Is A-T-em safe?

Business

License

Is A-T-em Safe or Scam?

Introduction

A-T-em is a forex broker that has garnered attention in the trading community for its claims of offering a wide range of trading instruments and a user-friendly platform. Established in Belize, A-T-em positions itself as a viable option for both novice and experienced traders looking to engage in forex trading. However, as the forex market is rife with scams and unreliable brokers, it is crucial for traders to conduct thorough due diligence before committing their funds. This article aims to assess the safety and legitimacy of A-T-em by examining various factors, including regulatory status, company background, trading conditions, customer feedback, and overall risk assessment. Our investigation is based on a comprehensive review of available online resources, including user experiences, expert analyses, and regulatory information.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical aspects to consider when evaluating its safety. A-T-em claims to be registered and operational since 2017, yet it lacks substantial regulatory oversight from reputable financial authorities. This absence of regulation raises significant concerns regarding the broker's legitimacy and the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Belize | Not Verified |

The lack of a valid regulatory license is a red flag; reputable brokers are typically overseen by top-tier regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US. These agencies impose strict compliance requirements to protect traders. A-T-em's claims of having licenses from various jurisdictions, including the Cyprus Securities and Exchange Commission, have been met with skepticism due to the absence of verifiable information. Without credible oversight, traders are advised to proceed with caution, as the risk of fraud or mismanagement is significantly heightened.

Company Background Investigation

A-T-em has been operational for several years, but its company history and ownership structure remain opaque. The broker claims to have conducted over 186,000 trading operations daily, but such figures warrant scrutiny. The lack of transparency regarding its ownership and management team raises questions about accountability and trustworthiness.

The management teams qualifications and experience are crucial in assessing a broker's reliability. Unfortunately, A-T-em does not provide substantial information about its leadership, which further diminishes its credibility. Transparency in business operations is essential for building trust, and A-T-em's failure to disclose relevant information about its management and operational practices is concerning.

Trading Conditions Analysis

A-T-em advertises a competitive fee structure, but the specifics of its trading conditions warrant a closer look. Understanding the costs associated with trading is vital for any trader looking to maximize their returns.

| Fee Type | A-T-em | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Low to Moderate |

The spread for major currency pairs is variable, which can lead to unexpected costs during trading. Furthermore, the absence of a transparent commission model raises concerns about hidden fees. Traders should be wary of brokers that do not clearly outline their fee structures, as this can lead to unexpected costs that may erode profits. A-T-em's claims of low trading costs may not hold true in practice, especially if traders encounter high overnight interest rates that are not adequately disclosed.

Customer Funds Safety

The safety of customer funds is paramount when selecting a forex broker. A-T-em's policies regarding fund security are not well-documented, and the absence of segregated accounts raises significant concerns. Segregation of funds is a common practice among reputable brokers, ensuring that client funds are kept separate from the broker's operational funds.

Moreover, A-T-em does not provide clear information about investor protection mechanisms or negative balance protection policies. These safeguards are essential in mitigating risks associated with trading, especially in a volatile market. The lack of transparency regarding these policies further exacerbates concerns about the safety of client funds, making it imperative for potential investors to exercise caution.

Customer Experience and Complaints

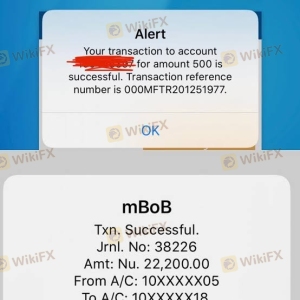

Customer feedback is a valuable indicator of a broker's reliability and service quality. A-T-em has received a mixed bag of reviews, with many users expressing dissatisfaction with the broker's customer service and withdrawal processes.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Non-responsive |

| Poor Customer Support | Medium | Unresolved |

| Misleading Information | High | Denial |

Common complaints include difficulties in withdrawing funds, unresponsive customer service, and allegations of misleading information regarding trading conditions. These issues are serious and indicate a lack of commitment to customer satisfaction. Traders should be cautious of brokers with a high volume of complaints, as this may signal deeper operational issues.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a positive trading experience. A-T-em claims to offer a user-friendly platform, but user experiences suggest that stability may be an issue. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

The quality of order execution is essential for traders, particularly in fast-moving markets. If A-T-em's platform exhibits high slippage rates or frequent rejections, it could hinder a trader's ability to execute their strategies effectively.

Risk Assessment

Using A-T-em poses several risks that potential traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight raises fraud concerns. |

| Fund Safety Risk | High | Absence of segregated accounts and protection policies. |

| Customer Service Risk | Medium | Numerous complaints about responsiveness. |

| Execution Risk | Medium | Reports of slippage and order issues. |

Given these risks, traders should carefully consider their options before engaging with A-T-em. It is advisable to seek alternative brokers with robust regulatory oversight, transparent fee structures, and a proven track record of customer satisfaction.

Conclusion and Recommendations

In conclusion, the evidence suggests that A-T-em may not be a safe choice for traders. The lack of regulatory oversight, transparency in company operations, and numerous customer complaints indicate potential red flags. While A-T-em markets itself as a legitimate forex broker, the absence of credible verification and accountability raises significant concerns.

For traders seeking a reliable trading experience, it is advisable to consider alternative brokers that are regulated by reputable authorities and have a proven track record of customer satisfaction. Brokers such as Interactive Brokers, TD Ameritrade, or Charles Schwab offer safer alternatives with robust protections for investor funds and transparent trading conditions. Always conduct thorough research and due diligence before selecting a forex broker to ensure your trading experience is secure and successful.

Is A-T-em a scam, or is it legit?

The latest exposure and evaluation content of A-T-em brokers.

A-T-em Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

A-T-em latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.