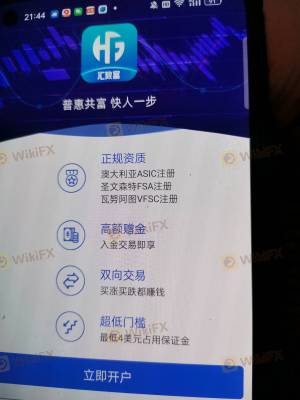

Regarding the legitimacy of FASTWIN forex brokers, it provides VFSC and WikiBit, .

Is FASTWIN safe?

Pros

Cons

Is FASTWIN markets regulated?

The regulatory license is the strongest proof.

VFSC Derivatives Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Profit Markets Limited

Effective Date:

2024-03-22Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Fastwin Safe or Scam?

Introduction

Fastwin is an online forex broker that has emerged in the trading landscape, claiming to provide a platform for users to trade various financial instruments. As the forex market grows increasingly competitive, traders are often drawn to platforms that promise high returns and low fees. However, the influx of new brokers also raises concerns about their legitimacy and reliability. It is essential for traders to conduct thorough evaluations of forex brokers to ensure their safety and protect their investments. This article investigates whether Fastwin is a safe trading option or a potential scam, using a comprehensive assessment framework that includes regulatory status, company background, trading conditions, customer experiences, and risk evaluations.

Regulatory and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. Regulatory bodies enforce rules and standards that protect traders, ensuring that brokers operate transparently and ethically. In the case of Fastwin, it claims to be registered in Vanuatu and holds a license from the Vanuatu Financial Services Commission (VFSC). However, this license is categorized as suspicious, with indications that it may be a clone of a legitimate regulatory entity.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| VFSC | 40452 | Vanuatu | Suspicious Clone |

The lack of robust regulatory oversight raises significant concerns regarding Fastwin's operational practices. A broker without effective regulation is often seen as a high-risk option for traders, as there is little recourse in cases of disputes or misconduct. Moreover, Fastwin's low rating on platforms like WikiFX indicates a lack of trustworthiness, with many users expressing concerns about withdrawal issues and overall transparency. Therefore, when assessing whether Fastwin is safe, the evidence suggests that its regulatory framework is inadequate, placing it in a questionable position within the forex market.

Company Background Investigation

Fastwin's background reveals a company that has been operational for approximately two to five years, but details about its ownership and management team remain largely undisclosed. The absence of clear information about the company's founders and their professional experiences raises red flags regarding its transparency and credibility. A legitimate broker typically provides comprehensive details about its management team to foster trust among potential clients.

Furthermore, the company's history is marred by allegations of fraudulent activities, with reports indicating that it may be using deceptive practices to lure in new clients. This lack of transparency and the dubious nature of its ownership structure contribute to the skepticism surrounding Fastwin's operations. The absence of clear communication and information about the company's background makes it challenging for traders to assess whether Fastwin is safe. Overall, the company's opacity in terms of ownership and management is a significant concern for potential users.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is crucial. Fastwin claims to offer competitive trading fees and a variety of financial instruments, including currency pairs, commodities, and indices. However, the overall fee structure and potential hidden costs warrant scrutiny to determine if they align with industry standards.

| Fee Type | Fastwin | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 0.0 pips | 1.0 pips |

| Commission Model | Fixed $5 | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The table indicates that Fastwin offers significantly lower spreads compared to the industry average, which may initially attract traders. However, the fixed commission of $5 raises questions about the overall cost-effectiveness of trading with Fastwin. Additionally, the lack of transparency regarding overnight interest rates and potential hidden fees could lead to unexpected costs for traders.

Traders should be cautious and ensure they fully understand the fee structure before engaging with Fastwin. The potential for hidden fees and the lack of clarity in its pricing model suggest that traders may face challenges in managing their trading costs effectively. Thus, when asking “Is Fastwin safe?” it is essential to consider these trading conditions critically.

Client Fund Security

The safety of client funds is paramount in the forex trading environment. Fastwin's approach to fund security is a vital aspect of its overall credibility. The broker claims to implement measures to protect client funds, including segregated accounts and investor protection policies. However, the effectiveness and transparency of these measures are unclear, as there is limited information available regarding their implementation.

Traders should be aware that inadequate protection measures can lead to significant financial risks, particularly in the event of broker insolvency or fraud. Furthermore, historical complaints from users regarding withdrawal issues raise concerns about Fastwin's ability to safeguard client funds. If a broker encounters financial difficulties and cannot honor withdrawal requests, clients may face substantial losses.

In summary, while Fastwin asserts that it prioritizes client fund security, the lack of detailed information and historical complaints suggest that traders should exercise caution. The question of whether Fastwin is safe remains unresolved, as the broker's security measures appear insufficient in protecting investor interests.

Customer Experience and Complaints

Analyzing customer feedback is essential for assessing a broker's reliability and service quality. Fastwin has received a mix of reviews, with many users expressing dissatisfaction with their experiences. Common complaints include difficulties in withdrawing funds, slow customer support responses, and issues with account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No response |

| Account Management | Medium | Inconsistent |

| Customer Support | High | Slow response |

The table highlights the significant issues that users have encountered while dealing with Fastwin. Withdrawal problems are particularly alarming, as they suggest potential financial mismanagement or deceitful practices. Moreover, the slow response from customer support exacerbates user frustrations, indicating a lack of commitment to resolving issues in a timely manner.

Several user testimonials illustrate the severity of these complaints. For instance, one user reported being unable to withdraw their funds after several attempts, leading to frustration and financial loss. Another individual mentioned that their account was blocked without explanation, further underscoring the lack of transparency and support from Fastwin. These patterns of complaints raise serious questions about Fastwin's operational integrity and whether it is indeed a safe platform for trading.

Platform and Execution Quality

The performance of a trading platform directly impacts a trader's experience and success. Fastwin claims to offer a user-friendly platform with robust features, but the actual performance and reliability of this platform are crucial to assess. Traders have reported mixed experiences regarding platform stability, order execution quality, and the occurrence of slippage.

Issues such as slow execution times and high slippage can significantly affect trading outcomes, especially for those employing strategies that rely on precise entry and exit points. Furthermore, if there are indications of platform manipulation or unfair practices, traders should be particularly cautious.

In conclusion, while Fastwin promotes its trading platform as efficient, the mixed feedback from users indicates that there may be underlying issues affecting performance. As traders evaluate whether "Is Fastwin safe?" they must consider these execution quality concerns seriously.

Risk Assessment

Using Fastwin presents several inherent risks that traders should be aware of. The combination of regulatory shortcomings, customer complaints, and potential issues with fund security creates a high-risk environment for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of effective regulation and oversight |

| Financial Risk | High | Potential for withdrawal issues and fund mismanagement |

| Customer Service Risk | Medium | Slow response times and inadequate support |

Given these risks, traders are advised to approach Fastwin with caution. It is essential to implement risk management strategies, such as limiting exposure and diversifying investments, to mitigate potential losses. Additionally, traders should stay informed about ongoing issues and developments related to Fastwin to make informed decisions.

Conclusion and Recommendations

In conclusion, the investigation into Fastwin raises significant concerns about its legitimacy and safety as a trading platform. The broker's regulatory status, lack of transparency, and historical complaints suggest that it may not be a reliable option for traders. The critical question of "Is Fastwin safe?" leans towards a negative response, given the evidence of potential scams and operational issues.

For traders seeking safer alternatives, it is advisable to consider well-regulated brokers with transparent practices and positive user feedback. Brokers with robust regulatory frameworks, established histories, and strong customer support are typically more trustworthy. Therefore, traders should prioritize these factors when selecting a trading platform to ensure the safety of their investments.

Is FASTWIN a scam, or is it legit?

The latest exposure and evaluation content of FASTWIN brokers.

FASTWIN Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FASTWIN latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.