Is FURION GLOBAL safe?

Business

License

Is Furion Global Safe or a Scam?

Introduction

Furion Global is an online trading broker that positions itself within the forex market, claiming to offer a wide range of trading instruments, including forex pairs, commodities, and cryptocurrencies. As the popularity of forex trading continues to grow, it becomes increasingly important for traders to carefully evaluate the brokers they choose to work with. The potential for scams and fraudulent activities in this space is significant, and traders must be vigilant to protect their investments. This article investigates whether Furion Global is a safe option for traders or if it raises red flags that indicate it may be a scam. Our investigation is based on a thorough review of available online resources, including regulatory information, user feedback, and market analysis.

Regulation and Legitimacy

One of the primary factors in determining if a trading broker is safe is its regulatory status. Brokers that operate under the oversight of reputable financial authorities are generally considered more trustworthy. In the case of Furion Global, claims of regulation by the Australian Securities and Investments Commission (ASIC) have been made. However, upon closer examination, it becomes evident that these claims are misleading.

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Not Verified |

Despite the assertion of being regulated, multiple sources indicate that Furion Global is not listed in ASIC's register, raising serious concerns about its legitimacy. Furthermore, the broker appears to be a successor entity to a previously regulated firm that had its license suspended due to fraudulent activities. This history of non-compliance is a significant indicator that Furion Global may not be safe for traders, as the lack of regulatory oversight means that investor funds are not protected by any legal framework.

Company Background Investigation

Furion Global operates under the name Furion Global Capital Pty Ltd, which was established in 2019. The company's claims of having offices in multiple countries, including Australia, the United States, and various Asian nations, further complicate its credibility. However, the absence of verifiable contact information and a lack of transparency regarding its ownership structure raise concerns about its operational integrity.

The management team behind Furion Global has not been thoroughly documented, and little information is available regarding their professional backgrounds. This lack of transparency can be alarming for potential investors, as a competent and experienced management team is crucial for a trustworthy trading environment. Additionally, the company's website does not provide adequate information about its operations, which is another indicator that it may not be a safe broker.

Trading Conditions Analysis

When evaluating whether Furion Global is safe, it is essential to consider its trading conditions, including fees and spreads. While the broker advertises competitive spreads and leverage options, the actual costs associated with trading can be less favorable than advertised.

| Fee Type | Furion Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 2% | 1.5% |

The spreads offered by Furion Global are slightly higher than the industry average, which may affect profitability for traders. Additionally, the lack of a clear commission structure raises questions about hidden fees that could impact overall trading costs. Such discrepancies can be a warning sign, indicating that the broker may not be as transparent as it claims to be, further contributing to the skepticism surrounding its safety.

Client Fund Security

The safety of client funds is a critical aspect when determining if Furion Global is safe. A reputable broker typically employs measures such as segregated accounts and investor protection schemes to safeguard client assets. However, Furion Global's website lacks detailed information on these security measures.

The absence of clear policies regarding fund segregation and negative balance protection raises concerns about the safety of client funds. If a broker does not provide adequate protection for investor capital, it significantly increases the risk of loss, particularly in volatile market conditions. Moreover, any historical issues related to fund security should be taken into account when assessing whether Furion Global is a safe trading option.

Customer Experience and Complaints

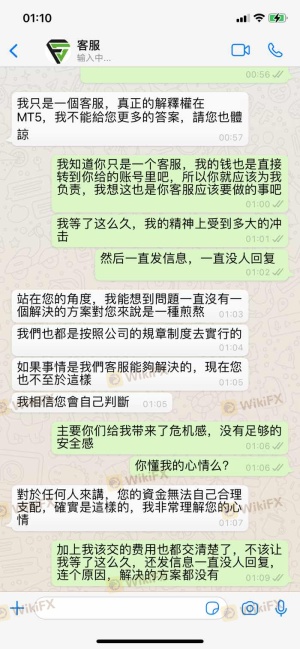

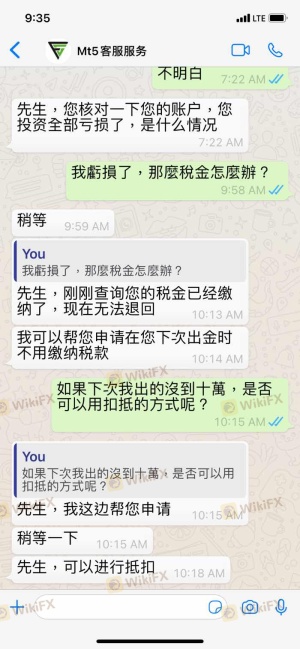

Analyzing customer feedback is essential for gauging the overall experience of traders with Furion Global. A review of online forums and user testimonials reveals a pattern of dissatisfaction among clients. Common complaints include difficulties in withdrawing funds, lack of responsive customer service, and issues related to account management.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Account Management | High | Unresponsive |

For instance, several users have reported being unable to withdraw their funds after making initial deposits, which is a significant red flag. The company's slow response times to customer inquiries further exacerbate these issues, creating an environment of frustration and mistrust among users. Such complaints indicate that Furion Global may not be a safe option for traders seeking reliable support and service.

Platform and Trade Execution

The performance of the trading platform is another crucial factor in determining whether Furion Global is safe. Traders rely on a stable and efficient platform to execute their trades effectively. However, reports suggest that users have experienced frequent outages and execution delays, leading to potential losses.

In addition, there are concerns about slippage and order rejections, which can significantly affect trading outcomes. If a broker's platform exhibits signs of manipulation or inefficiencies, it raises questions about its integrity and safety for traders.

Risk Assessment

When considering whether to engage with Furion Global, it is vital to assess the overall risks associated with trading through this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status |

| Fund Security Risk | High | Lack of clear security measures |

| Customer Service Risk | Medium | Poor response to complaints |

Given the high regulatory and fund security risks, potential traders should approach Furion Global with caution. It is advisable to seek out brokers with established reputations and robust regulatory frameworks to mitigate these risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that Furion Global is not a safe trading option for forex traders. The lack of regulatory oversight, coupled with numerous customer complaints and insufficient transparency regarding fund security, indicates that the broker may pose significant risks to investors.

Traders are advised to exercise extreme caution and consider alternative brokers that are fully regulated and have a proven track record of reliability and customer satisfaction. Reputable options include brokers regulated by established authorities such as the FCA or ASIC, which provide better protection for client funds and a more trustworthy trading environment. Ultimately, ensuring the safety of your investments should be the top priority when selecting a trading broker.

Is FURION GLOBAL a scam, or is it legit?

The latest exposure and evaluation content of FURION GLOBAL brokers.

FURION GLOBAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FURION GLOBAL latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.