Is BT Global safe?

Pros

Cons

Is Bt Global Safe or a Scam?

Introduction

Bt Global is a forex broker that has emerged in recent years, positioning itself within the competitive landscape of online trading. With the rise of digital trading platforms, it has become increasingly important for traders to carefully evaluate the legitimacy and reliability of brokers before committing their funds. The forex market is rife with both reputable and dubious firms, making it essential for traders to distinguish between the two. This article aims to provide an objective analysis of Bt Global, focusing on its regulatory status, company background, trading conditions, customer safety, and user experiences. Our investigation is based on a thorough review of available online resources, user reviews, and regulatory information, ensuring a comprehensive assessment of whether Bt Global is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its trustworthiness. A broker that operates under strict regulatory oversight is generally seen as more reliable than one that does not. Bt Global claims to be regulated, but the specifics of its licensing and oversight are murky. The following table summarizes the key regulatory details:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

As evidenced by the table, Bt Global lacks proper regulatory oversight, which raises significant concerns about its legitimacy. The absence of a regulatory framework means that clients have little recourse in the event of disputes or issues with fund withdrawals. Regulatory bodies are crucial for protecting investors' interests, ensuring that brokers adhere to strict operational standards. Without such oversight, the risk of fraud or mismanagement increases substantially. Furthermore, the lack of historical compliance records further complicates the assessment of Bt Global's credibility.

Company Background Investigation

Understanding the company behind a trading platform is vital for assessing its reliability. Bt Global, reportedly established in 2019, operates from China, a jurisdiction often associated with lax regulatory practices. The ownership structure of the company is unclear, and there is limited information available regarding its management team and operational history.

The lack of transparency surrounding the companys background is concerning. A reputable broker typically provides detailed information about its founders, management team, and operational history, allowing potential clients to gauge its credibility. In contrast, Bt Global's obscurity may indicate potential risks associated with investing through this platform. Traders are encouraged to conduct thorough research before engaging with any broker, especially those that do not readily disclose their corporate structure and leadership.

Trading Conditions Analysis

A broker's trading conditions, including fees and spreads, play a significant role in determining its overall attractiveness to traders. Bt Global claims to offer competitive trading conditions, but the specifics remain vague. The following table outlines the core trading costs associated with Bt Global:

| Fee Type | Bt Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1-1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Low |

The spread for major currency pairs at Bt Global is higher than the industry average, which could significantly impact trading profitability. Additionally, the lack of clarity regarding commission structures and overnight interest rates raises red flags. Traders should be wary of potential hidden fees that could erode their trading capital. Such discrepancies often suggest that the broker may not prioritize transparency, which is crucial for building trust with clients.

Customer Funds Safety

The safety of customer funds is paramount when selecting a broker. Bt Global's policies regarding fund protection are unclear, and there is no indication that it employs robust measures such as segregated accounts or negative balance protection. The absence of these safety nets can expose traders to significant risks, including the potential loss of their entire investment.

A reputable broker typically ensures that client funds are kept in separate accounts, safeguarding them from operational risks. Furthermore, the lack of any historical incidents or complaints regarding fund safety from Bt Global raises additional concerns. Traders should be cautious and conduct due diligence before entrusting their funds to any broker, especially one that lacks a clear safety policy.

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability. Analyzing user experiences can provide valuable insights into the operational practices of a broker. For Bt Global, user reviews indicate several recurring issues, particularly concerning fund withdrawals and customer service responsiveness. The following table summarizes the main types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Slow |

| Platform Reliability | High | Unresponsive |

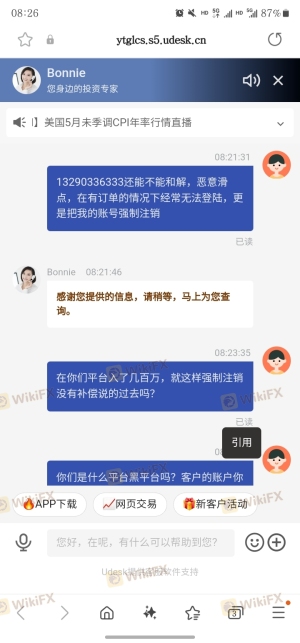

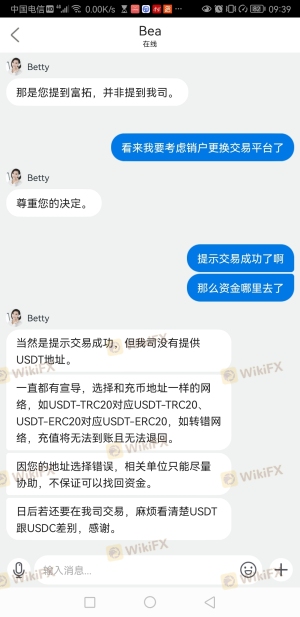

Many users have reported difficulties in withdrawing their funds, a serious concern that suggests potential fraudulent activity. The poor responsiveness of customer service further exacerbates these issues, leaving clients feeling unsupported and vulnerable. The combination of high severity complaints and inadequate company responses raises significant concerns about whether Bt Global is safe for trading.

Platform and Trade Execution

A broker's trading platform is a critical component of the trading experience. It should be stable, user-friendly, and capable of executing trades efficiently. However, reviews of Bt Global's platform indicate potential issues with performance and reliability. Users have reported instances of slippage and order rejections, which can severely impact trading outcomes.

Moreover, the lack of transparency regarding the technology underlying the trading platform raises questions about its integrity. Traders should be cautious of platforms that do not provide clear information about their operational mechanisms, as this can often indicate underlying issues.

Risk Assessment

Using Bt Global presents several risks that potential traders should consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | High | Lack of fund protection and high fees. |

| Operational Risk | Medium | Complaints regarding platform reliability. |

Given the high-risk levels associated with Bt Global, traders are advised to exercise extreme caution. It may be prudent to seek alternative brokers with established reputations and regulatory oversight to mitigate potential risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that Bt Global raises several red flags that indicate it may not be a safe trading option. The absence of regulatory oversight, coupled with high complaint rates and unclear trading conditions, creates a precarious environment for traders. While some users may have had positive experiences, the overarching concerns about fund safety and operational transparency warrant caution.

For traders seeking reliable and secure trading environments, it is advisable to consider established brokers regulated by reputable authorities. Alternatives such as brokers regulated by the FCA, ASIC, or CySEC may offer greater security and peace of mind. Ultimately, ensuring the safety of your investments should be the top priority when selecting a trading platform.

Is BT Global a scam, or is it legit?

The latest exposure and evaluation content of BT Global brokers.

BT Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BT Global latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.