Is Filvek safe?

Business

License

Is Filvek Safe or Scam?

Introduction

Filvek, a forex broker that emerged in 2017, claims to provide a diverse range of trading instruments, including forex, commodities, and options. As the forex market continues to grow, it attracts both seasoned traders and newcomers. However, the presence of unregulated and potentially fraudulent brokers poses significant risks to investors. Therefore, it is crucial for traders to conduct thorough evaluations of any forex broker before committing their funds. In this article, we will investigate Filvek's credibility, focusing on its regulatory status, company background, trading conditions, and customer experiences. Our analysis will be based on a review of multiple sources, including regulatory databases and user feedback, to provide a comprehensive assessment of whether Filvek is safe for trading.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor that determines its legitimacy and reliability. Filvek is registered in the United States but has been flagged as unauthorized by the National Futures Association (NFA). This lack of valid regulation means that Filvek operates without oversight from any government or financial authority, which inherently increases the risk for investors.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0557315 | United States | Unauthorized |

The absence of regulation raises concerns about the broker's accountability and adherence to industry standards. Regulatory bodies like the NFA impose strict regulations to protect traders, and the lack of such oversight could lead to potential fraud or mismanagement of client funds. Given that Filvek operates as a suspicious clone, it is essential for traders to approach this broker with caution and consider the implications of trading with an unregulated entity.

Company Background Investigation

Filvek was established in 2017 and claims to operate from the United States. However, the details regarding its ownership structure and management team remain unclear, raising questions about its transparency. A thorough investigation into the company's history reveals a lack of verifiable information, which is a red flag for potential investors.

The management teams background is another crucial aspect to consider. A broker with experienced and reputable leadership is more likely to adhere to ethical standards and provide a reliable trading environment. Unfortunately, Filvek does not provide sufficient information regarding its management, which further compounds the uncertainty surrounding its operations.

Overall, the lack of transparency and information disclosure about Filvek's ownership and management team creates a sense of unease for potential investors, leading to the question: Is Filvek safe for trading?

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is vital. Filvek offers a variety of trading instruments but lacks clarity regarding its fee structure and trading costs. This lack of transparency can be concerning, especially for traders who rely on clear cost structures to make informed trading decisions.

| Fee Type | Filvek | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of detailed information regarding spreads, commissions, and overnight interest rates raises concerns about potential hidden fees. Traders must be cautious of any unusual or excessive fees that may not be disclosed upfront. A broker's fee structure should be competitive and transparent to ensure traders can maximize their profits without unexpected costs.

Given the lack of information about trading conditions, it becomes increasingly challenging to assess whether Filvek is safe for trading.

Customer Fund Safety

The safety of customer funds is paramount when selecting a forex broker. Filvek's policies regarding fund security are not clearly outlined, which could indicate a lack of robust measures to protect client deposits. Key aspects to consider include fund segregation, investor protection, and negative balance protection.

While reputable brokers typically segregate client funds in separate accounts to ensure that they are not used for operational expenses, Filvek's lack of clarity on this matter raises concerns. Furthermore, without investor protection schemes in place, clients may have limited recourse in the event of a broker's insolvency or malpractice.

Historically, any issues related to fund safety or disputes could significantly impact a broker's reputation. Unfortunately, Filvek does not provide sufficient information on its fund safety measures, leading to uncertainty about whether Filvek is safe for traders' investments.

Customer Experience and Complaints

Customer feedback is a valuable resource for evaluating a broker's reliability and service quality. Analyzing user experiences with Filvek reveals a mix of opinions, with several complaints highlighting issues related to withdrawal difficulties and unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Unresponsiveness | Medium | Average |

Common complaints include delays in processing withdrawals and a lack of communication from customer support. These issues can significantly affect a trader's experience and raise concerns about the broker's legitimacy.

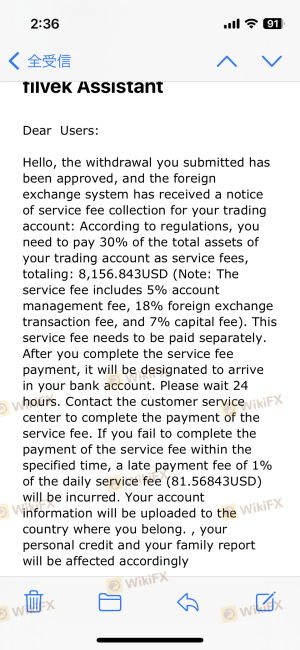

For instance, one user reported being unable to withdraw funds until additional verification fees were paid, which is a common tactic used by fraudulent brokers to trap clients. Such complaints underscore the need for potential investors to exercise caution and consider whether Filvek is safe for their trading activities.

Platform and Execution

The trading platform provided by a broker plays a crucial role in the overall trading experience. Filvek offers its proprietary trading platform, which has been criticized for being less user-friendly than industry-standard platforms like MetaTrader 4. Users have reported issues with platform stability, order execution quality, and instances of slippage.

Traders rely on efficient and reliable platforms to execute their trades promptly. Any signs of platform manipulation or execution issues can lead to significant financial losses. Therefore, the perceived shortcomings of Filvek's platform raise additional questions about whether Filvek is safe for trading.

Risk Assessment

Using Filvek as a trading platform presents several risks that potential investors should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Safety Risk | High | Lack of transparency regarding fund security. |

| Customer Service Risk | Medium | Complaints about unresponsiveness. |

| Trading Platform Risk | Medium | Issues with execution and stability. |

To mitigate these risks, traders should conduct thorough research before investing. It is advisable to start with a small deposit, if at all, and to monitor the trading experience closely. Should any red flags arise, traders should consider withdrawing their funds and exploring alternative brokers.

Conclusion and Recommendations

After a comprehensive analysis of Filvek, it is evident that the broker presents several risks that potential investors should carefully weigh. The lack of regulation, transparency regarding company operations, and numerous customer complaints raise significant concerns about whether Filvek is safe for trading.

For traders seeking reliable forex brokers, it is advisable to consider well-regulated alternatives that have a proven track record of transparency and customer satisfaction. Brokers such as Tickmill, Aetos, and Grand Capital are recommended options that provide robust regulatory oversight and favorable trading conditions.

In conclusion, while Filvek may appear attractive at first glance, the inherent risks involved warrant caution. Prospective investors should prioritize their safety and consider the potential implications of trading with an unregulated broker like Filvek.

Is Filvek a scam, or is it legit?

The latest exposure and evaluation content of Filvek brokers.

Filvek Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Filvek latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.