Is BCP GROUP safe?

Pros

Cons

Is BCP Group Safe or Scam?

Introduction

BCP Group, also known as BCP Group Ltd, positions itself as a player in the forex trading market, focusing primarily on retail clients. With the allure of high returns and a user-friendly trading platform, it attracts many traders, especially in regions like China. However, as the forex market is rife with scams and unregulated brokers, it is essential for traders to meticulously evaluate the legitimacy and reliability of any forex broker before committing their funds. In this article, we will analyze BCP Group's regulatory status, company background, trading conditions, customer safety measures, and user experiences to determine whether BCP Group is safe or a scam. Our investigation is based on a thorough review of various online sources, including regulatory bodies, user testimonials, and expert analyses.

Regulation and Legitimacy

The regulatory environment is a cornerstone of any financial service's credibility. BCP Group operates without any valid regulatory oversight, which raises significant concerns about its legitimacy. A broker's regulatory status ensures that it adheres to certain standards of operation, providing a safety net for clients. Heres a summary of the core regulatory information for BCP Group:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that BCP Group is not subject to the scrutiny of a regulatory authority, which can lead to potential misconduct. This lack of oversight is particularly alarming, as it allows the broker to operate without standard industry practices, such as maintaining client funds in segregated accounts or following fair trading practices. Furthermore, the historical compliance record of BCP Group is non-existent, as it has no prior engagements with regulatory bodies to establish a track record of compliance. This absence of oversight raises a red flag, making it imperative for traders to consider whether BCP Group is safe for their investments.

Company Background Investigation

BCP Group Ltd has been operational for approximately 5 to 10 years, primarily targeting the Chinese market. While the company claims to offer a diverse range of financial instruments, its ownership structure and management team remain obscure, contributing to the skepticism surrounding its legitimacy. The lack of transparency about the company's history and ownership raises questions about the accountability and reliability of BCP Group.

The management teams professional background is also unclear, which further complicates the evaluation of the broker's trustworthiness. A reputable broker typically has a well-documented history of its leadership, showcasing their expertise and experience in the financial markets. Without this information, potential clients are left in the dark regarding who is managing their investments.

Moreover, BCP Group's information disclosure practices are questionable. A trustworthy broker should provide clear and accessible information about its operations, fees, and terms of service. The lack of such transparency can be seen as a tactic to obscure the true nature of its business practices, leading many to believe that BCP Group is not safe.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is crucial. BCP Group's fee structure has raised concerns among traders, with reports of hidden fees and predatory practices. A transparent and fair fee structure is essential for traders to assess their potential profitability accurately. Below is a comparison of the core trading costs associated with BCP Group:

| Fee Type | BCP Group | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Variable | 1.0 - 2.0 pips |

| Commission Structure | Hidden | 0 - 10 USD |

| Overnight Interest Range | High | 1.5 - 3% |

The spread on major currency pairs is reported to be variable, which can be detrimental for traders who rely on predictable costs. Additionally, the presence of hidden commissions can significantly erode profits. Traders have also reported high overnight interest rates, which can deter long-term trading strategies. Given these conditions, it is essential for potential clients to consider whether BCP Group is safe for their trading activities.

Customer Fund Safety

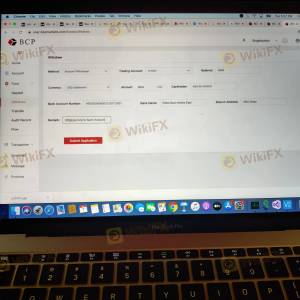

The safety of customer funds is a paramount concern for any trader. BCP Group's approach to fund security appears to be inadequate. The lack of regulatory oversight means that there are no enforced standards for fund segregation, which is a common practice among reputable brokers to protect client assets. Furthermore, there are no indications that BCP Group offers investor protection measures, such as negative balance protection, which can leave traders vulnerable to significant losses.

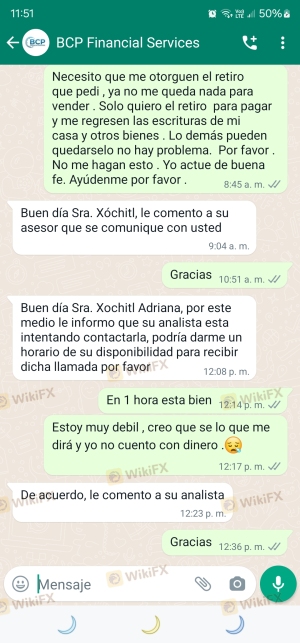

Historically, there have been complaints regarding the inability to withdraw funds, which is a common tactic employed by fraudulent brokers. Such incidents not only highlight the risks associated with trading with BCP Group but also raise questions about the broker's commitment to safeguarding client interests. Without robust security measures in place, it is difficult to ascertain whether BCP Group is safe for traders looking to invest their money.

Customer Experience and Complaints

User feedback is an invaluable resource for assessing a broker's reliability. Many traders have reported negative experiences with BCP Group, particularly concerning withdrawal issues and poor customer service. The common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Hidden Fees | Medium | Inconsistent |

| Poor Communication | High | Unresponsive |

The severity of these complaints suggests a systemic issue within the broker's operational practices. Users have expressed frustration over their inability to withdraw funds, often citing a lack of communication from the company when attempting to resolve issues. Additionally, the presence of hidden fees has led to dissatisfaction among traders, further damaging BCP Group's reputation. The overall customer experience points to a concerning trend, leading many to conclude that BCP Group is not safe for trading.

Platform and Execution

The trading platform offered by BCP Group is another critical factor in evaluating its legitimacy. Users have reported mixed experiences regarding platform performance, with some citing issues related to stability and order execution. A reliable trading platform should provide seamless execution of trades, minimal slippage, and a user-friendly interface. However, there have been allegations of delayed order execution and high slippage rates, which can significantly impact trading outcomes.

Moreover, any signs of potential platform manipulation can be alarming for traders. While there is no definitive evidence of such practices at BCP Group, the combination of poor execution quality and user complaints raises questions about the integrity of the trading environment. Traders must consider whether BCP Group is safe based on their platform's reliability and execution standards.

Risk Assessment

Using BCP Group comes with inherent risks that potential clients should carefully consider. Below is a risk scorecard summarizing the key risk areas associated with trading with BCP Group:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Hidden fees and withdrawal issues |

| Operational Risk | Medium | Platform stability concerns |

| Customer Service Risk | High | Poor response to complaints |

Given the high-risk levels across multiple categories, it is crucial for traders to approach BCP Group with caution. To mitigate these risks, potential clients should conduct thorough research, consider using smaller amounts for initial trading, and seek alternative brokers with better reputations and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that BCP Group is not safe for traders. The lack of regulation, poor customer feedback, and concerning trading conditions raise significant red flags. Traders should be particularly wary of the potential for hidden fees and withdrawal issues, which are common indicators of scam brokers.

For traders looking for reliable alternatives, it is advisable to consider brokers that are well-regulated and have a proven track record of positive customer experiences. Examples of such brokers include those regulated by top-tier authorities like the FCA (UK) or ASIC (Australia). These brokers typically offer better security for client funds, transparent fee structures, and responsive customer service, ensuring a safer trading environment.

Ultimately, it is essential for traders to prioritize their safety and conduct thorough due diligence before engaging with any broker, especially one like BCP Group, which shows multiple signs of being potentially unsafe.

Is BCP GROUP a scam, or is it legit?

The latest exposure and evaluation content of BCP GROUP brokers.

BCP GROUP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BCP GROUP latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.