Chiron 2025 Review: Everything You Need to Know

Summary

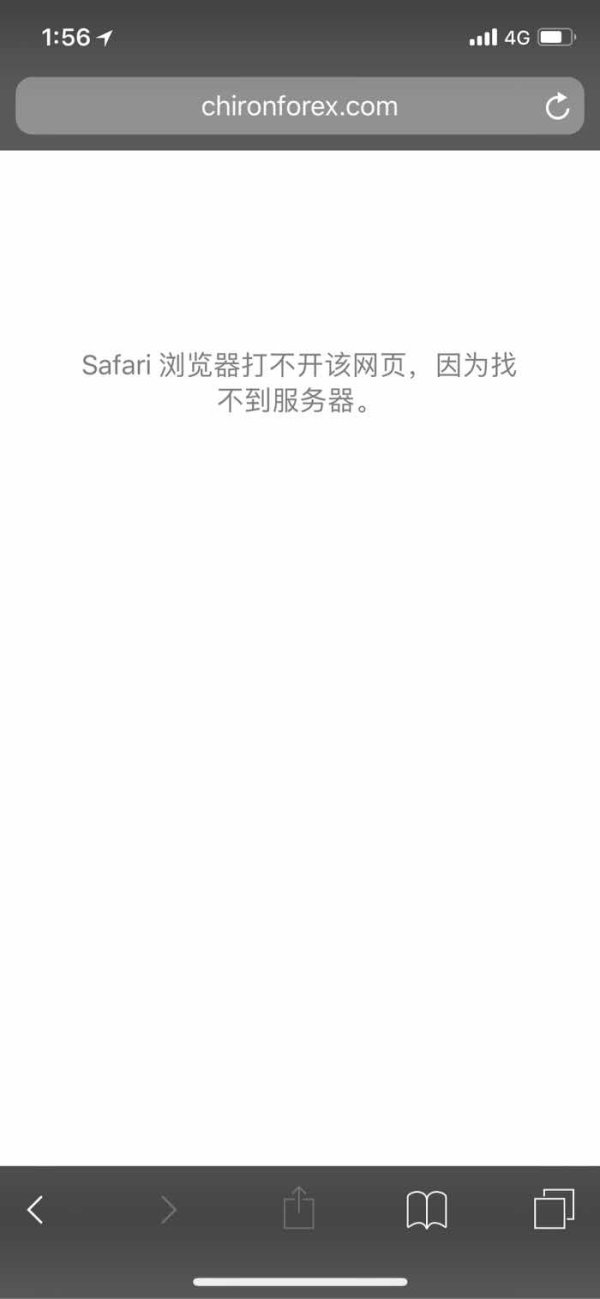

This chiron review looks at Chiron Group Limited, a financial company that has caused major concerns in the trading world. The company has been marked as a possible scam. Industry watchers give it a very negative rating. The company works with very little openness and lacks proper rules and clear ways of doing business that real brokers usually have.

This operation has hidden management and questionable business methods that have made fraud recovery experts issue warnings. FraudRecoveryExperts.com strongly tells users not to invest with this company because of serious safety issues. The company seems to target high-risk traders, especially those looking for chances in new markets, but this creates more red flags since there are no proper safety measures.

Our study shows that Chiron Group Limited does not meet basic industry standards for broker work. It lacks important information about trading conditions, following rules, and protecting clients. This chiron review warns potential investors about the major risks of this company.

Important Disclaimer

You need to know that Chiron Group Limited may work under different legal systems in various places when you evaluate it. This could expose clients to different levels of regulatory risk. The lack of clear regulatory information makes it impossible to know which legal protections might apply to client money or trading activities.

Our evaluation method uses mainly available user feedback and public information, though big information gaps exist about this company's operations. Future clients should know that the lack of clear operational data is itself a major risk factor, since real brokers usually provide full disclosure of their services, fees, and regulatory status.

Rating Framework

We have evaluated Chiron across six important areas based on available information and industry standards:

Broker Overview

Chiron Group Limited works as a financial services company, though specific founding details and corporate history stay mostly hidden in available documents. The company has been called an anonymous operation. This immediately raises concerns about accountability and following regulations. Real brokers provide detailed corporate information, founding dates, and management team details, but Chiron Group Limited keeps a very unclear operational structure.

The business model seems to focus on forex trading services, though specific operational details stay unclear. This lack of openness extends to basic aspects of the business, including trading platforms offered, asset classes available, and execution models used. Real brokers usually provide full information about their business operations, making the absence of such details especially concerning.

Chiron Group Limited fails to provide clear information about licensing or oversight from recognized financial authorities from a regulatory view. This chiron review finds no evidence of proper regulatory registration with major financial regulators. This represents a critical problem for any company handling client funds. The absence of regulatory oversight means clients lack the protections usually associated with licensed financial service providers, including compensation schemes and dispute resolution mechanisms.

Regulatory Status: Available information shows no clear regulatory authorization from recognized financial authorities. This absence of proper licensing represents a basic concern for potential clients seeking legitimate trading services.

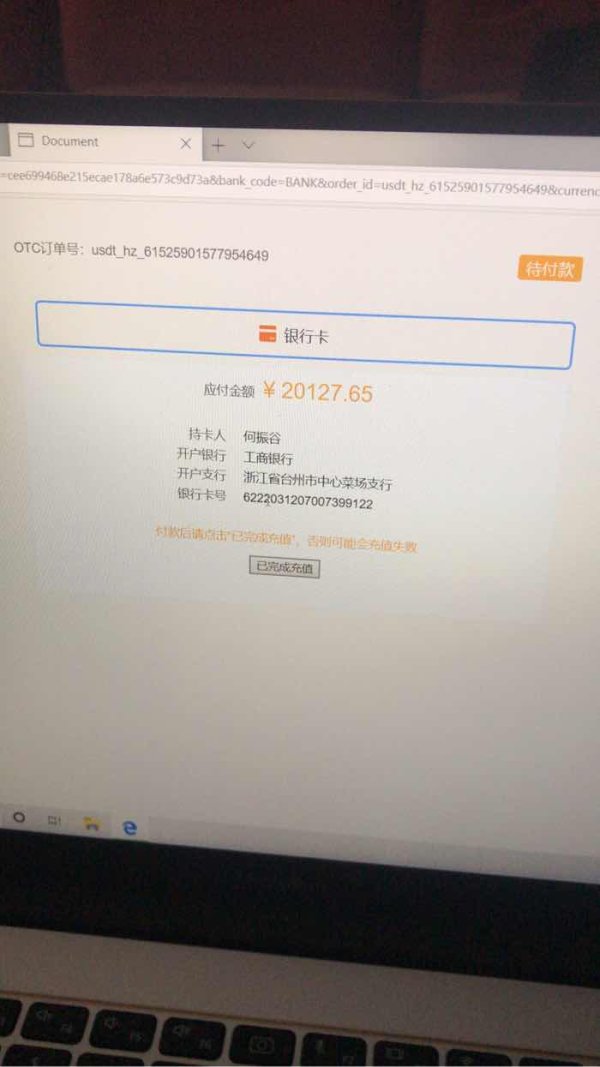

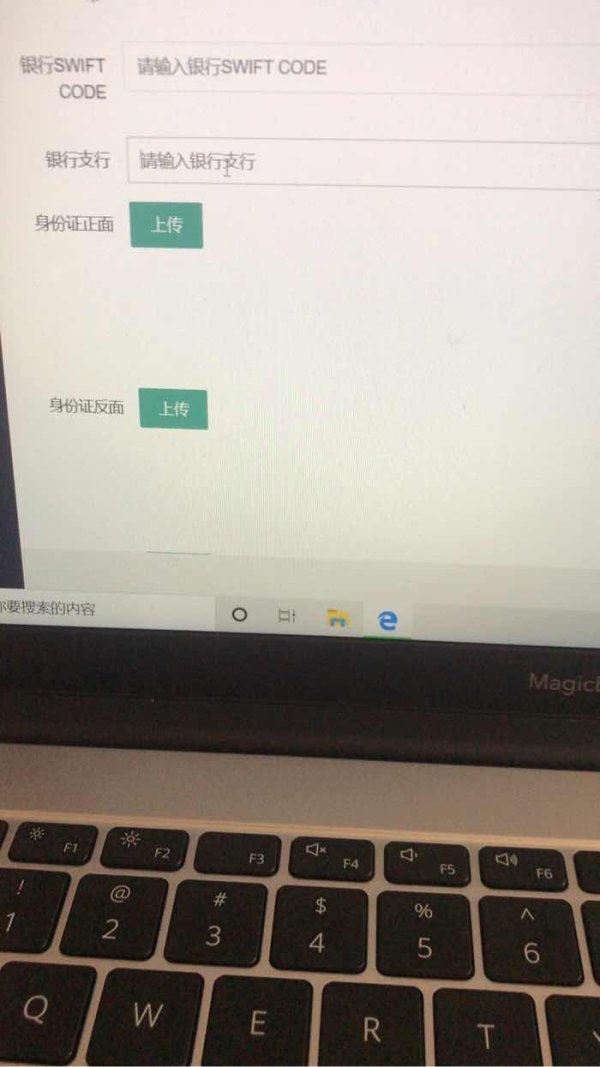

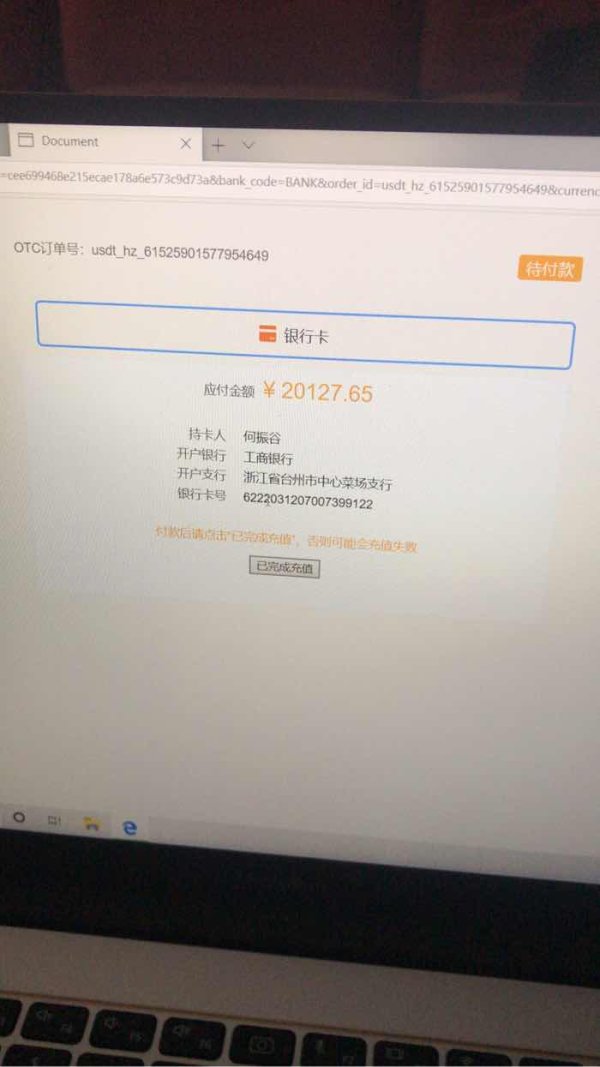

Deposit and Withdrawal Methods: Specific information about funding methods, processing times, and associated fees has not been disclosed in available materials. This creates uncertainty about basic operational procedures.

Minimum Deposit Requirements: No clear minimum deposit thresholds have been identified in available documentation. This makes it impossible to assess accessibility for different investor categories.

Promotional Offers: Information about bonus structures, promotional campaigns, or incentive programs stays unavailable in current documentation.

Available Assets: The range of tradeable instruments, including currency pairs, commodities, indices, or other financial products, has not been clearly specified in available materials.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other charges stays undisclosed. This prevents meaningful cost analysis.

Leverage Ratios: Maximum leverage levels and margin requirements have not been specified in available documentation.

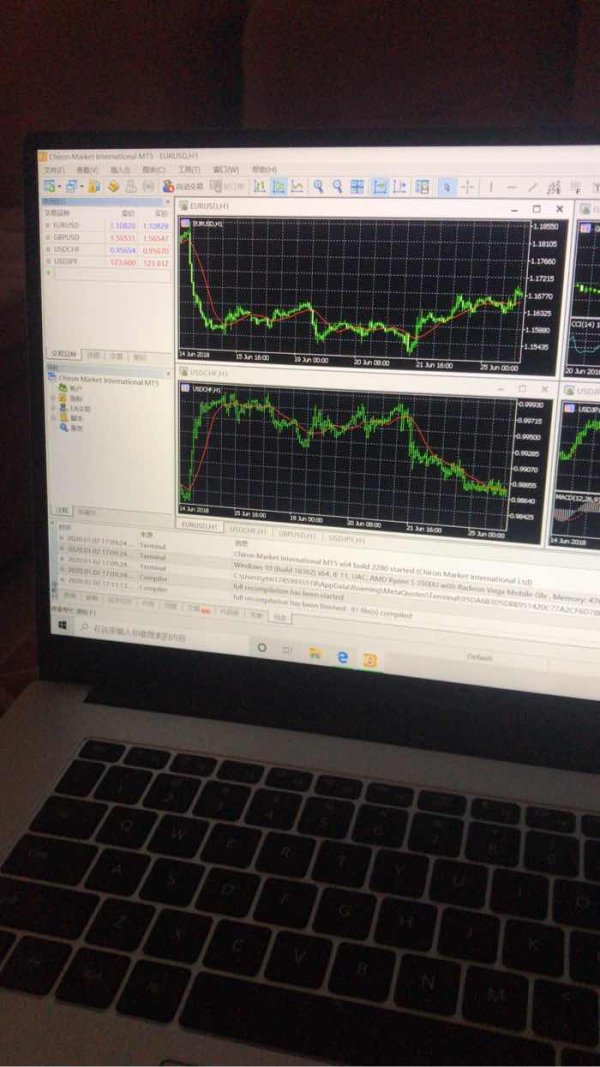

Platform Options: Specific trading platforms, whether proprietary or third-party solutions like MetaTrader, stay unidentified in current materials.

Geographic Restrictions: Jurisdictional limitations and service availability by region have not been clearly outlined.

Customer Support Languages: Available communication languages and support channels stay unspecified.

This complete lack of basic operational information represents a significant departure from industry standards. Legitimate brokers provide detailed disclosure across all these areas. Such transparency gaps constitute major red flags in this chiron review.

Account Conditions Analysis

The evaluation of account conditions reveals major concerns about transparency and client protection. Established brokers offer detailed account specifications, but Chiron Group Limited provides minimal information about account structures. This makes it impossible for potential clients to make informed decisions about their trading arrangements.

Account type variety and specific features stay largely undisclosed. This prevents meaningful comparison with industry standards. Real brokers usually offer multiple account tiers with clearly defined benefits, minimum requirements, and associated costs. The absence of such information suggests either inadequate service development or deliberate opacity designed to hide unfavorable terms.

Minimum deposit requirements create uncertainty about financial commitments and accessibility when unspecified. Professional brokers establish clear deposit thresholds to help clients understand entry requirements and plan their investment strategies accordingly. The lack of such basic information raises questions about operational professionalism and client service standards.

Account opening procedures and verification requirements also stay unclear. This creates potential complications for clients seeking to establish trading relationships. Standard industry practice involves transparent onboarding processes with clearly defined documentation requirements and timeline expectations.

User feedback about account conditions reflects significant concerns about safety and transparency. Several sources indicate that potential clients have expressed reservations about engaging with a company that fails to provide basic account information. This chiron review finds that the lack of clear account specifications represents a major barrier to client confidence and operational legitimacy.

The assessment of trading tools and resources reveals significant problems in available information and apparent service offerings. Professional forex brokers usually provide complete suites of analytical tools, research resources, and educational materials to support client trading activities. Chiron Group Limited's offerings in this area stay largely unspecified in available documentation.

Trading platform capabilities, including charting tools, technical indicators, and order management features, have not been clearly outlined. This absence of platform information prevents potential clients from evaluating whether available tools meet their analytical and execution requirements. Established brokers routinely provide detailed platform specifications, demo access, and feature comparisons to help clients make informed decisions.

Research and market analysis resources appear to be absent or undisclosed, and these form a cornerstone of professional trading services. Quality brokers usually offer daily market commentary, economic calendars, fundamental analysis, and expert insights to support client decision-making. The lack of such resources suggests either limited service capabilities or inadequate disclosure practices.

Educational resources, including webinars, tutorials, and trading guides, stay unidentified in current materials. Professional brokers recognize that client education contributes to trading success and usually invest significantly in educational content development and delivery.

Automated trading support, including Expert Advisor compatibility and algorithmic trading features, has not been addressed in available information. Modern trading environments increasingly rely on automated strategies. This makes platform capabilities in this area increasingly important for serious traders.

User feedback about tools and resources indicates mixed experiences, with some users expressing satisfaction while others report concerns about service quality and availability. However, the limited feedback available makes it difficult to establish clear patterns or reliable assessments of actual service delivery.

Customer Service and Support Analysis

Customer service evaluation reveals a complex picture with mixed user experiences and significant information gaps about support infrastructure. Professional brokers usually maintain complete customer support systems with multiple contact channels, extended availability, and multilingual capabilities to serve diverse client bases effectively.

Available communication channels and contact methods stay largely unspecified in current documentation. Standard industry practice includes phone support, email assistance, live chat capabilities, and sometimes social media engagement. The absence of clear contact information raises concerns about accessibility and responsiveness when clients require assistance.

Response time commitments and service level agreements have not been disclosed. This creates uncertainty about support quality and reliability. Professional brokers usually publish response time targets and availability schedules to set appropriate client expectations and demonstrate service commitment.

Service quality assessment based on limited user feedback presents a mixed picture. Some users have reportedly expressed satisfaction with customer interactions. This suggests that when support is available, it may meet basic service standards. However, other feedback indicates concerns about overall service reliability and professionalism.

Multilingual support capabilities stay unspecified, potentially limiting accessibility for international clients. Global brokers usually offer support in multiple languages to serve diverse client populations effectively. This makes language capabilities an important service differentiator.

Operating hours and availability schedules have not been clearly communicated. This creates uncertainty about when clients can expect support access. Professional brokers usually provide extended support hours aligned with major trading sessions to ensure assistance availability during active market periods.

Problem resolution processes and escalation procedures stay undocumented, raising questions about how complex issues or disputes might be handled. Established brokers maintain formal complaint procedures and regulatory reporting mechanisms to ensure fair treatment and dispute resolution.

Trading Experience Analysis

The evaluation of trading experience reveals major information gaps that prevent complete assessment of platform performance and execution quality. Professional trading environments require strong technological infrastructure, reliable execution, and complete functionality to support effective client trading activities.

Platform stability and performance metrics stay unspecified in available documentation. Reliable brokers usually provide uptime statistics, execution speed data, and system performance reports to demonstrate technological capabilities and service reliability. The absence of such information raises questions about infrastructure quality and operational transparency.

Order execution quality, including fill rates, slippage statistics, and rejection rates, has not been disclosed. These metrics represent critical performance indicators that serious traders use to evaluate broker capabilities and execution reliability. Professional brokers routinely publish execution statistics to demonstrate service quality and competitive positioning.

Platform functionality and feature completeness stay largely unknown due to insufficient disclosure. Modern trading platforms require complete order types, advanced charting capabilities, risk management tools, and analytical features to support professional trading activities. The lack of detailed platform information prevents meaningful evaluation of trading capabilities.

Mobile trading experience and cross-platform synchronization have not been addressed in available materials. Contemporary trading increasingly relies on mobile access and multi-device functionality. This makes platform flexibility and mobile capabilities essential service components.

Trading environment characteristics, including available market data, news feeds, and real-time information access, stay unspecified. Professional trading requires complete market information and timely data delivery to support informed decision-making and effective strategy execution.

User feedback about trading experience indicates mixed results, with limited available testimonials preventing clear pattern identification. The absence of substantial user experience data makes it difficult to assess actual platform performance and client satisfaction levels. This chiron review finds that inadequate disclosure of trading experience factors represents a significant concern for potential clients seeking reliable trading services.

Trust and Safety Analysis

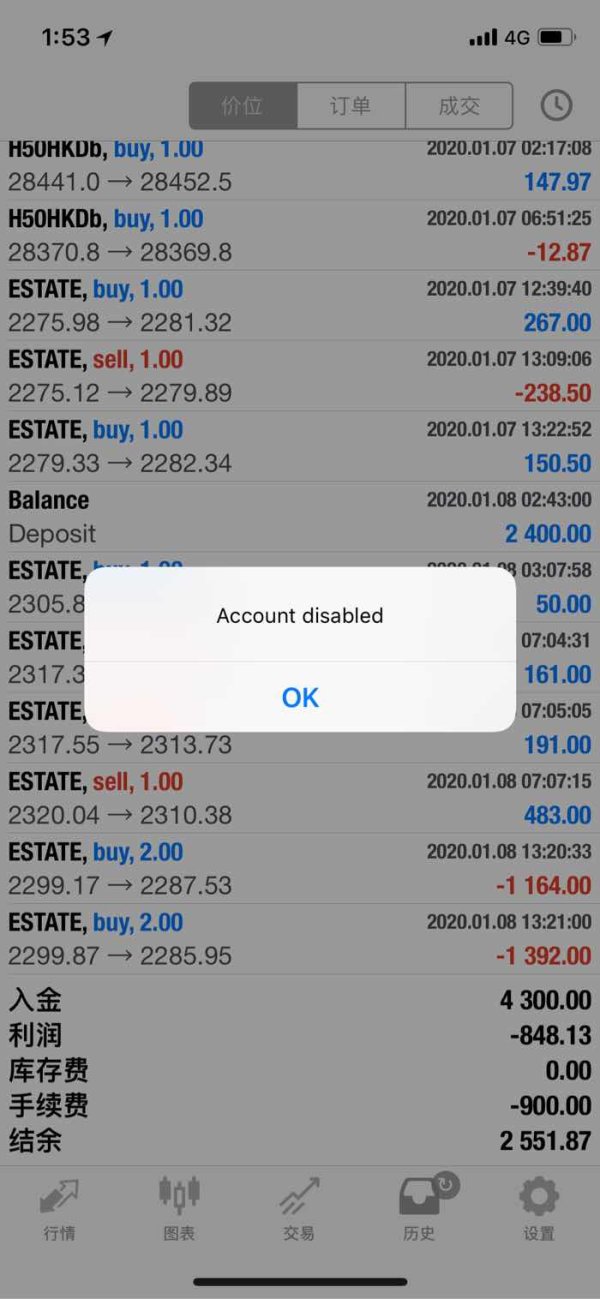

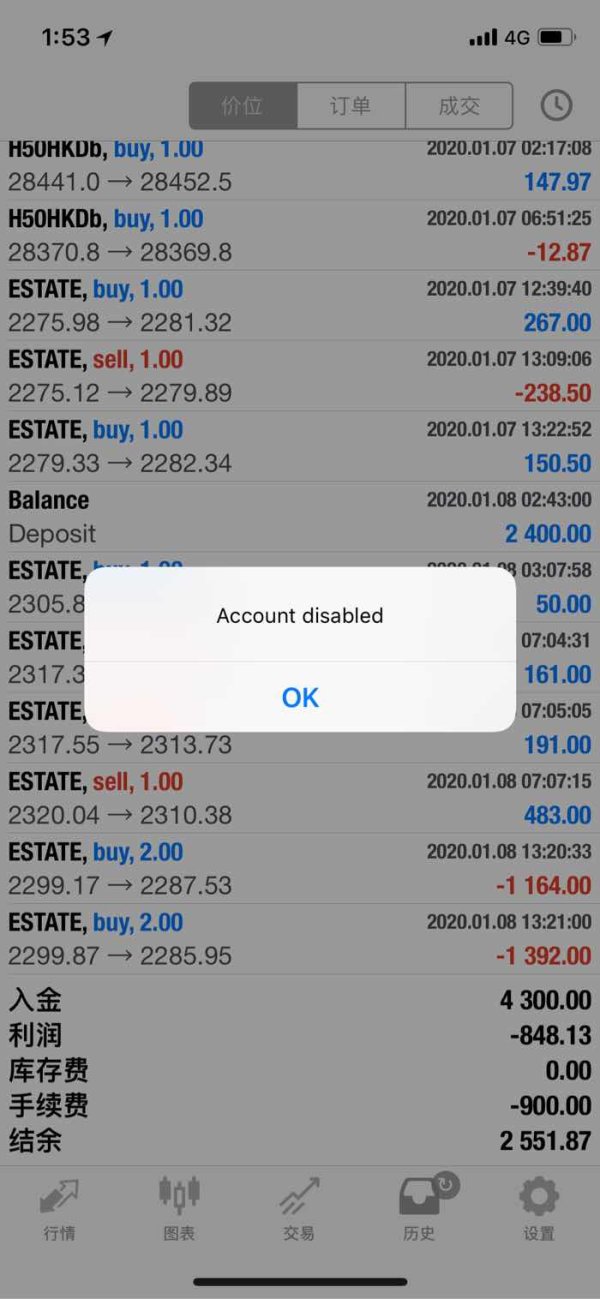

Trust and safety evaluation reveals critical problems that raise major concerns about client protection and operational legitimacy. Chiron Group Limited has been explicitly identified as a potential scam operation. Fraud recovery experts strongly advise against investment with this company.

Regulatory authorization represents the most significant concern in this assessment. No evidence exists of proper licensing or oversight from recognized financial authorities such as the FCA, CySEC, ASIC, or other major regulators. This absence of regulatory supervision means clients lack basic protections usually associated with licensed financial service providers, including compensation schemes, dispute resolution mechanisms, and operational oversight.

Fund security measures stay completely unspecified, creating major uncertainty about client capital protection. Real brokers usually maintain segregated client accounts, provide detailed custody arrangements, and carry professional indemnity insurance to protect client interests. The absence of such disclosures represents a critical safety problem.

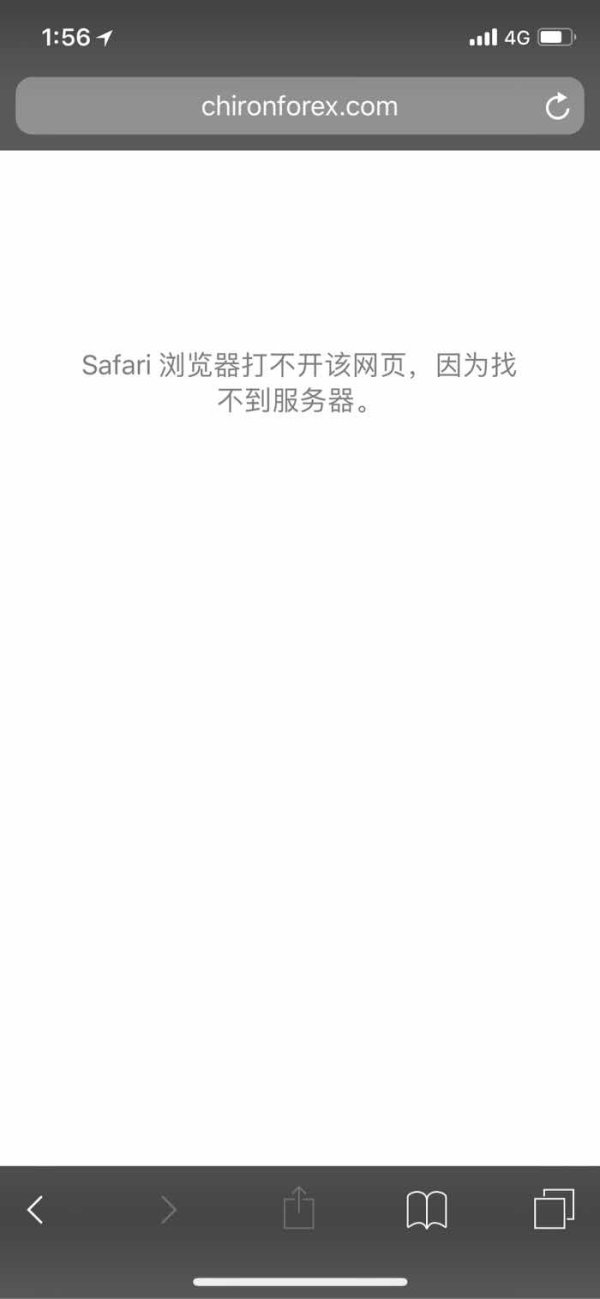

Corporate transparency issues extend beyond basic regulatory compliance to basic business disclosure. The characterization of Chiron Group Limited as an "anonymous scam group" by fraud recovery specialists indicates serious concerns about management identity, operational accountability, and business legitimacy.

Industry reputation has been severely damaged by multiple warnings from fraud recovery experts and user safety concerns. FraudRecoveryExperts.com has specifically flagged this company as problematic. They advise users to avoid investment due to major risk factors.

Negative incident handling and response to safety concerns appear inadequate based on available information. The continued operation despite fraud warnings suggests either inability or unwillingness to address legitimate safety concerns raised by industry observers and potential clients.

Third-party validation and independent verification of business operations stay absent, further undermining confidence in operational legitimacy. Professional brokers usually undergo regular audits, maintain professional memberships, and seek independent validation of their business practices and financial stability.

User Experience Analysis

User experience assessment reveals mixed feedback patterns with significant safety concerns overshadowing operational considerations. The limited available feedback prevents complete satisfaction analysis, though existing testimonials indicate major variation in client experiences and expectations.

Overall user satisfaction appears damaged by safety concerns and transparency issues. Some users have reportedly expressed satisfaction with certain service aspects, but these positive experiences are overshadowed by broader concerns about company legitimacy and operational safety.

Interface design and usability stay unspecified in available documentation, preventing evaluation of platform accessibility and user-friendliness. Professional brokers usually invest significantly in user interface development and regularly update platform designs based on client feedback and usability testing.

Registration and verification processes have not been clearly outlined, creating uncertainty about onboarding experiences and documentation requirements. Standard industry practice involves streamlined registration with clear verification steps and reasonable processing timeframes.

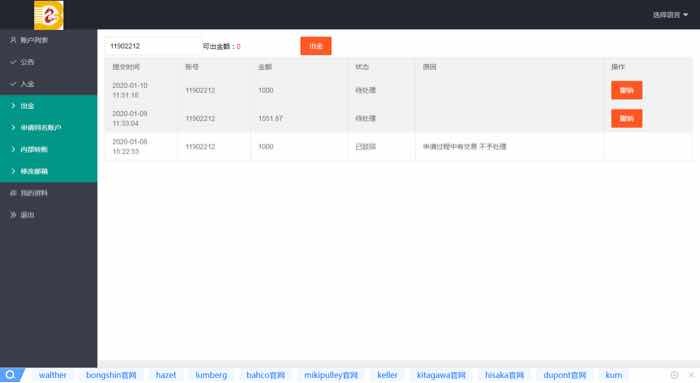

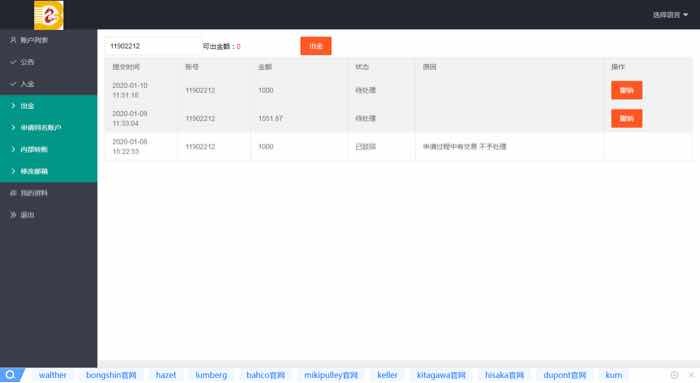

Funding operation experiences stay largely undocumented, raising questions about deposit and withdrawal processes, processing times, and associated fees. User experiences with financial transactions represent critical satisfaction factors that professional brokers monitor closely and optimize continuously.

Common user complaints center primarily on safety and transparency concerns rather than specific operational issues. The characterization of this company as potentially fraudulent has generated warnings that overshadow detailed service feedback.

User demographic analysis suggests attraction primarily to high-risk tolerance traders, though this positioning raises additional concerns given inadequate safety protections. Professional brokers usually serve diverse client segments with appropriate risk disclosures and protection measures.

Improvement recommendations based on available feedback focus primarily on transparency enhancement and regulatory compliance rather than operational refinements. The basic issues identified require complete business restructuring rather than incremental service improvements.

Conclusion

This complete chiron review concludes with a strongly negative overall assessment of Chiron Group Limited due to major safety concerns and operational problems. The company has been explicitly identified as a potential scam operation by fraud recovery experts. Users are strongly advised against investment or engagement.

The evaluation reveals critical problems across all assessment dimensions, with particular concerns about regulatory compliance, operational transparency, and client protection measures. The absence of proper licensing, unclear business operations, and fraud warnings create an unacceptable risk environment for potential clients.

This company is not recommended for any investor category, including high-risk tolerance traders, due to basic safety and legitimacy concerns. The primary disadvantages include complete lack of regulatory oversight, anonymous management structure, and explicit fraud warnings from industry experts. Some limited positive feedback exists about customer service interactions, but these marginal benefits are entirely overshadowed by major safety risks and operational concerns that make engagement inadvisable under any circumstances.