Think Market 247 2025 Review: Everything You Need to Know

Executive Summary

Think Market 247 has emerged as one of the most controversial names in the forex brokerage industry. This think market 247 review reveals concerning findings that every potential trader should be aware of before making any decisions. According to multiple industry sources and regulatory warnings, Think Market 247 operates as an unregulated forex broker. Several financial watchdogs have flagged this broker and placed it on blacklists maintained by various regulatory authorities.

Despite offering some basic features such as demo accounts and swap-free options, the broker's lack of proper regulatory oversight raises significant red flags. These concerns focus on trader fund safety and operational transparency that legitimate brokers typically provide. The broker claims to provide competitive spreads and CFD trading opportunities across various asset classes. However, these offerings are overshadowed by serious concerns about its regulatory status and questionable business practices.

This broker may only be suitable for traders with extremely high risk tolerance who fully understand the implications of trading with an unregulated entity. Based on current evidence and regulatory warnings, most financial experts strongly advise against engaging with Think Market 247 for any trading activities.

Important Notice

This review is based on available public information, user feedback, and regulatory reports as of 2025. Trading with unregulated brokers carries significant risks, including potential loss of funds with limited recourse for recovery available to affected traders. The information presented here reflects the current regulatory status and market reputation of Think Market 247. Multiple financial authorities have consistently flagged this broker as an unregulated entity that poses risks to retail traders.

Our evaluation methodology incorporates user testimonials, regulatory database searches, and industry expert analyses to provide a comprehensive assessment. This approach helps us evaluate both the broker's offerings and its overall reliability in the current market environment.

Rating Overview

Broker Overview

Think Market 247 Ltd operates as a forex and CFD trading platform. The company has attracted significant negative attention from regulatory authorities and industry watchdogs who monitor broker activities. While the company's exact establishment date remains unclear from available sources, it has positioned itself as a provider of online trading services. The broker targets retail clients seeking exposure to foreign exchange markets and contracts for difference.

The broker's business model centers around offering forex and CFD trading opportunities. However, the lack of detailed information about its operational history and corporate structure raises immediate concerns about its legitimacy. According to regulatory databases, Think Market 247 operates without proper financial services authorization. This places it in the category of unregulated financial service providers that pose substantial risks to client funds and trading security.

This think market 247 review reveals that the broker attempts to attract clients through promises of competitive trading conditions. These claims are undermined by its fundamental lack of regulatory compliance with industry standards. The company's registration status and operational transparency fall well below industry standards expected from legitimate financial service providers.

Regulatory Status: Think Market 247 operates as an unregulated broker without authorization from recognized financial authorities. The company has been flagged by multiple regulatory bodies and appears on several industry blacklists. This indicates serious concerns about its legitimacy and operational compliance with standard financial regulations.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not clearly detailed in available sources. This lack of transparency raises concerns about operational procedures and client fund management that legitimate brokers typically disclose. The absence of clear payment method information suggests potential issues with fund processing and client service standards.

Minimum Deposit Requirements: The exact minimum deposit requirements are not specified in available documentation. This suggests a lack of clear terms and conditions that legitimate brokers typically provide upfront to potential clients. The absence of transparent deposit requirements makes it difficult for traders to plan their account funding strategies.

Promotional Offers: Available sources do not mention specific bonus programs or promotional offers from this broker. Unregulated brokers often use attractive bonuses to lure unsuspecting traders before implementing restrictive withdrawal conditions. The lack of clear promotional information may indicate either limited marketing efforts or undisclosed terms that could affect trader accounts.

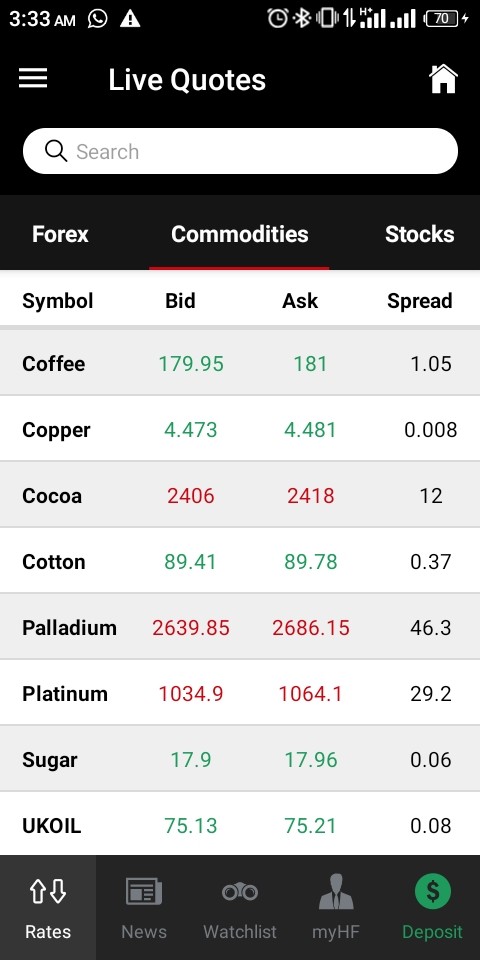

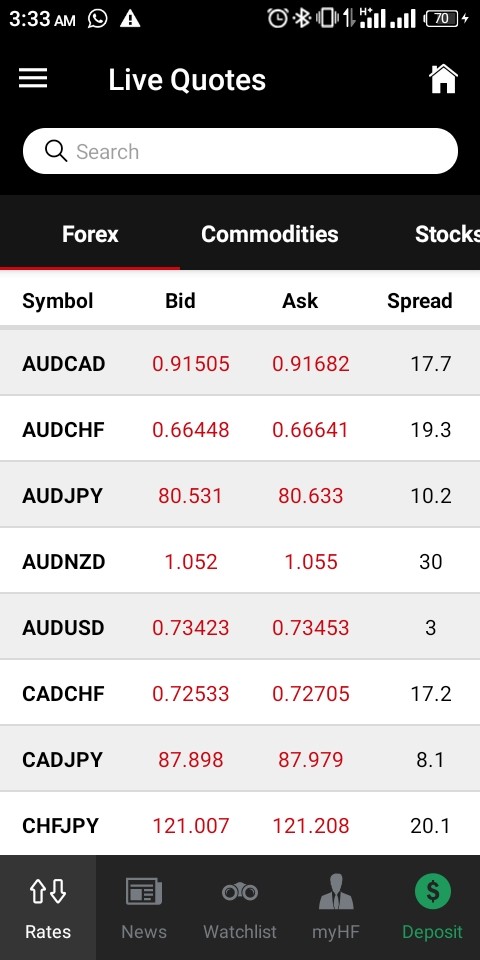

Available Trading Assets: The broker claims to offer forex and CFD trading opportunities across various asset classes. However, the specific range and quality of available instruments remain unclear from public sources. This lack of detailed asset information makes it difficult for traders to assess whether the broker meets their trading needs.

Cost Structure: While the broker mentions competitive spreads, detailed information about actual trading costs, commissions, and fee structures is not readily available. This makes it impossible for traders to accurately assess the true cost of trading with this broker. The absence of transparent pricing information represents a significant concern for cost-conscious traders.

Leverage Options: Specific leverage ratios offered by Think Market 247 are not detailed in available sources. This is concerning given the importance of leverage information for risk management and trading strategy development. The lack of clear leverage information prevents traders from making informed decisions about position sizing and risk exposure.

Trading Platform Options: The specific trading platforms offered by Think Market 247 are not clearly identified in available documentation. This raises questions about the technological infrastructure supporting client trading activities and platform reliability. The absence of platform information makes it difficult for traders to assess whether the broker's technology meets their trading requirements.

This comprehensive think market 247 review highlights the significant information gaps that characterize this broker's public presence. These gaps serve as warning signs for potential clients who need transparent information to make informed trading decisions.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions offered by Think Market 247 represent one of the most concerning aspects of this broker's service offering. Unlike regulated brokers that provide clear, detailed information about account types, minimum deposits, and trading conditions, Think Market 247 fails to offer transparent details. The broker does not provide comprehensive information about its account structures or the benefits that traders might expect.

Available sources indicate that the broker does not provide comprehensive information about different account tiers, special features, or account-specific benefits. These features are standard offerings that traders typically expect from legitimate financial service providers. The absence of clear minimum deposit requirements and account opening procedures suggests a lack of standardized operational protocols. Regulatory authorities typically mandate these protocols to protect client interests and ensure fair trading conditions.

Furthermore, the broker's failure to provide detailed information about account features such as Islamic accounts, professional trader accounts, or institutional services indicates a limited service offering. This limitation falls well below industry standards set by reputable brokers. The lack of transparency regarding account terms and conditions makes it impossible for potential clients to make informed decisions about their trading arrangements.

This think market 247 review emphasizes that the poor account conditions, combined with the broker's unregulated status, create an environment where trader rights and protections are severely compromised. The absence of clear account documentation and terms of service represents a significant red flag. Experienced traders should recognize these warning signs before committing funds to any trading account.

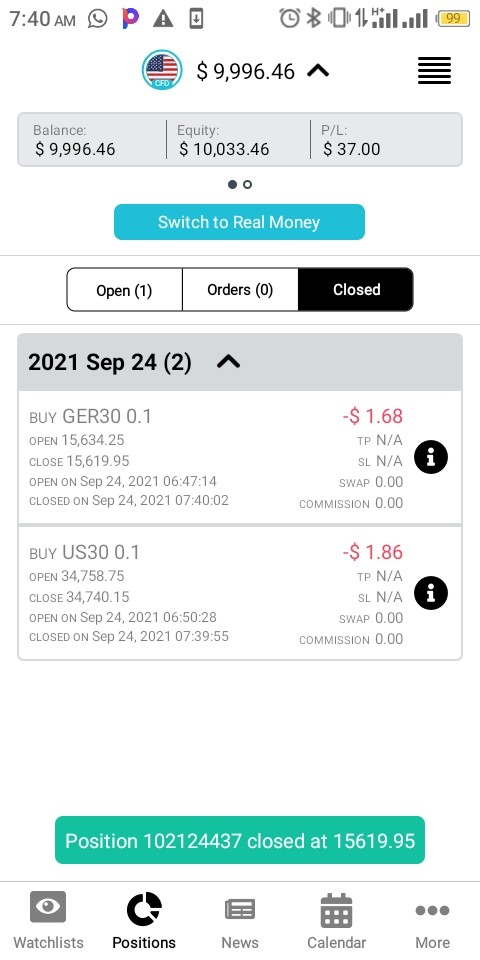

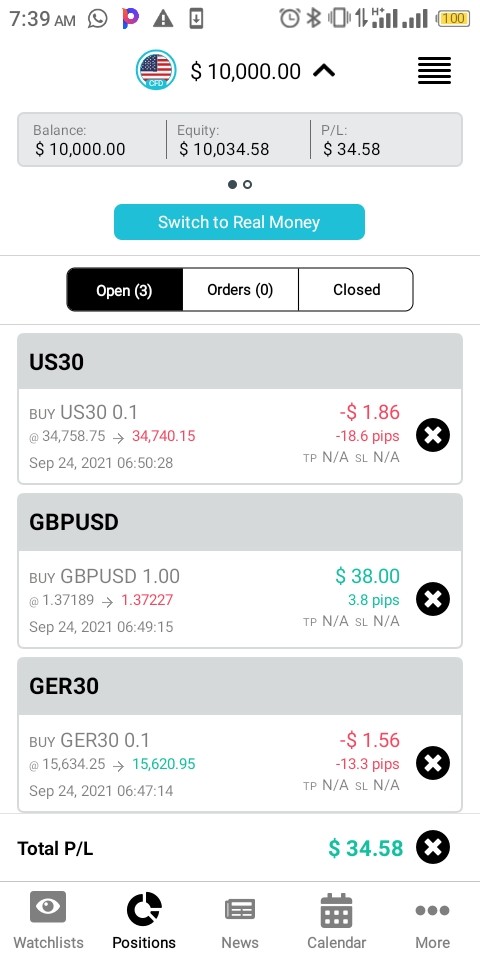

Think Market 247's tools and resources offering presents a mixed picture, with some basic features available but significant gaps in comprehensive trading support. According to available information, the broker does provide demo accounts, which allows potential clients to test trading conditions without risking real capital. Additionally, the broker offers swap-free options. These features may appeal to traders with specific religious or strategic requirements for their trading activities.

However, the broker's tool offering appears limited when compared to regulated competitors who typically provide comprehensive research resources, technical analysis tools, and educational materials. The absence of detailed information about advanced trading tools, market analysis resources, or automated trading support suggests limitations. Think Market 247's technological infrastructure may be less sophisticated than industry leaders who invest heavily in trading technology.

The lack of comprehensive educational resources is particularly concerning, as legitimate brokers typically invest heavily in client education and market analysis to support trader success. Without proper educational support and research tools, traders are left to navigate complex financial markets with minimal guidance from their broker. This lack of support can significantly impact trading performance and learning opportunities for new traders.

While the demo account availability provides some value for initial platform testing, the overall tools and resources offering falls short of expectations. Traders should expect comprehensive support from their trading service provider. The limitations become more significant when considering the additional risks associated with the broker's unregulated status.

Customer Service and Support Analysis (Score: 3/10)

Customer service quality represents a critical weakness in Think Market 247's operational framework, with multiple sources warning potential clients about inadequate support structures and responsiveness issues. The broker's customer service capabilities appear to be significantly limited, with unclear communication channels and uncertain availability. These limitations raise concerns about client support during critical trading situations when immediate assistance may be required.

Available sources do not provide detailed information about customer service hours, available communication methods, or response time guarantees. These features are standard offerings provided by regulated brokers who prioritize client satisfaction and support. The absence of comprehensive customer service information suggests that traders may face difficulties when seeking assistance. Problems could arise with account issues, technical problems, or trading disputes that require professional resolution.

Multiple industry warnings about Think Market 247 specifically mention concerns about client communication and support quality. Several sources advise traders to avoid the broker entirely due to poor service experiences reported by previous users. These warnings indicate systemic issues with customer care that extend beyond simple communication preferences to fundamental problems. The issues appear to involve basic client relationship management that legitimate brokers typically handle professionally.

The combination of limited customer service information and negative industry feedback creates a situation where traders cannot rely on adequate support when facing trading challenges or account issues. This makes Think Market 247 an unsuitable choice for traders who value responsive customer service. Professional traders typically require reliable support channels to maintain their trading operations effectively.

Trading Experience Analysis (Score: 4/10)

The trading experience offered by Think Market 247 presents several concerns that significantly impact its viability as a reliable trading partner. While the broker claims to offer competitive spreads, the lack of detailed information about execution quality, platform stability, and order processing creates uncertainty. Potential clients cannot accurately assess the actual trading environment that they can expect from this broker.

Without specific information about trading platform performance, execution speeds, or slippage rates, potential clients cannot accurately assess whether Think Market 247 can deliver the trading conditions necessary for successful market participation. The absence of detailed platform specifications and performance metrics suggests that the broker may not prioritize technological excellence in its service delivery. This could result in suboptimal trading conditions that affect trader performance and profitability.

Furthermore, the lack of information about mobile trading capabilities, advanced order types, and platform customization options indicates that the trading experience may be limited. Regulated competitors typically invest heavily in platform development and user experience optimization to attract and retain clients. These limitations can significantly impact trader performance and satisfaction, especially for active traders who rely on advanced platform features.

This think market 247 review highlights that while the broker mentions competitive spreads, the overall trading experience appears compromised by limited transparency and unclear platform capabilities. The fundamental risks associated with trading through an unregulated entity further compound these concerns. Unregulated brokers cannot guarantee standard industry protections that regulated entities provide to their clients.

Trust and Reliability Analysis (Score: 1/10)

Trust and reliability represent the most critical weakness in Think Market 247's profile, with the broker receiving the lowest possible score due to its unregulated status and inclusion on multiple industry blacklists. The broker operates without authorization from recognized financial regulatory authorities, which means client funds lack the protections typically provided by regulatory oversight. Compensation schemes that protect trader funds are also unavailable through this unregulated entity.

Multiple financial watchdogs and industry sources have specifically warned against engaging with Think Market 247. These warnings cite concerns about its operational legitimacy and client fund safety that could affect trader accounts. These warnings come from credible sources within the financial services industry who have identified significant red flags. The concerns involve the broker's operational structure and regulatory compliance with industry standards.

The absence of proper regulatory authorization means that Think Market 247 cannot provide the fund segregation, financial reporting, and operational transparency that regulated brokers are required to maintain. This creates a situation where client funds may be at risk, with limited recourse available if problems arise. Issues could include withdrawal difficulties or account access problems that regulated brokers typically resolve through established procedures.

Industry reputation analysis reveals consistent negative feedback and warnings about Think Market 247. Multiple sources advise traders to seek regulated alternatives that provide better protection and service quality. The combination of regulatory warnings, blacklist inclusion, and negative industry feedback creates a trust profile that makes this broker unsuitable for any serious trading activity.

User Experience Analysis (Score: 2/10)

User experience with Think Market 247 is characterized by significant concerns and widespread negative feedback from industry sources and user communities. Multiple sources specifically warn traders to avoid this broker, indicating systemic issues with user satisfaction and service delivery. These problems extend beyond simple preference differences to fundamental issues with broker reliability and service quality.

The lack of detailed information about registration processes, account verification procedures, and platform navigation suggests that the user experience may be poorly developed. Regulated competitors typically prioritize user interface design and customer journey optimization to enhance client satisfaction. Without clear onboarding procedures and user support documentation, new clients may face difficulties in establishing and managing their trading accounts effectively.

Available feedback indicates that users have experienced problems with various aspects of the broker's service delivery. This has led to widespread recommendations to seek alternative trading partners who provide better service quality. These user experience issues appear to be systemic rather than isolated incidents, suggesting fundamental problems. The issues involve the broker's operational approach and client service philosophy that affects overall user satisfaction.

The combination of negative user feedback, industry warnings, and limited transparency about user support procedures creates a user experience profile that falls well below acceptable standards. Professional trading services typically maintain higher standards for client satisfaction and user experience quality. Traders seeking reliable, user-friendly trading environments should consider regulated alternatives that prioritize client satisfaction and provide comprehensive user support.

Conclusion

This comprehensive think market 247 review reveals a broker that poses significant risks to potential clients and fails to meet basic industry standards for regulatory compliance, operational transparency, and client protection. With an overall rating of 2.8/10, Think Market 247 represents one of the most problematic brokers currently operating in the retail trading space. The broker's numerous deficiencies make it unsuitable for serious trading activities.

The broker's unregulated status, combined with multiple regulatory warnings and blacklist inclusions, makes it unsuitable for any trader seeking reliable, secure trading services. While the broker offers some basic features such as demo accounts and swap-free options, these limited benefits are far outweighed by the fundamental risks. The risks are associated with its regulatory status and operational concerns that could affect client funds and trading security.

Even traders with extremely high risk tolerance should seriously consider the implications of engaging with an unregulated broker that lacks the basic protections and oversight mechanisms that regulated entities provide. The potential for fund loss, withdrawal difficulties, and limited recourse options makes Think Market 247 a poor choice for any serious trading activity. Traders should prioritize regulated brokers that offer comprehensive protection and transparent operations.