Is bithoven safe?

Pros

Cons

Is Bithoven Safe or Scam?

Introduction

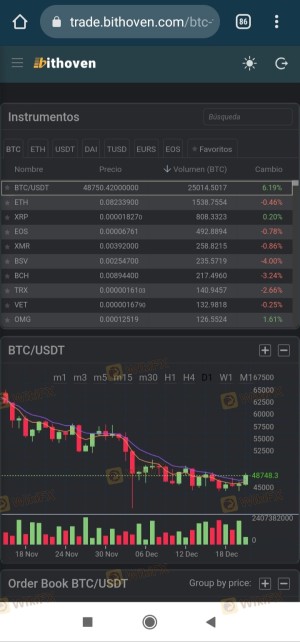

Bithoven is a cryptocurrency trading platform that has positioned itself in the competitive landscape of the forex and crypto markets since its inception in 2019. Operating under the name Fortis Ltd., Bithoven has garnered attention for its user-friendly interface and a variety of trading options, particularly in the realm of cryptocurrencies. However, with the proliferation of online trading platforms, traders must exercise caution and conduct thorough due diligence before engaging with any broker. The importance of evaluating a broker's legitimacy cannot be overstated, as the risks associated with unregulated or poorly regulated entities can lead to significant financial losses. This article aims to provide an objective analysis of Bithoven's safety and legitimacy by examining its regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

Understanding the regulatory environment in which Bithoven operates is crucial for assessing its safety. Bithoven is registered with the Financial Services Authority (FSA) of Saint Vincent and the Grenadines. While this registration is a positive sign, it is essential to note that the FSA is not considered a top-tier regulatory body compared to others like the UKs Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC). The lack of stringent regulatory oversight raises concerns regarding the level of investor protection afforded to traders.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSA | N/A | Saint Vincent and the Grenadines | Verified |

The regulatory quality is a significant factor in determining whether Bithoven is safe. The FSA's relaxed regulations mean that traders may not receive the same level of protection as they would with brokers regulated by more reputable agencies. Furthermore, Bithoven‘s history of compliance remains unclear, as there are limited records of its operational practices and adherence to regulatory standards. This lack of transparency raises questions about the broker’s commitment to safeguarding its clients' interests.

Company Background Investigation

Bithoven was established in 2019 and has since aimed to cater to a growing clientele, claiming over 60,000 users and $300 million in cryptocurrency exchanged through its platform. Despite its rapid growth, the company's ownership structure and management team remain somewhat opaque. The absence of detailed information about the executive team raises concerns about the broker's transparency and accountability.

A thorough investigation into the company's history reveals that it operates from an offshore jurisdiction, which often allows brokers to circumvent stringent regulations. While offshore registration can offer certain operational advantages, it also poses risks, as traders may find it challenging to seek legal recourse in case of disputes. The overall transparency of Bithoven is questionable, as it does not provide comprehensive information about its management or operational practices, which is a critical aspect for potential investors to consider.

Trading Conditions Analysis

When evaluating whether Bithoven is safe, it is essential to analyze its trading conditions and fee structures. Bithoven employs a flat trading fee of 0.2% across all cryptocurrency transactions, which is relatively competitive in the industry. However, traders should be aware of additional withdrawal fees that vary depending on the cryptocurrency being withdrawn.

| Fee Type | Bithoven | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (from 0) | 0.5% - 1.5% |

| Commission Model | 0.2% per trade | 0.1% - 0.5% |

| Overnight Interest Range | Variable | 0.5% - 2% |

The absence of a minimum deposit requirement is a positive aspect, making it accessible for new traders. However, the withdrawal fees can be considered higher than average, which may deter some users. Additionally, the lack of transparency regarding spreads and potential hidden fees is a red flag for traders. Overall, while Bithoven offers competitive trading conditions, the potential for unexpected costs may raise concerns about whether it is truly safe for traders.

Customer Funds Security

A critical aspect of determining whether Bithoven is safe lies in its customer funds security measures. Bithoven claims to implement various security protocols, including two-factor authentication (2FA) and SSL encryption, to protect user data and transactions. However, the effectiveness of these measures is contingent upon their consistent application and the broker's commitment to maintaining high security standards.

Furthermore, the company does not clearly outline its policies regarding fund segregation and investor protection schemes. The lack of negative balance protection is another significant concern, as traders could potentially lose more than their initial investment. Historical incidents involving fund security issues or disputes are not well-documented, which leaves potential clients with limited information to assess the risks associated with trading on Bithoven.

Customer Experience and Complaints

Customer feedback is a valuable resource for evaluating whether Bithoven is safe. While some users report positive experiences with the platform's ease of use and customer support, there are also numerous complaints regarding withdrawal issues and lack of responsiveness. Common patterns in customer complaints include difficulties in withdrawing funds, slow customer service responses, and unclear fee structures.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response, unclear policies |

| Customer Support | Medium | Generally responsive, but lacks live chat |

| Fee Transparency | Medium | Lack of clarity on costs |

For example, one user reported being unable to withdraw their funds after multiple requests, raising concerns about the reliability of Bithoven's withdrawal process. Another user highlighted the slow response time from customer support, which can be frustrating for traders seeking immediate assistance. These complaints suggest that while Bithoven may provide a functional trading platform, its customer service and withdrawal processes require significant improvement.

Platform and Execution

In assessing whether Bithoven is safe, it is essential to evaluate the performance and reliability of its trading platform. Bithoven utilizes the MetaTrader 5 (MT5) platform, known for its advanced features and user-friendly interface. However, users have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

The platform's execution quality is crucial for traders, especially in the fast-paced cryptocurrency market. Reports of high slippage rates may indicate underlying issues with order execution, which can be detrimental for traders relying on precise entry and exit points. Additionally, any signs of potential platform manipulation should be closely scrutinized, as they can severely undermine trust in the broker.

Risk Assessment

The overall risk profile of using Bithoven must be carefully considered. While the platform offers several advantages, such as low fees and a wide range of cryptocurrencies, the regulatory environment, customer complaints, and execution issues present significant risks.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operates under a weak regulatory authority |

| Withdrawal Risk | Medium | Complaints about withdrawal difficulties |

| Execution Risk | Medium | Reports of slippage and rejections |

To mitigate these risks, traders should consider starting with a small investment and thoroughly researching the platform before committing significant capital. Utilizing demo accounts can also help traders familiarize themselves with the platform's features and execution quality without risking real funds.

Conclusion and Recommendations

In conclusion, the evidence gathered indicates that while Bithoven offers some appealing features, there are several concerning aspects that warrant caution. The weak regulatory oversight, coupled with numerous customer complaints about withdrawal issues and execution problems, raises red flags regarding the broker's overall safety.

For traders looking for a reliable and secure trading environment, it may be prudent to consider alternative brokers with stronger regulatory credentials and proven track records. Brokers such as eToro, IG, or OANDA, which are regulated by more reputable authorities, provide a higher level of security and investor protection. Ultimately, while Bithoven may serve certain traders' needs, potential users should approach with caution and thoroughly assess their risk tolerance before engaging with the platform.

As the question remains, is Bithoven safe? The answer is nuanced; while it is operational and offers various trading options, the associated risks and regulatory concerns suggest that traders should be vigilant and consider safer alternatives.

Is bithoven a scam, or is it legit?

The latest exposure and evaluation content of bithoven brokers.

bithoven Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

bithoven latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.