Is CASTLE MARKET safe?

Pros

Cons

Is Castle Market Safe or Scam?

Introduction

Castle Market is a forex broker that claims to offer a wide range of trading options, including forex currency pairs, commodities, and cryptocurrencies. Established in 2022, it positions itself as a competitive player in the rapidly evolving forex market. However, the increasing number of scams in the financial sector necessitates that traders exercise caution when selecting a broker. It is essential to evaluate the legitimacy and reliability of brokers like Castle Market to avoid potential financial losses. This article employs a comprehensive investigation framework, analyzing regulatory status, company background, trading conditions, client safety, and customer feedback to determine whether Castle Market is a trustworthy broker or a scam.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor that can significantly affect a trader's experience and safety. Castle Market claims to operate under a license issued by the MISA (Ministry of Investment and Strategic Affairs) in Comoros, but it lacks regulation from more reputable financial authorities such as the FCA or NFA. The absence of stringent regulatory oversight raises red flags about the broker's legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| MISA | T 2023323 | Comoros | Unverified |

The quality of regulation is paramount in ensuring that brokers adhere to high standards of conduct, including transparency, fund segregation, and client protection. Castle Market's unregulated status poses significant risks for traders, as it may engage in questionable practices without any oversight. Furthermore, the broker has been labeled as "unauthorized" by various financial watchdogs, indicating a lack of compliance with industry standards. This raises serious concerns about the safety and reliability of trading with Castle Market.

Company Background Investigation

Castle Market is relatively new to the forex landscape, having been established in 2022. The company claims to have its headquarters in Ho Chi Minh City, Vietnam, but there is limited information available about its ownership structure and the backgrounds of its management team. The lack of transparency surrounding the company's history and ownership raises doubts about its credibility.

The management teams expertise is crucial for a broker's success, as experienced professionals can navigate the complexities of the financial markets. However, Castle Market does not provide sufficient information regarding its team members, which is a common trait among potential scam brokers. This lack of information can lead to a lack of trust from potential clients, who are left in the dark about who is managing their investments.

In addition, the company's website does not provide comprehensive information about its operations, which is a significant concern for potential investors. The absence of clear and accessible information about the companys history and management team further compounds the uncertainty surrounding Castle Market.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is essential. Castle Market claims to provide competitive trading conditions, including high leverage of up to 1:3000, low minimum deposits, and access to over 1000 trading instruments. However, the specifics of their fee structure and any unusual charges are crucial in assessing the overall trading experience.

| Fee Type | Castle Market | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | 1-2 pips |

| Commission Model | TBD | Varies |

| Overnight Interest Range | TBD | Varies |

While Castle Market advertises low trading costs, the lack of detailed information on spreads, commissions, and overnight fees raises concerns. Many brokers that operate without proper regulation often employ hidden fees or unfavorable trading conditions to enhance their profit margins at the expense of traders. Therefore, potential clients should be wary of any broker that does not provide transparent and comprehensive information regarding its fee structure.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Castle Market claims to implement various measures to protect client funds, including fund segregation and investor protection policies. However, without proper regulation, these claims remain unverified and may not hold any real value.

The absence of a regulatory framework means that there is no guarantee that client funds will be kept in separate accounts, which is a standard practice among reputable brokers. Furthermore, the lack of negative balance protection can expose traders to significant risks, especially in highly volatile markets. Historical data on any past incidents of fund mismanagement or client complaints regarding fund safety would provide further insight into the broker's reliability.

Customer Experience and Complaints

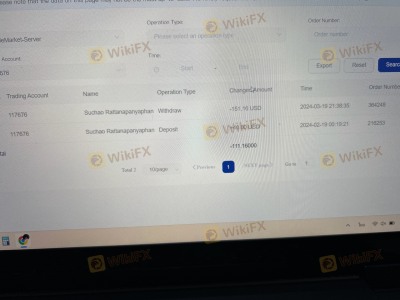

Customer feedback is a vital aspect of evaluating a broker's credibility. Castle Market has received a mix of reviews, with many users reporting issues related to poor customer service, withdrawal problems, and a lack of responsiveness to complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Misleading Promotions | High | Unresponsive |

Common complaints include unfulfilled promises regarding bonuses and withdrawal delays, which are significant warning signs of potential fraud. Additionally, many users have reported that their inquiries were ignored or inadequately addressed, further indicating a lack of professionalism and reliability.

For instance, one user recounted a situation where they were promised a no-deposit bonus but received no feedback after fulfilling the necessary conditions. Such experiences highlight the importance of thorough research and caution when dealing with brokers like Castle Market.

Platform and Execution

The trading platform is another critical component of a trader's experience. Castle Market claims to utilize the popular MetaTrader 5 platform, which is known for its advanced trading capabilities. However, user reviews suggest that the platform may suffer from issues related to execution quality, including slippage and rejected orders.

A reliable broker should provide a seamless trading experience with minimal disruptions. Instances of platform manipulation or technical issues can significantly impact trading performance and lead to financial losses. Therefore, potential clients should be cautious about brokers that do not have a proven track record of reliable platform performance.

Risk Assessment

Using Castle Market involves several risks, primarily due to its unregulated status and the lack of transparency surrounding its operations.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Risk | High | Potential for loss of funds |

| Operational Risk | Medium | Issues with platform reliability |

Traders should be aware of these risks and consider implementing risk mitigation strategies, such as using smaller trade sizes and maintaining a diversified portfolio. Engaging with a regulated broker can also help reduce exposure to these risks.

Conclusion and Recommendations

In conclusion, the evidence presented suggests that Castle Market exhibits several characteristics commonly associated with scam brokers. The lack of regulatory oversight, transparency regarding company information, and numerous customer complaints raise significant concerns about its legitimacy.

Traders are advised to exercise extreme caution when considering Castle Market as a trading option. For those looking for reliable alternatives, it is recommended to explore brokers that are well-regulated and have a proven track record of positive customer experiences. Brokers such as OANDA, IG, and Forex.com have established reputations in the industry and offer a safer trading environment for investors.

Is CASTLE MARKET a scam, or is it legit?

The latest exposure and evaluation content of CASTLE MARKET brokers.

CASTLE MARKET Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CASTLE MARKET latest industry rating score is 1.94, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.94 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.