Is Admiral Trades safe?

Business

License

Is Admiral Trades A Scam?

Introduction

Admiral Trades is a relatively new player in the forex market, positioning itself as a broker that offers a range of trading instruments including forex, CFDs, and commodities. As with any financial endeavor, particularly in the volatile world of forex trading, it is crucial for traders to conduct thorough due diligence before committing their funds. The potential for scams and fraudulent activities in this sector is significant, making it essential for investors to evaluate the legitimacy and reliability of brokers like Admiral Trades. In this article, we will investigate whether Admiral Trades is a safe and trustworthy broker or if it raises red flags that warrant caution. Our assessment is based on a comprehensive review of available data, including regulatory status, company background, trading conditions, and user experiences.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining the safety of any trading platform. A broker that is regulated by a reputable authority is generally considered safer, as these regulators impose strict guidelines to protect investors. In the case of Admiral Trades, our investigation reveals a concerning lack of regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Admiral Trades is not registered with any recognized financial authority, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). This absence of regulation is alarming, as it means that traders using Admiral Trades do not have the protections that come with regulated brokers, such as segregated accounts and compensation schemes for lost funds. The lack of regulatory oversight raises significant concerns about the broker's operations and the safety of client funds. Without a regulatory framework, there is little recourse for traders in the event of disputes or fraudulent activity.

Company Background Investigation

Admiral Trades was established in 2021, and its corporate structure claims to be based in the UK. However, the lack of verifiable information about its ownership and management raises suspicions. There is little publicly available information regarding the companys history, and attempts to find details about its founders or key management team members have proven fruitless. This lack of transparency is a significant red flag for potential investors.

Furthermore, the absence of a physical office and verifiable corporate registration information further complicates the trustworthiness of Admiral Trades. When a broker does not disclose its ownership structure or management experience, it can indicate an attempt to obscure potentially negative aspects of its operations. The lack of transparency and verifiable information about Admiral Trades makes it difficult for traders to ascertain the credibility of the broker, which is essential for ensuring a safe trading environment.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer are a fundamental aspect. Admiral Trades claims to provide competitive trading fees and a variety of account types. However, our analysis reveals a more complex picture.

| Fee Type | Admiral Trades | Industry Average |

|---|---|---|

| Spread for Major Pairs | 1.5 pips | 1.0 pips |

| Commission Model | Not specified | Varies |

| Overnight Interest Range | Not disclosed | Varies |

Admiral Trades advertises spreads starting at 1.5 pips for major currency pairs, which is higher than the industry average. Additionally, the commission structure is not clearly defined, leaving traders in the dark about potential hidden fees. The lack of transparency regarding overnight interest rates and other trading costs adds to the concerns about the broker's overall fee structure.

Unusually high spreads and vague commission policies can significantly impact traders' profitability, making it crucial to understand the true cost of trading with Admiral Trades. This lack of clarity in their fee structure could be indicative of a broader issue with transparency and trustworthiness.

Client Fund Security

The security of client funds is paramount when choosing a broker. Admiral Trades claims to implement various security measures; however, the absence of regulatory oversight raises questions about the effectiveness of these measures. Without a regulatory framework, there is no guarantee that client funds are held in segregated accounts, which is a standard practice among regulated brokers.

Moreover, there are no indications that Admiral Trades offers negative balance protection, which is essential for preventing traders from losing more than their initial investment. The lack of investor protection schemes means that clients could potentially lose their entire investment without any recourse.

The absence of historical data regarding any past security breaches or fund mismanagement by Admiral Trades further complicates the assessment of fund security. Traders must be cautious when dealing with unregulated brokers, as the risks associated with fund safety are significantly heightened.

Customer Experience and Complaints

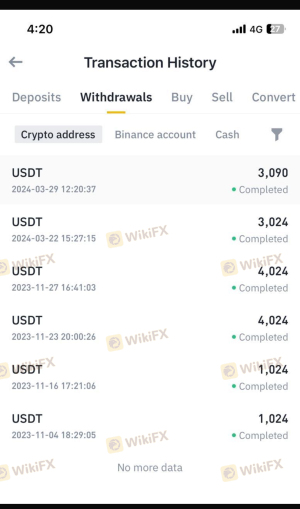

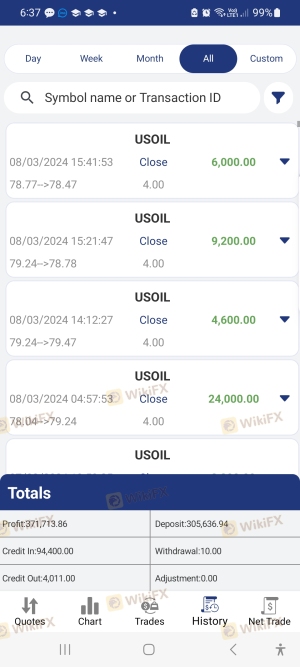

Customer feedback is a vital component in evaluating a broker's reliability. A review of user experiences with Admiral Trades reveals a troubling pattern of complaints. Many users have reported difficulties with withdrawals, citing that their requests were either delayed or outright denied.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Limited |

| Customer Support | Low | Average |

Common complaints include issues with the withdrawal process, where users have experienced significant delays or were pressured to deposit additional funds before their withdrawals could be processed. Such practices are often indicative of a scam, as legitimate brokers typically facilitate withdrawals promptly and without undue conditions.

In addition to withdrawal issues, users have expressed concerns about the lack of transparency regarding account management and trading conditions. The overall sentiment from customers paints a concerning picture of Admiral Trades, suggesting that the broker may not prioritize client satisfaction or trust.

Platform and Execution

The trading platform offered by Admiral Trades is described as user-friendly; however, it lacks the advanced features that many traders expect from a modern trading environment. The platform does not support popular trading software like MetaTrader 4 or 5, which are widely used in the industry for their robust functionalities.

Moreover, reports of poor order execution quality, including slippage and high rejection rates, have surfaced among users. These issues can severely impact trading performance, leading to frustration and financial losses.

In summary, while Admiral Trades presents itself as a broker with a user-friendly platform, the lack of advanced features and reports of execution issues raise concerns about the overall trading experience.

Risk Assessment

Trading with Admiral Trades carries several inherent risks, primarily due to its unregulated status and questionable business practices. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Fund Security Risk | High | No segregation of funds |

| Withdrawal Risk | High | Issues reported with withdrawals |

| Transparency Risk | Medium | Lack of clear information |

Given the high-risk levels associated with trading through Admiral Trades, it is essential for potential clients to approach this broker with extreme caution. Traders should consider alternative options that offer greater regulatory protections and transparency.

Conclusion and Recommendations

In conclusion, Admiral Trades does not appear to be a safe broker. The absence of regulatory oversight, coupled with poor customer feedback and questionable trading conditions, raises significant red flags. Traders should be especially wary of the potential for withdrawal issues and a lack of transparency in fees and operations.

For those seeking to engage in forex trading, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of reliability. Some recommended alternatives include brokers like Admiral Markets, which are regulated by multiple authorities and have demonstrated a commitment to client security and satisfaction.

In light of the findings, it is prudent for traders to prioritize their safety and opt for brokers that provide the necessary regulatory protections and transparent operations.

Is Admiral Trades a scam, or is it legit?

The latest exposure and evaluation content of Admiral Trades brokers.

Admiral Trades Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Admiral Trades latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.