Is AMDEN CAPITAL safe?

Business

License

Is Amden Capital A Scam?

Introduction

Amden Capital positions itself as a player in the forex market, offering trading services across various asset classes, including currencies, commodities, and indices. As the financial landscape becomes increasingly complex, traders must exercise caution when evaluating forex brokers. The potential for scams and fraudulent activities is ever-present, making it crucial for traders to thoroughly assess the legitimacy of any broker before committing their funds. This article aims to provide a comprehensive evaluation of Amden Capital, utilizing a combination of qualitative analysis and structured data to determine whether it is a safe option for traders or if it exhibits characteristics of a scam.

Regulation and Legitimacy

The regulatory status of a broker is a fundamental aspect that determines its credibility and safety. Amden Capital's lack of credible regulatory oversight raises significant concerns. A reputable broker should be registered with a recognized financial authority, which ensures compliance with stringent operational standards.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of valid regulatory information for Amden Capital indicates a high potential risk for traders. Without oversight from a recognized authority, traders are vulnerable to potential fraud and mismanagement of their funds. Regulatory bodies like the FCA (Financial Conduct Authority) or ASIC (Australian Securities and Investments Commission) provide essential investor protections, which are notably absent in this case. Furthermore, historical compliance issues can often serve as red flags, and the lack of transparency in Amden Capital's regulatory history only adds to the skepticism surrounding its operations.

Company Background Investigation

Amden Capital's history and ownership structure are critical to understanding its operational integrity. Founded in 2004, the company claims to have extensive experience in the financial sector, yet details about its ownership and management team remain vague. A lack of clear information regarding the individuals at the helm can lead to questions about their qualifications and intentions.

The management team's professional background is crucial in assessing the broker's reliability. Transparent companies often disclose their leadership profiles and qualifications; however, Amden Capital does not provide sufficient information in this regard. This opacity raises concerns about the company's commitment to transparency and accountability. The level of information disclosure is a vital factor for traders, as it directly impacts their trust in the broker. Without a clear understanding of who is managing their funds, traders may find themselves in precarious positions.

Trading Conditions Analysis

Understanding the trading conditions and fee structures of a broker is essential for evaluating its overall attractiveness. Amden Capital's fee structure appears to be lacking clarity, which can lead to unexpected costs for traders. The absence of transparent information regarding spreads, commissions, and overnight interest rates can create confusion and mistrust among users.

| Fee Type | Amden Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The potential for hidden fees or unusual commission structures is a common tactic employed by unscrupulous brokers. Traders should be wary of any broker that does not provide straightforward information about its fees. In the case of Amden Capital, the lack of detailed fee disclosures raises significant concerns about the overall trading experience and potential profitability for clients.

Client Funds Security

The security of client funds is paramount when selecting a forex broker. Amden Capital's approach to safeguarding client deposits is unclear, which can be alarming for potential traders. Effective fund security measures typically include segregated accounts, investor protection schemes, and negative balance protection policies.

The absence of information regarding these critical security measures poses a risk for traders. Without assurances that their funds are adequately protected, traders may face the threat of losing their investments due to the broker's mismanagement or insolvency. Historical incidents of fund security breaches can further exacerbate these concerns, although no specific incidents have been reported for Amden Capital. Nonetheless, the lack of transparency in this area is a significant red flag.

Customer Experience and Complaints

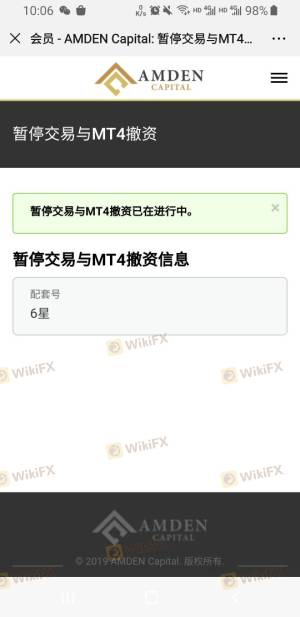

Customer feedback serves as an invaluable resource for assessing a broker's reliability. Amden Capital has received mixed reviews from users, with several complaints highlighting issues such as withdrawal difficulties and lack of responsive customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delay | Medium | Average |

| Misleading Information | High | Poor |

Two notable cases involved users reporting their inability to withdraw funds, which is a common complaint among potentially fraudulent brokers. The company's inadequate response to these issues further amplifies concerns about its legitimacy. A broker's willingness to address and resolve client complaints is a crucial indicator of its overall reliability and commitment to customer satisfaction.

Platform and Execution

The performance and stability of a trading platform are essential for a seamless trading experience. Amden Capital's platform has been criticized for its instability, with reports of slippage and order rejections. These issues can significantly impact a trader's ability to execute trades effectively.

The potential for platform manipulation is another concern, as brokers with poor execution practices may engage in unethical behaviors to benefit from client losses. Traders should be vigilant for signs of manipulation, such as consistently poor execution during volatile market conditions.

Risk Assessment

Engaging with Amden Capital presents several risks that potential traders should consider. The overall lack of regulation, unclear fee structures, and negative customer feedback contribute to a high-risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No credible oversight. |

| Financial Risk | Medium | Unclear fee structures. |

| Operational Risk | High | Platform instability and execution issues. |

To mitigate these risks, it is advisable for traders to conduct thorough research, consider alternative brokers with robust regulatory oversight, and maintain a cautious approach when trading with unregulated entities.

Conclusion and Recommendations

In conclusion, the evidence suggests that Amden Capital exhibits several characteristics commonly associated with scam brokers. The lack of regulatory oversight, unclear fee structures, and negative customer experiences indicate a need for caution. Traders should be wary of engaging with Amden Capital and consider alternative options that offer greater transparency and regulatory protection.

For those seeking safer trading environments, it is advisable to explore brokers with solid regulatory credentials, transparent fee structures, and positive customer feedback. Engaging with well-regulated brokers can significantly reduce the risks associated with forex trading, ensuring a more secure trading experience.

Is AMDEN CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of AMDEN CAPITAL brokers.

AMDEN CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AMDEN CAPITAL latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.