Is RC Global safe?

Pros

Cons

Is Rc Global Safe or Scam?

Introduction

Rc Global is a forex broker that has garnered attention in the trading community, primarily due to its offshore registration and lack of robust regulatory oversight. As traders increasingly turn to online platforms for forex trading, it becomes essential to meticulously evaluate the legitimacy and safety of these brokers. This evaluation is crucial because the forex market is rife with both opportunities and risks, and choosing an unregulated broker can lead to substantial financial losses.

In this article, we will investigate whether Rc Global is safe or a potential scam. Our assessment will be based on a comprehensive review of its regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and overall risk assessment. We will use information from reputable financial websites and customer reviews to provide a balanced perspective.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical aspects to consider when determining its safety. Regulators ensure that brokers adhere to strict guidelines aimed at protecting traders and their funds. In the case of Rc Global, it is registered in Belize and claims to hold a license from the International Financial Services Commission (IFSC). However, many reviews indicate that this license is not sufficient to ensure safety and legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| International Financial Services Commission (IFSC) | Not publicly available | Belize | Not verified |

The quality of regulation in Belize is often criticized due to its lenient requirements and lack of oversight. This raises concerns about the safety of funds deposited with Rc Global. The broker has been reported to be in the process of surrendering its license, further complicating its regulatory standing. Without oversight from reputable authorities such as the UK's Financial Conduct Authority (FCA) or Australia's Australian Securities and Investments Commission (ASIC), traders may be exposed to higher risks. Based on these findings, it is evident that Rc Global is not safe for traders seeking a secure trading environment.

Company Background Investigation

Understanding the background of Rc Global is crucial for assessing its credibility. Established in 2018, Rc Global is operated by Rc Global Financial Ltd. The broker claims to have offices in various locations, including the USA, UK, and France, with its primary office situated in Hong Kong. However, the lack of transparency regarding its ownership structure and operational history raises red flags.

The management team behind Rc Global has not been widely publicized, and there is little information available regarding their professional backgrounds. This anonymity can be concerning for potential clients, as it leaves traders without a clear understanding of who is managing their funds. Furthermore, the company's website does not provide comprehensive information about its trading conditions or regulatory compliance, which is essential for transparency.

In summary, the lack of transparency surrounding Rc Global's ownership and management, coupled with its offshore registration, suggests that traders should exercise caution. It is advisable to consider brokers with clear leadership and regulatory oversight, as this can significantly reduce the risks associated with trading.

Trading Conditions Analysis

When evaluating whether Rc Global is safe, it is essential to analyze its trading conditions. The broker offers trading on the MetaTrader 4 (MT4) platform, which is popular among traders for its user-friendly interface and advanced trading tools. However, the overall fee structure and trading conditions presented by Rc Global raise concerns.

| Fee Type | Rc Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1.4 pips |

| Commission Structure | Not specified | Varies by broker |

| Overnight Interest Range | Not disclosed | Varies by broker |

The spread for major currency pairs, such as EUR/USD, is reported to be around 2 pips, which is significantly higher than the industry average of 1.4 pips. Additionally, the lack of clarity regarding commission structures and overnight interest rates further complicates the evaluation of overall trading costs. Traders often prefer brokers that provide transparent and competitive pricing structures, as hidden fees can erode potential profits.

Given these findings, it is evident that Rc Global's trading conditions are not competitive, and traders may find better options with brokers that offer lower spreads and clearer fee disclosures.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. Rc Global claims to implement various measures to protect client funds, but the effectiveness of these measures is questionable. As an offshore broker, it is not required to maintain client funds in segregated accounts, which is a standard practice among reputable brokers.

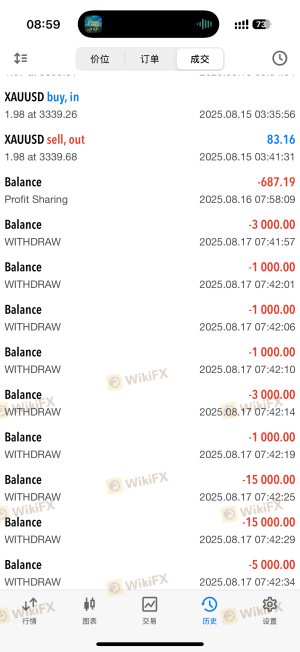

The absence of investor protection schemes, such as those provided by the FCA or ASIC, further exacerbates the risks associated with trading with Rc Global. In the event of financial difficulties or insolvency, traders may find it challenging to recover their funds. Historical complaints and reports suggest that Rc Global has faced issues related to fund withdrawals, raising concerns about the safety of deposited funds.

In conclusion, without adequate measures for fund protection and a lack of regulatory oversight, it is clear that Rc Global is not a safe choice for traders looking to secure their investments.

Customer Experience and Complaints

Analyzing customer feedback is crucial in determining whether Rc Global is a scam. A review of various online platforms reveals a pattern of negative experiences among clients. Common complaints include difficulties in withdrawing funds, unresponsive customer service, and issues with account access.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Access | Medium | Slow |

| Customer Support | High | Unresponsive |

Many users have reported that their accounts were frozen or that they faced excessive delays in processing withdrawals. In some cases, clients were asked to pay additional fees to access their funds, which raises serious concerns about the legitimacy of the broker's practices.

For instance, one user reported that after depositing a significant amount, they were unable to withdraw their funds despite repeated requests. This pattern of complaints suggests that Rc Global may engage in practices that could be classified as fraudulent, further solidifying the perception that it is not a trustworthy broker.

Platform and Trade Execution

The trading platform is a critical component of the trading experience, influencing order execution quality and overall user satisfaction. Rc Global offers the MT4 platform, known for its reliability and advanced features. However, user reviews indicate mixed experiences regarding platform performance.

Traders have reported issues such as slippage and order rejections, which can significantly impact trading outcomes. Additionally, there are concerns about the potential for platform manipulation, as some users have described experiences where their trades were unexpectedly altered or executed at unfavorable prices.

In summary, while the MT4 platform is generally well-regarded, the performance issues reported by Rc Global users raise questions about the integrity of its trading environment. Therefore, traders should be cautious when considering this broker, as the platform may not provide the reliability needed for successful trading.

Risk Assessment

The overall risk of trading with Rc Global is elevated due to the combination of its regulatory status, trading conditions, and customer experiences.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of adequate regulation and oversight. |

| Financial Risk | High | High spreads and potential withdrawal issues. |

| Operational Risk | Medium | Reports of platform performance issues. |

Given these factors, it is essential for traders to consider the potential risks involved with Rc Global. To mitigate these risks, it is advisable to conduct thorough research on any broker before opening an account. Traders should also consider using brokers with established reputations and robust regulatory frameworks to ensure the safety of their investments.

Conclusion and Recommendations

In conclusion, after thoroughly evaluating Rc Global, it is clear that the broker presents several red flags that suggest it may not be safe for traders. The lack of robust regulation, high trading costs, and numerous customer complaints indicate that Rc Global may engage in practices that could be considered fraudulent.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Brokers regulated by the FCA or ASIC are generally recommended due to their stringent requirements for fund protection and operational transparency.

In summary, Rc Global is not a safe choice, and traders should exercise caution when considering this broker for their forex trading needs.

Is RC Global a scam, or is it legit?

The latest exposure and evaluation content of RC Global brokers.

RC Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RC Global latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.