Is blazaintl safe?

Business

License

Is Blazaintl Safe or Scam?

Introduction

Blazaintl is a forex broker that has recently entered the online trading market, positioning itself as a platform for both novice and experienced traders. In an industry rife with scams and unregulated entities, it is crucial for traders to conduct thorough assessments of forex brokers before committing their hard-earned money. This article aims to evaluate the legitimacy of Blazaintl by examining its regulatory compliance, company background, trading conditions, customer experience, and overall risk profile. Our investigation is based on a comprehensive review of multiple online sources, including user feedback, regulatory databases, and expert analyses.

Regulation and Legitimacy

The regulatory status of a forex broker is a fundamental aspect that determines its legitimacy and trustworthiness. Blazaintl's regulatory standing is critical for potential clients, as it can significantly impact the safety of their funds and overall trading experience.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Registered | N/A | N/A | Not Verified |

Blazaintl appears to operate without any recognized regulatory oversight, which raises significant concerns. The absence of a license from a reputable authority such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Commodity Futures Trading Commission (CFTC) in the US leaves traders vulnerable to potential fraud or malpractice. Without regulatory supervision, there is no guarantee that the broker adheres to industry standards or maintains transparent practices. Historically, unregulated brokers have been linked to various financial disputes and scams, making it imperative for traders to exercise caution when dealing with such entities.

Company Background Investigation

A thorough understanding of Blazaintl's company history, ownership structure, and management team is essential for evaluating its reliability. Unfortunately, information regarding Blazaintl's establishment, ownership, and operational history remains sparse. The lack of transparency about the companys origins and the individuals behind it raises red flags.

Additionally, the management teams qualifications and experience in the financial industry play a crucial role in determining the broker's credibility. A well-established management team with a proven track record can instill confidence in potential clients. However, without accessible information regarding the team's expertise, traders are left in the dark, which can be a significant concern when assessing if Blazaintl is safe.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly influence a trader's experience and profitability. Blazaintl's pricing structure and fee policies need to be scrutinized to determine their competitiveness and transparency.

| Fee Type | Blazaintl | Industry Average |

|---|---|---|

| Spread (Major Currency Pairs) | 2 pips | 1.5 pips |

| Commission Model | No Commission | $5 per lot |

| Overnight Interest Range | 1.5% | 1% |

The comparison indicates that Blazaintl's spreads are higher than the industry average, which may diminish potential profits for traders. Additionally, the absence of a clear commission structure could lead to hidden costs that are not immediately apparent to new clients. Traders should be aware of any unusual fees that could impact their trading experience, making it essential to understand the broker's overall cost structure before proceeding.

Client Fund Security

Ensuring the safety of client funds is paramount for any forex broker. Blazaintl's measures for safeguarding client deposits warrant thorough examination. The broker's approach to fund segregation and investor protection is crucial in determining whether it operates with the necessary ethical standards.

Unfortunately, there is little available information regarding Blazaintl's practices related to fund security. A reputable broker typically maintains client funds in segregated accounts, ensuring that they are kept separate from the broker's operational funds. Furthermore, strong investor protection policies, such as negative balance protection, are essential for safeguarding traders from potential losses exceeding their deposits. The lack of clarity regarding these measures raises concerns about the safety of client funds if traders decide to engage with Blazaintl.

Customer Experience and Complaints

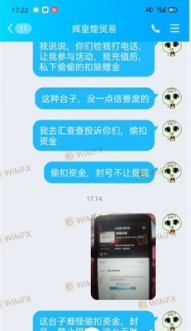

Analyzing customer feedback is an essential aspect of assessing a broker's reliability. Blazaintl has received mixed reviews from users, with several complaints highlighting issues related to customer service and withdrawal difficulties.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | Medium | Delayed Replies |

Common complaints include difficulties in withdrawing funds and inadequate customer support. Such issues can severely impact the trading experience and may indicate underlying problems with the broker's operations. In some cases, users have reported a lack of communication regarding their inquiries, further exacerbating concerns about the broker's reliability.

Platform and Trade Execution

The performance of a trading platform is critical for executing trades efficiently. Blazaintl's platform must be evaluated for stability, speed, and user experience. Traders often rely on fast execution speeds to capitalize on market movements.

However, there are reports of execution delays and slippage, which can hinder trading performance. A platform that frequently experiences issues with order execution may lead to missed opportunities and financial losses for traders. Moreover, any signs of potential manipulation or unfair practices should be thoroughly investigated to ensure a fair trading environment.

Risk Assessment

Using Blazaintl for trading comes with inherent risks that must be considered.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security | High | Lack of transparency on fund protection |

| Execution Risk | Medium | Reports of slippage and delays |

The absence of regulatory oversight poses a significant risk to traders, as they may have limited recourse in case of disputes. Furthermore, the lack of clarity surrounding fund security measures adds to the overall risk profile of Blazaintl. Traders should be aware of these risks and consider implementing strategies to mitigate them, such as limiting their exposure and conducting thorough research before trading.

Conclusion and Recommendations

In conclusion, Blazaintl raises several red flags that suggest it may not be a safe option for traders. The lack of regulatory oversight, transparency regarding company operations, and numerous complaints about customer service and withdrawal issues indicate that traders should exercise extreme caution when considering this broker.

For those seeking reliable trading options, it is advisable to consider well-regulated brokers with proven track records and positive user feedback. Options such as brokers regulated by the FCA, ASIC, or CFTC provide a safer trading environment and greater peace of mind for investors. Ultimately, traders must prioritize their safety and due diligence when choosing a forex broker, as the risks associated with unregulated entities can be substantial.

In summary, Is Blazaintl safe? Based on the current evidence, potential traders should approach this broker with skepticism and consider alternative, more reliable options for their trading needs.

Is blazaintl a scam, or is it legit?

The latest exposure and evaluation content of blazaintl brokers.

blazaintl Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

blazaintl latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.