Castle Market 2025 Review: Everything You Need to Know

Executive Summary

Castle Market Fx is a new forex broker that started in 2022. It shows both good chances and big problems for traders who might want to use it. The broker offers very high leverage up to 1:3000 and lets traders access many types of investments like stocks, bonds, commodities, currencies, options, and futures. But people who use it have very different opinions about how good it is.

Castle Market gets a 4.1 rating from 23 user reviews, but this score has some serious problems. Many sources have warned that this platform might be a scam, which makes people question if they can trust it and if it works properly. The broker works from Mangalore, Karnataka, India. It uses the MetaTrader 5 platform for trading.

This broker seems to want traders who like high risks and are interested in big leverage chances and many different trading tools. However, users have shared worrying feedback about trust problems, bad customer service, and possible fraud, so traders should be very careful if they think about using Castle Market Fx. The broker doesn't share clear information about regulations and isn't very open about its business, which makes these problems worse and means it's only good for people who are willing to take big risks.

Important Notice

Regional Entity Differences: Castle Market Fx has not shared specific information about regulations in the sources we can find. This means traders in different areas may have different levels of legal protection and ways to get help if something goes wrong. Not having clear regulatory oversight is a big problem for traders from other countries.

Review Methodology: We made this complete assessment by looking at user feedback from many review websites, available market information, and details the broker shared through different channels. Since the broker doesn't share much information openly, some parts of this review depend heavily on what users experienced and what other people observed instead of official broker documents.

Rating Framework

Broker Overview

Castle Market Fx started working in 2022 and says it's a forex and multi-asset trading broker with its main office in Badaga Yedapadavu, Mangalore, Karnataka, India. Since it's new in the competitive forex broker business, the company has tried to get traders by offering high leverage and access to many different financial tools. But the broker's short time in business and limited track record have made people in the trading community doubt it.

The company works mainly as an online trading platform and focuses on giving access to global financial markets through digital channels. Even though Castle Market Fx started recently, it has tried to position itself as a complete trading solution, but people still question if it can really operate well and survive long-term in the highly regulated financial services sector.

Castle Market Fx uses the MetaTrader 5 (MT5) platform as its main trading interface and gives traders access to stocks, bonds, commodities, currencies, options, and futures. The broker's business plan seems to focus on attracting traders by offering high leverage ratios, with maximum leverage reaching 1:3000. However, the lack of detailed information about the company's regulatory status, how it operates, and how it manages risks has worried potential clients and industry watchers. This castle market review tries to give clarity on these important parts.

Regulatory Status: The information we can find doesn't say anything about oversight from recognized financial authorities, which is a big red flag for potential traders who want regulated trading environments.

Deposit and Withdrawal Methods: We don't have specific information about supported payment methods, processing times, and fees in available sources. This shows a lack of transparency in financial operations.

Minimum Deposit Requirements: The broker hasn't clearly said what minimum deposit requirements are in available documentation. This makes it hard for potential clients to plan their initial investment.

Bonus and Promotions: We haven't found any specific information about welcome bonuses, trading competitions, or promotional offers in available sources.

Tradeable Assets: The platform offers access to multiple asset classes including stocks, bonds, commodities, currencies, options, and futures. This gives traders diversified investment opportunities across global markets.

Cost Structure: EUR/USD spreads begin from 7 pips according to available information, though we don't know about comprehensive commission structures and additional fees. The relatively wide spreads may hurt trading profits, especially for frequent traders.

Leverage Options: Maximum leverage of 1:3000 is available, which represents extremely high risk exposure. It may not be suitable for inexperienced traders or those in regulated areas with leverage restrictions.

Platform Options: The broker only offers MetaTrader 5 (MT5) as its trading platform. This gives access to advanced charting tools and automated trading capabilities.

Geographic Restrictions: We don't have specific information about restricted countries or regions in current documentation.

Customer Support Languages: Available sources don't say which languages the customer service team supports.

This castle market review highlights the concerning lack of detailed operational information. Established and transparent brokers typically provide this information.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

Castle Market Fx's account conditions present several areas of concern that contribute to its below-average rating in this category. The broker has failed to provide clear information about different account types, their specific features, or the requirements for accessing various service levels. This lack of transparency makes it difficult for potential traders to understand what they can expect from their trading relationship with the platform.

The absence of clearly stated minimum deposit requirements is particularly problematic. Traders cannot adequately plan their initial investment or understand the financial commitment required to access different features or services. Industry standards typically require brokers to provide comprehensive information about account tiers, minimum balances, and associated benefits.

User feedback suggests that account holders have experienced difficulties in understanding the terms and conditions of their trading accounts. Several reviewers have indicated that they found the account setup process unclear and lacking in detailed explanations of fees, restrictions, and operational procedures.

The broker's failure to provide information about specialized account types, such as Islamic accounts for Muslim traders, further limits its appeal to diverse trading communities. Established brokers typically offer multiple account configurations to meet different trader needs and regulatory requirements.

This castle market review emphasizes that the poor rating in account conditions stems primarily from the broker's lack of transparency. The negative experiences reported by existing users regarding account management and operational clarity also contribute to this rating.

Castle Market Fx receives a moderate rating for tools and resources, primarily based on its provision of the MetaTrader 5 platform. MT5 is widely recognized as a professional-grade trading interface. It offers comprehensive charting capabilities, technical analysis tools, and support for automated trading strategies through Expert Advisors (EAs).

The platform provides access to multiple asset classes, allowing traders to diversify their portfolios across stocks, bonds, commodities, currencies, options, and futures. This variety of tradeable instruments represents a significant strength because it enables traders to implement diverse strategies and hedge positions across different markets.

However, the broker appears to lack comprehensive educational resources, market research, and analysis tools that are typically expected from full-service brokers. There is no evidence of daily market commentary, economic calendars, or educational webinars that could help traders improve their skills and market understanding.

The absence of proprietary research tools or third-party analysis partnerships limits the value proposition for traders who rely on fundamental analysis. It also limits value for those who require detailed market insights to inform their trading decisions. Many established brokers provide access to premium research from recognized financial institutions.

User feedback suggests that while the basic trading functionality through MT5 is adequate, the overall ecosystem of supporting tools and resources is limited. This is especially true compared to more established competitors in the forex brokerage space.

Customer Service and Support Analysis (5/10)

Customer service represents a critical area where Castle Market Fx receives mixed reviews from its user base. The broker's support infrastructure appears to be inconsistent, with some users reporting satisfactory experiences while others express significant frustration with response times and problem resolution capabilities.

Available information does not specify the customer support channels offered by the broker, such as live chat, email, or phone support. This lack of clarity about how to contact customer service creates uncertainty for traders who may need assistance with their accounts or trading activities.

Response time feedback from users varies considerably, with some reporting acceptable service while others indicate lengthy delays in receiving responses to their inquiries. Inconsistent response times can be particularly problematic in the fast-moving forex market where timing is crucial for trading decisions.

The quality of problem resolution has also received mixed feedback. Some users indicate that their issues were not adequately addressed or that customer service representatives lacked the knowledge to provide effective solutions. This suggests potential training deficiencies within the support team.

The absence of information about multilingual support capabilities may limit the broker's accessibility to international traders. These traders prefer to communicate in their native languages. Established brokers typically provide support in multiple languages to serve their global client base effectively.

Trading Experience Analysis (5/10)

The trading experience with Castle Market Fx presents a mixed picture based on available user feedback and platform capabilities. While the MetaTrader 5 platform provides a solid foundation for trading activities, user reports suggest several areas where the overall experience falls short of industry standards.

Platform stability appears to be a concern, with some users reporting connectivity issues and occasional platform freezes during active trading sessions. These technical problems can be particularly costly in volatile market conditions where rapid execution is essential for successful trading outcomes.

Order execution quality has received mixed reviews, with some traders reporting instances of slippage and requotes that negatively impact their trading results. Consistent and fair execution is fundamental to a positive trading experience, and any issues in this area significantly affect trader confidence.

The spread stability and pricing accuracy have also been questioned by some users, though the limited available information makes it difficult to assess the full extent of these concerns. EUR/USD spreads starting from 7 pips appear relatively wide compared to industry standards, which may impact trading profitability.

Mobile trading experience information is not available in current sources. This is concerning given the importance of mobile accessibility in modern trading. Most professional traders expect seamless mobile platform functionality for monitoring and managing positions on the go.

This castle market review indicates that while basic trading functionality is available through MT5, the overall trading experience is hampered by technical issues. User reports of execution concerns also hurt the experience.

Trust and Safety Analysis (3/10)

Trust and safety represent the most significant concerns in this Castle Market Fx evaluation. This results in the lowest rating among all assessed categories. The broker's credibility has been seriously undermined by multiple scam warnings and negative user feedback regarding its trustworthiness and operational integrity.

The absence of clear regulatory oversight from recognized financial authorities is a major red flag that significantly impacts the broker's trustworthiness. Regulated brokers typically provide detailed information about their regulatory status, license numbers, and compliance procedures, none of which are clearly available for Castle Market Fx.

Fund security measures and client money protection protocols are not detailed in available information. This leaves traders uncertain about the safety of their deposits. Established brokers typically maintain segregated client accounts and provide clear information about deposit insurance or compensation schemes.

The company's transparency regarding its ownership structure, financial backing, and operational procedures is severely lacking. This opacity makes it difficult for potential clients to assess the broker's stability and long-term viability, which are crucial factors in selecting a trading partner.

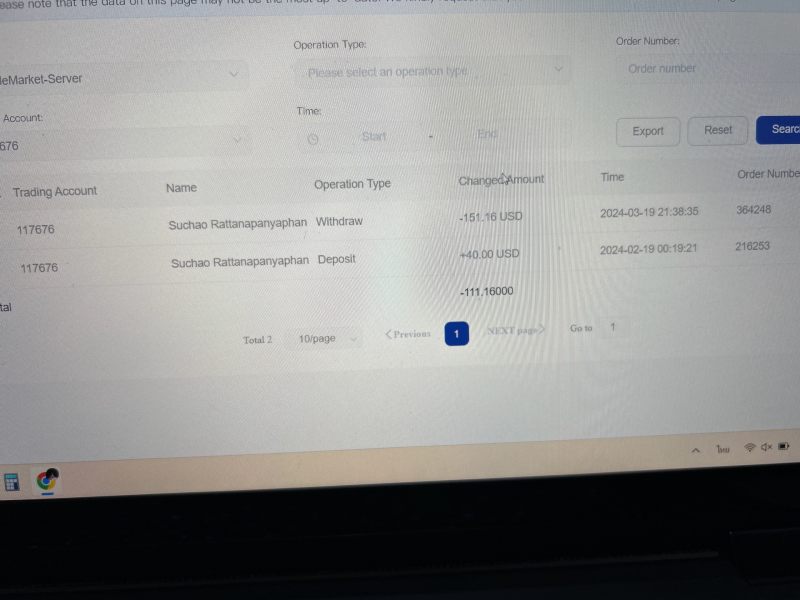

Multiple sources have flagged potential fraudulent activities associated with the platform. User complaints about difficulty in withdrawing funds or accessing customer service have further eroded confidence in the broker's legitimacy.

Industry reputation appears to be poor, with the broker being frequently mentioned in connection with scam warnings. Trading community forums and review platforms often give cautionary advice about this broker.

User Experience Analysis (4/10)

User experience with Castle Market Fx reflects the various operational challenges and trust issues that characterize this broker. With an overall user rating of 4.1 based on 23 reviews, the platform demonstrates below-average satisfaction levels that align with the concerns identified in other evaluation categories.

The registration and account verification process appears to lack clarity, with users reporting confusion about required documentation and approval timelines. A streamlined onboarding process is essential for positive first impressions, and deficiencies in this area often indicate broader operational issues.

Interface design and platform usability through MT5 receive mixed feedback, though this may be more related to user familiarity with the platform rather than broker-specific customizations. The lack of additional proprietary tools or enhanced user interfaces limits the differentiation from other MT5-based brokers.

Fund management experiences, including deposits and withdrawals, have generated negative feedback from some users who report difficulties in accessing their money or unclear fee structures. These issues are particularly concerning as they directly impact trader confidence and financial security.

Common user complaints center around trust issues, poor customer service experiences, and concerns about the broker's legitimacy. The frequency and consistency of these complaints suggest systemic issues rather than isolated incidents.

The target user profile appears to be high-risk tolerance traders who are attracted to high leverage opportunities. However, even this demographic should be cautious given the numerous red flags identified in user feedback and operational transparency issues.

Conclusion

This comprehensive castle market review reveals a broker that presents significant risks despite offering some attractive features such as high leverage and diverse asset access. Castle Market Fx's lack of regulatory transparency, combined with multiple scam warnings and poor user feedback, makes it unsuitable for most traders seeking a reliable and trustworthy trading partner.

While the platform may appeal to high-risk tolerance traders attracted to 1:3000 leverage ratios and multi-asset trading capabilities, the substantial concerns about fund security, operational transparency, and customer service quality outweigh these potential benefits. The broker's poor performance across most evaluation categories, particularly in trust and safety, indicates fundamental operational deficiencies.

Recommendation: Traders should exercise extreme caution and consider regulated alternatives with established track records, transparent operations, and positive user feedback. The risks associated with Castle Market Fx appear to significantly outweigh any potential trading advantages the platform might offer.