Ctin 2025 Review: Everything You Need to Know

Ctin, an Australian forex broker established in 2018, has garnered mixed reviews from users and experts alike. While it is regulated by the Australian Securities and Investments Commission (ASIC), its reputation is marred by concerns about its operational transparency and customer service. This review aims to provide a comprehensive overview of Ctin, focusing on user experiences, advantages, disadvantages, and expert opinions.

Note: It is important to consider that Ctin operates under different entities in various regions, which may affect its regulatory standing and user experience. This review synthesizes information from multiple sources to ensure fairness and accuracy.

Ratings Overview

We assess brokers based on user feedback, regulatory standing, and overall service quality.

Broker Overview

Ctin was founded in 2018 and is primarily based in Australia, with its headquarters located in Melbourne. The broker provides access to a variety of trading platforms, including its proprietary Ctin Trader Pro, which is compatible with Windows and Mac. However, it does not support popular platforms like MetaTrader 4 or 5, which may deter some traders. Ctin offers a range of trading instruments, including forex, CFDs, commodities, and indices, appealing to a diverse audience. Its primary regulator is ASIC, which is considered a reputable authority in the financial services sector.

Detailed Section

Regulatory Regions

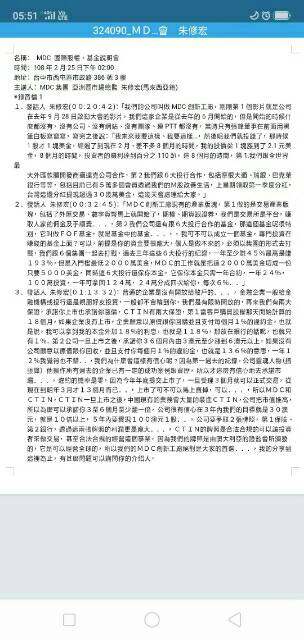

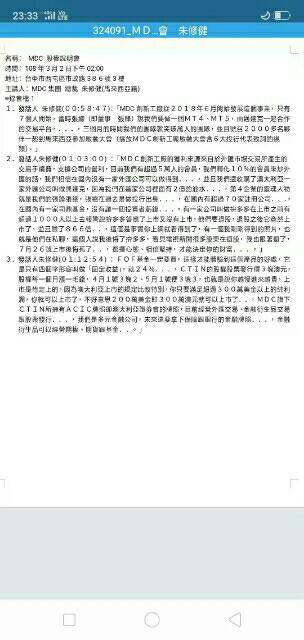

Ctin is regulated by the Australian Securities and Investments Commission (ASIC), which is known for its stringent regulatory requirements. However, some reviews suggest that Ctin may be operating as a "suspicious clone" of other legitimate brokers, raising concerns about its regulatory compliance. For example, a report from WikiFX indicates that while Ctin is licensed under ASIC, it is marked as a "suspicious clone," which could imply potential risks for traders (WikiFX).

Deposit/Withdrawal Currencies

Ctin primarily supports trading in Australian dollars (AUD) and other major currencies. However, specific information regarding deposit and withdrawal methods is sparse, with some users expressing frustration over the lack of clarity on these processes. According to user feedback, there is a significant delay in processing withdrawal requests, which is a critical factor for traders when evaluating a broker's reliability.

Minimum Deposit

The minimum deposit requirement for opening an account with Ctin is not explicitly stated across various reviews, which could deter potential clients. As noted on multiple platforms, the absence of clear information regarding deposit amounts and terms can lead to uncertainty among traders.

Ctin does not appear to offer any significant bonuses or promotions, which is a common practice among many forex brokers. This could be a disadvantage for traders looking for added incentives to open an account. The lack of promotional offers may also reflect the broker's focus on compliance and regulatory standards rather than aggressive marketing tactics.

Tradable Asset Classes

Ctin provides access to a diverse range of asset classes, including forex pairs, CFDs, commodities, and indices. This variety allows traders to diversify their portfolios. However, the absence of cryptocurrencies may limit options for those interested in trading digital assets.

Costs (Spreads, Fees, Commissions)

The cost structure at Ctin includes fixed commissions per share for stock trades and a fixed rate of 0.5% for currency conversions. While some users appreciate the transparent fee structure, others have raised concerns about the overall competitiveness of Ctin's spreads and fees compared to other brokers in the market.

Leverage

Ctin offers leverage options, but specific details regarding the maximum leverage available are not consistently reported across sources. This lack of clarity may lead to confusion among traders, especially those who rely heavily on leverage for their trading strategies.

Ctin primarily offers its proprietary trading platform, Ctin Trader Pro, along with a web-based platform and a mobile application. However, the absence of widely used platforms like MetaTrader 4 or 5 may limit its appeal to traders who prefer those tools for their trading strategies.

Restricted Regions

Ctin primarily caters to clients in Australia, and there is limited information regarding its services in other regions. This could be a limiting factor for international traders seeking a reliable broker.

Available Customer Service Languages

Ctin offers customer service support primarily in English, which may pose challenges for non-English speaking traders. User reviews indicate that while customer service representatives are generally responsive, there can be long wait times for assistance, which is a common concern among users.

Repeated Ratings Overview

Detailed Breakdown

-

Account Conditions: Ctin offers a straightforward account setup process, but the lack of clarity regarding minimum deposits and withdrawal procedures raises concerns.

Tools and Resources: The proprietary trading platform is functional but lacks the features and user-friendliness of more established platforms like MetaTrader, which may limit advanced traders.

Customer Service and Support: While customer service is generally responsive, users report long wait times and insufficient information on key aspects like deposits and withdrawals.

Trading Setup (Experience): Users have noted that the trading experience is relatively smooth, but the absence of popular trading tools can be limiting.

Trust Level: While regulated by ASIC, the "suspicious clone" status raises significant concerns about Ctin's overall trustworthiness.

User Experience: Overall user experience is mixed, with some appreciating the service while others express frustration over the lack of transparency and delays in withdrawals.

In conclusion, Ctin presents a mixed picture for potential traders. While it is regulated by ASIC and offers a range of trading instruments, concerns regarding its operational transparency, customer service, and the absence of popular trading platforms may deter some traders. As always, potential clients should conduct thorough research and consider their trading needs before opening an account with Ctin.