Is CHIRON safe?

Business

License

Is Chiron a Scam?

Introduction

Chiron Group Limited, a broker in the forex market, has garnered attention for its trading services, which claim to cater to both novice and experienced traders. As the forex market is notoriously volatile and susceptible to scams, it is crucial for traders to carefully evaluate brokers before committing their funds. This article aims to provide a comprehensive analysis of Chiron, examining its regulatory status, company background, trading conditions, client experiences, and overall safety. The findings are based on a review of various online sources, including user reviews, regulatory databases, and industry reports.

Regulation and Legitimacy

The regulatory status of a forex broker is a key indicator of its legitimacy. Regulated brokers are subject to strict oversight, which can provide a layer of protection for traders. Unfortunately, Chiron Group Limited operates without a valid license from any recognized financial authority. This absence of regulation raises significant concerns about the safety of funds and the potential for fraudulent activities.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulation means that there is no oversight of Chiron's operations, which can expose traders to various risks. Furthermore, the absence of a physical office address and the use of vague corporate language on their website contribute to a perception of untrustworthiness. These factors are critical for assessing whether Chiron is safe for trading or if it poses a risk to potential investors.

Company Background Investigation

Chiron Group Limited has a relatively obscure history, with limited information available regarding its establishment and ownership structure. The company claims to provide a modern trading platform with a variety of financial instruments. However, the lack of transparency in its corporate structure is concerning.

The management team behind Chiron remains largely unrecognized in the financial industry, with few verifiable credentials or experience in forex trading. This lack of reputable leadership raises red flags about the company's ability to operate ethically and effectively. Transparency is a crucial element for any financial institution, and Chiron's failure to disclose essential information about its operations and management undermines its credibility.

Trading Conditions Analysis

Chiron's trading conditions are another area of concern. While the broker advertises competitive spreads and various trading instruments, the absence of clear information regarding its fee structure can mislead potential investors.

| Fee Type | Chiron | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2% |

The lack of transparency regarding spreads, commissions, and overnight interest rates could indicate hidden fees that may not be immediately apparent to traders. This ambiguity can lead to unexpected costs, which is a common tactic employed by less scrupulous brokers. Therefore, it is essential for traders to exercise caution and thoroughly investigate the fee structures of any broker they consider.

Client Funds Safety

Client funds' safety is paramount when selecting a forex broker. Chiron's website does not provide clear information regarding its security measures, such as fund segregation, investor protection, or negative balance protection policies.

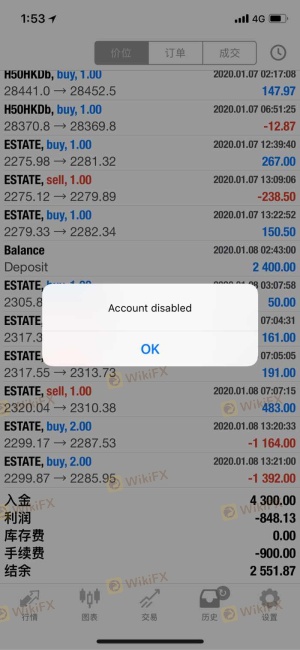

Many user reviews indicate that clients have experienced difficulties accessing their funds, with reports of accounts being locked or withdrawals being denied. These issues raise serious concerns about the broker's ability to safeguard clients' investments and highlight the potential risks associated with trading through Chiron.

Client Experience and Complaints

User feedback is a valuable resource for assessing a broker's reliability. Unfortunately, the reviews for Chiron Group Limited are overwhelmingly negative. Many clients report losing significant amounts of money and encountering unresponsive customer service when trying to resolve issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Lockouts | High | Poor |

| Misleading Promotions | Medium | Poor |

Typical complaints involve unresponsive support, withdrawal difficulties, and allegations of fraudulent practices. For example, one user reported losing over €10,000 and was unable to retrieve their funds after numerous attempts to contact customer support. Such experiences suggest that Chiron may not prioritize client satisfaction or safety, further indicating potential scam-like behavior.

Platform and Execution

Chiron's trading platform has been described as user-friendly; however, users have reported issues with stability and execution quality. Problems such as slippage and order rejections can significantly impact a trader's profitability and overall experience.

There are also concerns regarding potential market manipulation, as several users have claimed that their trades were executed at unfavorable prices without explanation. This lack of trust in the platform's integrity is a significant issue that potential clients should consider before trading with Chiron.

Risk Assessment

Engaging with Chiron Group Limited presents several risks that traders should consider before investing their funds.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | Reports of funds being inaccessible. |

| Operational Risk | Medium | Issues with platform stability. |

To mitigate these risks, traders should conduct thorough research, avoid depositing large amounts of money, and consider using regulated alternatives. It is crucial to prioritize safety and choose brokers with established reputations and regulatory oversight.

Conclusion and Recommendations

Based on the evidence presented, it is clear that Chiron Group Limited raises several red flags that suggest it may not be a safe trading option. The lack of regulation, negative user experiences, and questionable trading conditions indicate that traders should exercise extreme caution when dealing with this broker.

For traders seeking reliable alternatives, it is recommended to consider well-regulated brokers with transparent practices and positive user feedback. Some reputable options include brokers such as IG, OANDA, and Forex.com, which are known for their regulatory compliance and commitment to client safety. Ultimately, the decision to trade with Chiron should be made with a full understanding of the associated risks and potential for loss.

Is CHIRON a scam, or is it legit?

The latest exposure and evaluation content of CHIRON brokers.

CHIRON Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CHIRON latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.