Is ANISFX safe?

Business

License

Is AnisFX Safe or Scam?

Introduction

AnisFX, a relatively new player in the forex trading market, has garnered attention for its promises of high leverage and attractive trading conditions. As with any online trading platform, it is crucial for traders to carefully evaluate the legitimacy and reliability of AnisFX before investing their hard-earned money. The forex market is rife with brokers, some of which are legitimate, while others may engage in fraudulent activities. Therefore, assessing the credibility of a broker like AnisFX is essential for protecting ones investments. This article aims to provide a comprehensive evaluation of AnisFX, using a structured approach that includes regulatory status, company background, trading conditions, client fund safety, customer experience, platform performance, risk assessment, and a final conclusion.

Regulation and Legitimacy

One of the first indicators of a broker's reliability is its regulatory status. AnisFX operates under the jurisdiction of St. Vincent and the Grenadines, a region known for its lenient regulatory framework. This raises questions about the broker's accountability and the safety of traders' funds. Below is a summary of AnisFX's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | St. Vincent and Grenadines | Unregulated |

The absence of a regulatory license is a significant red flag. Regulatory bodies, such as the FCA in the UK or ASIC in Australia, impose strict guidelines to protect traders. Without such oversight, traders using AnisFX may find themselves vulnerable to potential fraud or mismanagement of funds. Moreover, the lack of transparency regarding the companys operations and ownership further complicates the situation. Historically, unregulated brokers have been associated with high risks, including sudden withdrawal restrictions, fund misappropriation, and a lack of recourse for traders in case of disputes.

Company Background Investigation

AnisFX is owned by Anis Trading LLC, which is registered in St. Vincent and the Grenadines. The company claims to have been established in 2018, but there is a scarcity of information regarding its management team and operational history. This lack of transparency can be concerning for potential investors, as a credible broker typically provides information about its founders and key personnel.

The anonymity surrounding AnisFX's management is alarming. A reputable broker usually discloses details about its leadership to build trust with clients. The absence of such information raises questions about the broker's intentions and operational integrity. Moreover, the company's limited online presence and low traffic rank indicate that it may not be a well-established trading platform, which could further jeopardize the safety of traders' funds.

Trading Conditions Analysis

AnisFX offers a variety of trading conditions, including high leverage ratios of up to 1:500, which can attract traders seeking to maximize their potential returns. However, this high leverage also amplifies the risk of significant losses. Below is a comparison of AnisFX's trading costs with industry averages:

| Cost Type | AnisFX | Industry Average |

|---|---|---|

| Spread for Major Pairs | 1.5 pips | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Variable | 2-5% |

While the spreads appear competitive, the lack of a clear commission structure and the potential for high overnight fees could result in unexpected costs for traders. Additionally, the platform offers a 10% deposit bonus, which is often a marketing tactic used by unregulated brokers to entice new clients. Such bonuses can complicate withdrawal processes, as brokers may impose stringent conditions before allowing clients to access their funds.

Client Fund Safety

The safety of client funds is a paramount concern when evaluating any broker. AnisFX does not provide adequate information regarding its fund security measures, such as whether client funds are held in segregated accounts or if there are any investor protection schemes in place. The absence of these safeguards raises significant concerns about the safety of traders' investments.

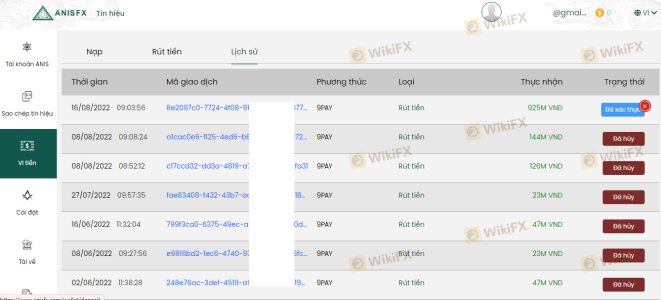

Moreover, there have been reports of withdrawal issues faced by clients, which is a common complaint among users of unregulated brokers. Without regulatory oversight, traders have limited recourse if they encounter difficulties retrieving their funds. The lack of transparency regarding the companys banking relationships further exacerbates these concerns, leaving traders exposed to potential financial risks.

Customer Experience and Complaints

Customer feedback is a vital aspect of assessing a broker's reliability. Reviews of AnisFX reveal a pattern of dissatisfaction among users, particularly concerning withdrawal processes and customer support. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | High | Poor |

| Misleading Marketing Claims | Medium | Average |

Many users have reported difficulties in withdrawing their funds, with some claiming that their requests were ignored or met with excessive delays. Additionally, the quality of customer support has been criticized, as traders often find it challenging to get timely assistance. These complaints suggest a significant gap in the companys commitment to customer service, which is crucial for maintaining trust in the trading environment.

Platform and Trade Execution

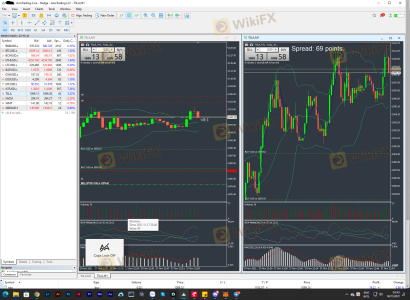

AnisFX provides access to the MetaTrader 5 (MT5) platform, which is known for its user-friendly interface and robust features. However, user experiences regarding platform performance have been mixed. Traders have reported instances of slippage and execution delays, which can significantly impact trading outcomes.

Moreover, there are concerns about potential platform manipulation, particularly given the broker's unregulated status. A reliable broker should provide a transparent trading environment, free from any manipulation that could disadvantage traders. The lack of oversight raises questions about the integrity of trade execution on AnisFX's platform.

Risk Assessment

Using AnisFX presents several risks for traders, particularly due to its unregulated nature. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of fund protection measures |

| Customer Service Risk | Medium | Poor response to complaints |

| Trading Execution Risk | Medium | Possible slippage and manipulation issues |

To mitigate these risks, traders should conduct thorough research before engaging with AnisFX or consider using regulated brokers that offer better protections and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that AnisFX may not be a safe trading option for potential investors. The broker's unregulated status, lack of transparency, and reported issues with fund withdrawals raise significant concerns about its legitimacy. Traders should exercise extreme caution when considering this platform and may want to explore alternative, regulated brokers that prioritize client safety and offer robust customer support.

For those seeking reliable trading options, consider brokers regulated by reputable authorities such as the FCA or ASIC, which provide a higher level of security and oversight. Ultimately, the safety of your investments should be your top priority, and opting for a well-regulated broker can help mitigate risks associated with online trading.

Is ANISFX a scam, or is it legit?

The latest exposure and evaluation content of ANISFX brokers.

ANISFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ANISFX latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.