Is FxCapitalTrading safe?

Business

License

Is FxCapitalTrading A Scam?

Introduction

FxCapitalTrading is an online forex broker that claims to offer a wide range of trading services, including forex, cryptocurrencies, and various financial instruments. As the forex market continues to expand, traders must be vigilant in assessing the legitimacy and safety of brokers like FxCapitalTrading. The importance of this evaluation cannot be overstated; unregulated or poorly governed brokers can expose traders to significant financial risks, including the potential loss of their invested capital. In this article, we will explore the regulatory status, company background, trading conditions, customer experiences, and overall risk assessment of FxCapitalTrading to determine if it is indeed a safe and legitimate trading platform or a potential scam. Our investigation is based on a synthesis of online reviews, regulatory databases, and user feedback.

Regulation and Legitimacy

The regulatory status of a forex broker is a crucial factor in assessing its legitimacy and safety. FxCapitalTrading operates without any recognized regulatory oversight, which raises significant concerns for potential traders. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that FxCapitalTrading does not adhere to any established financial standards or practices, which can lead to a lack of protections for traders. Regulatory bodies like the Financial Conduct Authority (FCA) in the UK and the Commodity Futures Trading Commission (CFTC) in the US impose strict requirements on licensed brokers, including capital adequacy, client fund segregation, and regular audits. The lack of such oversight for FxCapitalTrading suggests that traders may not have recourse in the event of disputes or financial malpractice.

Historically, unregulated brokers have been associated with higher risks, including fraud, market manipulation, and poor customer service. Therefore, the absence of regulatory oversight is a significant red flag when assessing whether FxCapitalTrading is safe or a scam.

Company Background Investigation

Understanding the background of FxCapitalTrading is essential to evaluate its credibility. The company claims to have been established relatively recently, but specific details about its ownership structure, management team, and operational history are vague or entirely absent. This lack of transparency is concerning, as reputable brokers typically provide detailed information about their founders and key personnel.

The management team‘s expertise and experience are critical indicators of a broker’s reliability. Unfortunately, without clear information on the backgrounds of those in charge at FxCapitalTrading, it is challenging to assess their qualifications or commitment to ethical trading practices. Furthermore, the company's website does not provide sufficient information regarding its physical address or operational locations, which is often a tactic used by fraudulent brokers to obscure their true nature.

In summary, the lack of transparency regarding the companys background and ownership raises questions about its legitimacy. Traders should be cautious when dealing with brokers that do not disclose relevant information, as this can be indicative of a potential scam.

Trading Conditions Analysis

Examining the trading conditions offered by FxCapitalTrading is essential to understanding the overall trading experience. The broker claims to provide competitive spreads and various trading options, but the lack of regulatory oversight raises concerns about the reliability of these claims.

| Fee Type | FxCapitalTrading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding spreads, commissions, and other trading costs is troubling. Many reputable brokers provide detailed information about their fee structures, allowing traders to make informed decisions. The lack of such transparency at FxCapitalTrading suggests that traders may encounter unexpected fees or unfavorable trading conditions.

Furthermore, if a broker offers unusually low spreads or promises guaranteed returns, it is essential to approach such claims with skepticism. These can often be indicators of a scam designed to lure traders into depositing funds without a clear understanding of the associated risks.

Client Funds Safety

The safety of client funds is a paramount concern when evaluating any forex broker. FxCapitalTrading's lack of regulation indicates that it may not have adequate measures in place to protect traders' investments.

Traders should look for brokers that maintain segregated accounts, ensuring that client funds are kept separate from the broker's operational funds. This practice protects traders in the event of the broker's insolvency. Additionally, many regulated brokers offer investor protection schemes that compensate clients in the event of fraud or mismanagement.

Unfortunately, there is no available information on whether FxCapitalTrading employs such safety measures. The absence of transparency regarding client fund protection raises significant concerns about the security of investments made with this broker. Historical issues related to client funds, if any, are not disclosed, further complicating the assessment of safety.

Customer Experience and Complaints

Customer feedback is a valuable resource for evaluating the reliability and service quality of a broker like FxCapitalTrading. Many online reviews indicate a pattern of complaints regarding withdrawal difficulties, lack of customer support, and unresponsive service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Transparency | High | Poor |

Common complaints from users suggest that many traders have faced challenges in withdrawing their funds, which is a significant red flag. If a broker makes it difficult for clients to access their money, it may indicate underlying issues with the broker's financial stability or operational practices.

Additionally, the quality of customer support is crucial for traders who may require assistance. Reports of unresponsive or inadequate customer service can deter potential clients and indicate a lack of commitment to client satisfaction.

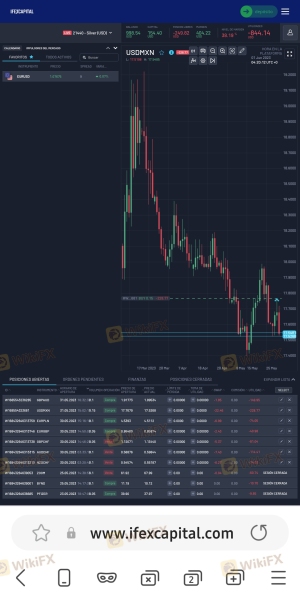

Platform and Trade Execution

The trading platform's performance, including stability and execution quality, is critical for a positive trading experience. FxCapitalTrading claims to provide a user-friendly platform, but the lack of detailed information regarding its functionality raises concerns.

Traders should be wary of any indications of platform manipulation, such as frequent slippage or order rejections, which can significantly impact trading outcomes. If a broker's platform consistently demonstrates poor execution quality, it can lead to frustration and financial losses for traders.

Risk Assessment

Engaging with FxCapitalTrading carries inherent risks that potential clients must consider. Below is a summary of key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, exposing traders to potential fraud. |

| Fund Safety Risk | High | Lack of information on client fund protection measures. |

| Customer Service Risk | Medium | Reports of poor customer support and withdrawal difficulties. |

| Transparency Risk | High | Insufficient information regarding company background and fees. |

To mitigate these risks, traders should conduct thorough research, seek regulated brokers with transparent practices, and avoid investing more than they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that FxCapitalTrading poses significant risks to potential traders. The absence of regulatory oversight, lack of transparency, and numerous complaints about withdrawal issues and customer service raises serious concerns about the broker's legitimacy.

For traders seeking to enter the forex market, it is advisable to consider regulated alternatives that offer a safer trading environment and better protections for client funds. Brokers regulated by reputable authorities, such as the FCA or ASIC, provide a higher level of assurance regarding fund safety and operational integrity.

In light of the findings, it is clear that FxCapitalTrading is not safe and may indeed be a scam. Traders should exercise extreme caution and consider reputable alternatives to ensure a secure trading experience.

Is FxCapitalTrading a scam, or is it legit?

The latest exposure and evaluation content of FxCapitalTrading brokers.

FxCapitalTrading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FxCapitalTrading latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.