Regarding the legitimacy of DUALIX forex brokers, it provides CYSEC, CYSEC and WikiBit, .

Is DUALIX safe?

Business

License

Is DUALIX markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RevokedLicense Type:

Market Making License (MM)

Licensed Entity:

Maxigrid Limited

Effective Date:

2011-05-31Email Address of Licensed Institution:

infobox@maxigrid.comSharing Status:

Website of Licensed Institution:

http://www.agmmarkets.com, www.dualix.com, www.maxigrid.comExpiration Time:

--Address of Licensed Institution:

214 Arch. Makarios III Avenue, Office 301, ‘IDEAL BUILDING’ Agias Zonis, 3030 Limassol, Cyprus, 214 Arch. Makariou III, Ideal Building, Office 301, Ayia Zoni, 3030, Limassol, Cyprus.Phone Number of Licensed Institution:

+357 25 262 922Licensed Institution Certified Documents:

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

MAXIFLEX LTD

Effective Date:

2014-11-10Email Address of Licensed Institution:

info@maxiflexglobal.comSharing Status:

No SharingWebsite of Licensed Institution:

https://europefx.com/, www.europecapitalgroup.com, www.europestocks.comExpiration Time:

--Address of Licensed Institution:

46 Ayiou Athanasiou Avenue, Floor 3 /Office 301a, 4102 Limassol, CyprusPhone Number of Licensed Institution:

35725262767Licensed Institution Certified Documents:

Is Dualix Safe or Scam?

Introduction

Dualix is an online forex and CFD broker that has positioned itself in the competitive landscape of the foreign exchange market. It offers a range of trading instruments, including currency pairs, commodities, indices, stocks, and cryptocurrencies. However, as with any broker, it is crucial for traders to carefully evaluate its credibility and safety before investing their hard-earned money. The foreign exchange market is rife with potential scams, and traders need to be vigilant to avoid falling victim to fraudulent practices. In this article, we will investigate the legitimacy of Dualix by examining its regulatory status, company background, trading conditions, customer fund safety, client experiences, and overall risks associated with trading through this broker.

Regulation and Legitimacy

One of the most critical factors in assessing whether Dualix is safe is its regulatory status. Regulation helps ensure that brokers adhere to certain standards of conduct, providing a layer of protection for traders' funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 145/11 | Cyprus | Revoked |

Dualix was previously regulated by CySEC, which is known for its stringent oversight of financial institutions. However, its license was revoked due to non-compliance with regulatory standards, specifically for engaging in fraudulent activities. This revocation raises significant concerns about the broker's legitimacy and whether it can be trusted with client funds. The lack of regulatory oversight means that Dualix is now operating as an unregulated broker, which increases the risk for traders. Given these circumstances, it is essential for potential clients to consider whether Dualix is safe to trade with.

Company Background Investigation

Dualix is owned by Maxigrid Ltd., a company that has faced scrutiny and regulatory action in the past. The company's history dates back to its establishment in 2011, but it has undergone a series of changes, including a name change from AGM Markets Limited. The management team behind Dualix has not been well publicized, leading to questions about their qualifications and experience in the financial industry.

Transparency is a vital aspect of a broker's credibility. Unfortunately, Dualix has not been forthcoming with information regarding its ownership structure and management team, which raises red flags for potential investors. The absence of detailed information about the company's leadership contributes to the perception that Dualix may not be safe for trading. Without clear transparency, traders may find it challenging to trust the broker with their investments.

Trading Conditions Analysis

When evaluating a broker, the overall cost structure and trading conditions are essential components. Dualix claims to offer competitive trading conditions; however, its fee structure has raised concerns among traders.

| Fee Type | Dualix | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 3 pips | 1-2 pips |

| Commission Model | Varies | Varies |

| Overnight Interest Range | Not specified | Varies |

The spread for major currency pairs at Dualix starts at 3 pips, which is significantly higher than the industry average of 1-2 pips. This discrepancy suggests that traders may incur higher trading costs when using Dualix compared to other brokers. Additionally, the broker has been known to impose various fees, including a €1,000 inactivity fee after six months, which is considered excessive. Such fees can quickly erode trading profits and may indicate that Dualix is not safe for traders who are looking for a cost-effective trading environment.

Client Fund Safety

Client fund safety is paramount when assessing whether Dualix is safe. The broker claims to implement measures such as segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable given the revocation of its regulatory license.

Traders must be aware that without regulatory oversight, there are no guarantees regarding the safety of their funds. The lack of an investor compensation scheme further exacerbates the risks associated with trading with Dualix. Historical data shows that many clients have reported issues with fund withdrawals, raising concerns about the broker's ability to safeguard client assets. Given these factors, potential traders should approach Dualix with caution and consider whether their funds would be secure with this broker.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. An analysis of user reviews for Dualix reveals a pattern of dissatisfaction among clients. Many traders have reported issues related to withdrawal delays, lack of communication, and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | Medium | Poor |

| High Fees | Medium | Average |

For instance, one user reported being unable to withdraw funds for several months, while another noted that customer support was unhelpful and dismissive. Such complaints highlight significant issues with Dualix's operational practices. Given the negative feedback and the severity of these complaints, it is evident that Dualix may not be safe for traders seeking a reliable and responsive broker.

Platform and Trade Execution

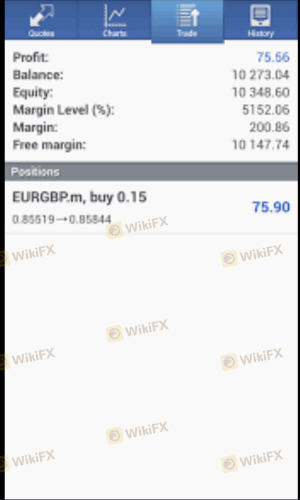

The trading platform offered by Dualix is a crucial aspect of the trading experience. The broker provides access to popular platforms like MetaTrader 4 and 5, which are known for their reliability and user-friendly interfaces. However, concerns have been raised regarding order execution quality, including reports of slippage and rejected orders.

Traders have expressed frustration over the execution speed and the apparent lack of transparency in how orders are processed. These issues may indicate potential manipulation or inefficiencies within the trading environment, further questioning whether Dualix is safe for traders. A broker's ability to execute trades effectively is critical for maintaining trust and ensuring a positive trading experience.

Risk Assessment

Trading with Dualix presents several risks that traders must consider before opening an account. The lack of regulation, high fees, and negative customer feedback contribute to an overall risk profile that is concerning.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Broker is unregulated after license revocation. |

| Financial Risk | Medium | High fees can erode trading profits. |

| Operational Risk | High | Poor customer service and withdrawal issues. |

To mitigate these risks, traders should conduct thorough research and consider using regulated brokers with a proven track record. It is advisable to start with a small investment and monitor the broker's performance before committing larger amounts.

Conclusion and Recommendations

In conclusion, the investigation into Dualix raises significant concerns about its legitimacy and safety. The revocation of its regulatory license, coupled with high trading costs and negative customer experiences, suggests that Dualix is not safe for traders seeking a reliable forex and CFD trading platform.

For traders considering their options, it is advisable to look for regulated brokers with transparent practices and positive client feedback. Some reputable alternatives include brokers regulated by the FCA or CySEC, which offer competitive trading conditions and robust customer support. In light of the findings, potential clients should exercise caution and consider whether the risks associated with Dualix outweigh the potential benefits of trading with this broker.

Is DUALIX a scam, or is it legit?

The latest exposure and evaluation content of DUALIX brokers.

DUALIX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DUALIX latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.