Corsa Futures 2025 Review: Everything You Need to Know

Executive Summary

Corsa Futures is a new online trading platform registered in Saint Kitts and Nevis. It offers forex and CFD trading services to retail investors. The broker advertises competitive spreads starting from 1 pip and zero commission trading, but multiple warning signals have emerged about its legitimacy and operational practices.

This corsa futures review reveals that despite the platform's attractive cost structure and use of the cTrader trading platform, potential investors should be extremely careful. There are numerous scam allegations and regulatory concerns. The broker operates under Corsa Group Intervest LTD and targets individual investors seeking low-cost trading opportunities.

However, the company's registration in Saint Kitts and Nevis raises questions about regulatory oversight and investor protection. According to recent reports from broker watchdog organizations, there have been multiple warnings about Corsa Futures potentially being a fraudulent operation. These organizations recommend that investors try to recover any deposited funds.

Key features include spreads starting from 1 pip, $0 commission structure, and access to the cTrader platform for trading forex, stocks, and indices. However, these apparent advantages are overshadowed by significant trust and safety concerns. This makes the broker unsuitable for most retail traders.

Important Notice: This review is based on publicly available information and user feedback as of 2025. Corsa Futures operates under different regulatory frameworks across regions, with its primary registration in Saint Kitts and Nevis. Investors should be aware that regulatory protection may vary significantly by jurisdiction.

This evaluation aims to provide comprehensive information to help potential investors make informed decisions. However, the overwhelming evidence suggests extreme caution is warranted when considering this broker.

Rating Framework

Broker Overview

Corsa Futures emerged in 2024 as a new player in the online trading industry. It is operated by Corsa Group Intervest LTD and registered in Saint Kitts and Nevis. The company positions itself as a cost-effective solution for traders seeking access to forex and CFD markets without traditional commission structures.

According to available information, the broker focuses primarily on attracting retail investors through competitive pricing and modern trading technology. The business model centers around providing low-cost trading services with spreads starting from 1 pip and zero commission charges. This approach appears designed to appeal to cost-conscious traders who prioritize minimizing trading expenses.

However, the company's brief operational history and limited market presence raise questions about its long-term viability and commitment to client service. Corsa Futures utilizes the cTrader trading platform, which represents a more modern approach compared to many competitors still relying on older MT4 systems. The platform supports trading across multiple asset classes including forex pairs, individual stocks, and market indices.

This diversification allows traders to build varied portfolios within a single account structure. However, the specific range and quality of available instruments remain unclear from current documentation. The broker's regulatory status represents a significant concern, as registration in Saint Kitts and Nevis typically provides minimal oversight compared to major financial centers.

This regulatory environment often lacks the comprehensive investor protection measures found in jurisdictions like the UK, EU, or Australia. This potentially leaves clients with limited recourse in case of disputes or operational issues.

Regulatory Jurisdiction: Corsa Futures operates under registration in Saint Kitts and Nevis. This is a jurisdiction known for relatively lenient regulatory requirements. This regulatory environment provides minimal oversight compared to major financial centers, potentially exposing investors to increased risks regarding fund security and operational standards.

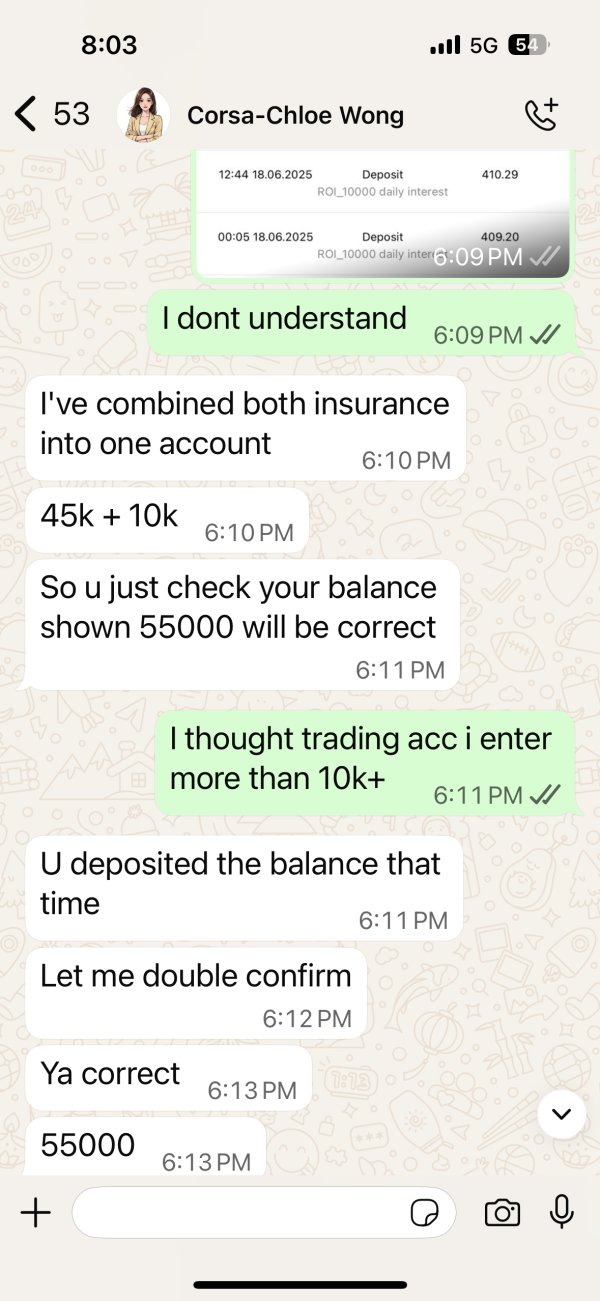

Deposit and Withdrawal Methods: Information regarding specific deposit and withdrawal options was not detailed in available sources. This represents a significant transparency gap for potential clients.

Minimum Deposit Requirements: The minimum initial deposit requirement was not specified in available documentation. This makes it difficult for potential clients to assess accessibility and plan their investment approach.

Bonus and Promotional Offers: No information about welcome bonuses, promotional offers, or incentive programs was found in the available sources.

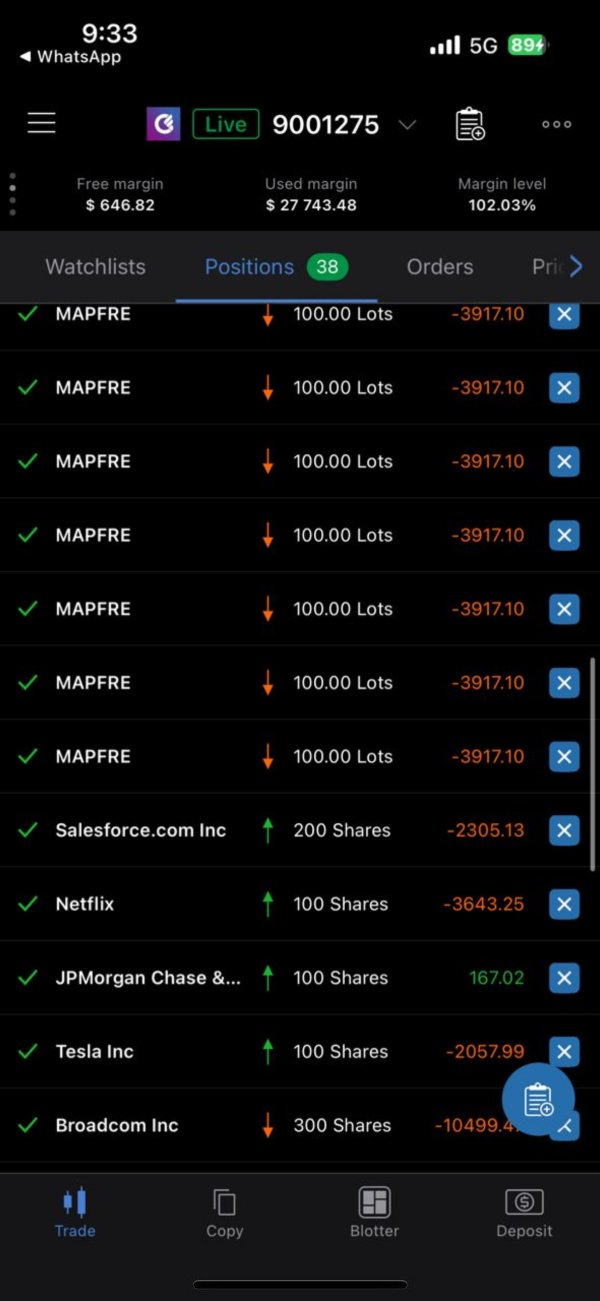

Tradeable Assets: The platform supports trading in forex currency pairs, individual stocks, and market indices. This provides reasonable diversification opportunities across major asset classes for retail traders.

Cost Structure: According to available information, Corsa Futures offers spreads starting from 1 pip with zero commission charges. However, the lack of detailed fee schedules and potential hidden costs raises transparency concerns about the true cost of trading.

Leverage Ratios: Specific maximum leverage ratios were not mentioned in available sources. This represents another important information gap for traders who rely on margin trading.

Platform Options: The broker exclusively uses the cTrader platform, which provides modern trading tools and interface design. However, specific features and capabilities were not detailed in available sources.

Geographic Restrictions: Information about countries or regions where services are restricted was not available in the source material.

Customer Service Languages: The range of languages supported by customer service representatives was not specified in available documentation.

This corsa futures review highlights significant information gaps that potential clients should consider when evaluating the broker's transparency and commitment to client communication.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions offered by Corsa Futures present a mixed picture that requires careful consideration. While the broker advertises competitive spreads starting from 1 pip and zero commission charges, the lack of comprehensive information about account types and requirements raises transparency concerns. According to available sources, specific details about different account tiers, their respective features, and qualification requirements were not clearly documented.

The absence of minimum deposit information represents a significant gap in the broker's transparency. Potential clients cannot adequately plan their investment approach without understanding the initial capital requirements. This lack of clarity extends to account opening procedures, verification requirements, and timeline expectations, all of which are standard disclosures among reputable brokers.

User feedback regarding account conditions remains limited, though existing reports suggest caution regarding the broker's overall reliability. The competitive cost structure, while attractive on paper, cannot compensate for the fundamental concerns about operational transparency and client protection measures. When compared to established brokers in the industry, Corsa Futures falls short in providing comprehensive account information that allows for informed decision-making.

The corsa futures review data suggests that while the advertised conditions may appear favorable, the lack of detailed documentation and user verification raises questions about the actual trading environment clients can expect.

Corsa Futures employs the cTrader platform, which represents a modern approach to online trading technology. The cTrader system generally provides advanced charting capabilities, multiple order types, and algorithmic trading support. However, specific implementations and customizations by Corsa Futures were not detailed in available sources.

The platform supports trading across forex, stocks, and indices, offering reasonable diversification opportunities for retail traders. However, the quality and depth of analytical tools, market research resources, and educational materials remain unclear based on current documentation. Most reputable brokers provide comprehensive market analysis, economic calendars, and educational content to support client trading decisions.

Research and analytical resources represent a crucial component of the trading experience, yet available information does not detail what specific tools and insights Corsa Futures provides to its clients. This gap in information makes it difficult to assess the broker's commitment to supporting informed trading decisions. The absence of detailed information about automated trading support, expert advisors, and algorithmic trading capabilities further limits the assessment of the platform's technical sophistication.

While cTrader generally supports these features, the specific implementation and restrictions imposed by Corsa Futures remain unclear.

Customer Service and Support Analysis (4/10)

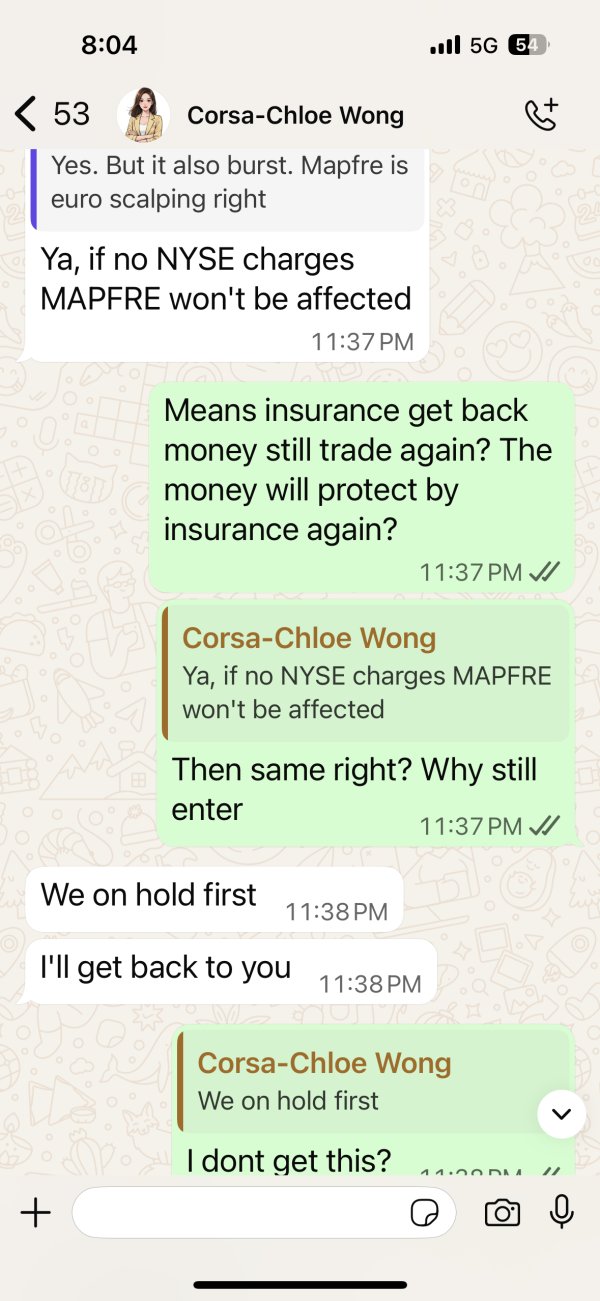

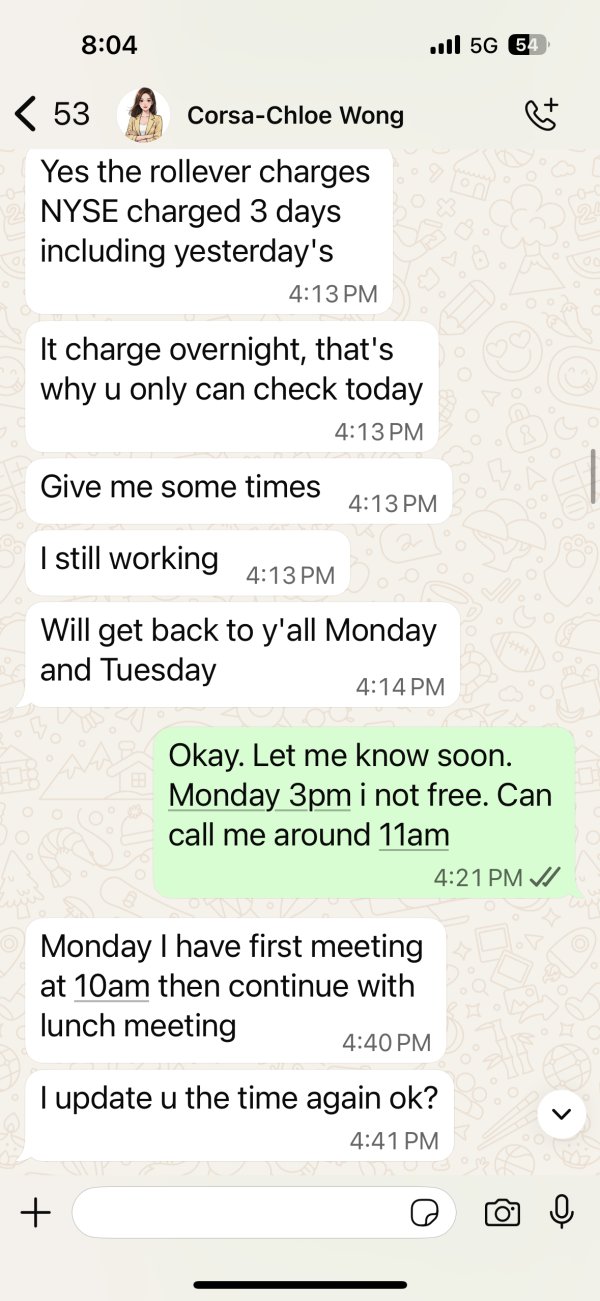

Customer service quality represents a critical weakness in the Corsa Futures offering. This is based on available feedback and documentation. Multiple sources indicate the presence of user complaints and concerns about the broker's responsiveness to client issues.

The lack of detailed information about customer service channels, availability hours, and response time commitments suggests inadequate attention to client support infrastructure. According to broker watchdog organizations, there have been warnings about Corsa Futures' handling of client concerns. These organizations recommend that investors attempt recovery of deposited funds.

This represents a severe red flag regarding the broker's commitment to client satisfaction and dispute resolution. The absence of information about multilingual support capabilities further limits the broker's appeal to international clients. Reputable brokers typically provide comprehensive language support and culturally appropriate customer service to serve diverse client bases effectively.

Problem resolution capabilities appear to be a particular weakness, based on the negative feedback and warning signals from industry watchdog organizations. The lack of documented case studies or positive client testimonials regarding successful problem resolution raises serious concerns about the broker's ability to handle client issues professionally and effectively.

Trading Experience Analysis (5/10)

The trading experience offered by Corsa Futures centers around the cTrader platform, which generally provides a modern and functional trading environment. However, specific performance metrics, execution quality data, and user experience feedback remain limited in available sources. The platform's stability, speed, and reliability under various market conditions were not documented in accessible reviews.

Order execution quality represents a crucial component of the trading experience, yet information about slippage rates, requote frequency, and execution speed was not available in the source material. These factors significantly impact actual trading costs and success rates, making their absence a notable transparency gap. The mobile trading experience, which has become essential for modern traders, was not specifically addressed in available documentation.

Most traders require seamless functionality across desktop and mobile platforms, yet the quality of Corsa Futures' mobile implementation remains unclear. Trading environment factors such as liquidity provision, spread stability during volatile market conditions, and server uptime statistics were not documented. Without this information, potential clients cannot adequately assess whether the trading environment will support their specific strategies and requirements.

User feedback regarding actual trading experiences remains notably sparse, with limited testimonials or detailed reviews about platform performance. This corsa futures review indicates that the absence of substantial user feedback makes it difficult to verify the broker's claims about trading conditions and platform quality.

Trust and Safety Analysis (2/10)

Trust and safety concerns represent the most significant weakness in the Corsa Futures proposition. There are multiple warning signals that should deter potential investors. The broker's registration in Saint Kitts and Nevis provides minimal regulatory oversight compared to major financial centers, offering limited investor protection measures.

Multiple broker watchdog organizations have issued warnings about Corsa Futures, with some sources explicitly labeling it as a potential scam operation. These warnings include recommendations for investors to attempt recovery of any funds already deposited with the broker. This represents an extremely serious red flag for potential clients.

The company's lack of transparency regarding fund security measures, segregated account policies, and insurance coverage further undermines confidence in its safety protocols. Reputable brokers typically provide detailed information about client fund protection, regulatory compliance, and risk management procedures. Industry reputation appears to be significantly damaged by the multiple warnings and negative assessments from independent review organizations.

The absence of positive third-party evaluations or industry recognition suggests that Corsa Futures has failed to establish credibility within the financial services community. Financial transparency remains a critical concern, with limited information available about the company's financial stability, audit procedures, or regulatory compliance history. This lack of transparency makes it impossible for potential clients to assess the broker's long-term viability and commitment to operational excellence.

User Experience Analysis (4/10)

Overall user satisfaction with Corsa Futures appears to be poor. This is based on available feedback and the absence of positive testimonials in accessible sources. The combination of trust concerns, limited customer service quality, and transparency gaps contributes to a subpar user experience that fails to meet modern broker standards.

The user interface and platform design, while benefiting from the modern cTrader system, cannot compensate for the fundamental operational and trust issues that plague the broker. Users require confidence in their broker's reliability and integrity, which Corsa Futures appears unable to provide based on current evidence. Registration and account verification processes were not detailed in available sources, making it difficult to assess the convenience and efficiency of onboarding new clients.

Streamlined account opening procedures represent an important component of positive user experience that remains undocumented. The fund management experience, including deposit and withdrawal procedures, processing times, and fee structures, lacks sufficient documentation to allow proper evaluation. These operational aspects significantly impact daily user experience and satisfaction levels.

Common user complaints appear to center around trust and reliability concerns rather than specific platform functionality issues. The corsa futures review evidence suggests that users are primarily concerned about the broker's legitimacy rather than technical aspects of the trading experience.

Conclusion

Based on comprehensive analysis of available information, Corsa Futures presents significant risks that outweigh any potential benefits for retail traders. While the broker advertises competitive spreads starting from 1 pip and zero commission structure, multiple warning signals from industry watchdog organizations and the lack of proper regulatory oversight make it unsuitable for most investors. The broker may initially appeal to cost-conscious traders seeking low-fee trading opportunities.

However, the substantial trust and safety concerns make it inappropriate for any investor who values fund security and regulatory protection. The registration in Saint Kitts and Nevis, combined with multiple scam warnings, creates an unacceptable risk profile for retail trading. Key advantages include competitive advertised spreads, zero commission structure, and access to the modern cTrader platform.

However, these benefits are completely overshadowed by critical disadvantages including weak regulatory oversight, multiple fraud warnings, poor transparency, and inadequate customer service quality. The overwhelming evidence suggests that potential investors should avoid Corsa Futures and seek established, properly regulated alternatives for their trading needs.