Regarding the legitimacy of HFBC forex brokers, it provides CYSEC and WikiBit, .

Is HFBC safe?

Pros

Cons

Is HFBC markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Performance Ronnaru Company Ltd

Effective Date:

2014-10-30Email Address of Licensed Institution:

prc@cytanet.com.cySharing Status:

No SharingWebsite of Licensed Institution:

www.prcbroker.com, www.prcmarkets.comExpiration Time:

--Address of Licensed Institution:

7B Andrea Papakosta street, Palouriotissa,1037 Nicosia, CyprusPhone Number of Licensed Institution:

+357 22 250 328Licensed Institution Certified Documents:

Is Hfbc Safe or Scam?

Introduction

Hfbc, a forex broker established in 2018 and based in Cyprus, has garnered attention in the foreign exchange market. With the increasing number of online trading platforms, it is crucial for traders to conduct thorough evaluations of brokers to protect their investments. The rise of scams in the forex industry necessitates a careful examination of a broker's legitimacy, regulatory compliance, and overall reputation. This article investigates Hfbc's safety and reliability by analyzing its regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

The regulatory status of a broker is a fundamental aspect of its legitimacy. Regulation ensures that brokers adhere to strict standards, providing a level of security for traders. Hfbc claims to be regulated, but the details surrounding its licensing raise concerns. The following table summarizes the core regulatory information for Hfbc:

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 731259 | Cyprus | Suspicious Clone |

| FCA | N/A | UK | Suspicious Clone |

The Cyprus Securities and Exchange Commission (CySEC) is a well-known regulatory body in the EU, and its oversight is generally considered a positive sign. However, Hfbc has been flagged as a "suspicious clone" by various sources, indicating that it may not be operating under legitimate regulatory oversight. The Financial Conduct Authority (FCA) has also categorized Hfbc as a suspicious entity, which is a significant red flag. The absence of a solid regulatory framework raises questions about Hfbc's commitment to compliance and investor protection.

Company Background Investigation

Hfbc's history is relatively short, having been established in 2018. The company operates under the name Hfbc Forex Group and claims to provide trading services globally. However, the lack of transparency regarding its ownership structure and the management team's qualifications is concerning. A broker's credibility is often tied to the expertise and reputation of its leadership. Unfortunately, there is limited information available about Hfbc's management team, making it difficult to assess their experience and track record in the financial industry.

Moreover, the company's transparency regarding its operations and financial health appears to be lacking. This absence of clear, accessible information can hinder potential clients from making informed decisions. A broker's willingness to disclose its operational details is essential for building trust among traders. Given these factors, it is prudent for potential investors to approach Hfbc with caution and conduct further research into its background.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience. Hfbc presents itself as a competitive trading platform; however, a closer examination reveals potential issues. The broker's fee structure and trading costs are critical factors to consider. The following table compares Hfbc's core trading costs with industry averages:

| Fee Type | Hfbc | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

Hfbc's spreads for major currency pairs are notably higher than the industry average, which may indicate an unfavorable trading environment for clients. Additionally, the absence of a commission model can be misleading, as hidden fees might still apply. Traders should be wary of any unusual or excessive fees, as these can erode potential profits and negatively affect trading strategies.

Client Funds Security

The safety of client funds is paramount when selecting a forex broker. Hfbc claims to implement various security measures, including fund segregation and investor protection policies. However, the effectiveness of these measures is questionable given the broker's dubious regulatory status. Segregated accounts are essential for ensuring that client funds are kept separate from the broker's operational funds, providing a layer of security in case of insolvency.

Moreover, the lack of information regarding negative balance protection policies raises concerns. Negative balance protection is crucial for preventing traders from losing more than their initial investment, especially during periods of high volatility. Hfbc's transparency regarding these security measures is insufficient, making it difficult for potential clients to assess the safety of their funds adequately.

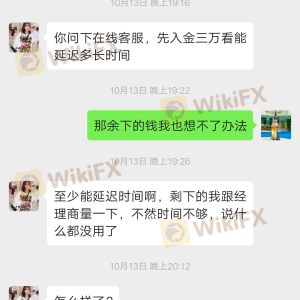

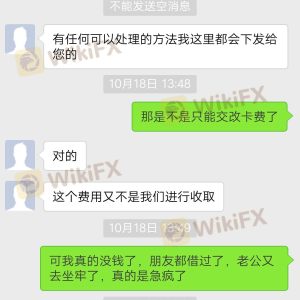

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability. An analysis of user experiences with Hfbc reveals a troubling pattern of complaints. Many users have reported difficulties with fund withdrawals and have expressed concerns about the broker's responsiveness. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Management Challenges | Medium | Fair |

| Customer Support Delays | High | Poor |

Numerous complaints indicate that clients have faced significant challenges when attempting to withdraw their funds, with reports of excuses and delays from customer support. Such issues are indicative of a potentially fraudulent operation and should not be taken lightly. The lack of effective communication and resolution from Hfbc further exacerbates concerns about its legitimacy and reliability.

Platform and Execution

The trading platform is a critical component of the trading experience. Hfbc offers a platform that supports various trading tools and functionalities. However, reports of execution issues, including slippage and order rejections, have been noted by users. A reliable trading platform should provide seamless order execution without manipulation. Any signs of platform manipulation can significantly undermine a trader's confidence and expose them to unnecessary risks.

Risk Assessment

Engaging with Hfbc comes with inherent risks that potential traders should consider. The following risk assessment summarizes key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lack of legitimate regulation raises red flags. |

| Fund Security | High | Insufficient transparency regarding fund protection. |

| Customer Support | Medium | Poor response to complaints and withdrawal issues. |

Given these risks, it is advisable for traders to exercise caution when considering Hfbc as their forex broker. Implementing risk mitigation strategies, such as starting with a small investment and closely monitoring account activity, can help safeguard against potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Hfbc may not be a safe choice for forex trading. The broker's dubious regulatory status, high trading costs, and numerous customer complaints raise significant concerns about its legitimacy. Traders should be particularly wary of the withdrawal issues reported by users and the overall lack of transparency regarding the broker's operations.

For those seeking reliable alternatives, consider brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback. Brokers such as HF Markets and other well-established firms may provide a safer trading environment. Ultimately, thorough research and careful evaluation are crucial for making informed trading decisions in the forex market.

Is HFBC a scam, or is it legit?

The latest exposure and evaluation content of HFBC brokers.

HFBC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HFBC latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.