Regarding the legitimacy of Asia Pacific forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is Asia Pacific safe?

Software Index

Risk Control

Is Asia Pacific markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

亞太金業有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

www.gold9188.comExpiration Time:

--Address of Licensed Institution:

香港上環孖沙街12-18號金銀商業大廈1樓01室Phone Number of Licensed Institution:

68729828Licensed Institution Certified Documents:

Is Asia Pacific Bullion Limited A Scam?

Introduction

Asia Pacific Bullion Limited, a broker based in Hong Kong, has positioned itself in the forex market as a provider of trading services primarily focused on precious metals. Established in 2018, the broker claims to offer a range of trading options, including London gold and silver. However, the forex market is rife with potential pitfalls, and traders must exercise caution when evaluating brokers. The importance of thorough due diligence cannot be overstated, as the financial landscape is filled with both legitimate firms and fraudulent operations. This article will employ a systematic approach to assess whether Asia Pacific Bullion Limited is safe or a potential scam, utilizing data from various sources, including regulatory information, customer reviews, and industry standards.

Regulation and Legitimacy

The regulatory status of a forex broker is a crucial factor in determining its legitimacy and safety. Asia Pacific Bullion Limited is reportedly regulated by the Hong Kong Gold Exchange, holding a license number 088. However, the effectiveness of this regulation is often questioned due to the varying levels of oversight that different regulatory bodies provide. Below is a summary of the broker's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Hong Kong Gold Exchange (HKGX) | 088 | Hong Kong | Verified |

The regulatory environment in Hong Kong is generally considered reliable, yet it is essential to recognize that not all regulations are equally stringent. While Asia Pacific Bullion Limited is licensed, there have been numerous complaints from users regarding withdrawal issues and customer service responsiveness. This raises concerns about the actual enforcement of regulations and the broker's compliance history. In recent months, reports of clients being unable to withdraw funds have surfaced, leading to questions about the safety of trading with this broker.

Company Background Investigation

Asia Pacific Bullion Limited has a relatively short history, having been established in 2018. Its ownership structure and management team are not widely publicized, which raises transparency concerns. A lack of detailed information about the management team can be a red flag for potential investors. Furthermore, the company's operational practices have been scrutinized, particularly regarding its customer service and responsiveness to client inquiries. The information disclosure level appears limited, which is not ideal for fostering trust with potential traders.

The broker's office is located in a commercial building in Hong Kong, which was confirmed by an on-site visit. While this indicates a physical presence, the absence of comprehensive information about the company's operations and management can lead to skepticism among traders. Overall, the company's transparency and history do not inspire significant confidence, further complicating the assessment of whether Asia Pacific Bullion Limited is safe.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading costs is essential. Asia Pacific Bullion Limited offers trading in precious metals, but detailed information about its fee structure is somewhat sparse. The following table summarizes the core trading costs associated with this broker:

| Fee Type | Asia Pacific Bullion Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not specified | 1.0 - 2.0 pips |

| Commission Model | Not specified | Varies |

| Overnight Interest Range | Not specified | Varies |

While the broker does not explicitly outline its fee structure, the lack of clarity around potential hidden fees is concerning. Traders should be wary of brokers that do not provide transparent information regarding their costs, as this could lead to unexpected charges that impact profitability. Furthermore, the absence of a clearly defined commission model raises questions about the overall trading experience and whether it aligns with industry standards.

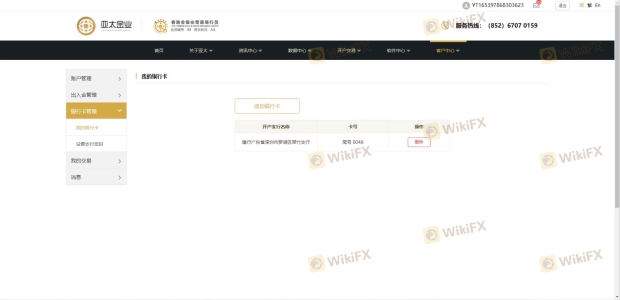

Client Fund Security

The safety of client funds is paramount when considering a forex broker. Asia Pacific Bullion Limited claims to implement various security measures, but the specifics of these measures are not well-documented. The segregation of client funds is a critical practice that ensures traders' money is kept separate from the broker's operational funds. However, there is limited information regarding whether Asia Pacific Bullion Limited follows this practice.

Additionally, the broker's policies on investor protection and negative balance protection are not clearly outlined. This lack of information can be alarming for potential traders, as it raises concerns about what would happen in the event of a market downturn or operational issues. Historical reports of clients facing difficulties withdrawing funds further exacerbate these concerns, leading to the question: Is Asia Pacific Bullion Limited safe for trading?

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Unfortunately, Asia Pacific Bullion Limited has garnered a significant number of complaints from users, particularly regarding withdrawal issues and customer service responsiveness. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| Lack of Transparency | High | Poor |

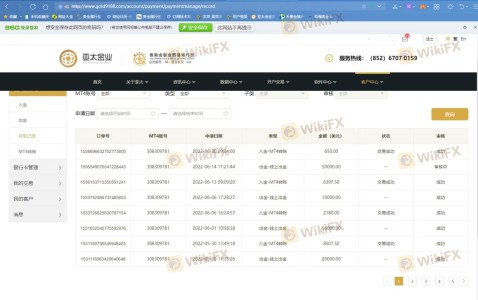

Many clients have reported being unable to withdraw their funds, with requests allegedly remaining under review for extended periods. This pattern raises serious concerns about the broker's operational integrity. For instance, one user reported a withdrawal request that remained pending for over two months, prompting them to seek legal recourse. Such experiences contribute to the growing perception that Asia Pacific Bullion Limited may not be a safe option for traders.

Platform and Trade Execution

The trading platform offered by Asia Pacific Bullion Limited is primarily MetaTrader 4 (MT4), a widely used platform known for its robust features and user-friendly interface. However, the performance and reliability of the platform are critical factors that can significantly impact trading outcomes. Users have reported issues related to order execution, including slippage and rejected orders. These problems can be detrimental to traders, especially in fast-moving markets.

While MT4 is generally considered a reliable platform, the specific execution quality at Asia Pacific Bullion Limited remains under scrutiny. Traders should be cautious and consider testing the platform with a demo account before committing significant capital. The presence of any signs of platform manipulation or inconsistent execution can be a significant red flag, leading to further doubts about whether Asia Pacific Bullion Limited is a safe broker.

Risk Assessment

Engaging with any forex broker carries inherent risks, and Asia Pacific Bullion Limited is no exception. A comprehensive risk assessment reveals several areas of concern. The following risk scorecard summarizes the key risk categories associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Limited transparency and oversight |

| Fund Security | High | Concerns about fund segregation |

| Customer Service | Medium | Poor response to complaints |

| Trading Conditions | High | Lack of clarity on fees and spreads |

Given these risks, it is crucial for traders to approach Asia Pacific Bullion Limited with caution. Implementing risk mitigation strategies, such as starting with smaller investments and conducting thorough research, can help protect against potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Asia Pacific Bullion Limited exhibits several characteristics that warrant caution. The combination of numerous complaints, regulatory concerns, and a lack of transparency raises significant doubts about the broker's safety. While it is regulated by the Hong Kong Gold Exchange, the effectiveness of this regulation is questionable, especially given the volume of negative feedback from clients.

Traders considering Asia Pacific Bullion Limited should be aware of the potential risks involved and may want to explore alternative options. Recommended alternatives include more established brokers with robust regulatory oversight and a proven track record of customer satisfaction. Ultimately, traders should prioritize safety and transparency when selecting a forex broker to ensure a secure trading experience.

Is Asia Pacific a scam, or is it legit?

The latest exposure and evaluation content of Asia Pacific brokers.

Asia Pacific Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Asia Pacific latest industry rating score is 6.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.