Regarding the legitimacy of Ektronix forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is Ektronix safe?

Business

License

Is Ektronix markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

EIGHTCAP PTY LTD

Effective Date: Change Record

2011-04-29Email Address of Licensed Institution:

compliance@eightcap.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

EIGHTCAP PTY LTD 'RIALTO SOUTH TOWER' L 35 525 COLLINS ST MELBOURNE VIC 3000Phone Number of Licensed Institution:

0383734800Licensed Institution Certified Documents:

Is Ektronix Safe or Scam?

Introduction

Ektronix is a relatively new player in the Forex market, having been established in 2021. As the foreign exchange (Forex) market continues to grow, the number of brokers has surged, making it essential for traders to carefully evaluate their options. With the potential for significant financial loss, traders must exercise caution when selecting a broker. This article aims to assess whether Ektronix is a safe trading platform or a potential scam. Our investigation is based on a comprehensive review of regulatory compliance, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

Regulation is a critical aspect of any Forex broker's legitimacy. It serves as a safety net for traders, ensuring that the broker adheres to specific standards of conduct. Ektronix claims to be regulated, but a closer look reveals that it operates under the supervision of the Australian Securities and Investments Commission (ASIC) as a "suspicious clone." This raises concerns about its legitimacy and trustworthiness.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Suspicious Clone |

ASIC is known for its strict regulatory standards, which are designed to protect traders. However, the designation of Ektronix as a "suspicious clone" indicates that it may not be operating under the same level of scrutiny as fully licensed brokers. The lack of a valid license and the negative equity policy further exacerbate concerns regarding the safety of trading with Ektronix.

Company Background Investigation

Ektronix's company history is another area of concern. Founded in 2021, it is a relatively new entrant in the Forex market. The ownership structure remains opaque, with limited information available about its founders or management team. This lack of transparency can be a red flag for potential investors.

The management teams professional experience is also unclear, which raises further questions about the broker's reliability. Established brokers typically have experienced teams with a proven track record in the financial industry. In contrast, Ektronix's lack of information makes it difficult to assess its credibility.

Trading Conditions Analysis

When evaluating whether Ektronix is safe, it is essential to consider its trading conditions, including fees and spreads. Ektronix's overall fee structure appears competitive; however, the presence of unusual fees may indicate hidden costs that could affect traders' profitability.

| Fee Type | Ektronix | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | 0.5% | 0.3% |

The spreads offered by Ektronix are slightly higher than the industry average, which may deter some traders. Furthermore, the absence of a clear commission structure raises questions about the potential for hidden fees. Transparency in fee structures is vital for traders to make informed decisions, and Ektronixs lack thereof is concerning.

Client Fund Security

Client fund safety is a crucial factor in determining whether Ektronix is safe. The broker claims to have measures in place for fund security, including segregated accounts and negative balance protection. However, the effectiveness of these measures is difficult to verify given the lack of regulatory oversight.

Traders should be particularly cautious, as the absence of a robust regulatory framework can lead to potential risks. Historical incidents involving fund mismanagement or fraud can severely impact a broker's reputation, and Ektronix's limited track record raises concerns about its reliability in safeguarding client funds.

Customer Experience and Complaints

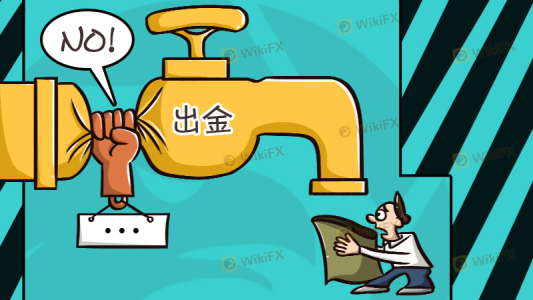

Customer feedback serves as an essential indicator of a broker's reliability. A review of user experiences with Ektronix reveals a mix of positive and negative sentiments. Common complaints include slow customer service response times and difficulties in withdrawing funds, which can be alarming for potential traders.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service | Medium | Inconsistent Support |

One notable case involved a trader who faced significant delays in processing a withdrawal request, leading to frustration and a loss of trust in the platform. Such issues are particularly concerning for traders who prioritize quick access to their funds.

Platform and Trade Execution

Evaluating the trading platform's performance is essential to determine whether Ektronix is safe. The platform's stability, user experience, and execution quality are critical factors for traders. Ektronix offers a standard trading platform, but reports of slippage and rejected orders have emerged, raising questions about the overall execution quality.

Users have reported instances of significant slippage during high volatility periods, which can lead to unexpected losses. Additionally, the frequency of rejected orders can negatively impact trading strategies and overall user satisfaction. These issues may indicate potential manipulation or inefficiencies in the trading platform.

Risk Assessment

Using Ektronix as a trading platform involves several risks that traders should be aware of. The lack of regulatory oversight, combined with customer complaints and execution issues, presents a challenging environment for traders.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under suspicious regulatory status |

| Execution Risk | Medium | Reports of slippage and rejected orders |

| Customer Service Risk | Medium | Slow response times and withdrawal issues |

To mitigate these risks, traders should consider setting strict risk management measures, such as stop-loss orders and position sizing, when trading with Ektronix. Additionally, potential clients should conduct thorough research and consider alternative brokers with stronger regulatory backgrounds.

Conclusion and Recommendations

In conclusion, the evidence suggests that Ektronix poses several risks that warrant caution. The broker's suspicious regulatory status, lack of transparency, and reported customer complaints raise significant concerns about its safety. While it may not be outright fraudulent, traders should approach Ektronix with caution and consider whether it aligns with their trading needs.

For traders seeking a reliable and trustworthy broker, it may be prudent to explore alternatives with established reputations and robust regulatory oversight. Brokers such as IG, OANDA, or Forex.com offer more transparent trading conditions and a higher level of security for client funds. Overall, while Ektronix may appeal to some traders, the associated risks suggest that it may not be the safest option in the Forex market.

Is Ektronix a scam, or is it legit?

The latest exposure and evaluation content of Ektronix brokers.

Ektronix Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ektronix latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.