Is AF index safe?

Business

License

Is AF Index Safe or Scam?

Introduction

AF Index is a forex brokerage that has emerged in the rapidly evolving landscape of online trading. Positioned as a platform for trading various financial instruments, including forex, cryptocurrencies, and indices, AF Index claims to offer competitive trading conditions and a user-friendly experience. However, the importance of carefully evaluating forex brokers cannot be overstated, particularly in a market rife with potential scams and unregulated entities. Traders must ensure that their chosen platform is not only reliable but also compliant with regulatory standards to protect their investments.

This article aims to investigate the legitimacy of AF Index by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. Our evaluation is based on extensive research, including reviews from various financial platforms, regulatory alerts, and user testimonials, providing a comprehensive overview of whether AF Index is safe or a scam.

Regulation and Legitimacy

When assessing the safety of any forex broker, regulatory compliance is a critical factor. A regulated broker is subject to oversight from financial authorities, which helps ensure that they operate fairly and transparently. Unfortunately, AF Index has been flagged by the Hong Kong Securities and Futures Commission (SFC) as an unlicensed entity. This raises significant concerns regarding the broker's legitimacy and the safety of customer funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Hong Kong SFC | N/A | Hong Kong | Unlicensed |

The lack of a valid license from a reputable regulatory body indicates that AF Index does not adhere to the necessary operational standards that protect traders. Regulatory bodies typically require brokers to maintain a certain level of capital, segregate client funds, and provide investor protection measures. The absence of these safeguards means that traders using AF Index are exposed to heightened risks, making it imperative to question: Is AF Index safe?

Company Background Investigation

AF Index's company background reveals a lack of transparency that is concerning for potential investors. Established in 2020, the broker claims to operate from an undisclosed location, with little information available about its ownership structure or management team. This opacity is a red flag, as reputable brokers typically provide clear details about their corporate governance and operational history.

The absence of a well-defined management team further complicates the assessment of AF Index's credibility. In an industry where experience and expertise are paramount, a lack of information about the individuals behind the broker raises doubts about its operational integrity. Furthermore, the company's failure to disclose its physical address or contact information is another indicator of potential issues. Therefore, traders should remain cautious and consider whether AF Index is safe for their investment needs.

Trading Conditions Analysis

Evaluating the trading conditions offered by AF Index is essential to understanding whether it operates as a legitimate broker. The platform offers a minimum deposit requirement of $100, which is relatively standard in the industry. However, the broker's promise of high leverage ratios of up to 1:400 is concerning, as such high leverage is often associated with unregulated brokers.

Additionally, the fee structure appears to lack clarity, with reports suggesting hidden charges and unfavorable withdrawal policies. This lack of transparency can lead to unexpected costs for traders, further complicating the decision to invest with AF Index.

| Fee Type | AF Index | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

This table highlights the potential discrepancies between AF Index's trading conditions and industry standards. The absence of a clear commission structure and the presence of unusually tight spreads warrant further scrutiny. Traders must ask themselves: Is AF Index safe if its trading conditions appear too good to be true?

Customer Funds Security

The security of customer funds is a paramount concern for any trader. Unfortunately, AF Index has been reported to lack essential measures for fund protection. The absence of segregated accounts means that client funds are not kept separate from the broker's operational funds, increasing the risk of loss in the event of financial difficulties.

Moreover, AF Index does not provide any information about investor protection schemes or negative balance protection, which are standard features offered by regulated brokers. This lack of safeguards raises significant concerns about the safety of funds held with AF Index. Historical reports of withdrawal issues and customer complaints further exacerbate these concerns, leading to the conclusion that traders should approach AF Index with caution. It is essential to consider whether AF Index is safe when evaluating the potential risks involved.

Customer Experience and Complaints

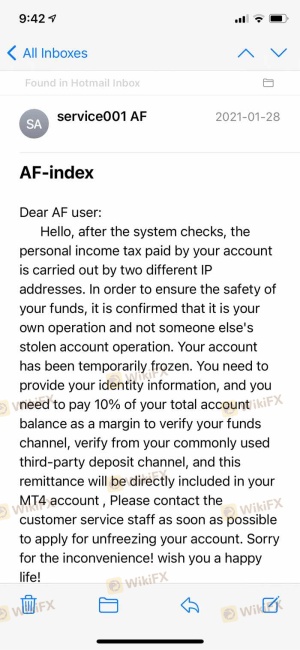

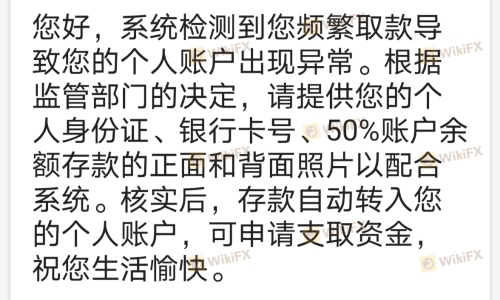

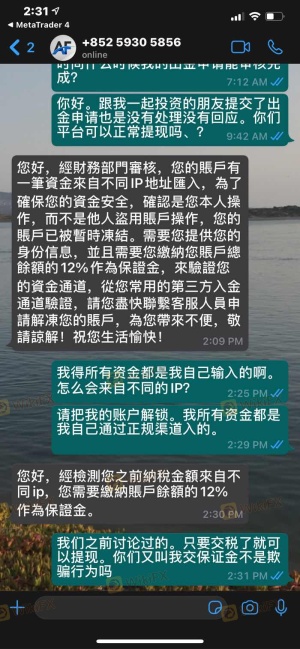

Customer feedback plays a crucial role in assessing the reliability of a forex broker. In the case of AF Index, numerous complaints have surfaced regarding withdrawal issues, lack of communication, and overall customer service quality. Many users have reported difficulties in withdrawing their funds, often citing requests for additional payments or taxes before processing withdrawals, which is a common tactic used by scam brokers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | High | Poor |

| Account Freezing | High | Poor |

The table above summarizes the main complaint types and their severity levels, indicating a troubling trend in user experiences with AF Index. Typical cases involve customers being asked to pay unexpected fees before they can access their funds, leading to frustration and financial loss. Such patterns strongly suggest that traders should be wary and question: Is AF Index safe for their trading activities?

Platform and Execution

The trading platform offered by AF Index is based on MetaTrader 4, a widely recognized platform known for its robust features and user-friendly interface. However, the quality of order execution and overall platform reliability is crucial for a positive trading experience. Reports of slippage, rejected orders, and execution delays have been noted by users, indicating potential manipulation or technical issues that could adversely affect trading outcomes.

Traders must be vigilant when considering the execution quality of AF Index's platform. If the platform exhibits signs of instability or poor performance, it raises questions about the broker's commitment to providing a fair trading environment. Thus, it is essential to assess whether AF Index is safe in terms of its platform reliability and execution quality.

Risk Assessment

Engaging with AF Index involves several inherent risks, primarily due to its unregulated status and the numerous complaints from users. These risks can be summarized in the following risk assessment table:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unlicensed broker with no oversight. |

| Fund Security Risk | High | Lack of segregated accounts and protections. |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues. |

The table highlights the significant risks associated with trading through AF Index, underscoring the necessity for potential traders to exercise extreme caution. To mitigate these risks, it is advisable for traders to seek out regulated brokers with transparent practices and robust customer support.

Conclusion and Recommendations

After a thorough examination of AF Index, it is evident that the broker presents numerous red flags that suggest it may not be a safe trading option. The lack of regulation, transparency issues, and consistent customer complaints raise serious concerns about the broker's legitimacy. Therefore, it is crucial for traders to ask themselves: Is AF Index safe?

In light of the findings presented, it is recommended that traders consider alternative, regulated brokers that offer better security, transparency, and customer support. Options such as brokers licensed by reputable regulatory authorities can provide a safer trading environment and peace of mind. Ultimately, the evidence suggests that potential investors should approach AF Index with caution and consider more reliable alternatives for their trading needs.

Is AF index a scam, or is it legit?

The latest exposure and evaluation content of AF index brokers.

AF index Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AF index latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.