FXGlobe 2025 Review: Everything You Need to Know

Executive Summary

FXGlobe is an online forex broker that has been operating since 2009. It has established itself as a regulated financial services provider under the supervision of CySEC (Cyprus Securities and Exchange Commission). This fxglobe review reveals a broker that serves over 45,000 retail investors globally. The company offers a diverse range of trading instruments including forex, commodities, indices, stocks, and cryptocurrencies.

Based on available user feedback and industry analysis, FXGlobe has earned an overall rating of 8 out of 10 from 226 customer reviews. This rating indicates generally positive user experiences. The broker's key strengths lie in its competitive CFD trading offerings, fast execution speeds, and responsive customer service support. Users particularly appreciate the platform's reliability. They also value the company's commitment to providing quality trading conditions.

The primary target audience for FXGlobe consists of retail investors, particularly those interested in forex and cryptocurrency trading. The broker's service model focuses on providing accessible trading solutions for individual traders rather than institutional clients. According to tradingbrokers.com, FXGlobe has positioned itself as a user-friendly platform. It caters to both novice and experienced traders seeking diverse asset exposure.

However, this evaluation is based on publicly available information and user testimonials. These sources may not capture all aspects of the trading experience. Potential traders should conduct their own due diligence before making investment decisions.

Important Notice

This fxglobe review is compiled based on publicly available information, user feedback, and regulatory filings as of 2025. FXGlobe operates under CySEC regulation in Cyprus. However, regulatory conditions may vary across different jurisdictions where the broker offers services.

It's important to note that regulatory frameworks and trading conditions can change over time. This review reflects the current available information. The analysis presented here is based on user testimonials and publicly disclosed data. These sources may not encompass all trading conditions or service aspects that individual traders might experience.

Prospective clients should independently verify all information and consider their own financial circumstances before engaging with any broker. Trading in forex and CFDs involves significant risk. It may not be suitable for all investors.

Rating Framework

Broker Overview

FXGlobe was established in 2009. Since then, it has grown to become a notable presence in the online trading industry. The company is headquartered in Cyprus and operates under the regulatory framework of the Cyprus Securities and Exchange Commission (CySEC). This provides a level of regulatory oversight that is recognized across the European Union. The broker has built its reputation by serving over 45,000 retail investors worldwide. It focuses on delivering accessible trading solutions for individual traders.

The company's business model centers on providing online financial trading services through CFD (Contracts for Difference) products. This approach allows clients to trade on price movements of various financial instruments without owning the underlying assets. According to investingbrokers.com, FXGlobe has positioned itself as a comprehensive trading platform. It caters to the diverse needs of modern retail traders.

FXGlobe offers trading access to multiple asset classes, including foreign exchange (forex), commodities, stock indices, individual stocks, and cryptocurrencies. This diversified offering allows traders to build varied portfolios and take advantage of different market opportunities across global financial markets. The broker's platform supports CFD trading across all these asset categories. It provides leverage options that can amplify both potential profits and losses.

The company operates under CySEC license, which requires adherence to strict European financial regulations including segregated client funds, regular audits, and participation in investor compensation schemes. This regulatory framework provides important protections for client investments. It ensures operational transparency that is essential for building trader confidence.

Regulatory Status

FXGlobe operates under the regulation of CySEC (Cyprus Securities and Exchange Commission). This provides European Union-level regulatory oversight. This regulatory framework ensures compliance with MiFID II directives. It provides important investor protections including segregated client funds and participation in the Investor Compensation Fund.

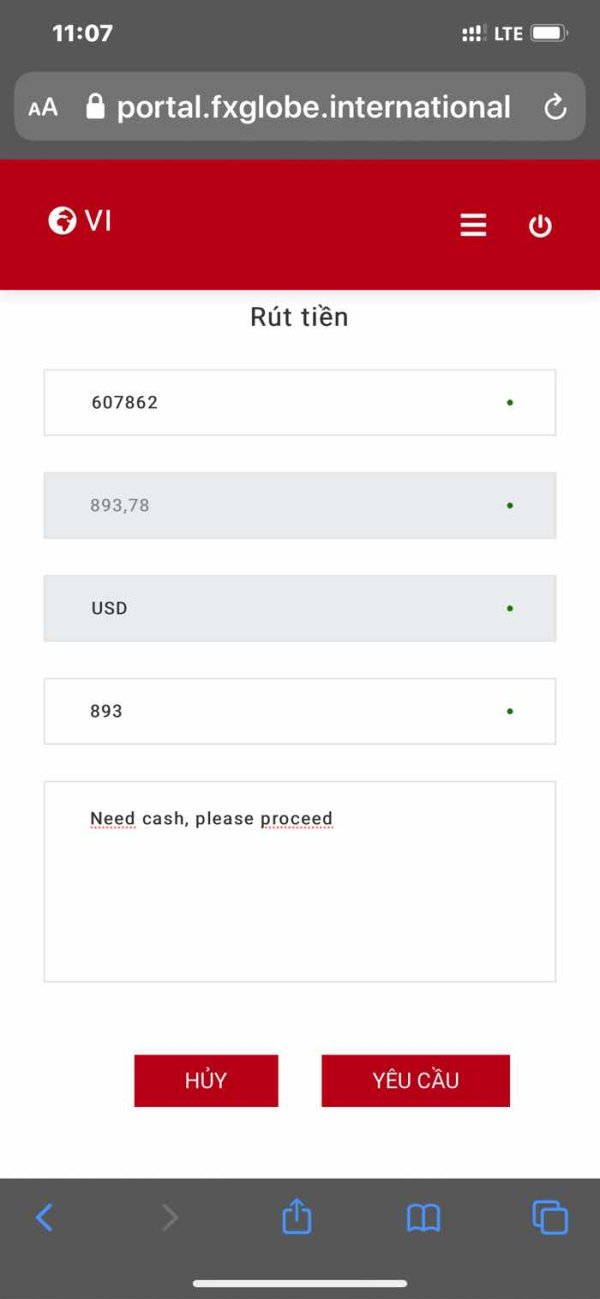

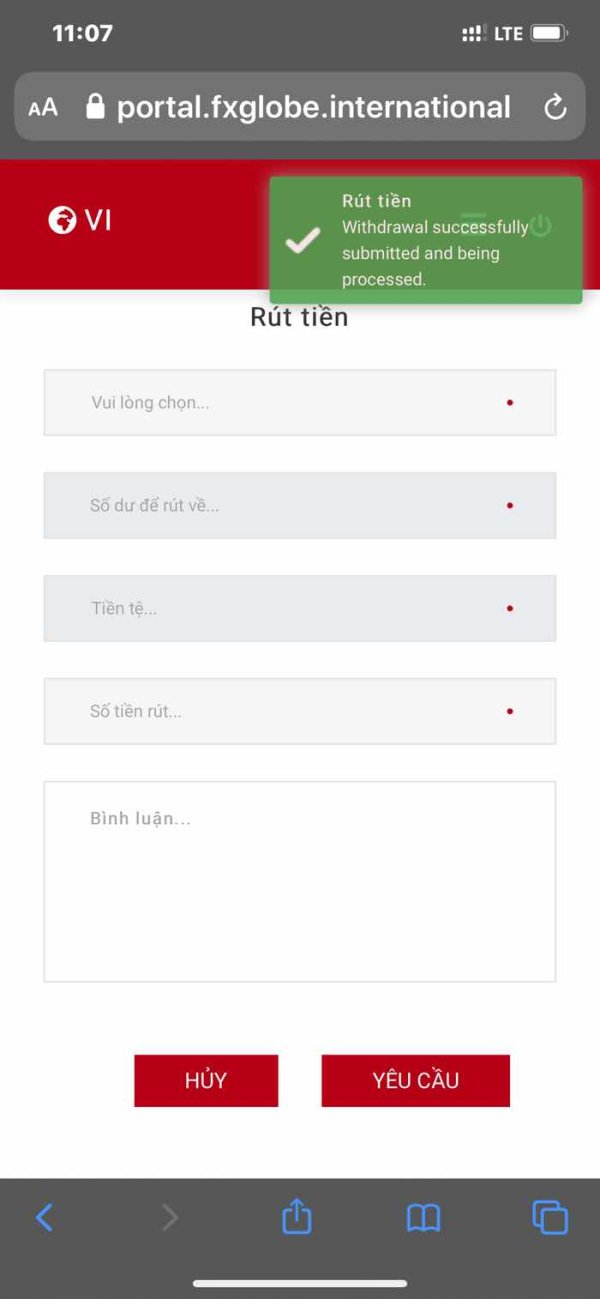

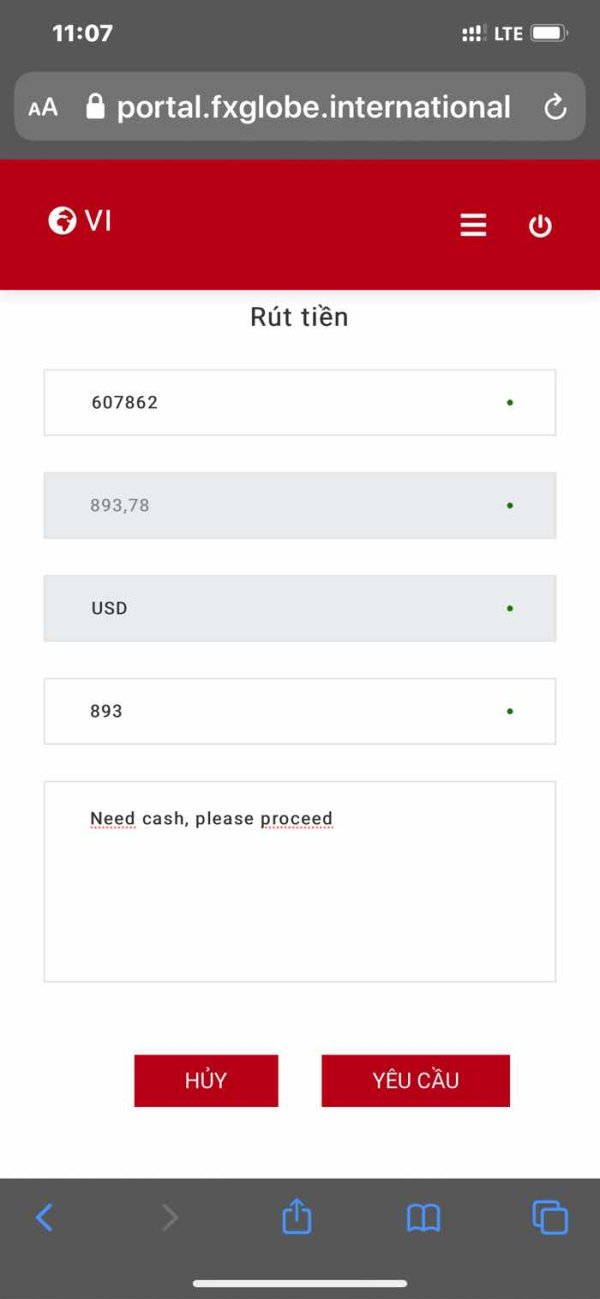

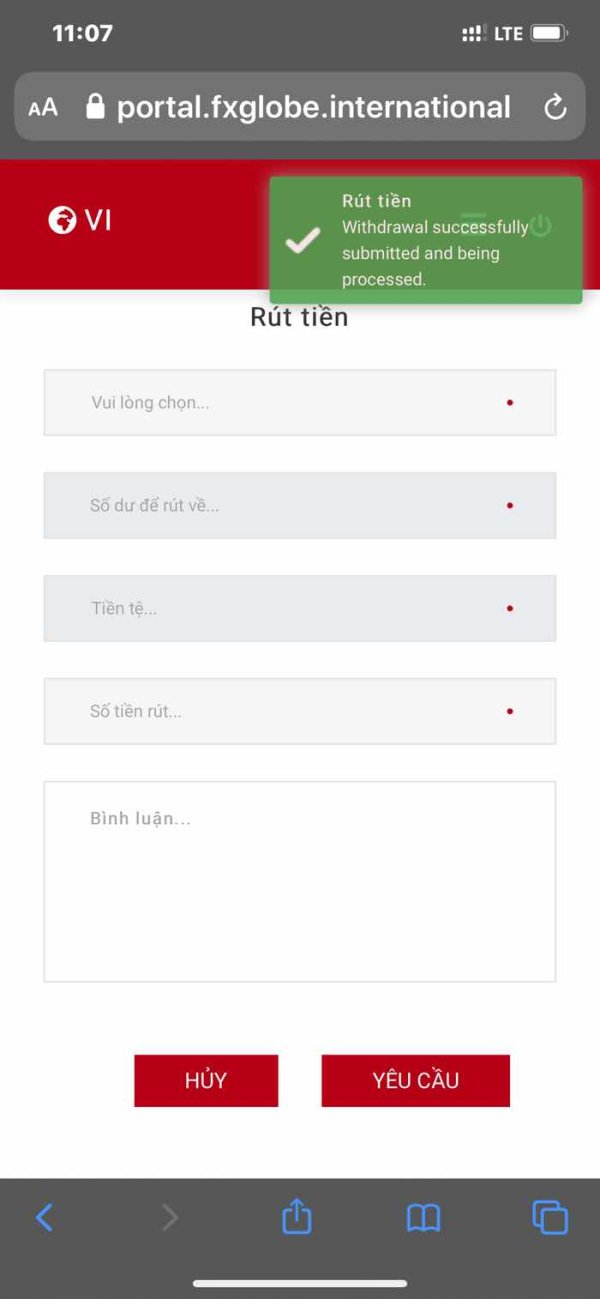

Deposit and Withdrawal Options

Specific information regarding deposit and withdrawal methods is not detailed in available public documentation. Prospective clients should contact FXGlobe directly to obtain current information about supported payment methods, processing times, and any associated fees.

Minimum Deposit Requirements

The minimum deposit requirement information is not specified in publicly available materials. This fxglobe review recommends contacting the broker directly for current account opening requirements and funding minimums.

Current promotional offerings and bonus programs are not detailed in available public information. Traders interested in promotional opportunities should inquire directly with FXGlobe about any available incentives or welcome bonuses.

Tradeable Assets

FXGlobe provides access to a comprehensive range of financial instruments through CFD trading. The asset classes include major and minor currency pairs in the forex market, popular commodities such as gold and oil, major stock indices from global markets, individual company stocks, and a selection of cryptocurrency pairs. This diverse offering enables traders to implement various trading strategies across different market sectors.

Cost Structure

Specific information regarding spreads, commissions, overnight fees, and other trading costs is not detailed in publicly available documentation. The cost structure represents a crucial factor for trading profitability. Potential clients should request detailed fee schedules directly from FXGlobe.

Leverage Options

Leverage ratios and margin requirements are not specified in available public materials. Given the regulatory environment under CySEC, leverage limits likely comply with ESMA guidelines for retail clients.

The specific trading platform or platforms offered by FXGlobe are not detailed in current public information. Platform selection is crucial for trading success. Prospective clients should inquire about available platform options and their features.

Geographic Restrictions

Information regarding geographic restrictions and service availability is not specified in available documentation. Regulatory requirements may limit service availability in certain jurisdictions.

Customer Support Languages

The range of languages supported by FXGlobe's customer service team is not detailed in publicly available information. However, the broker's European base suggests multilingual support capabilities.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

The evaluation of FXGlobe's account conditions is limited by the lack of specific publicly available information regarding account types, minimum deposit requirements, and detailed fee structures. This fxglobe review finds that while the broker operates under proper regulatory oversight, the absence of transparent pricing information impacts the overall assessment of account conditions.

Account opening processes and verification requirements are not detailed in available materials. This makes it difficult to assess the accessibility and convenience of beginning trading with FXGlobe. The regulatory framework under CySEC suggests standard KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures are in place. However, specific documentation requirements and processing times are not publicly disclosed.

The lack of information about different account tiers or special account features, such as Islamic accounts for Muslim traders, represents a gap in publicly available information. Many modern brokers offer various account types tailored to different trading styles and experience levels. FXGlobe's specific offerings in this area require direct inquiry.

Without detailed information about spreads, commissions, and other trading costs, it's challenging to evaluate the competitiveness of FXGlobe's account conditions against industry standards. This transparency gap affects the broker's rating in this category. Traders need clear cost information to make informed decisions about their trading activities.

FXGlobe demonstrates strength in its trading tools and resources, particularly in CFD trading capabilities across multiple asset classes. User feedback indicates positive experiences with the broker's trading tools. This suggests that the platform provides effective functionality for executing trades and managing positions across various financial instruments.

The broker's offering of diverse asset classes including forex, commodities, indices, stocks, and cryptocurrencies provides traders with comprehensive market access through a single platform. This diversity allows for portfolio diversification and the implementation of various trading strategies across different market sectors and time frames.

However, specific information about research and analysis resources is not detailed in available public materials. Many successful traders rely on market analysis, economic calendars, and research reports to inform their trading decisions. The absence of detailed information about these resources limits the complete evaluation of FXGlobe's analytical offerings.

Educational resources and training materials are not specifically mentioned in available documentation. In today's competitive brokerage environment, educational content has become increasingly important for trader development and retention. The availability and quality of educational resources would significantly impact the overall value proposition for new and developing traders.

Customer Service and Support Analysis (Score: 8/10)

FXGlobe receives consistently positive feedback regarding customer service quality and responsiveness. User reviews indicate that the broker provides excellent customer support with fast response times to client inquiries and issues. This strong performance in customer service represents one of FXGlobe's key competitive advantages.

The quality of customer service appears to be a standout feature based on user testimonials. Clients express satisfaction with the helpfulness and professionalism of support staff. Quick resolution of issues and proactive communication seem to be hallmarks of FXGlobe's customer service approach.

However, specific details about customer service channels, availability hours, and multilingual support are not provided in available public information. Modern traders expect multiple contact methods including phone, email, live chat, and sometimes social media support. The availability of 24/5 or 24/7 support during market hours is also crucial for active traders.

The geographic distribution of customer service capabilities and local language support would be important factors for international clients. While user feedback is positive overall, more detailed information about service accessibility across different time zones and languages would provide a more complete picture of FXGlobe's customer support capabilities.

Trading Experience Analysis (Score: 7/10)

User feedback consistently highlights FXGlobe's fast execution speeds as a significant strength of the trading experience. Quick order execution is crucial for successful trading, particularly in volatile markets where price movements can occur rapidly. The positive user feedback regarding execution speed suggests that FXGlobe has invested in robust technological infrastructure.

Order execution quality appears to be well-regarded by users, with multiple testimonials praising the reliability and speed of trade processing. This is particularly important for active traders and those implementing time-sensitive trading strategies where execution delays can impact profitability.

However, specific information about trading platforms, their features, and technical capabilities is not detailed in available public materials. Platform stability, advanced order types, charting capabilities, and analytical tools are all crucial components of the overall trading experience that require more detailed evaluation.

Mobile trading capabilities and cross-device synchronization are increasingly important in modern trading environments. However, specific information about FXGlobe's mobile offerings is not available in current documentation. The quality of mobile trading applications can significantly impact user experience, particularly for traders who need to monitor and manage positions while away from their primary workstations.

This fxglobe review notes that while user feedback on execution quality is positive, the lack of detailed platform information limits a comprehensive assessment of the complete trading experience.

Trust and Safety Analysis (Score: 6/10)

FXGlobe operates under CySEC regulation, which provides important regulatory oversight and investor protections. CySEC is a respected regulatory authority within the European Union. Its oversight includes requirements for segregated client funds, regular audits, and participation in investor compensation schemes.

The regulatory framework under CySEC ensures that FXGlobe must adhere to strict operational standards and maintain adequate capital reserves. This regulatory oversight provides important safeguards for client investments. It ensures that the broker operates within established financial industry standards.

However, industry discussions suggest that FXGlobe has faced some controversial aspects that impact its overall reputation. While specific details of these controversies are not elaborated in available materials, the existence of such discussions affects the broker's trust rating. This suggests that potential clients should conduct thorough due diligence.

The absence of detailed information about specific fund safety measures, insurance coverage beyond regulatory minimums, and transparency regarding company financial health limits the complete evaluation of trust and safety factors. Modern traders increasingly value transparency regarding broker financial stability and risk management practices.

User Experience Analysis (Score: 8/10)

FXGlobe achieves a strong user satisfaction rating of 8 out of 10 based on 226 customer reviews. This indicates high overall satisfaction among the broker's client base. This positive rating suggests that users generally find value in FXGlobe's services and are satisfied with their overall trading experience.

The high user satisfaction rating reflects positively on multiple aspects of the broker's operations, including platform reliability, customer service quality, and overall service delivery. Sustained positive user feedback over a substantial number of reviews indicates consistent service quality rather than isolated positive experiences.

The broker appears to be well-suited for retail investors, particularly those interested in forex and cryptocurrency trading. The user base feedback suggests that FXGlobe successfully meets the needs of individual traders seeking access to diverse financial markets through CFD trading.

However, specific information about user interface design, account management features, and the overall user journey from registration through active trading is not detailed in available materials. These factors significantly impact user experience but require more detailed analysis to evaluate comprehensively.

The absence of detailed information about common user complaints or areas for improvement limits the complete assessment of user experience factors. Understanding both positive aspects and areas needing enhancement would provide a more balanced view of the overall user experience with FXGlobe.

Conclusion

FXGlobe presents itself as an established forex and CFD broker with over 15 years of operation and regulatory oversight from CySEC. The broker demonstrates particular strengths in customer service quality and trade execution speed. It earns positive feedback from its user base of over 45,000 retail investors. The high user satisfaction rating of 8 out of 10 from 226 reviews indicates that FXGlobe successfully delivers value to its target audience of retail traders interested in forex and cryptocurrency markets.

The broker's comprehensive asset offering across forex, commodities, indices, stocks, and cryptocurrencies provides traders with diverse market access through CFD trading. However, this evaluation reveals significant gaps in publicly available information regarding specific trading conditions, platform features, and detailed cost structures that are essential for informed trading decisions.

While FXGlobe's regulatory status under CySEC provides important investor protections and operational oversight, potential clients should conduct thorough due diligence and directly verify all trading conditions, fees, and service features before committing to trading activities. The broker appears most suitable for retail investors seeking responsive customer service and reliable trade execution. It is particularly well-suited for those interested in diversified CFD trading across multiple asset classes.