Is GRAS SAVOYE safe?

Pros

Cons

Is Gras Savoye Safe or Scam?

Introduction

Gras Savoye is a broker that has positioned itself within the forex market since its establishment in 2017. As a part of the larger Willis Towers Watson network, it offers a variety of financial services, including insurance brokerage and risk management consulting. However, the rapid growth of online trading platforms has led to an influx of forex brokers, making it crucial for traders to evaluate their options carefully. Many brokers have been flagged for fraudulent practices, which can lead to significant financial losses for traders. Therefore, assessing the legitimacy of Gras Savoye is essential for potential investors. This article will investigate the safety and reliability of Gras Savoye by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulatory and Legality

The regulatory status of a forex broker is one of the most critical factors to consider when evaluating its safety. Gras Savoye claims to be regulated by the Financial Conduct Authority (FCA) in the United Kingdom; however, there are conflicting reports regarding its legitimacy.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| FCA | 495825 | United Kingdom | Suspicious Clone |

The FCA is known for its stringent regulatory standards, which aim to protect investors. However, Gras Savoye has been flagged as a "suspicious clone," indicating that it may not be operating under the legitimate license. This raises significant concerns about the broker's compliance with regulatory requirements. While no negative regulatory disclosures have been found, the absence of a clear regulatory framework can expose traders to risks, including potential fraud and loss of funds. Thus, when asking, "Is Gras Savoye safe?" the answer remains ambiguous due to its questionable regulatory status.

Company Background Investigation

Gras Savoye has a relatively short history, having been established in 2017. Despite its affiliation with Willis Towers Watson, which has a robust reputation in the insurance and risk management sectors, the broker's limited operational history raises questions about its long-term viability. The management team behind Gras Savoye comprises professionals with varying backgrounds in finance and risk management, but the lack of transparency regarding their specific qualifications is concerning.

The ownership structure of Gras Savoye is also worth noting. It operates under the umbrella of Willis Towers Watson, a well-established entity in the industry. However, the transition from a traditional insurance brokerage to a forex broker may not be seamless. The companys transparency regarding operational changes and disclosures is crucial for building trust with potential clients.

Trading Conditions Analysis

When evaluating whether Gras Savoye is safe for trading, it's essential to consider its trading conditions, including fees and spreads. A broker's fee structure can significantly impact a trader's profitability.

| Fee Type | Gras Savoye | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | None | 0.5% - 1.5% |

| Overnight Interest Range | High | Low |

Gras Savoye's variable spreads for major currency pairs can be a double-edged sword. While competitive, they may also indicate a lack of transparency in pricing. Additionally, the absence of a commission model could suggest hidden fees, which traders should be wary of. High overnight interest rates can further erode profits, making it imperative for traders to read the fine print before engaging with the broker. Therefore, the question "Is Gras Savoye safe?" becomes more pertinent as traders must navigate these potentially unfavorable trading conditions.

Customer Funds Security

The safety of customer funds is paramount when assessing a broker's reliability. Gras Savoye claims to implement various security measures, including segregated accounts to protect client funds. This practice is standard among reputable brokers and is designed to ensure that client funds are kept separate from the company's operational capital.

Moreover, the broker should ideally offer investor protection schemes, which can provide additional security for traders in the event of insolvency. However, there is little information available regarding the specific protections Gras Savoye offers, such as negative balance protection.

Historically, the broker has faced complaints regarding withdrawal issues, which raises red flags about its financial practices. If clients are unable to access their funds, it could indicate deeper systemic issues within the brokerage. Therefore, when asking, "Is Gras Savoye safe?" the answer is complicated by the lack of clarity surrounding its fund security protocols.

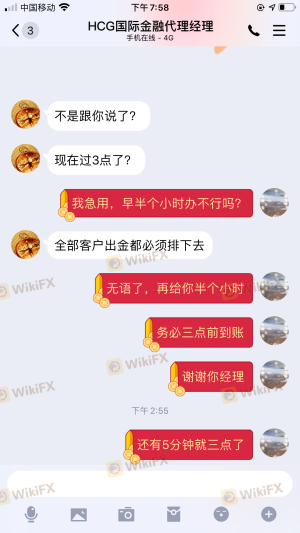

Customer Experience and Complaints

Customer feedback is a critical component in evaluating the safety of any broker. Reviews and testimonials can provide insight into the overall client experience. Unfortunately, many users have reported issues with Gras Savoye, particularly related to withdrawal difficulties.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service Delays | Medium | Inconsistent |

Common complaints include the inability to withdraw funds and unresponsive customer service. These issues have led many to label Gras Savoye as a scam, as clients report feeling trapped in their investments. For instance, one user claimed to have earned substantial profits but was unable to withdraw their funds, leading to frustration and distrust. Such complaints significantly impact the broker's reputation and raise questions about its legitimacy.

Platform and Execution

The trading platform's performance is another crucial factor in determining the overall safety of a broker. Users have reported mixed experiences with Gras Savoye's platform, citing issues with stability and execution quality.

Many traders have experienced slippage during high-volatility periods, which can lead to unexpected losses. Moreover, instances of rejected orders have been reported, further complicating the trading experience. If a broker's platform cannot execute trades reliably, it casts doubt on its overall credibility. Therefore, the question "Is Gras Savoye safe?" gains urgency as traders consider the potential risks associated with unreliable trading platforms.

Risk Assessment

Engaging with any forex broker carries inherent risks, and Gras Savoye is no exception.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Uncertain regulatory status |

| Fund Security | Medium | Potential issues with withdrawals |

| Trading Conditions | Medium | Variable spreads and hidden fees |

| Customer Support | High | Poor response to client complaints |

The combination of high regulatory risk, concerns over fund security, and poor customer support creates a precarious situation for potential traders. To mitigate these risks, traders are advised to conduct thorough due diligence, seek alternative brokers with better reputations, and ensure they fully understand the terms and conditions before committing any funds.

Conclusion and Recommendations

In conclusion, the evidence surrounding Gras Savoye suggests that caution is warranted. While the broker has established itself within the forex market, significant concerns about its regulatory status, customer experiences, and overall transparency raise red flags. Therefore, potential traders should approach with caution and consider alternative options.

For those still interested in forex trading, it is advisable to explore brokers with solid regulatory backing, transparent pricing structures, and positive customer reviews. Brokers like IG, OANDA, and Forex.com are worth considering as safer alternatives. Ultimately, the question "Is Gras Savoye safe?" leans towards a negative response, urging traders to prioritize their financial security and consider more reputable options.

Is GRAS SAVOYE a scam, or is it legit?

The latest exposure and evaluation content of GRAS SAVOYE brokers.

GRAS SAVOYE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GRAS SAVOYE latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.