Admiral Trades 2025 Review: Everything You Need to Know

Executive Summary

Admiral Trades operates as an unregulated offshore forex broker. This broker has received mostly negative user feedback across various review platforms. According to multiple sources including WikiBit and independent trading forums, this admiral trades review reveals significant concerns about the broker's legitimacy and operational practices.

The broker offers four different account types with a minimum deposit requirement of $250. This positions itself as accessible to entry-level traders. However, the lack of regulatory oversight and overwhelming negative user testimonials raise serious red flags about the platform's reliability.

The broker primarily targets traders from English-speaking markets including the United Kingdom, France, Italy, Germany, and the United States. Despite its low entry barrier, user experiences consistently highlight issues with customer service, platform stability, and withdrawal processes. The absence of clear regulatory compliance and transparency in operational procedures makes Admiral Trades a high-risk choice for forex trading activities.

Important Disclaimers

Admiral Trades operates as an offshore broker without clear regulatory oversight in major financial jurisdictions. This significantly impacts user protection and recourse options. The regulatory status of this broker may vary across different regions, and potential users should verify local compliance before engaging with their services.

This admiral trades review is based on available user feedback, public information, and market research as of 2025. The subjective nature of some assessments should be considered when making trading decisions.

Overall Rating Framework

Broker Overview

Admiral Trades presents itself as a forex trading platform catering to international markets. Specific details about its founding date and corporate background remain unclear in available documentation. The broker operates under an offshore business model, which typically allows for more flexible operational parameters but often comes with reduced regulatory oversight and consumer protection measures.

According to WikiBit reports, the broker focuses primarily on forex trading services. Comprehensive information about additional financial instruments remains limited.

The platform appears to target retail traders seeking entry-level access to forex markets. This is evidenced by its relatively low minimum deposit requirement. However, the lack of detailed information about the company's leadership, physical headquarters, or operational history raises transparency concerns that are frequently cited in user reviews.

This admiral trades review finds that the broker's business model relies heavily on attracting new clients through low barriers to entry. It fails to provide adequate disclosure about its operational framework and risk management practices.

Regulatory Status: Admiral Trades operates without clear regulatory oversight from major financial authorities. This positions it as an offshore broker with limited consumer protection frameworks.

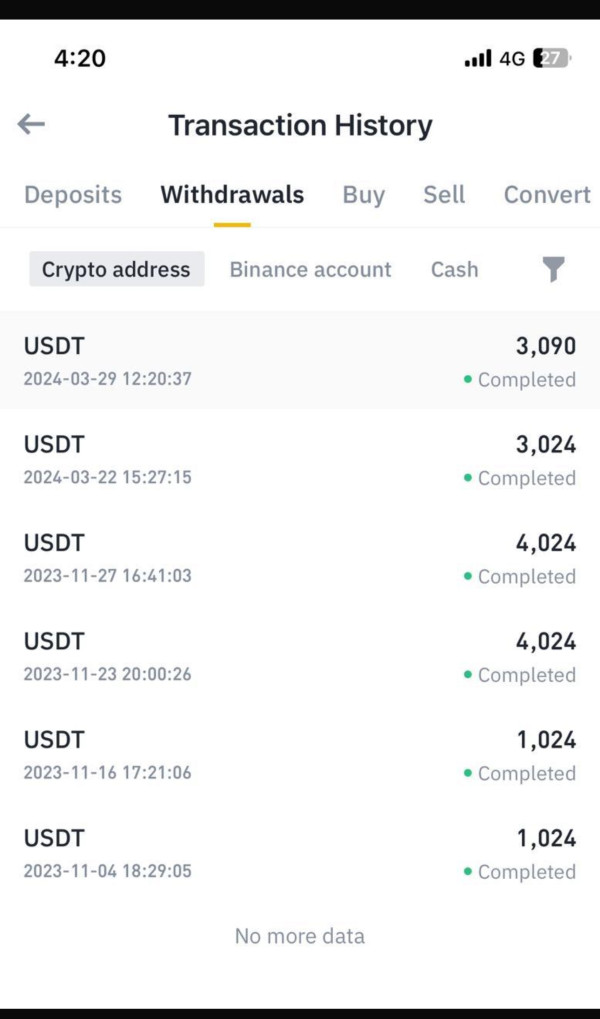

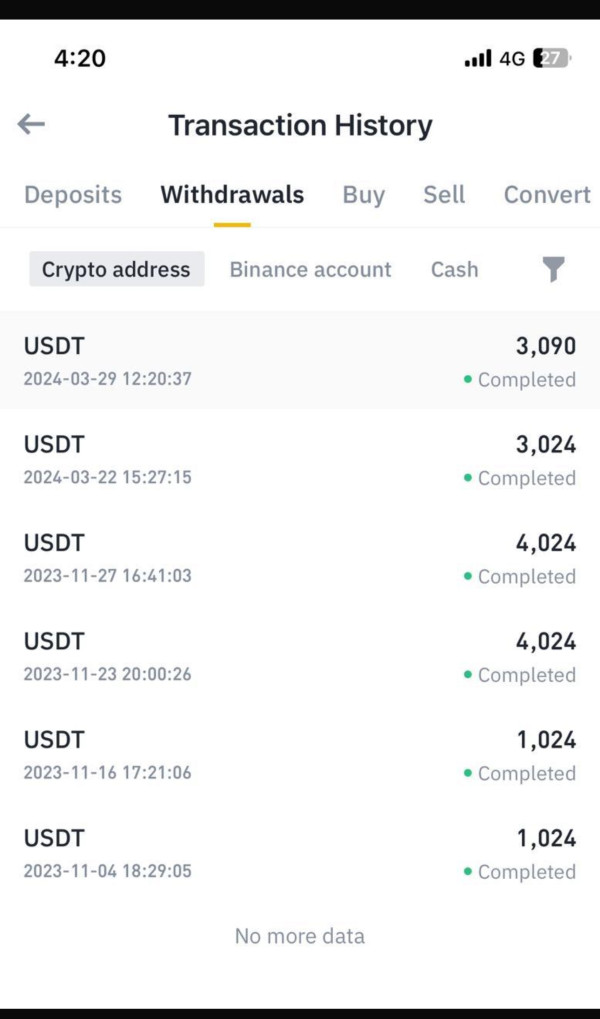

Deposit and Withdrawal Methods: Specific information about payment processing methods and withdrawal procedures is not comprehensively detailed in available sources. This contributes to user uncertainty about fund accessibility.

Minimum Deposit Requirements: The broker requires a minimum deposit of $250 across its account offerings. This makes it accessible to entry-level traders but lacks competitive advantages compared to regulated alternatives.

Promotional Offers: Details about bonus structures and promotional campaigns are not clearly outlined in available documentation. This suggests limited marketing incentives.

Trading Assets: Comprehensive information about available trading instruments remains unclear in current documentation. This includes currency pairs, commodities, and other financial products.

Cost Structure: Specific details about spreads, commissions, and additional fees are not transparently disclosed. This creates uncertainty about total trading costs for potential users.

Leverage Options: Information about maximum leverage ratios and margin requirements is not clearly specified in available sources.

Platform Technology: Details about trading platform options are not comprehensively outlined. This includes desktop and mobile applications.

Geographic Restrictions: The broker primarily serves traders from the United Kingdom, France, Italy, Germany, and the United States. Specific regulatory compliance in these regions remains unclear.

Customer Support Languages: Specific information about multilingual support options is not detailed in available documentation.

This admiral trades review highlights significant information gaps. Potential users should consider these when evaluating the broker's transparency and operational clarity.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

Admiral Trades offers four distinct account types. Specific details about the features and benefits of each tier are not comprehensively disclosed in available documentation. The minimum deposit requirement of $250 positions the broker as accessible to entry-level traders, particularly those with limited initial capital.

However, this apparent advantage is significantly undermined by the lack of transparency regarding commission structures, spread variations, and account-specific benefits.

User feedback consistently highlights confusion about account terms and conditions. Many traders report unexpected fees and unclear pricing structures. The absence of detailed information about account opening procedures, verification requirements, and ongoing maintenance costs creates additional uncertainty for potential clients.

Compared to regulated brokers offering similar minimum deposits, Admiral Trades lacks the transparency and consumer protection measures that experienced traders typically expect.

The admiral trades review data suggests that while the low entry barrier may attract new traders, the overall account conditions fail to provide the clarity and competitive advantages necessary for informed trading decisions. The lack of detailed account specifications and unclear fee structures significantly impact the overall value proposition for potential users.

Available information about Admiral Trades' trading tools and analytical resources is notably limited. This raises concerns about the platform's capability to support informed trading decisions. User feedback suggests that the broker provides minimal educational resources, market analysis, or advanced trading tools that are typically expected from modern forex platforms.

The absence of detailed information about charting capabilities, technical indicators, and automated trading support indicates significant limitations in the platform's functionality.

Research and analysis resources appear to be minimal. Users report limited access to market insights, economic calendars, or professional trading guidance. Educational materials for new traders are not prominently featured or adequately comprehensive based on available user experiences.

This includes tutorials, webinars, and trading guides. The lack of robust analytical tools particularly impacts traders who rely on technical analysis and automated trading strategies.

Expert opinions suggest that the limited tool set significantly restricts the platform's appeal to serious traders who require comprehensive market analysis and advanced trading capabilities. The absence of integration with popular third-party tools and platforms further limits the broker's competitive position in the market.

Customer Service and Support Analysis (Score: 2/10)

Customer service quality emerges as one of the most significant weaknesses in user feedback about Admiral Trades. Multiple sources report consistently poor experiences with support team responsiveness, professionalism, and problem-resolution capabilities. Users frequently cite extended response times, unhelpful interactions, and difficulty reaching qualified support personnel when encountering platform or account issues.

The availability of customer service channels appears limited. Users report challenges in accessing timely assistance through available communication methods. Response times for critical issues are consistently reported as unsatisfactory by the user community.

This includes account access problems and withdrawal requests. Service quality assessments from independent sources indicate that the support team lacks the expertise and resources necessary to address complex trading-related inquiries effectively.

Multilingual support capabilities and service availability across different time zones appear inadequate for the broker's international client base. User testimonials consistently describe frustrating experiences when seeking assistance, with many reporting that their concerns were not adequately addressed or resolved. The overall customer service experience significantly undermines user confidence and satisfaction with the platform.

Trading Experience Analysis (Score: 3/10)

User feedback regarding the trading experience on Admiral Trades platform reveals significant concerns about stability, execution quality, and overall functionality. Traders frequently report platform connectivity issues, unexpected downtime, and technical glitches that interfere with normal trading activities. The reliability problems appear to be particularly problematic during high-volatility market periods when consistent platform access is most critical.

Order execution quality receives criticism from users who report experiencing slippage, delayed fills, and pricing discrepancies that negatively impact trading outcomes. The platform's ability to handle rapid market movements and provide consistent execution appears limited based on user experiences. Mobile trading capabilities and cross-device synchronization are not comprehensively detailed, suggesting potential limitations for traders who require flexible access options.

Platform functionality and user interface design receive mixed feedback. Some users report navigation difficulties and limited customization options. The overall trading environment appears to lack the sophistication and reliability that experienced traders expect from modern forex platforms.

This admiral trades review indicates that technical performance issues significantly impact the overall trading experience and user satisfaction levels.

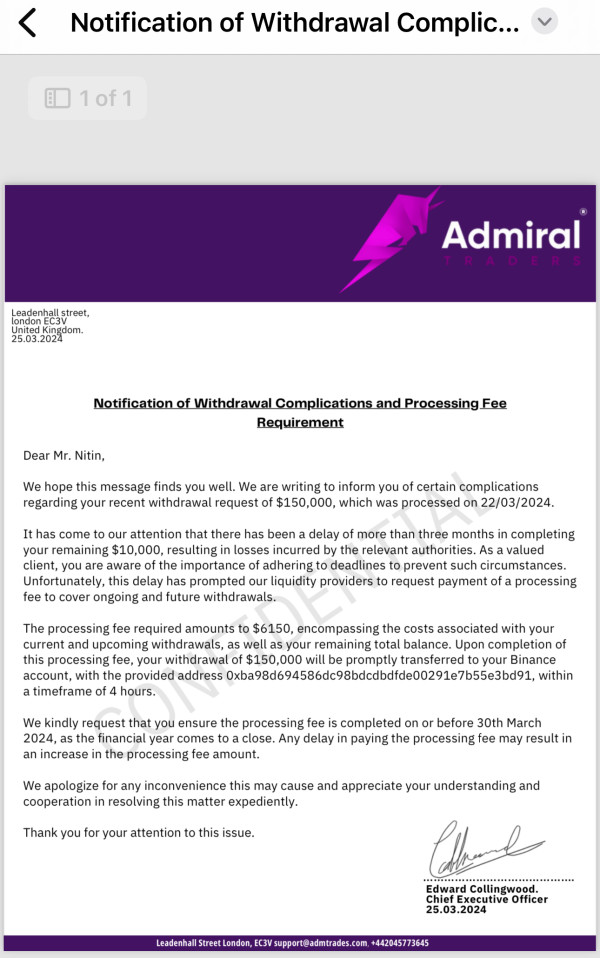

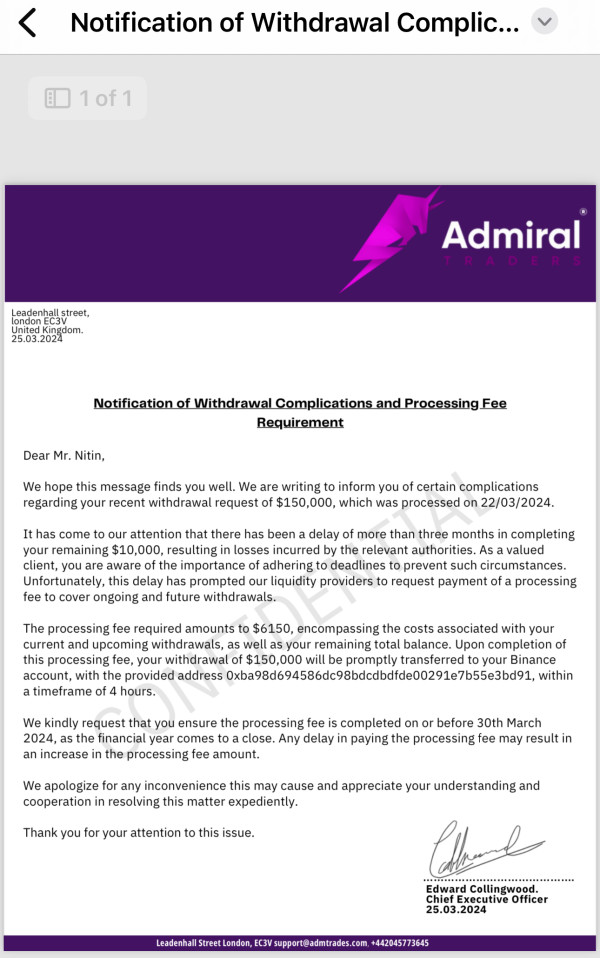

Trust and Reliability Analysis (Score: 1/10)

Trust and reliability represent the most significant concerns surrounding Admiral Trades. This is primarily due to its unregulated status and lack of oversight from recognized financial authorities. The absence of regulatory compliance with major jurisdictions eliminates important consumer protection measures that regulated brokers must maintain.

This includes segregated client funds, dispute resolution procedures, and operational transparency requirements.

Fund security measures and client money protection protocols are not clearly outlined or verified by independent regulatory bodies. This creates substantial risk for deposited funds. The broker's operational transparency is significantly limited, with minimal disclosure about company ownership, financial backing, or operational procedures that would typically be required under regulatory frameworks.

Industry reputation and third-party assessments consistently raise red flags about the broker's legitimacy and operational practices. User testimonials frequently express concerns about potential fraudulent activities, withdrawal difficulties, and misleading marketing practices. The overwhelming negative feedback from the trading community, combined with the absence of regulatory oversight, creates a high-risk environment that experienced traders typically avoid.

Independent review platforms and trading forums consistently advise caution when considering Admiral Trades as a trading partner.

User Experience Analysis (Score: 2/10)

Overall user satisfaction with Admiral Trades is predominantly negative based on available feedback from multiple sources and review platforms. The majority of user testimonials describe disappointing experiences across various aspects of the platform, from initial registration through ongoing trading activities. User satisfaction surveys and independent reviews consistently rank the broker below industry standards for reliability, transparency, and service quality.

Interface design and platform usability receive criticism for being outdated and difficult to navigate. This is particularly true for users transitioning from more established trading platforms. Registration and account verification processes are reported as unnecessarily complicated and time-consuming, with users frequently experiencing delays and additional documentation requests that extend the onboarding timeline.

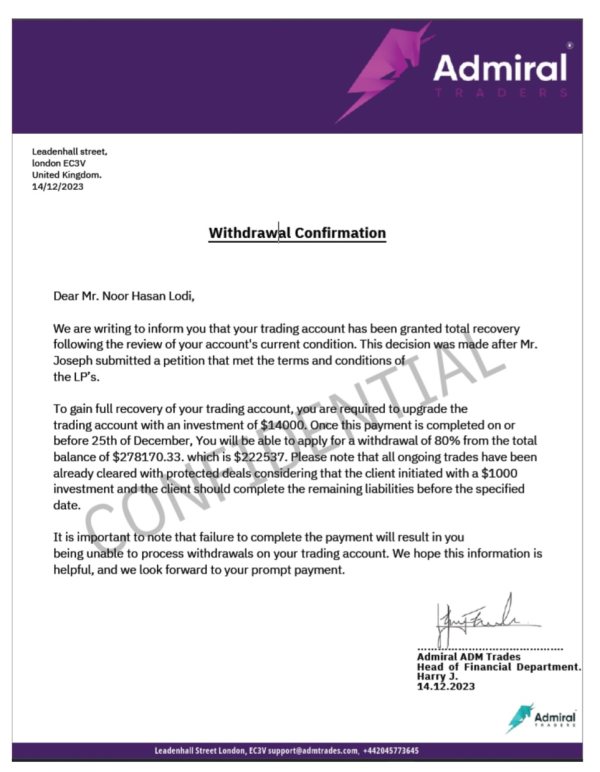

Fund management experiences generate significant user complaints about delays, unexpected fees, and complicated procedures. This includes deposit and withdrawal processes. Common user grievances include misleading marketing promises, poor communication from support teams, and difficulty accessing deposited funds.

The user demographic analysis suggests that the platform primarily attracts inexperienced traders who may be more susceptible to high-risk, unregulated brokers. Even this audience reports significant dissatisfaction with the overall experience.

Conclusion

This comprehensive admiral trades review reveals significant concerns that potential users should carefully consider before engaging with this unregulated forex broker. While the low minimum deposit of $250 may appear attractive to entry-level traders, the overwhelming negative user feedback, absence of regulatory oversight, and lack of transparency in operational procedures create a high-risk trading environment. The consistently poor ratings across all evaluation criteria, particularly in trust and reliability, indicate that Admiral Trades fails to meet industry standards for legitimate forex trading services.

The broker is not recommended for traders seeking reliable, transparent, and regulated trading services. Experienced traders and those prioritizing fund security should consider regulated alternatives that provide comprehensive consumer protection and operational transparency. The significant information gaps and negative user experiences highlighted in this review suggest that potential clients should exercise extreme caution when considering Admiral Trades as a trading platform.