could face higher costs than expected. Additionally, any unusual fees or hidden charges could further erode profitability, making it essential for traders to scrutinize the fine print before committing funds.

Client Fund Security

The safety of client funds is paramount when considering whether Global Exchange is safe. Unfortunately, the company does not provide adequate information regarding its client fund security measures. In regulated environments, brokers are required to maintain segregated accounts to protect client funds and often participate in compensation schemes to safeguard against potential insolvency.

Without such protections, traders may find themselves vulnerable to financial loss should the broker face operational difficulties. Additionally, there is no indication that Global Exchange offers negative balance protection, which is a critical feature for managing risk in volatile markets.

Customer Experience and Complaints

Customer feedback is a vital aspect of assessing a broker's reliability. Reviews of Global Exchange reveal a mixed bag of experiences, with several users reporting difficulties in withdrawing funds and receiving timely support. These issues can significantly impact a trader's overall experience and raise concerns about the broker's operational integrity.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Inconsistent |

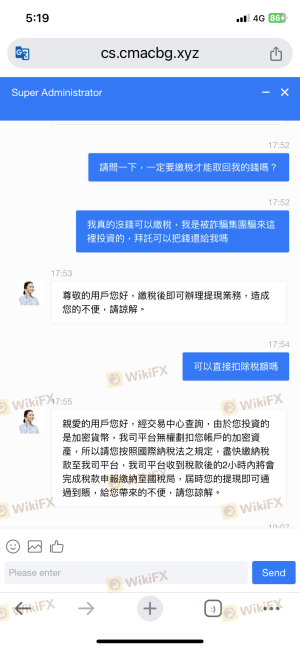

Common complaints include delays in fund withdrawals and poor customer service, which can leave traders feeling frustrated and unsupported. In some cases, users have reported that their accounts were frozen or that they were asked to pay additional fees before they could access their funds, which are typical warning signs of potential scams.

Platform and Trade Execution

The trading platform used by a broker is crucial for ensuring a smooth trading experience. Global Exchange offers several platforms, including the widely used MetaTrader 4 (MT4). However, user reviews suggest that the platform may experience stability issues, leading to slippage and rejected orders during critical trading times.

Traders have reported instances of poor execution quality, which can result in significant financial losses, particularly in fast-moving markets. Any signs of platform manipulation, such as artificially widening spreads or preventing trades from being executed, should be taken very seriously and warrant caution.

Risk Assessment

Engaging with Global Exchange carries inherent risks that traders must consider. The absence of regulation, coupled with customer complaints and unclear trading conditions, creates a precarious trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight |

| Financial Risk | High | Potential loss of funds |

| Execution Risk | Medium | Possible slippage and rejections |

To mitigate these risks, traders should conduct thorough due diligence, consider using smaller amounts to test the platform, and remain vigilant for any unusual activity. Additionally, exploring alternative brokers with robust regulatory oversight may provide a safer trading environment.

Conclusion and Recommendations

After a thorough investigation of Global Exchange, it is evident that the broker poses several risks that potential traders should carefully consider. The lack of regulatory oversight, coupled with numerous customer complaints and unclear trading conditions, raises significant concerns about the safety of engaging with this broker.

In conclusion, while Global Exchange may offer attractive trading conditions, the associated risks suggest that traders should proceed with caution. It is advisable to explore alternative brokers that are well-regulated, transparent, and have a proven track record of customer satisfaction. By prioritizing safety and due diligence, traders can better navigate the complexities of the forex market and protect their investments.

Is Global exchange a scam, or is it legit?

The latest exposure and evaluation content of Global exchange brokers.

Global exchange Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Global exchange latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.