Regarding the legitimacy of fxglobe forex brokers, it provides CYSEC, VFSC, FSCA and WikiBit, (also has a graphic survey regarding security).

Is fxglobe safe?

Software Index

Risk Control

Is fxglobe markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP) 19

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

FXGlobe Ltd

Effective Date:

2013-06-20Email Address of Licensed Institution:

support@fxglobe.euSharing Status:

No SharingWebsite of Licensed Institution:

www.fxglobe.euExpiration Time:

--Address of Licensed Institution:

Louki Akrita 2 Street, Limassol, 3030, CyprusPhone Number of Licensed Institution:

+357 25 870 060Licensed Institution Certified Documents:

VFSC Derivatives Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

FS International Limited

Effective Date: Change Record

2023-07-04Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

APLFX (PTY) LTD

Effective Date:

2021-12-07Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

BUILDING 1FOREST ROADWAVERLEY2199Phone Number of Licensed Institution:

0716054190Licensed Institution Certified Documents:

Is FXGlobe A Scam?

Introduction

FXGlobe is a forex broker that has positioned itself in the competitive landscape of online trading, offering a variety of financial instruments including forex pairs, CFDs, and commodities. Established in 2008 and headquartered in Limassol, Cyprus, FXGlobe claims to provide a user-friendly trading experience with advanced platforms and competitive trading conditions. However, the forex market is rife with potential pitfalls, making it crucial for traders to carefully evaluate the legitimacy and trustworthiness of brokers before committing their funds. This article aims to provide an objective analysis of FXGlobe, focusing on its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks. The investigation is based on information gathered from various reputable sources, including regulatory bodies, user reviews, and financial analysis websites.

Regulation and Legitimacy

The regulatory framework within which a broker operates is a vital indicator of its legitimacy and safety. FXGlobe is regulated by the Cyprus Securities and Exchange Commission (CySEC) and has additional licenses from the Vanuatu Financial Services Commission (VFSC) and the Financial Sector Conduct Authority (FSCA) in South Africa. Below is a summary of the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 205/13 | Cyprus | Verified |

| VFSC | 700227 | Vanuatu | Verified |

| FSCA | 52045 | South Africa | Verified |

While the presence of regulation by CySEC is a positive aspect, it is essential to note that the broker also operates under the VFSC, which is often considered a less stringent regulatory body. The quality of regulation can significantly impact the safety of client funds and the overall trading environment. Additionally, FXGlobe has faced warnings from regulatory authorities, including the UK's Financial Conduct Authority (FCA) and Italy's CONSOB, for providing services without proper authorization in certain jurisdictions. These warnings raise concerns about the broker's adherence to regulatory standards and customer protection mechanisms.

Company Background Investigation

FXGlobe Ltd. has a history that dates back to 2008, initially starting as a small trading venture among friends. Over the years, it has evolved into a more structured financial services provider, catering to a global clientele. The ownership structure of FXGlobe is somewhat opaque, with limited information available about its management team. While the company claims to prioritize transparency, the lack of detailed disclosures regarding its leadership and operational practices is a potential red flag.

The management team‘s background and professional experience are critical in assessing the broker’s reliability. However, user feedback indicates a lack of responsiveness from customer support, which further complicates the evaluation of the company's operational transparency. The absence of a well-defined leadership profile and clear communication about the companys structure can lead to skepticism among potential clients regarding FXGlobe's integrity.

Trading Conditions Analysis

FXGlobe offers a variety of trading accounts with different conditions, including a standard account with a minimum deposit of $250 and an ECN account requiring a deposit of $2,000. The broker provides leverage of up to 1:500, which can be attractive for traders seeking to maximize their exposure but also comes with increased risk. The overall fee structure is another critical aspect that traders should consider. Below is a comparison of core trading costs:

| Fee Type | FXGlobe | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.7 pips | From 1.0 pips |

| Commission Model | $7 per lot (ECN) | $5 per lot |

| Overnight Interest Range | Varies | Varies |

While FXGlobes spreads may seem competitive, they are on the higher end compared to some industry peers. Additionally, the commission structure for ECN accounts may deter some traders due to the relatively high fees. It is crucial for traders to carefully review the fee schedule and understand how these costs can impact their overall trading profitability.

Customer Fund Security

The security of customer funds is paramount in the forex trading environment. FXGlobe claims to implement measures such as segregated accounts to protect client funds. This practice ensures that client funds are kept separate from the broker's operational funds, providing an additional layer of security. Furthermore, FXGlobe is a member of the investor compensation fund, which can offer some level of protection in the event of insolvency.

However, historical issues related to fund withdrawals and customer complaints raise questions about the effectiveness of these security measures. Traders have reported difficulties in accessing their funds and have expressed concerns regarding the broker's responsiveness to withdrawal requests. It is vital for potential clients to be aware of these issues and consider the implications for the safety of their investments.

Customer Experience and Complaints

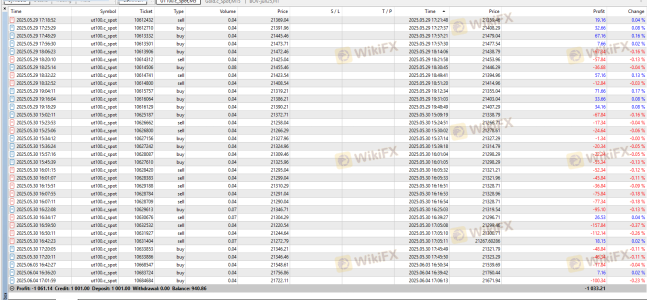

User feedback and reviews are invaluable in assessing the performance and reliability of a broker. FXGlobe has received a mix of reviews, with some users praising its trading platform and educational resources, while others have reported significant issues, particularly concerning customer support and fund withdrawals. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Inconsistent |

| Poor Customer Support | Medium | Evasive |

| Platform Stability Issues | High | Unaddressed |

Two notable case studies highlight these concerns. One user reported a prolonged delay in processing a withdrawal request, leading to frustration and financial strain. Another trader expressed dissatisfaction with the quality of customer support, noting that inquiries were often met with vague responses and a lack of resolution. These patterns of complaints suggest that while FXGlobe may offer competitive trading conditions, the overall customer experience may leave much to be desired.

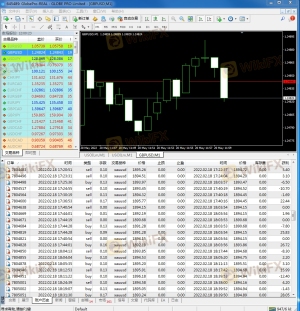

Platform and Trade Execution

The performance of a trading platform is critical for a seamless trading experience. FXGlobe offers the popular MetaTrader 4 (MT4) and its proprietary web trader. However, user experiences indicate that there have been issues with platform stability, including slow execution times and occasional glitches.

Order execution quality is another area of concern, with reports of slippage and rejected orders. Traders have noted that during periods of high volatility, the platform may struggle to execute trades at desired prices, leading to potential losses. These issues can significantly impact a trader's ability to capitalize on market opportunities and raise questions about the broker's operational integrity.

Risk Assessment

Using FXGlobe involves several risks that potential clients should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Mixed regulatory oversight, with warnings from authorities. |

| Customer Fund Security | High | Reports of withdrawal issues and customer dissatisfaction. |

| Platform Reliability | High | User complaints about execution delays and platform stability. |

To mitigate these risks, potential clients should conduct thorough due diligence, consider starting with a demo account, and be cautious about the amount of capital they commit to trading with FXGlobe.

Conclusion and Recommendations

In conclusion, FXGlobe presents a complex picture. While it is regulated by CySEC and claims to adhere to industry standards, the presence of warnings from regulatory bodies and numerous customer complaints raises significant concerns. The broker's operational transparency and responsiveness to client needs are questionable, which may deter potential investors.

For traders considering FXGlobe, it is advisable to proceed with caution. Those new to trading or with limited experience may want to explore more established brokers with a stronger reputation for customer service and regulatory compliance. Alternative brokers with robust regulatory oversight and positive user feedback should be prioritized to ensure a safer trading environment.

Is fxglobe a scam, or is it legit?

The latest exposure and evaluation content of fxglobe brokers.

fxglobe Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

fxglobe latest industry rating score is 4.84, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.84 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.