Is Booc safe?

Pros

Cons

Is Booc Safe or a Scam?

Introduction

Booc is a forex broker that has emerged in the competitive landscape of online trading, offering a variety of financial instruments, including forex, commodities, and cryptocurrencies. Founded in 2011 and based in the United States, Booc aims to attract traders with competitive spreads and a user-friendly trading platform. However, the growing number of complaints and concerns about its regulatory status have prompted traders to approach this broker with caution. In the world of forex trading, where the potential for profit is accompanied by significant risk, it is crucial for traders to thoroughly evaluate the legitimacy and reliability of their chosen brokers. This article will investigate Booc's regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk assessment to determine whether it is a safe trading option or a potential scam.

Regulation and Legitimacy

Regulatory Status

The regulatory environment is a critical factor in assessing the legitimacy of any forex broker. Booc claims to be regulated by the National Futures Association (NFA) in the United States; however, there are serious concerns regarding the authenticity of this claim. Several sources indicate that Booc may be operating without valid regulatory oversight, which raises red flags for potential investors.

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| NFA | 0561418 | United States | Suspicious Activity |

The NFA is known for its stringent regulations, ensuring that brokers adhere to high standards of operation and client protection. However, Booc's association with a non-member entity raises questions about its compliance and the safety of client funds. The absence of a robust regulatory framework not only diminishes the credibility of Booc but also exposes traders to potential risks, including fraud and mismanagement of funds.

Discussion on Regulatory Quality

Regulatory quality is paramount for any trading platform. A well-regulated broker typically provides a safe trading environment, ensuring that clients' funds are protected and that the broker operates transparently. In Booc's case, the indications of suspicious activity and the lack of a verified regulatory status suggest that traders may not be adequately protected. This lack of oversight can lead to various issues, including difficulty in withdrawing funds, unfulfilled promises regarding trading conditions, and potential loss of capital. Therefore, it is crucial for traders to be aware of these risks when considering Booc as their trading partner.

Company Background Investigation

Company History and Ownership Structure

Booc was established in 2011 and claims to operate from New York, USA. Despite its relatively short history, the company has positioned itself as a diverse trading platform, offering various financial instruments. However, the lack of transparency regarding its ownership structure and management team raises concerns about accountability and trustworthiness.

The absence of detailed information about the company's founders and key executives contributes to a perception of opacity, which is often associated with less reputable brokers. A transparent broker typically provides information about its leadership team, including their qualifications and experience in the financial industry. In Booc's case, the lack of such information may deter potential clients who prioritize transparency and trust in their trading relationships.

Assessment of Transparency and Information Disclosure

Transparency is critical in establishing trust between a broker and its clients. A reputable broker should provide clear and accessible information regarding its operations, including its regulatory status, fee structures, and trading conditions. Booc's limited information disclosure raises concerns, as potential clients may find it challenging to make informed decisions about their investments. This lack of transparency can lead to misunderstandings and disputes, further complicating the trading experience.

Trading Conditions Analysis

Overall Fee Structure and Model

Booc advertises competitive trading conditions, including low spreads and a variety of account types. However, the actual fee structure is not clearly outlined on its website, which can create confusion for potential traders. Understanding the complete cost of trading is essential for making informed decisions, as hidden fees can significantly impact profitability.

| Fee Type | Booc | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0 | 1-2 pips |

| Commission Model | Not Disclosed | Varies |

| Overnight Interest Range | Not Disclosed | Varies |

The absence of a transparent fee structure is concerning, as traders may encounter unexpected costs that could erode their profits. Additionally, the lack of clarity regarding commissions and overnight interest rates may deter traders, especially those who are risk-averse or new to the forex market.

Discussion on Unusual or Problematic Fee Policies

Unusual fee policies can be a significant indicator of a broker's reliability. If a broker employs complex or hidden fees, it can lead to a negative trading experience and financial losses for clients. Booc's lack of clarity regarding its fee structure raises questions about its commitment to transparency and fairness. Traders should be cautious of brokers that do not provide clear information about their fees, as this can be a sign of potential scams or unscrupulous practices.

Client Fund Safety

Analysis of Fund Safety Measures

The safety of client funds is a paramount concern for any trader. Booc claims to implement various safety measures to protect client funds, but the lack of regulatory oversight raises concerns about the effectiveness of these measures. A reputable broker typically segregates client funds from its operational funds, ensuring that clients' money is protected in the event of bankruptcy or financial difficulties.

Traders should be aware of the importance of fund segregation, investor protection schemes, and negative balance protection policies. Booc's failure to clearly communicate these safety measures may lead to heightened risks for traders, particularly in volatile market conditions.

Discussion on Historical Fund Safety Issues

Historical issues related to fund safety can severely impact a broker's reputation. While there are no widely reported incidents involving Booc's mishandling of client funds, the lack of transparency regarding its safety measures can lead to uncertainty. Traders should be cautious and conduct thorough research before entrusting their capital to any broker, especially one with unclear safety protocols.

Customer Experience and Complaints

Analysis of Customer Feedback and User Experience

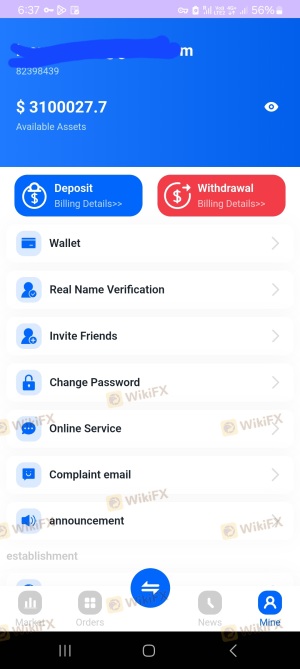

Customer feedback is a valuable indicator of a broker's reliability and service quality. Booc has garnered a mix of positive and negative reviews, with many users expressing dissatisfaction with the withdrawal process and customer support. Common complaints include difficulty in accessing funds, unresponsive customer service, and issues related to account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

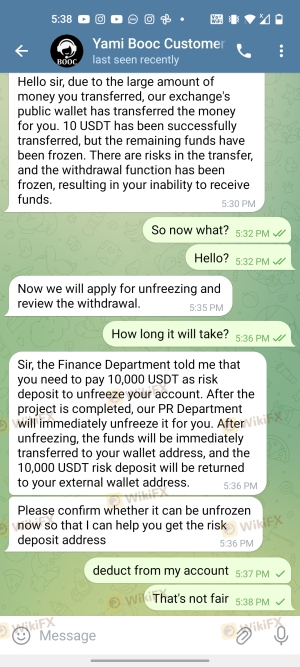

| Withdrawal Issues | High | Slow response |

| Customer Service Quality | Medium | Email-only support |

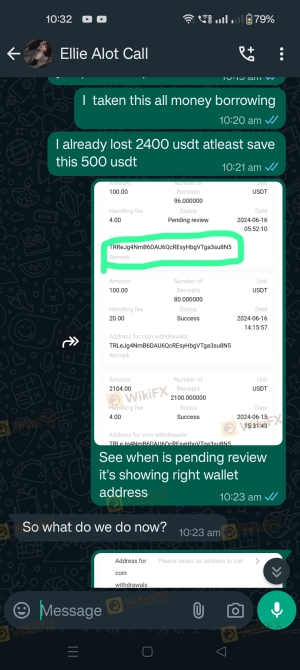

Case Studies of Common Complaints

One notable complaint involves a trader who reported being unable to withdraw funds after several requests. The trader claimed that Booc's customer service was unresponsive and that they faced additional fees when attempting to access their money. Such experiences highlight the potential risks associated with trading with Booc, particularly for those who may require timely access to their funds.

Another case involved a trader who encountered issues with account verification, leading to delays in trading. This situation further underscores the concerns regarding Booc's customer service and operational efficiency, which can significantly impact the overall trading experience.

Platform and Execution

Evaluation of Platform Performance and User Experience

Booc utilizes the ST5 trading platform, which is designed to be user-friendly and feature-rich. While the platform offers various tools for analysis and trading, user experiences have been mixed. Some traders report satisfaction with the platform's functionality, while others have experienced issues with stability and execution speed.

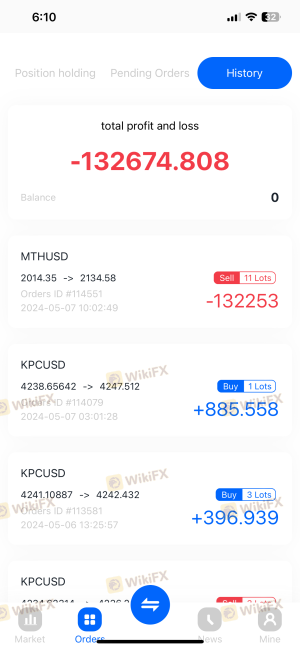

Analysis of Order Execution Quality

Order execution quality is critical for successful trading. Traders expect timely and accurate execution of their orders, especially in fast-moving markets. Reports of slippage and rejected orders raise concerns about Booc's execution quality. Traders should be aware of the potential for delays and inaccuracies when trading with Booc, as these issues can negatively impact their trading results.

Risk Assessment

Comprehensive Discussion of Overall Risk

Using Booc as a trading platform presents various risks that traders must consider. The lack of regulatory oversight, unclear fee structures, and mixed customer feedback contribute to an overall perception of risk. Traders should carefully evaluate their risk tolerance and consider whether the potential rewards of trading with Booc outweigh the inherent risks.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of valid regulation raises concerns. |

| Financial Risk | Medium | Unclear fee structure may impact profits. |

| Operational Risk | High | Mixed reviews on customer service and platform stability. |

Specific Risk Mitigation Recommendations

To mitigate risks when trading with Booc, traders should consider the following strategies:

- Conduct Thorough Research: Always investigate a broker's regulatory status, fee structures, and user reviews before opening an account.

- Start with a Small Investment: If you choose to trade with Booc, consider starting with a small amount to limit potential losses.

- Diversify Trading Platforms: Avoid relying solely on one broker. Diversifying across multiple platforms can help spread risk.

Conclusion and Recommendations

In conclusion, Booc presents several concerning factors that traders should carefully consider. The lack of clear regulatory oversight, mixed customer feedback, and potential issues with fund safety raise significant red flags. While Booc may offer competitive trading conditions, the risks associated with trading on this platform may outweigh the benefits.

For traders seeking a reliable and secure trading environment, it is advisable to explore alternative brokers with strong regulatory frameworks, transparent fee structures, and positive user experiences. Options such as brokers regulated by the FCA or ASIC may provide a safer trading environment, ensuring that traders can execute their strategies with confidence. Ultimately, thorough research and due diligence are essential for navigating the complexities of the forex market and safeguarding your investments.

Is Booc a scam, or is it legit?

The latest exposure and evaluation content of Booc brokers.

Booc Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Booc latest industry rating score is 1.33, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.33 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.