Eliom FX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive eliom fx review reveals major concerns about the broker's safety for traders. Eliom FX was established in 2022 and incorporated in Saint Vincent and the Grenadines, but it operates without any regulatory licenses. This raises immediate red flags about fund security and how transparent their operations really are. The platform offers MetaTrader 4 for forex and CFD trading with leverage up to 1:100. They target users who want easy entry to financial markets.

However, user feedback shows a troubling picture. Multiple traders report losing all their funds completely. One user stated "All my money disappeared on this scam, eliom fx are some thieves." The broker's trading robots have performed very poorly too. Three out of four automated trading systems crashed within less than a year of operation. When people asked about these failures, the company reportedly hides behind terms of service stating "investing is risky" rather than investigating what went wrong.

The platform may appeal to traders looking for easy forex and CFD trading opportunities. However, the lack of regulatory oversight combined with widespread user complaints about fund safety makes this broker unsuitable for serious traders who want to protect their capital.

Important Disclaimer

This review uses publicly available information and user feedback from various sources including Trustpilot and industry watchdog sites. The evaluation has not been verified through direct testing of the platform. Eliom FX operates without regulatory licenses, so potential users should know that legal protections may vary significantly across different jurisdictions. The broker's SVG incorporation provides minimal regulatory oversight compared to major financial centers. This potentially exposes traders to increased risks regardless of their location.

Overall Rating Framework

Broker Overview

Company Background and Establishment

Eliom FX entered the forex market in 2022 as an SVG-incorporated brokerage entity. The company is headquartered in Saint Vincent and the Grenadines. According to available company information, the broker positions itself as a provider of online multi-asset trading services. They primarily focus on foreign exchange and contracts for difference.

However, the company's rapid market entry without establishing proper regulatory credentials has raised questions about its long-term viability. Their commitment to trader protection also remains questionable. The broker's business model centers on providing accessible trading opportunities through the widely recognized MetaTrader 4 platform. Despite claiming to offer comprehensive trading services, industry analysis suggests that Eliom FX operates with minimal oversight and questionable leadership transparency. These characteristics are commonly associated with high-risk brokerages.

Trading Platform and Asset Coverage

Eliom FX uses the MetaTrader 4 platform as its primary trading interface. The platform offers access to forex pairs and CFD instruments. The platform provides standard MT4 functionality, though specific details about available currency pairs, commodities, or indices remain unclear in publicly available documentation. The broker advertises leverage ratios up to 1:100. This falls within conservative ranges compared to some offshore competitors but may still pose significant risks for inexperienced traders.

This eliom fx review notably lacks specific details about regulatory oversight. No licensing information appears in official company materials or independent verification sources.

Detailed Service Analysis

Regulatory Status and Compliance

Available information shows that Eliom FX operates without recognized regulatory licenses from major financial authorities. This absence of oversight significantly impacts trader protections and dispute resolution mechanisms.

Deposit and Withdrawal Methods

Specific information about funding options and withdrawal procedures was not detailed in available company documentation. This raises concerns about operational transparency.

Minimum Deposit Requirements

The broker has not clearly disclosed minimum account opening requirements in accessible materials. This makes it difficult for potential clients to assess entry barriers.

Promotional Offers

No specific bonus or promotional programs were identified in the reviewed company information.

Available Trading Assets

The platform focuses primarily on forex currency pairs and CFD products. However, the exact range of instruments remains unspecified in available documentation.

Cost Structure Analysis

Critical information regarding spreads, commissions, and overnight financing charges requires further investigation. These details were not prominently featured in accessible company materials.

Leverage Ratios

Maximum leverage is advertised at 1:100. This positions the broker in the moderate risk category compared to higher-leverage competitors.

Platform Technology

The exclusive use of MetaTrader 4 provides familiar functionality for experienced traders. However, it may limit advanced features available on newer platforms.

Geographic Restrictions

Specific regional limitations were not detailed in the reviewed materials.

Customer Support Languages

Available support language options were not specified in accessible company information.

Account Conditions Analysis

The account structure at Eliom FX presents several transparency challenges that potential traders should carefully consider. While the broker offers MetaTrader 4 access with leverage up to 1:100, critical details about account types, minimum deposits, and fee structures remain unclear in publicly available materials. This lack of transparency represents a significant departure from industry standards. Reputable brokers typically provide comprehensive account specifications.

User feedback suggests that account opening processes may lack the robust verification procedures expected from regulated brokerages. The absence of detailed account documentation raises questions about the broker's commitment to know-your-customer requirements and anti-money laundering compliance. Additionally, the limited information about Islamic accounts or other specialized account types suggests a narrow service offering compared to established competitors.

The 1:100 leverage ratio is moderate compared to some offshore brokers, but it still presents substantial risk when combined with the platform's regulatory status. Without proper oversight mechanisms, traders may find themselves exposed to risks that extend beyond normal market volatility. This eliom fx review emphasizes that the combination of limited transparency and unregulated status creates an environment where account holders face heightened uncertainty about their capital protection.

Eliom FX's technological infrastructure centers around the MetaTrader 4 platform. The platform provides standard charting tools, technical indicators, and automated trading capabilities. However, the broker's implementation appears problematic based on user experiences. The platform's automated trading features, specifically the trading robots, have demonstrated significant reliability issues that directly impact trader performance and confidence.

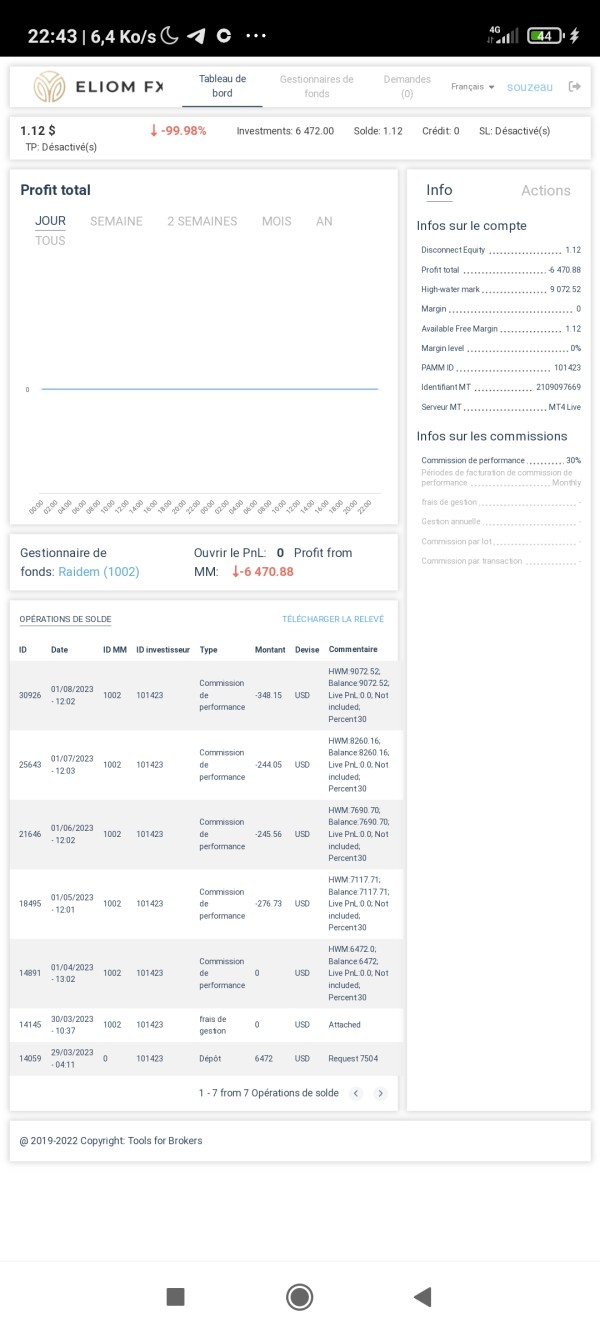

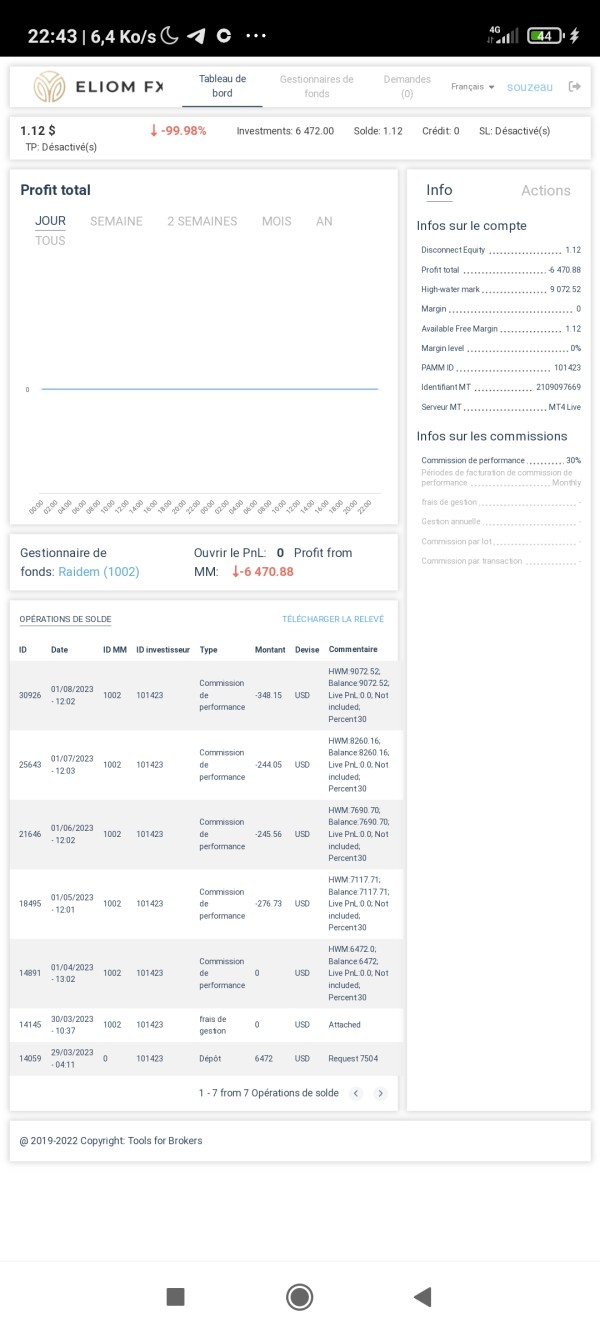

According to user reports, three out of four available trading robots crashed within their first year of operation. This represents a 75% failure rate for automated trading systems. This exceptionally high failure rate suggests inadequate testing, poor risk management protocols, or insufficient technical infrastructure to support automated trading strategies. When confronted about these systematic failures, the company reportedly deflected responsibility rather than addressing underlying technical issues.

The absence of proprietary research tools, market analysis resources, or educational materials further limits the platform's value proposition. Unlike regulated brokers that typically provide comprehensive market research, economic calendars, and educational content, Eliom FX appears to offer minimal supplementary resources beyond basic MT4 functionality. This limited toolkit particularly disadvantages novice traders who require additional guidance and market insights to develop their trading skills effectively.

Customer Service and Support Analysis

Customer service quality represents one of the most concerning aspects of the Eliom FX offering. This assessment is based on available user feedback and reported experiences. Multiple trader accounts describe unresponsive support when facing serious issues, including fund withdrawal problems and technical difficulties with trading systems. The pattern of poor customer service appears systemic rather than isolated. This suggests inadequate staffing or training for support personnel.

User reports indicate that when traders experience problems with the automated trading systems or fund access, the company's response typically involves referencing terms of service rather than investigating specific issues. This defensive approach contrasts sharply with industry best practices. Reputable brokers actively work to resolve client concerns and maintain transparent communication throughout the process.

The lack of detailed information about support channels, availability hours, or escalation procedures in company materials further compounds these concerns. Professional brokerages typically provide multiple contact methods, clearly defined response timeframes, and specialized support for different types of inquiries. The absence of such structured support systems suggests that Eliom FX may lack the organizational infrastructure necessary to handle client needs effectively. This becomes particularly problematic during periods of market stress or technical difficulties.

Trading Experience Analysis

The trading experience at Eliom FX presents a mixed picture. The familiar MetaTrader 4 interface provides some stability while underlying execution and reliability issues create significant concerns. User feedback indicates inconsistent platform performance, with particular problems related to automated trading system stability and order execution quality. These technical issues directly impact the practical trading experience and raise questions about the broker's technological infrastructure.

Platform stability concerns become especially pronounced when considering the documented failures of trading robots. The systematic breakdown of automated trading systems suggests that the broker's technical infrastructure may be inadequate for supporting sophisticated trading strategies or high-frequency operations. Such reliability issues can result in unexpected losses and missed trading opportunities. This becomes particularly problematic for traders relying on automated strategies.

Order execution quality and pricing transparency represent additional areas of concern based on user reports. While specific data about slippage rates, requote frequency, or execution speeds was not available in reviewed materials, the general pattern of user dissatisfaction suggests that execution quality may not meet professional standards. The combination of technical instability and execution concerns creates a trading environment that may be unsuitable for serious traders requiring reliable, professional-grade services.

Trust and Safety Analysis

The trust and safety profile of Eliom FX presents significant red flags that potential traders must carefully consider. The broker's operation without regulatory licenses from recognized financial authorities eliminates crucial investor protections typically available through regulated entities. This regulatory gap means that traders have limited recourse through official channels if disputes arise or if the broker fails to meet its obligations.

User reports of fund disappearance represent the most serious trust concern. Multiple accounts describe complete loss of deposited capital. One particularly concerning user statement, "All my money disappeared on this scam, eliom fx are some thieves," illustrates the severity of reported problems. Such allegations, when appearing across multiple sources, suggest systematic issues with fund handling or withdrawal processes rather than isolated incidents.

The company's incorporation in Saint Vincent and the Grenadines provides minimal regulatory oversight compared to major financial centers. This jurisdiction choice, combined with the lack of transparent leadership information and proper licensing, follows patterns commonly associated with questionable financial operations. The absence of segregated client accounts, deposit insurance, or other standard safety measures leaves traders vulnerable to total capital loss. This eliom fx review strongly emphasizes that the current trust and safety profile makes the broker unsuitable for traders prioritizing capital protection and regulatory compliance.

User Experience Analysis

Overall user satisfaction with Eliom FX appears predominantly negative based on available feedback from multiple sources. The recurring themes in user reports center on fund safety concerns, technical system failures, and poor customer service responsiveness. These consistent patterns across different review platforms suggest systematic operational problems rather than isolated user experiences.

The user demographic appears to include traders attracted by low entry barriers and promises of automated trading profits. However, the reality described in user feedback contrasts sharply with marketing promises. This leads to widespread dissatisfaction. The particularly poor performance of trading robots has left many users feeling misled about the platform's capabilities and profit potential.

Common complaints include complete fund losses, unresponsive customer service, and trading system crashes that occur without warning or adequate explanation. Users report feeling abandoned when problems arise. The company reportedly hides behind legal disclaimers rather than addressing legitimate concerns. The pattern of negative experiences suggests that Eliom FX may lack the operational infrastructure and commitment necessary to provide satisfactory service to its client base.

For potential users considering this platform, the overwhelming negative feedback should serve as a strong warning about the risks involved. While some traders seeking high-risk opportunities might still consider the platform, the evidence suggests that most users would be better served by choosing regulated alternatives with proven track records of client protection and service quality.

Conclusion

This comprehensive eliom fx review reveals a broker with significant operational and safety concerns that make it unsuitable for most traders. While the platform offers MetaTrader 4 access and moderate leverage ratios, these limited advantages are overshadowed by the lack of regulatory oversight. Widespread user reports of fund losses and systematic failures of trading systems create additional concerns.

The broker may only be appropriate for extremely high-risk tolerance traders who fully understand and accept the possibility of total capital loss. However, even risk-seeking traders would likely find better opportunities with regulated brokers offering similar leverage and platform access with proper investor protections.

The combination of no regulatory licenses, poor customer service, technical system failures, and multiple user reports of fund disappearance creates an unacceptable risk profile for serious trading activities. Traders prioritizing capital safety and professional service standards should seek regulated alternatives. These alternatives should have proven track records and proper oversight mechanisms.