rannforex 2025 Review: Everything You Need to Know

1. Abstract

This rannforex review gives you a complete look at the broker. The company started in 2013 and is registered in St. Vincent and the Grenadines. The broker says it offers an ECN pricing model that works well for scalpers, high-frequency traders, and day traders who need fast order execution. It supports both MetaTrader 4 and MetaTrader 5 platforms. These platforms let traders access many financial instruments including forex, cryptocurrencies, indices, precious metals, and energies. With a maximum leverage of 1:100, rannforex says it creates a low-cost environment perfect for traders who want tight spreads and raw market pricing. However, the lack of clear rules and many negative user reviews create concerns about trust and risk factors with this broker. This review uses public information and user feedback. It shows both special features and warning signs in how the company operates.

2. Notice

You should know that rannforex is registered in St. Vincent and the Grenadines. This means it does not follow the strict rules seen in other major financial areas. This location may put traders at different legal risks depending on where they live. The review here uses only user feedback and public data without any personal investigation. Important details like deposit and withdrawal processes, minimum deposit amounts, bonus offers, and customer service options have not been clearly shared in available information. Because of this, future users should be careful and do more research before trading with this broker.

3. Rating Framework

4. Broker Overview

Rannforex started in 2013. Its founder, Dmitry Rannev, runs the company and has over 15 years of experience in the forex industry. The company is based in St. Vincent and the Grenadines and claims to offer a cost-effective, A-Book trading model made for scalpers, high-frequency traders, and day traders. Rannforex focuses on giving low-cost trading chances with speed and efficiency as main goals. However, the lack of detailed information about account conditions and fees creates doubt about some of its claims. Many industry watchers have said that the broker's promise of ECN pricing could help traders who want raw market access, but some warning signs about transparency remain.

The rannforex review also shows its promise to offer strong trading platforms. The broker supports the well-known MetaTrader 4 and MetaTrader 5 platforms. These let users access advanced charting tools, technical indicators, and automated trading options. Rannforex offers many different tradable assets including forex pairs, cryptocurrencies, indices, precious metals, and energy commodities. Despite these good features, the broker has not shown any connection with major regulatory bodies. This has led to mixed experiences among users about safety and service quality. These factors show why careful engagement is important given the broker's limited regulatory transparency.

Regulatory Region:

Rannforex is registered in St. Vincent and the Grenadines. It does not give clear details about any regulatory licenses or oversight. This lack of regulatory information suggests possible legal risks depending on the trader's local area. According to available data, the broker's registration in this area means there are fewer consumer protections compared to brokers regulated by stricter authorities.

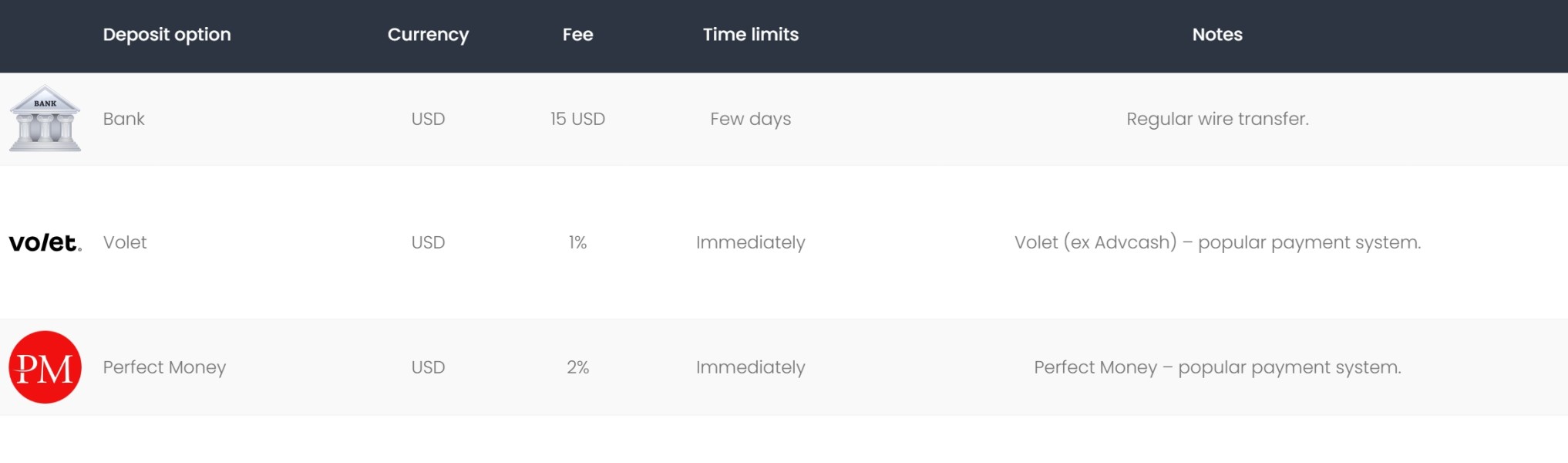

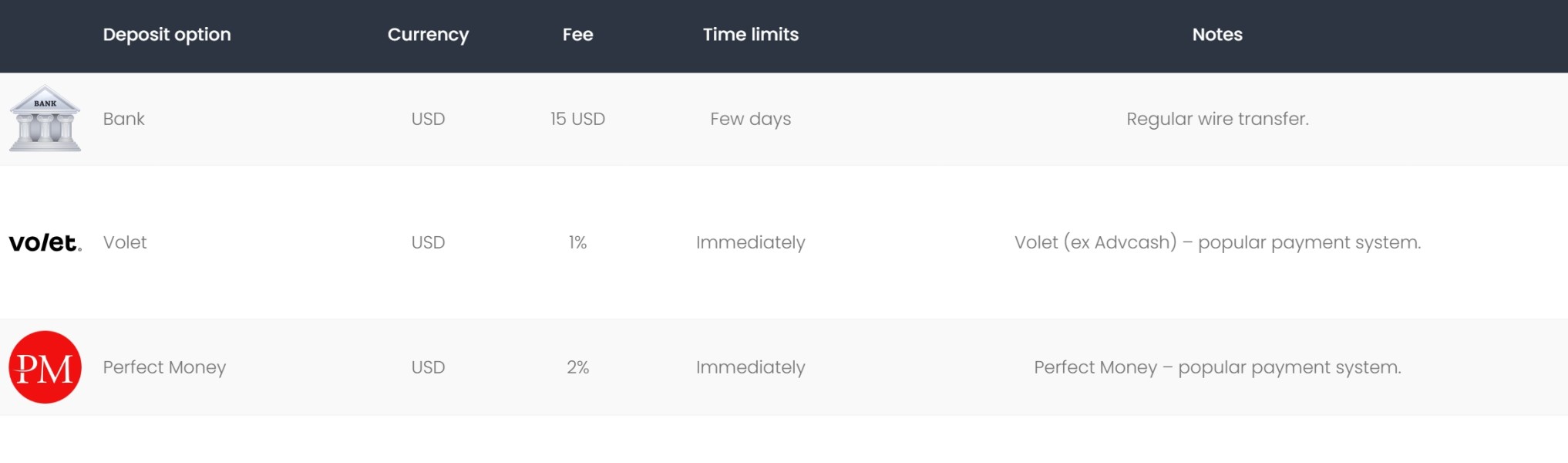

Deposit and Withdrawal Methods:

The available information does not include specific details about deposit and withdrawal methods that rannforex accepts. Traders should get more information directly from the broker before starting any transactions.

Minimum Deposit Requirements:

No clear information on minimum deposit requirements was given in the summary. This makes it hard for future traders to know the starting capital needed to open an account.

Bonus and Promotion Offers:

Details about bonus promotions or incentive offers are clearly missing. The available information does not discuss any current bonus programs that rannforex might offer to new or existing clients.

Tradable Assets:

Rannforex offers many different tradable instruments. The broker gives access to major forex pairs, many cryptocurrencies, indices, precious metals, and energy commodities. This variety aims to help traders who want to build diverse portfolios and take advantage of changing market conditions across asset classes.

Cost Structure:

The brokerage model at rannforex uses floating spreads. The EUR/USD pair reportedly has spreads that can reach up to 6 points. Although the broker talks about low-cost trading conditions, there is a lack of transparency about commission fees and other costs. As a result, while the spread structure looks competitive, the overall clarity on fee structures stays poor. This may affect cost calculations for high-frequency traders.

Leverage Ratio:

Rannforex offers a maximum leverage of 1:100. This is designed to attract high-frequency traders who need more exposure in their trading positions. However, traders should carefully consider what such leverage means in volatile market conditions.

Platform Selection:

The broker offers two well-known trading platforms – MT4 and MT5. These platforms serve different trading preferences and are known for their strong performance, advanced charting tools, and support for automated trading strategies. Although both platforms are widely used, the exact details of platform features with respect to user improvements remain to be fully explained.

Regional Restrictions:

There is no detailed information about geographic trading restrictions. The summary does not give clear region-based prohibitions. This leaves it unclear whether certain areas are excluded from accessing rannforex's services.

Customer Service Languages:

Details about the languages in which customer support is offered are not mentioned. This lack of clarity may create challenges for non-English speakers or traders who need support in other languages.

This section serves as an important information source for potential traders. It highlights both the broker's strengths in platform provision and asset diversity, as well as the big gaps in regulatory and transactional transparency. The absence of complete details in areas such as deposit methods and bonus structures shows the need for further investigation before engaging in trading activities with rannforex review.

6. Detailed Rating Analysis

6.1 Account Conditions Analysis

When looking at the account conditions of rannforex, several key points stand out despite limited information. The broker offers only one type of account—a simple setup aimed at high-frequency traders. There is no information about the minimum deposit requirement. This creates uncertainty for future clients about entry costs. Furthermore, information on whether specialty accounts, such as Islamic or commission-free alternatives, are offered is completely missing. The account opening process is not explained, and transparency about the terms and conditions stays minimal. The floating spread model on the platform suggests possible changes in trading costs. Yet specific details on commission fees and other pricing factors are not available in the public data. Users have reported mixed experiences, with some noting that the lack of detailed account options may lead to a less customized trading experience. Overall, the information from public sources leaves many questions about account flexibility unanswered. This contributes to the moderate rating for account conditions in this rannforex review.

Rannforex offers access to industry-standard trading platforms, including MetaTrader 4 and MetaTrader 5. These platforms are well-known for their stability and extensive toolsets. These platforms provide advanced charting, technical indicators, and the ability for automated trading—a critical need for high-frequency and scalping traders. In terms of tradable instruments, the broker's range includes forex, cryptocurrencies, indices, metals, and energies. This presents a diverse ecosystem to meet various trader demands. However, the review data does not include detailed information on extra market analysis tools, educational resources, or in-depth research materials. While the availability of these platforms and the range of tradable assets are positives, the absence of additional trading aids or customized research tools leaves room for improvement. The lack of a complete set of educational materials and automated trading support also creates a drawback, particularly for new users. Thus, while the technical infrastructure meets modern standards, the overall tool and resource package appears somewhat basic when compared to more advanced brokerage offerings. This is an important point noted in this rannforex review.

6.3 Customer Service and Support Analysis

Customer service is a critical part in evaluating any broker. In the case of rannforex, the available user feedback shows significant problems. Reports have highlighted slow response times and an overall lack of satisfactory support. This negatively impacts the trading experience. Although the broker is expected to provide multi-channel communication modes, such as email, live chat, or phone support, detailed information on these channels is missing. Furthermore, the review data does not explain whether support is offered 24/7 or during limited hours. This leaves users uncertain about accessibility during market hours. There is also no mention of multi-language support, which may limit accessibility for non-English speakers. The sparse details on customer service protocols and the repeated mention of delayed responses in user testimonials result in a low score for customer support. These concerns, as highlighted in several user experiences and combined feedback, show notable operational weaknesses in customer service. This is a key consideration in this rannforex review.

6.4 Trading Experience Analysis

The trading experience at rannforex is defined by its promise to offer ECN raw pricing. This model appeals mainly to high-frequency traders and scalpers seeking minimal interference in market price feeds. The broker's provision of the MT4 and MT5 platforms ensures that traders have access to sophisticated charting tools and technical analysis capabilities. However, user feedback suggests that platform stability and order execution speed, while adequate for basic operations, may not be consistent across all trading sessions. Reports have shown variability in the execution quality of trades. Some users experience delays that could impact day trading activities. Additionally, while the broker claims competitive spreads—up to 6 points on major pairs like EUR/USD—the changing nature of these spreads combined with the absence of detailed commission data may affect overall trading costs. Mobile trading experience information is not explained. This leaves a gap in understanding the broker's performance across different devices. Overall, while the trading environment is functional and meets the needs of high-frequency traders, potential issues with execution consistency and the unexplained variability in costs are factors that lower the overall rating. This is outlined in this rannforex review.

6.5 Trust Analysis

Trust remains a major concern when evaluating rannforex. This is largely due to its registration in St. Vincent and the Grenadines and the lack of clear regulatory oversight. There is no disclosure of specific regulatory licenses or detailed funding security measures. This fact raises considerable red flags among the trading community. The absence of transparent financial reporting and management disclosures further reduces trust. User testimonials often reference issues and inconsistencies. Some interpret these as signs of broader concerns about the broker's acceptable risk profile. Despite claims of a cost-effective trading model, the potential for hidden fees and the lack of verified safeguards for client funds create an environment of uncertainty. The limited detail on risk management and the absence of proactive measures to handle negative incidents further hurt its reliability. These combined factors, along with industry comparisons that point to more strictly regulated environments elsewhere, contribute to a very low trust rating for rannforex. This is reflected in this review.

6.6 User Experience Analysis

User experience with rannforex is mixed. Several reported concerns weigh heavily on the overall satisfaction of its clients. While the broker provides access to commonly used trading platforms such as MT4 and MT5, user feedback shows challenges with platform usability and the fund management process. This is particularly true for deposit and withdrawal operations. Several users have commented on the difficult nature of navigating the interface and the lack of clarity in the registration and verification process. Despite the claim of a trader-friendly, low-cost environment, friction is commonly reported in day-to-day account management tasks. Moreover, issues with customer service further add to the negative aspects of the user interface experience. Delays and insufficient support leave traders feeling unsupported in critical moments. In summary, although rannforex attempts to offer a versatile and efficient trading experience tailored to high-frequency traders, the persistent technical and service-related issues contribute to a less than satisfactory overall user experience. This is an important critique underscored in this rannforex review.

7. Conclusion

In summary, rannforex presents an interesting option for traders who focus on scalping, high-frequency, and day trading. This is due to its provision of ECN pricing and access to both MT4 and MT5 platforms. However, the notable absence of clear regulatory oversight, detailed fee structures, and strong customer service measures reduces its overall trust and reliability. The broker's strengths in offering a diverse range of instruments and low-cost trading conditions are balanced by user reports of poor support and limited transparency in account conditions. As such, while rannforex may attract experienced traders willing to navigate these risks, caution is recommended for those prioritizing regulatory safety and a comprehensive trading ecosystem. This rannforex review serves as a reminder to conduct thorough personal research before engaging with the platform.