Is Eliom FX safe?

Business

License

Is Eliom FX A Scam?

Introduction

Eliom FX is a relatively new player in the forex market, claiming to offer a variety of trading options for both novice and experienced traders. Established in 2021 and registered in Saint Vincent and the Grenadines, Eliom FX presents itself as a broker that promises competitive trading conditions and a user-friendly platform. However, the rapid growth of online trading has also led to a rise in fraudulent activities, making it crucial for traders to carefully evaluate the legitimacy of their chosen brokers. This article aims to investigate whether Eliom FX is a safe trading option or a potential scam. Our analysis is based on various online sources, reviews, and regulatory information, ensuring a comprehensive understanding of the broker's credibility.

Regulation and Legitimacy

One of the primary factors to consider when evaluating any forex broker is its regulatory status. Regulation not only ensures that brokers adhere to specific standards but also protects traders in case of disputes or financial issues. Eliom FX is registered in Saint Vincent and the Grenadines, a jurisdiction known for its loose regulatory framework, particularly concerning forex trading.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | 2091 LLC 2022 | Saint Vincent and the Grenadines | Not Regulated |

As indicated in the table, Eliom FX does not hold a valid license from any reputable financial authority. The SVG FSA has ceased to supervise brokers, raising questions about the safety of funds deposited with Eliom FX. The absence of regulatory oversight is a significant red flag, as it means that traders have little recourse in case of disputes or malfeasance. Unregulated brokers often operate without the necessary checks and balances, making it easier for them to engage in fraudulent activities.

Company Background Investigation

Eliom FX was founded in 2021, making it a relatively new entrant in the forex trading landscape. The company's ownership structure is not fully transparent, which is concerning for potential investors. While the broker claims to have a professional management team, detailed information about their backgrounds and qualifications is scarce. This lack of transparency can be a warning sign, as reputable brokers typically provide comprehensive information about their leadership and operational history.

The company's website offers limited insights into its operational practices and policies, which further compounds concerns regarding its credibility. A broker that fails to disclose essential information about its management and operational history may not be acting in the best interests of its clients. As such, the question arises: Is Eliom FX safe for traders? The lack of transparency and regulatory oversight suggests that it may not be.

Trading Conditions Analysis

When considering whether Eliom FX is a scam, it's essential to evaluate its trading conditions. The broker claims to offer competitive spreads and various account types, but the minimum deposit requirement is notably high compared to industry standards.

| Fee Type | Eliom FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1.0-1.5 pips |

| Commission Model | $7-$10 per lot | $5-$8 per lot |

| Overnight Interest Range | Not Disclosed | 0.5%-2% |

The table above highlights some of the core trading costs associated with Eliom FX. The broker's lack of transparency regarding spreads and overnight interest rates raises concerns about hidden fees that could affect traders' profitability. Additionally, the high minimum deposit requirement of $5,000 for certain accounts is significantly above the industry average, which typically allows for smaller initial investments. This could deter many potential traders from engaging with the platform, further questioning its accessibility and fairness.

Client Fund Safety

Another critical aspect to consider is the safety of client funds. Eliom FX does not provide clear information on how it protects client funds, which is a significant concern for potential investors.

The broker's website lacks details on whether client funds are held in segregated accounts, a common practice among regulated brokers to ensure that clients' money is protected in case the broker faces financial difficulties. Furthermore, the absence of investor protection schemes, such as compensation funds, means that traders could potentially lose their entire investment without any recourse.

Historically, unregulated brokers have been known to engage in questionable practices, including the misappropriation of client funds. The lack of transparency regarding Eliom FX's fund management policies raises serious concerns about the safety of traders' investments. Therefore, potential clients should carefully consider whether Eliom FX is a safe option for their trading activities.

Customer Experience and Complaints

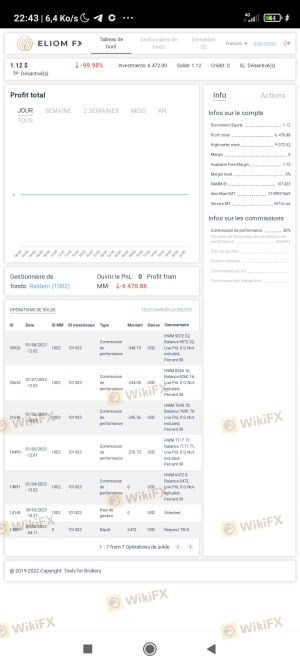

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews and testimonials about Eliom FX reveal a mixed bag of experiences, with some users praising the platform's ease of use, while others report issues related to withdrawals and customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Account Management | Medium | Unresponsive |

| Spread Discrepancies | Medium | No Clarification |

Common complaints include difficulties in withdrawing funds, which is a significant concern for any trader. Reports suggest that clients have experienced delays and complications when attempting to access their money. These issues, coupled with the lack of a robust customer support system, further raise questions about the broker's credibility.

In one notable case, a trader reported that their account was emptied overnight, with the broker claiming no responsibility. Such incidents are alarming and indicate a potential pattern of behavior that could be detrimental to traders. This raises the question: Is Eliom FX safe? The accumulating evidence suggests that clients may be at risk.

Platform and Execution

The trading platform offered by Eliom FX is primarily the MetaTrader 4 (MT4), a widely used platform in the forex industry. While MT4 is known for its reliability and user-friendly interface, the execution quality, slippage, and potential for manipulation are areas of concern.

Users have reported instances of slippage during high volatility periods, which can adversely affect trading outcomes. Moreover, there are allegations that the broker may manipulate quotes, leading to unfavorable trading conditions for clients. Such practices are common among unregulated brokers and raise serious ethical questions about the broker's operations.

Risk Assessment

Using Eliom FX presents several risks that potential traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of transparent fund management |

| Execution Risk | Medium | Potential for slippage and manipulation |

| Customer Service Risk | High | Poor responsiveness to complaints |

The high-risk levels across multiple categories suggest that trading with Eliom FX could expose investors to significant financial jeopardy. Traders should exercise extreme caution and consider alternative options that offer more robust protections and transparency.

Conclusion and Recommendations

In conclusion, the evidence gathered raises serious concerns about the legitimacy of Eliom FX as a forex broker. Its lack of regulatory oversight, transparency issues, and troubling customer feedback suggest that it may not be a safe option for traders. The question remains: Is Eliom FX safe? Based on the analysis, it appears that the risks outweigh the potential benefits.

For traders seeking reliable and secure options, it is advisable to consider brokers that are well-regulated and have a proven track record of protecting client funds. Some recommended alternatives include established brokers that are regulated by reputable authorities such as the FCA, ASIC, or CySEC. These brokers typically offer better customer support, transparent fee structures, and a higher level of investor protection.

Is Eliom FX a scam, or is it legit?

The latest exposure and evaluation content of Eliom FX brokers.

Eliom FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Eliom FX latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.