Is APO FINANCE LTD safe?

Business

License

Is APO Finance Ltd Safe or a Scam?

Introduction

APO Finance Ltd, also known as apo forex 77.com, positions itself as a forex and CFD broker in the competitive landscape of the forex market. As traders seek opportunities for investment, the importance of evaluating the credibility and safety of their chosen brokers cannot be overstated. The potential for scams and fraudulent activities in the forex industry necessitates a thorough investigation of any broker before committing funds. This article aims to provide an objective analysis of APO Finance Ltd, assessing its safety and legitimacy based on regulatory status, company background, trading conditions, client experiences, and risk factors.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety and legitimacy. Regulation serves as a safeguard for clients, ensuring that brokers adhere to strict operational standards. In the case of APO Finance Ltd, it claims to be regulated by the Financial Crimes Enforcement Network (FinCEN); however, there is no verifiable evidence to support these claims. This lack of transparency raises significant red flags regarding the broker's legitimacy.

| Regulatory Agency | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FinCEN | Not Provided | United States | Unverified |

The absence of a valid license from a reputable regulatory body such as the FCA (Financial Conduct Authority) or ASIC (Australian Securities and Investments Commission) suggests that APO Finance Ltd operates without the oversight necessary to protect investors. This raises concerns about the broker's adherence to industry standards and its overall credibility. As a general rule, working with unregulated brokers poses a substantial risk to traders, making it imperative for potential clients to exercise caution when considering APO Finance Ltd.

Company Background Investigation

APO Finance Ltd's history and ownership structure play a vital role in assessing its reliability. Unfortunately, detailed information regarding the company's origins, ownership, and management team is scarce. The brokers website lacks comprehensive disclosures, which further complicates the transparency of its operations. A well-established broker typically provides clear insights into its history, including milestones and regulatory compliance.

Furthermore, the absence of information about the management team raises questions about their qualifications and expertise in the financial sector. Without a qualified team at the helm, the broker's ability to navigate the complexities of the forex market and provide reliable services may be compromised. Given these factors, it is essential for traders to remain vigilant and skeptical about the claims made by APO Finance Ltd.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for any trader. In the case of APO Finance Ltd, the broker claims to provide various trading instruments, including forex, commodities, and indices. However, the lack of clarity regarding its fee structure and trading costs is concerning.

| Fee Type | APO Finance Ltd | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1.0 - 2.0 pips |

| Commission Model | Not Disclosed | Varies (0 - 10 USD) |

| Overnight Interest Range | Not Disclosed | 2.0% - 5.0% |

The absence of specific information regarding spreads, commissions, and overnight interest rates raises questions about potential hidden fees that could detrimentally affect traders' profitability. Traders should be wary of brokers that do not provide transparent information about their trading conditions, as it may indicate a lack of commitment to fair trading practices.

Client Funds Security

The safety of client funds is a paramount concern when evaluating a broker. APO Finance Ltd claims to implement certain security measures for client funds; however, the details regarding fund segregation, investor protection, and negative balance protection policies remain vague. A reputable broker typically ensures that client funds are held in segregated accounts, separate from the company's operational funds, to protect investors in the event of insolvency.

Moreover, the absence of documented investor protection schemes raises further concerns about the safety of funds deposited with APO Finance Ltd. Historical issues related to fund security or disputes have not been disclosed, which could indicate a lack of accountability on the part of the broker. Without robust security measures in place, traders could face significant risks when trading with this broker.

Customer Experience and Complaints

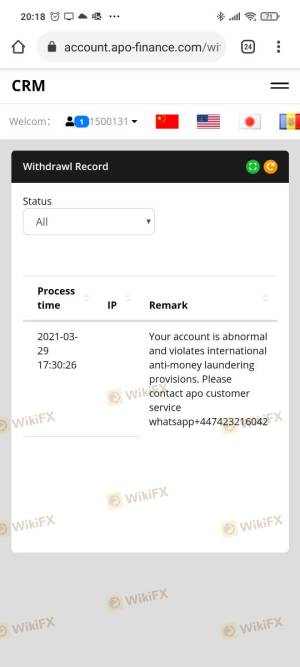

Customer feedback and experiences are invaluable indicators of a broker's performance. In the case of APO Finance Ltd, numerous negative reviews have surfaced, casting doubt on the broker's reliability. Common complaints include difficulty in withdrawing funds, poor customer support, and a lack of transparency regarding trading conditions.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Support | Medium | Inadequate |

| Transparency | High | Lacking Information |

Typical case studies reveal that clients have encountered significant delays in fund withdrawals, often without satisfactory explanations from the broker. Such patterns of complaints suggest systemic issues within the organization, indicating that potential clients should exercise extreme caution before engaging with APO Finance Ltd.

Platform and Execution

The trading platform offered by a broker is a crucial aspect of the trading experience. APO Finance Ltd claims to provide access to the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading features. However, user experiences regarding platform performance, stability, and execution quality remain mixed.

Traders have reported instances of slippage and order rejections, which can severely impact trading outcomes. Additionally, any indications of platform manipulation or unfair trading practices could further erode trust in the broker's operations. As such, it is essential for potential clients to thoroughly research user reviews and experiences before committing to trading with APO Finance Ltd.

Risk Assessment

Engaging with any broker carries inherent risks, and APO Finance Ltd is no exception. A comprehensive risk assessment reveals several areas of concern that traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status |

| Fund Safety Risk | High | Lack of investor protection |

| Execution Risk | Medium | Reports of slippage |

Given the high-risk profile associated with trading with APO Finance Ltd, potential clients are advised to consider alternative brokers with better regulatory oversight and a proven track record of reliability.

Conclusion and Recommendations

In conclusion, the evidence presented raises significant concerns regarding the safety and legitimacy of APO Finance Ltd. The broker's unregulated status, lack of transparency, and numerous client complaints suggest that it may not be a safe option for traders. While some may find the allure of trading with this broker appealing, the risks involved far outweigh any potential benefits.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are well-regulated and have a history of positive client experiences. Brokers regulated by top-tier authorities such as the FCA or ASIC offer a higher level of protection and peace of mind for traders.

To summarize, is APO Finance Ltd safe? The overwhelming evidence suggests that it is not, and traders should exercise caution before engaging with this broker.

Is APO FINANCE LTD a scam, or is it legit?

The latest exposure and evaluation content of APO FINANCE LTD brokers.

APO FINANCE LTD Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

APO FINANCE LTD latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.