Is FX MingDao safe?

Business

License

Is FX MingDao Safe or a Scam?

Introduction

FX MingDao is a forex broker based in Hong Kong, offering a range of trading services in the foreign exchange market. As the online trading landscape expands, it becomes increasingly vital for traders to carefully evaluate brokers before committing their funds. The potential for scams and unethical practices in the forex industry necessitates a thorough investigation of any broker's legitimacy. This article aims to assess whether FX MingDao is a safe trading option or a potential scam by analyzing its regulatory status, company background, trading conditions, client experiences, and overall risk profile.

Regulation and Legitimacy

Regulatory oversight is a critical factor in determining a broker's trustworthiness. FX MingDao operates without any valid regulatory licenses, which raises significant concerns regarding its legitimacy. The absence of regulation is a red flag, as it leaves traders without recourse in cases of disputes or financial mishaps.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulation from reputable authorities means that FX MingDao does not adhere to the stringent operational standards set by recognized financial institutions. This absence of oversight can lead to potential risks, including market manipulation, withdrawal issues, and overall lack of accountability. Moreover, traders need to be aware that unregulated brokers often operate in jurisdictions that do not provide adequate investor protection, increasing the likelihood of encountering scams.

Company Background Investigation

FX MingDao's company history is shrouded in ambiguity, with limited information available regarding its ownership structure and operational history. The broker claims to have been established for a few years, but the lack of transparency surrounding its formation and management raises questions about its credibility.

The management teams background is also crucial in assessing the broker's reliability. Unfortunately, there is little to no publicly available information about the individuals behind FX MingDao, making it difficult to gauge their experience and qualifications in the financial trading sector. A well-structured company with a transparent ownership model typically inspires more confidence among traders, but FX MingDao's opacity in this area is concerning.

Furthermore, the broker's website offers minimal resources and information for potential clients, which is another indicator of its lack of professionalism. A reputable broker usually provides comprehensive details about its services, trading platforms, and educational resources, whereas FX MingDao appears to fall short in these aspects.

Trading Conditions Analysis

An essential aspect of evaluating any forex broker is understanding its trading conditions, including fees and spreads. FX MingDao's fee structure is reportedly high, with various hidden charges that may not be immediately apparent to traders.

| Fee Type | FX MingDao | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low to Medium |

| Commission Model | Varies | Fixed/Variable |

| Overnight Interest Range | Unclear | Clear Guidelines |

The lack of clarity regarding spreads and commissions can be problematic for traders, as it may lead to unexpected costs that could significantly impact profitability. Moreover, the high spread rates associated with FX MingDao can deter traders, especially those engaging in high-frequency trading strategies.

Additionally, the absence of clear information about overnight interest rates raises concerns about the broker's transparency. Traders should be cautious of brokers that do not provide explicit details about their trading costs, as this could indicate potential manipulation or unfair practices.

Client Fund Security

The safety of client funds is of utmost importance when selecting a broker. FX MingDao does not appear to have robust measures in place to protect client funds. The absence of segregated accounts, which are essential for ensuring that client funds are kept separate from the broker's operating capital, is a significant risk factor.

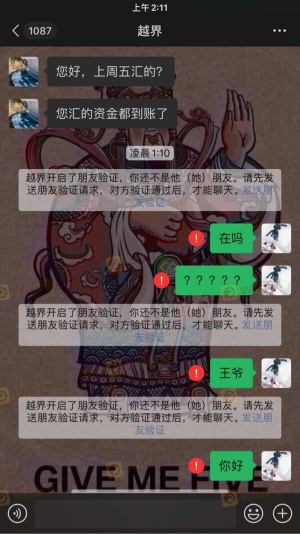

Moreover, there is no indication that FX MingDao provides investor protection schemes or negative balance protection. This lack of security measures can expose traders to substantial financial risks, particularly in volatile market conditions. Historical complaints from clients regarding withdrawal issues further highlight the potential dangers of trading with an unregulated broker like FX MingDao.

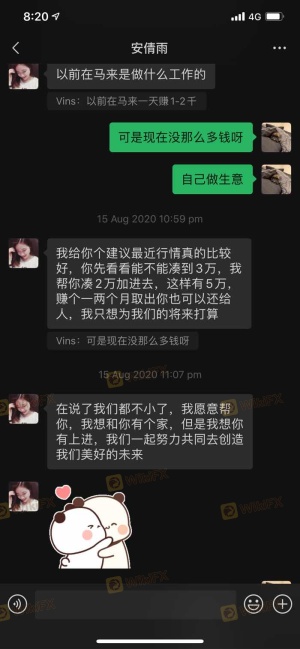

Customer Experience and Complaints

Analyzing customer feedback is essential in understanding a broker's reputation. Reports from users of FX MingDao indicate a pattern of complaints, particularly concerning withdrawal delays and account access issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Blocking | High | Poor |

| Slippage Problems | Medium | Average |

Many clients have reported being unable to withdraw their funds, with some experiencing delays of weeks or even months. Such complaints are serious and suggest a lack of operational integrity within the broker. The poor response from the company regarding these issues further exacerbates the situation, leaving traders feeling vulnerable and unsupported.

Additionally, the prevalence of severe slippage during trading execution raises concerns about the broker's reliability. Traders have reported significant discrepancies between the expected execution price and the actual price, which can lead to unexpected losses.

Platform and Execution

The performance and reliability of a broker's trading platform are crucial for a seamless trading experience. FX MingDao offers a trading platform that has been criticized for its instability and execution issues. Traders have reported frequent outages and technical glitches, which can severely impact trading effectiveness.

Moreover, the quality of order execution is another critical aspect that has been called into question. Instances of high slippage and order rejections have been reported, raising suspicions of possible manipulation. Traders should be wary of brokers that exhibit such behaviors, as they can significantly hinder trading performance.

Risk Assessment

Using FX MingDao presents several risks that potential traders should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation, high potential for fraud. |

| Financial Risk | High | Lack of fund protection measures. |

| Operational Risk | Medium | Complaints regarding withdrawal issues and platform stability. |

Given the high-risk profile associated with FX MingDao, traders should approach this broker with caution. It is advisable to conduct thorough research and consider alternative brokers that offer better regulatory oversight and client protection.

Conclusion and Recommendations

In conclusion, the evidence suggests that FX MingDao poses significant risks to traders. The lack of regulation, poor customer feedback, and questionable trading conditions raise red flags regarding its legitimacy.

For traders seeking a reliable and safe trading environment, it is recommended to consider brokers with established regulatory frameworks, transparent fee structures, and positive customer experiences. Some alternative options include brokers regulated by top-tier authorities such as the FCA, ASIC, or NFA, which provide greater assurance of safety and accountability in trading practices.

Ultimately, while the allure of trading with FX MingDao may be tempting, the potential risks outweigh the benefits, making it a broker to approach with extreme caution.

Is FX MingDao a scam, or is it legit?

The latest exposure and evaluation content of FX MingDao brokers.

FX MingDao Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FX MingDao latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.