Is CORSA FUTURES safe?

Business

License

Is Corsa Futures A Scam?

Introduction

Corsa Futures is a forex broker that has emerged in the competitive landscape of online trading, positioning itself as a platform that offers various trading opportunities for investors. As the forex market continues to grow, it becomes increasingly essential for traders to carefully evaluate the legitimacy and reliability of the brokers they choose to work with. This is because the presence of fraudulent brokers can lead to significant financial losses and a lack of recourse for affected traders. In this article, we will conduct a thorough investigation into Corsa Futures, assessing its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our analysis is based on comprehensive research, including reviews from reputable financial websites and user feedback.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. Corsa Futures has been scrutinized for its lack of regulation by recognized financial authorities. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards and that clients' funds are protected. Without proper oversight, traders may be exposed to considerable risks, including the potential for fraud.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Corsa Futures does not hold a valid license from any reputable regulatory body, which raises significant concerns about its operations. The absence of regulation implies that the broker is not subject to the same scrutiny and accountability as regulated entities. This lack of oversight can lead to unethical practices, such as mismanagement of client funds and misleading advertising. Furthermore, the fact that Corsa Futures operates without a regulatory framework suggests that it may not prioritize the safety and security of its clients.

Company Background Investigation

Corsa Futures appears to lack transparency regarding its corporate structure and ownership. The broker does not provide clear information about its founding members or management team, which is a red flag for potential investors. A reputable brokerage typically discloses information about its executives, including their qualifications and experience in the financial sector. The absence of such details can indicate a lack of accountability and professionalism.

Additionally, Corsa Futures has not established a solid track record in the industry. The companys history is relatively obscure, and there are few verifiable details about its operational practices or client interactions. This lack of background information can make it challenging for potential traders to assess the broker's reliability and trustworthiness.

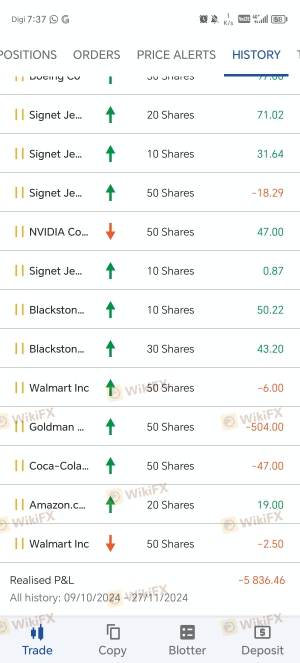

Trading Conditions Analysis

When evaluating a broker, it is crucial to understand its trading conditions, including fees, spreads, and commission structures. Corsa Futures claims to offer competitive trading conditions, but a closer examination reveals several concerning aspects. The broker's fee structure is not transparent, and there are indications of hidden fees that could impact traders' profitability.

| Fee Type | Corsa Futures | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clear information regarding spreads and commissions is troubling. Traders should be cautious of brokers that do not openly disclose their fee structures, as this can lead to unexpected costs and reduced returns on investment. Furthermore, any unusual or excessive fees can be indicative of a broker's intent to profit at the expense of its clients.

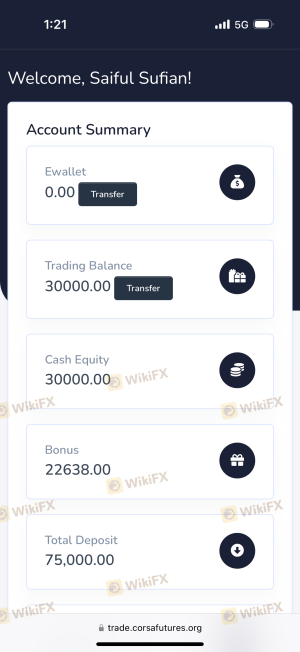

Customer Funds Safety

The safety of client funds is paramount in the forex trading landscape. Corsa Futures has been criticized for its inadequate measures to ensure the security of traders' funds. A reputable broker typically employs strict fund segregation practices, meaning clients' money is kept in separate accounts from the broker's operational funds. This practice protects investors in the event of the broker's insolvency.

However, Corsa Futures does not appear to follow such protocols, which raises concerns about the safety of client deposits. Additionally, the broker lacks investor protection mechanisms, such as negative balance protection, which could leave traders vulnerable to significant losses. Historical incidents involving fund mismanagement or disputes further exacerbate these concerns, as they indicate a lack of accountability and transparency.

Customer Experience and Complaints

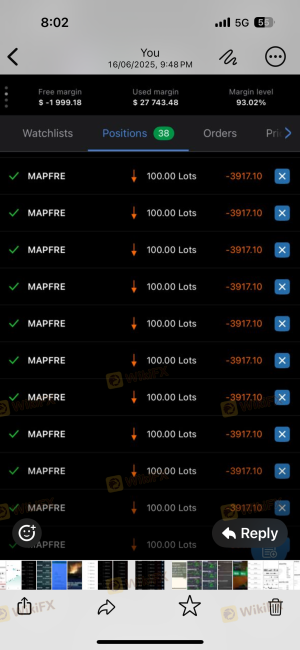

Customer feedback is a vital component in assessing a broker's reliability and service quality. Reviews of Corsa Futures reveal a pattern of negative experiences among traders. Common complaints include difficulties in withdrawing funds, unresponsive customer support, and misleading advertising practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Responsiveness | Medium | Poor |

| Misleading Marketing Practices | High | Poor |

One notable case involved a trader who reported being unable to withdraw their funds after multiple attempts. Despite reaching out to customer support, the trader received no satisfactory response, leading to frustration and financial loss. Such incidents highlight the importance of choosing a broker with a solid reputation for customer service and transparency.

Platform and Trade Execution

The trading platform offered by Corsa Futures is another critical aspect to consider. A reliable trading platform should provide a seamless user experience, efficient order execution, and robust analytical tools. However, reviews suggest that Corsa Futures' platform may not meet these standards. Users have reported issues with platform stability, slow execution speeds, and instances of slippage.

In addition, there are concerns about potential manipulation of trading conditions, which could negatively impact traders' experiences. A credible broker should prioritize the integrity of its trading environment, ensuring that clients can execute trades with confidence.

Risk Assessment

Engaging with Corsa Futures carries several risks that potential traders should consider. The lack of regulation, transparency, and poor customer feedback all contribute to an overall risk profile that is concerning.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized financial authorities. |

| Fund Safety Risk | High | Inadequate measures for fund segregation and protection. |

| Customer Service Risk | Medium | Poor responsiveness and support for client inquiries. |

To mitigate these risks, traders should conduct thorough research before committing funds to Corsa Futures. It may be prudent to seek out regulated alternatives that offer greater security and reliability.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Corsa Futures exhibits numerous red flags that warrant caution. The lack of regulation, transparency issues, and negative customer feedback indicate that this broker may not be trustworthy. As such, traders should be wary of engaging with Corsa Futures, particularly if they value the safety of their investments.

For those seeking reliable trading options, it is advisable to consider well-regulated brokers that have a proven track record of positive customer experiences and transparent practices. Some recommended alternatives include brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC, which prioritize client safety and offer robust trading conditions.

Is CORSA FUTURES a scam, or is it legit?

The latest exposure and evaluation content of CORSA FUTURES brokers.

CORSA FUTURES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CORSA FUTURES latest industry rating score is 1.35, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.35 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.