Is Auu Global Limited safe?

Business

License

Is Auu Global Limited A Scam?

Introduction

Auu Global Limited is a relatively obscure player in the forex market, positioning itself as a financial investment brand that claims to offer a wide range of trading services. However, the lack of transparency surrounding its operations raises significant concerns among potential traders. In the highly volatile and often risky world of forex trading, it is crucial for traders to carefully evaluate the credibility and reliability of brokers before committing their funds. This article aims to investigate the legitimacy of Auu Global Limited, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The evaluation is based on a thorough review of available online resources and user feedback.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its credibility. Regulated brokers are subject to oversight by recognized financial authorities, which helps ensure that they adhere to industry standards and protect traders' funds. In the case of Auu Global Limited, the broker currently operates without any valid regulatory licenses, which raises red flags about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation suggests that Auu Global Limited is not held accountable to any external authority, increasing the risk for traders. Without regulatory oversight, there are no guarantees regarding the safety of clients' funds, compliance with trading standards, or recourse in the event of disputes. Historical compliance data shows that unregulated brokers often engage in dubious practices, making it essential for traders to approach Auu Global Limited with caution. The lack of a valid regulatory framework indicates that traders may be exposed to significant risks, including potential fraud.

Company Background Investigation

Auu Global Limited claims to operate as a financial investment brand, but there is little information available regarding its history, ownership structure, or management team. The company was incorporated in April 2020 in the UK, but its operational transparency is severely lacking. The official website does not provide clear information about the individuals behind the company or their professional qualifications. This lack of transparency raises concerns about the company's legitimacy and reliability.

The company's website features broken links and poorly translated content, which further detracts from its credibility. Additionally, Auu Global Limited appears to operate multiple domains, including a uu forex.com and a uu 999.com, which is often a tactic used by untrustworthy brokers to obscure their true identity and operations. The absence of a clear and accountable management structure is a significant concern, as it makes it difficult for traders to ascertain who is handling their investments and whether they can be trusted.

Trading Conditions Analysis

The trading conditions offered by Auu Global Limited are another area of concern. While the broker claims to provide access to over 250 trading instruments, specific details regarding spreads, commissions, and leverage are vague or entirely absent. This lack of clarity can lead to unexpected costs for traders.

| Fee Type | Auu Global Limited | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Not Specified | 1-2 Pips |

| Commission Structure | Not Specified | Varies |

| Overnight Interest Range | Not Specified | 2-5% |

Without clear information on trading costs, traders may find themselves facing higher expenses than anticipated, which can significantly impact their profitability. Moreover, reports suggest that the broker may impose unusual fees or restrictions on withdrawals, which is a common tactic employed by fraudulent brokers to retain clients' funds.

Customer Funds Security

The safety of customer funds is paramount when choosing a forex broker. A regulated broker typically offers protections such as segregated accounts and negative balance protection. However, Auu Global Limited lacks these essential safeguards. The absence of regulatory oversight means that there are no guarantees regarding the security of traders' funds.

Traders should be particularly concerned about the lack of information on whether Auu Global Limited employs any measures to protect client funds. Reports indicate that traders have faced difficulties when attempting to withdraw their funds, raising serious questions about the broker's reliability and trustworthiness. Without proper investor protection mechanisms in place, traders could potentially lose their investments without any recourse.

Customer Experience and Complaints

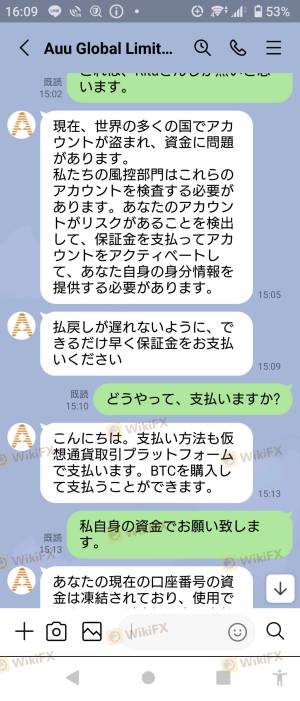

Customer feedback is a valuable indicator of a broker's reliability. Unfortunately, Auu Global Limited has garnered numerous complaints from users, primarily revolving around withdrawal issues. Many traders have reported their withdrawal requests being denied or delayed, which is a significant red flag.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| Lack of Transparency | Medium | Minimal Response |

| Poor Customer Support | High | Non-existent |

Typical cases involve traders who, after depositing funds, encounter significant hurdles when attempting to access their money. In some instances, brokers may request additional fees or impose conditions that prevent withdrawals, which is a common tactic used by scam brokers. The overall customer experience with Auu Global Limited appears to be negative, with many users expressing frustration and concern over the broker's practices.

Platform and Trade Execution

Auu Global Limited claims to offer a trading platform powered by MetaTrader 4, a popular choice among traders for its user-friendly interface and robust features. However, the performance and reliability of the platform remain unverified. Reports of slippage and rejected orders have surfaced, indicating potential issues with trade execution.

Traders should be wary of any signs of platform manipulation, as this can severely impact trading outcomes. The lack of transparency regarding execution quality raises concerns about the broker's integrity. A reliable broker should provide clear information about order execution policies and any potential risks associated with trading on their platform.

Risk Assessment

Engaging with Auu Global Limited poses several risks for traders. The absence of regulation, combined with numerous complaints and lack of transparency, creates a high-risk environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight or protection |

| Fund Security Risk | High | No safeguards for client funds |

| Withdrawal Risk | High | Reports of denied or delayed withdrawals |

| Transparency Risk | Medium | Lack of information about operations |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers that offer regulatory protection and a proven track record of reliability.

Conclusion and Recommendations

In conclusion, Auu Global Limited raises multiple red flags that suggest it may not be a safe option for traders. The absence of regulation, numerous complaints regarding fund withdrawals, and a lack of transparency all point to the potential for fraudulent practices. Traders should exercise extreme caution when considering this broker and weigh the risks against the benefits.

For those seeking to engage in forex trading, it is advisable to opt for regulated brokers with a proven track record of reliability and customer satisfaction. Some reputable alternatives include brokers regulated by the FCA in the UK or ASIC in Australia, which provide robust protections for traders. Ultimately, the safety of your investments should be the top priority when selecting a forex broker.

Is Auu Global Limited a scam, or is it legit?

The latest exposure and evaluation content of Auu Global Limited brokers.

Auu Global Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Auu Global Limited latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.