Regarding the legitimacy of EMR FX forex brokers, it provides ASIC, VFSC and WikiBit, (also has a graphic survey regarding security).

Is EMR FX safe?

Business

Software Index

Is EMR FX markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Forex Execution (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

EMR CAPITAL PTY LTD

Effective Date: Change Record

2011-10-21Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 2 150 COLLINS ST MELBOURNE VIC 3000 AUSTRALIAPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

EMR TECHNOLOGY PTY LIMITED

Effective Date:

2017-05-29Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is EMR FX Safe or a Scam?

Introduction

EMR FX, established in 2017, positions itself as a forex broker operating primarily in Australia. With the ever-growing popularity of forex trading, it is essential for traders to thoroughly evaluate the credibility of their chosen brokers. Unscrupulous firms can easily mislead inexperienced traders, leading to significant financial losses. Therefore, conducting a comprehensive assessment of EMR FX's regulatory status, company background, trading conditions, and customer experiences is crucial. This article employs a structured approach to investigate whether EMR FX is a safe trading platform or a potential scam, based on various data sources and user feedback.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. EMR FX claims to be regulated by the Vanuatu Financial Services Commission (VFSC) and the Australian Securities and Investments Commission (ASIC). However, there are concerns regarding the revocation of its licenses by the VFSC, which raises questions about its operational legality. Below is a summary of EMR FX's regulatory information:

| Regulating Authority | License Number | Regulating Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission (VFSC) | 40272 | Vanuatu | Revoked |

| Australian Securities and Investments Commission (ASIC) | 410316 | Australia | Exceeded |

The revocation of the VFSC license indicates a significant regulatory risk, suggesting that EMR FX may not operate under strict oversight. While ASIC is known for its rigorous standards, the fact that EMR FX has exceeded its licensing requirements raises further concerns. Traders should be wary of engaging with brokers who have questionable regulatory histories, as this can lead to a lack of investor protection and increased risks.

Company Background Investigation

EMR FX is a relatively young broker, having been founded in 2017. The company operates under the name EMR Technology Pty Limited and is based in Australia. However, details regarding its ownership structure and management team remain sparse. A thorough background check reveals that the transparency and disclosure of information are not at the level one would expect from a reputable broker. The lack of available information about the management team and their professional backgrounds raises red flags about the company's operational integrity.

In addition, the company's website does not provide clear insights into its ownership or the qualifications of its key personnel. This lack of transparency can be a warning sign for potential investors, as a credible broker should openly share information about its leadership and operational practices. Without a well-defined structure and experienced management, the safety of trading with EMR FX comes into question.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. EMR FX operates on the MetaTrader 4 (MT4) platform, which is widely used in the forex industry. However, the broker's fee structure appears to be less competitive compared to industry standards. Below is a comparison of EMR FX's core trading costs:

| Cost Type | EMR FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 4 pips | 1-1.5 pips |

| Commission Structure | Not disclosed | Varies by broker |

| Overnight Interest Range | Not specified | Varies by broker |

The spread of 4 pips for major currency pairs is significantly higher than the industry average, which may reduce potential profitability for traders. Additionally, the lack of clarity surrounding the commission structure and overnight interest rates raises concerns about hidden fees that could impact trading outcomes. Such unfavorable trading conditions can be detrimental to traders, especially those who engage in frequent trading strategies.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. EMR FX claims to implement measures to ensure the security of traders' funds, including segregated accounts. However, the effectiveness of these measures remains unverified due to the broker's questionable regulatory status. The absence of robust investor protection schemes, such as those provided by higher-tier regulators, further exacerbates concerns.

Moreover, there have been reports of fund withdrawal issues, with users claiming difficulties in accessing their money. These incidents highlight potential vulnerabilities in EMR FX's operational practices, raising alarms about the safety of client funds. Traders should be cautious when dealing with brokers that do not have a proven track record of safeguarding client assets.

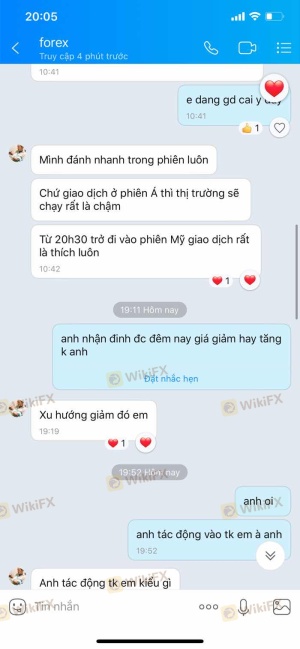

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing a broker's reliability. EMR FX has received mixed reviews from users, with several complaints regarding poor customer service and withdrawal issues. Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Fund withdrawal delays | High | Slow response |

| Inducement to deposit more funds | High | Unresponsive |

| Account deactivation without notice | Medium | Poor communication |

One notable case involved a trader who reported being unable to withdraw funds after multiple requests, leading to frustration and distrust in the broker's operations. Such experiences can significantly impact a trader's confidence in the broker and highlight the importance of responsive customer support.

Platform and Execution

The trading platform's performance and execution quality are critical factors for traders. EMR FX utilizes the MT4 platform, known for its user-friendly interface and extensive features. However, some users have reported issues with order execution, including slippage and rejected orders. These problems can adversely affect trading performance, particularly for those employing precise trading strategies.

Additionally, the lack of advanced security features, such as two-step authentication, raises concerns about the platform's overall security. Traders should be aware of these risks when considering EMR FX as their trading platform.

Risk Assessment

Using EMR FX presents several risks that traders should be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Revoked licenses raise significant concerns. |

| Fund Safety | High | Reports of withdrawal issues and lack of investor protection. |

| Trading Conditions | Medium | High spreads and unclear fees impact profitability. |

| Customer Support | High | Poor response to complaints and issues. |

To mitigate these risks, traders should consider using smaller amounts for initial deposits and thoroughly researching alternative brokers with better regulatory standing and customer feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that EMR FX presents several red flags that potential traders should carefully consider. The revoked regulatory licenses, high trading costs, and poor customer feedback indicate that EMR FX may not be a safe option for forex trading. While the broker has been operational since 2017, the lack of transparency and significant complaints raise concerns about its legitimacy.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers regulated by top-tier authorities such as the FCA or ASIC should be prioritized to ensure a safer trading environment. Always conduct thorough research and due diligence before committing to any broker to protect your investments effectively.

Is EMR FX a scam, or is it legit?

The latest exposure and evaluation content of EMR FX brokers.

EMR FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EMR FX latest industry rating score is 5.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.