Is ADAR Capital safe?

Business

License

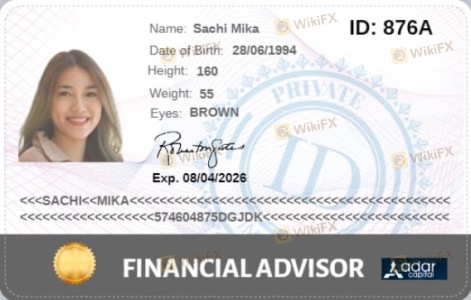

Is Adar Capital A Scam?

Introduction

Adar Capital is a forex broker that positions itself as a gateway to a vast financial market, offering access to over 200 trading instruments, including forex, shares, indices, and commodities. Established in 2019 and registered in Saint Vincent and the Grenadines, Adar Capital claims to provide a platform for traders worldwide. However, with the influx of unregulated brokers in the forex market, it is crucial for traders to exercise caution when selecting a trading partner. The potential for fraud is high, and understanding the legitimacy of a broker is essential for safeguarding investments. This article investigates the safety and reliability of Adar Capital by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk factors.

Regulation and Legitimacy

One of the primary factors determining a broker's trustworthiness is its regulatory status. Regulatory bodies ensure that brokers adhere to specific standards designed to protect investors. In the case of Adar Capital, the broker is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment. Notably, the Financial Services Authority (FSA) of Saint Vincent does not regulate forex, CFD, or binary options trading, which raises significant concerns about the legitimacy of Adar Capital.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSA SVG | Not Applicable | Saint Vincent | Unregulated |

The absence of a robust regulatory framework means that Adar Capital does not fall under the oversight of any reputable financial authority. This lack of regulation is compounded by warnings from various regulatory bodies, including the UK's Financial Conduct Authority (FCA) and Spain's Comisión Nacional del Mercado de Valores (CNMV), which have flagged Adar Capital as a clone firm. Such warnings indicate that the broker is not authorized to provide financial services, further questioning its legitimacy. The absence of regulatory oversight raises red flags regarding the safety of funds and the potential for fraudulent activities, leading to the conclusion that Adar Capital is not safe.

Company Background Investigation

Adar Capital is operated by Sonorous Group LLC, a company that also lacks transparency regarding its ownership and management structure. The broker claims to have been established in 2019, but there is little verifiable information about its history or the individuals behind it. The lack of publicly available information about the management team is concerning, as reputable brokers typically provide details about their leadership to build trust with potential clients.

Furthermore, the company's operational base in Saint Vincent and the Grenadines raises additional concerns. This jurisdiction is often associated with unregulated brokers, making it a popular choice for fraudulent firms looking to evade stringent regulations. The absence of a physical office or transparent information about the company's operations diminishes the credibility of Adar Capital. As a result, potential investors should be wary, as the companys lack of transparency and regulatory oversight strongly suggests that Adar Capital is not safe for trading.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions offered is essential. Adar Capital's fee structure appears to be competitive at first glance, with spreads starting as low as 0.0 pips for certain account types. However, the absence of detailed information regarding other costs, such as commissions and overnight fees, raises questions about the overall transparency of its pricing model.

| Fee Type | Adar Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 0.1-0.5 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Varies |

The potential for hidden fees or unusual withdrawal conditions is a common tactic employed by unregulated brokers to increase their profitability at the expense of traders. Additionally, Adar Capital's leverage of up to 1:500 is significantly higher than the industry standard, which is often capped at 1:30 for retail clients in regulated environments. This high leverage, while attractive, can lead to substantial losses, particularly for inexperienced traders. Overall, the opaque fee structure and high leverage suggest that trading with Adar Capital may expose clients to unexpected costs and risks, reinforcing the notion that Adar Capital is not safe.

Client Fund Safety

The safety of client funds is a critical consideration when assessing a broker's reliability. Adar Capital claims to implement various security measures, including the use of segregated accounts. However, the lack of regulatory oversight means that there are no guarantees regarding the safety of these funds. Without a reputable regulatory authority to enforce fund protection measures, clients may find themselves vulnerable to potential losses.

Moreover, Adar Capital does not provide negative balance protection, a feature that safeguards clients from losing more than their deposited amount. This absence of protection increases the risk of significant financial loss, especially when combined with high leverage. Historical complaints and reports of clients struggling to withdraw their funds further exacerbate concerns about the broker's commitment to safeguarding client assets. Given these factors, it is evident that Adar Capital is not safe for investors looking to protect their capital.

Customer Experience and Complaints

Customer feedback is an essential element in evaluating a broker's reliability. Numerous reviews and complaints regarding Adar Capital indicate a troubling pattern of customer dissatisfaction. Many users report difficulties in withdrawing funds, lack of communication from customer support, and delayed processing times.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inadequate |

| Account Access Problems | High | Poor |

For example, one user reported that after making a deposit, they were unable to withdraw their funds, leading to frustration and financial loss. Another complaint highlighted the lack of communication from customer support, with users stating that their inquiries went unanswered for weeks. These recurring issues suggest that Adar Capital may not prioritize customer service or the resolution of complaints, further questioning its reliability. The volume and severity of complaints strongly indicate that Adar Capital is not safe for potential investors.

Platform and Trade Execution

The performance and reliability of a trading platform are vital for a successful trading experience. Adar Capital offers a proprietary web-based trading platform, which lacks the advanced features and user-friendliness of industry-standard platforms like MetaTrader 4 or MetaTrader 5. Users have reported issues with platform stability, order execution quality, and instances of slippage.

Moreover, the absence of a mobile trading application limits accessibility for traders who prefer to manage their accounts on-the-go. The platform's basic functionality and lack of advanced trading tools raise concerns about its ability to support effective trading strategies. Given these limitations, potential traders may find that the platform does not meet their needs, further solidifying the view that Adar Capital is not safe for trading.

Risk Assessment

Engaging with Adar Capital presents several risks that potential investors should consider. The combination of unregulated status, high leverage, opaque fee structures, and poor customer feedback creates an environment fraught with potential pitfalls.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Financial Risk | High | High leverage and unclear fee structure |

| Operational Risk | Medium | Platform stability and execution issues |

| Customer Service Risk | High | Poor responses to customer complaints |

To mitigate these risks, potential investors should conduct thorough research before engaging with any broker. It is advisable to consider alternative brokers with robust regulatory oversight and positive customer feedback. Seeking guidance from reputable financial advisors may also help in making informed decisions.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Adar Capital is not safe for trading. The lack of regulation, combined with numerous customer complaints and concerns about fund safety, paints a troubling picture of the broker's operations. Potential investors should exercise extreme caution and consider seeking alternative brokers that are regulated and have a proven track record of reliability.

For those looking for safer trading options, consider well-established brokers regulated by reputable authorities, such as the FCA, ASIC, or CySEC. These brokers typically offer better protection for client funds and a higher level of service, ensuring a more secure trading environment.

Is ADAR Capital a scam, or is it legit?

The latest exposure and evaluation content of ADAR Capital brokers.

ADAR Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ADAR Capital latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.