Veonco 2025 Review: Everything You Need to Know

Summary: The overall assessment of Veonco is predominantly negative, with numerous reports indicating it operates as an unregulated broker, raising significant concerns regarding user safety and withdrawal issues. However, it does offer a range of trading options and a customizable platform, which may appeal to some traders.

Note: It is crucial to be aware that different entities may operate under the Veonco name across various jurisdictions, which could complicate the regulatory landscape. This review aims to provide a balanced perspective based on multiple sources to ensure accuracy.

Ratings Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user reviews, expert opinions, and factual data about the broker's offerings.

Broker Overview

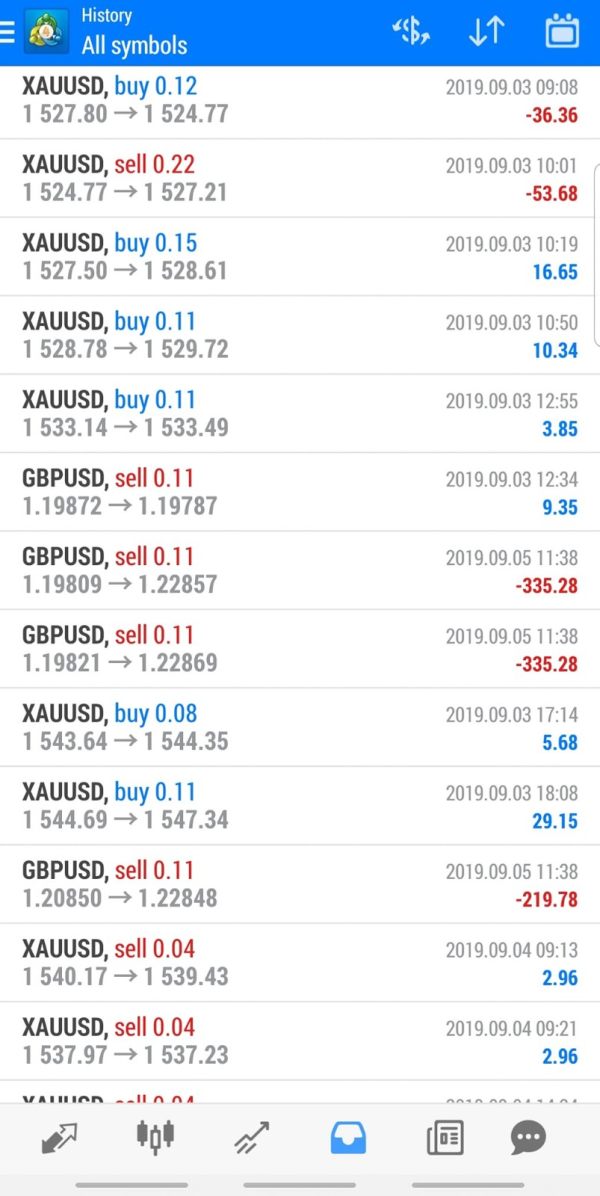

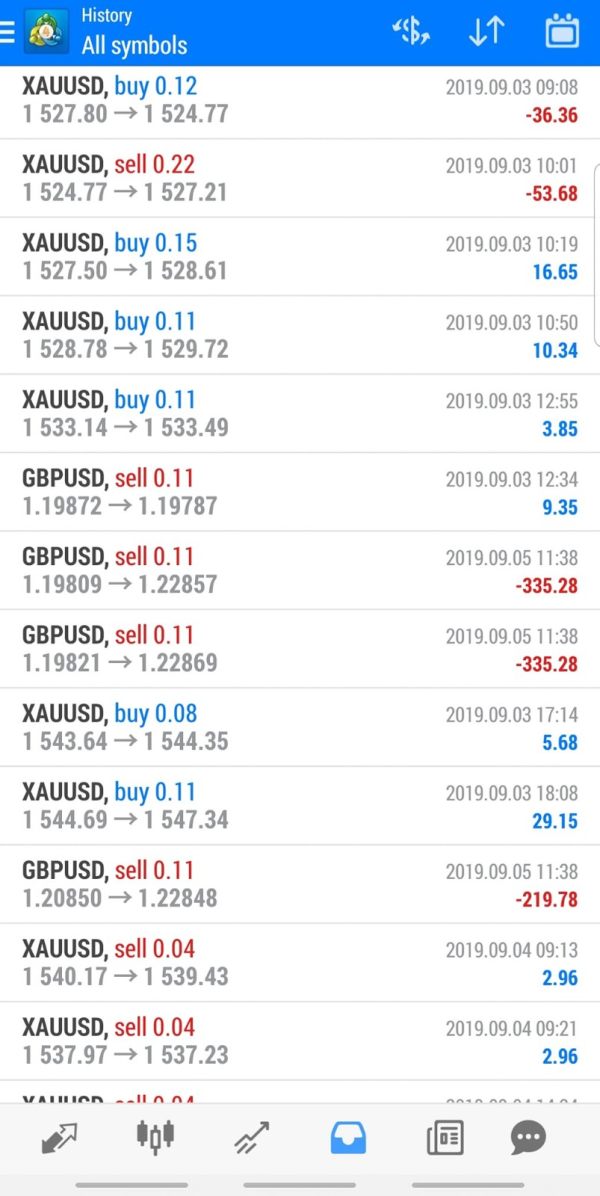

Founded in 2019, Veonco operates as an online forex and CFD broker, primarily targeting retail traders. The broker claims to provide access to a wide array of financial instruments, including forex pairs, cryptocurrencies, commodities, and indices. However, it lacks a clear regulatory framework, which is a significant red flag for potential users. The trading platform offered is MetaTrader 5 (MT5), known for its advanced trading features, although some reviews suggest that the platform's performance may vary.

Detailed Analysis

Regulatory Landscape

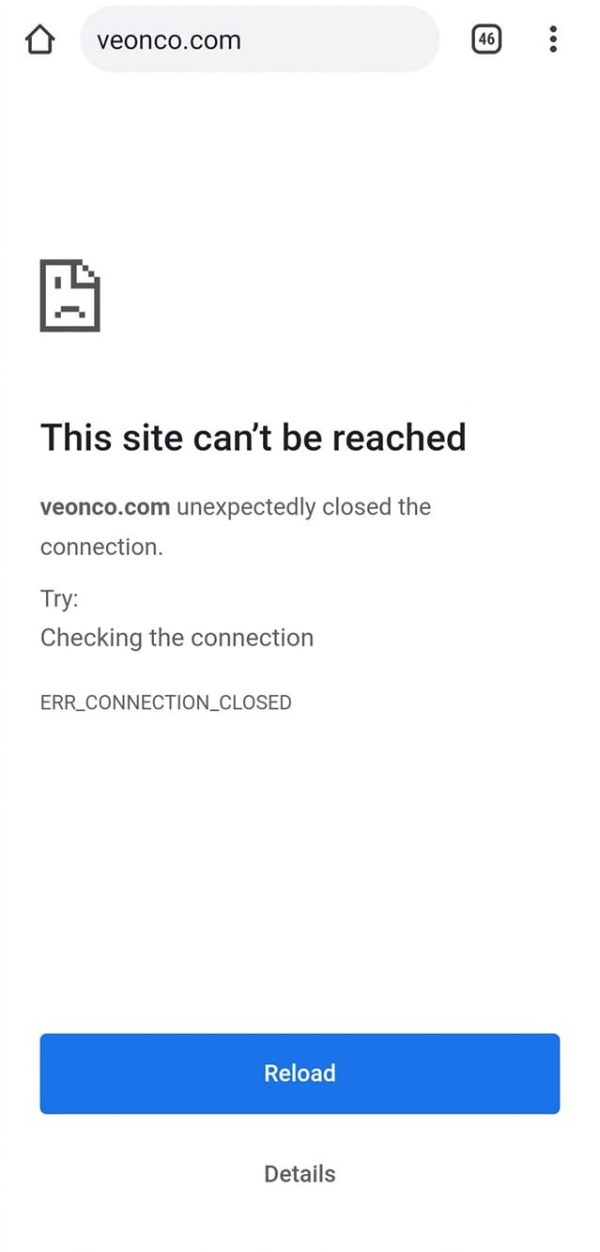

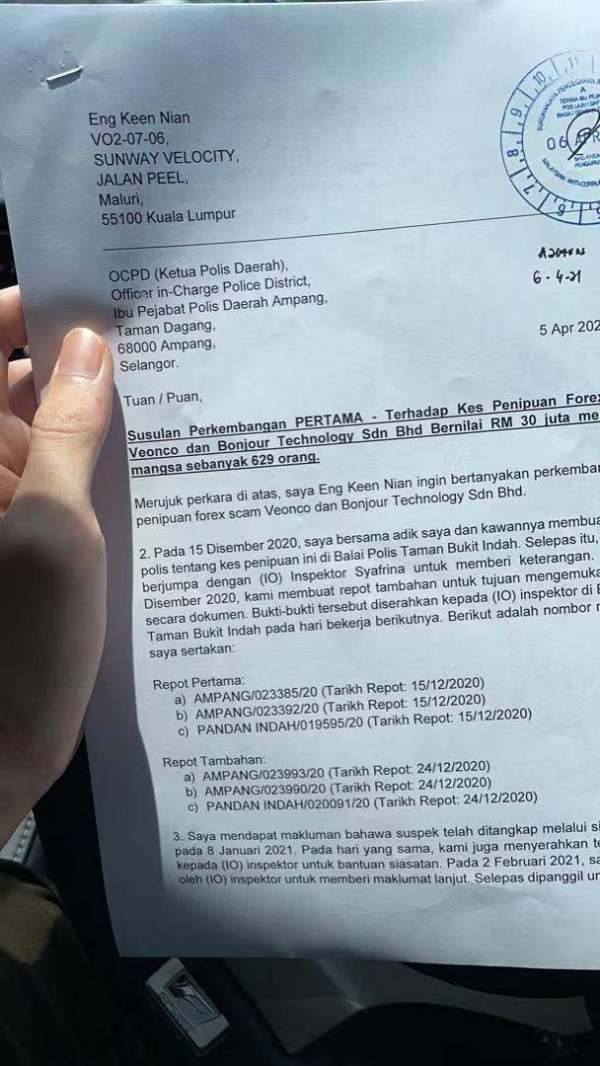

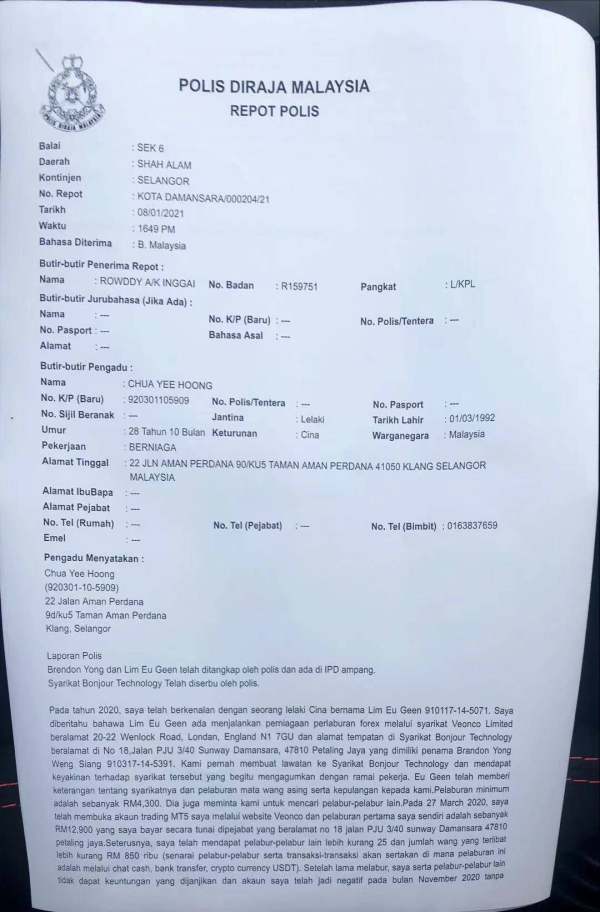

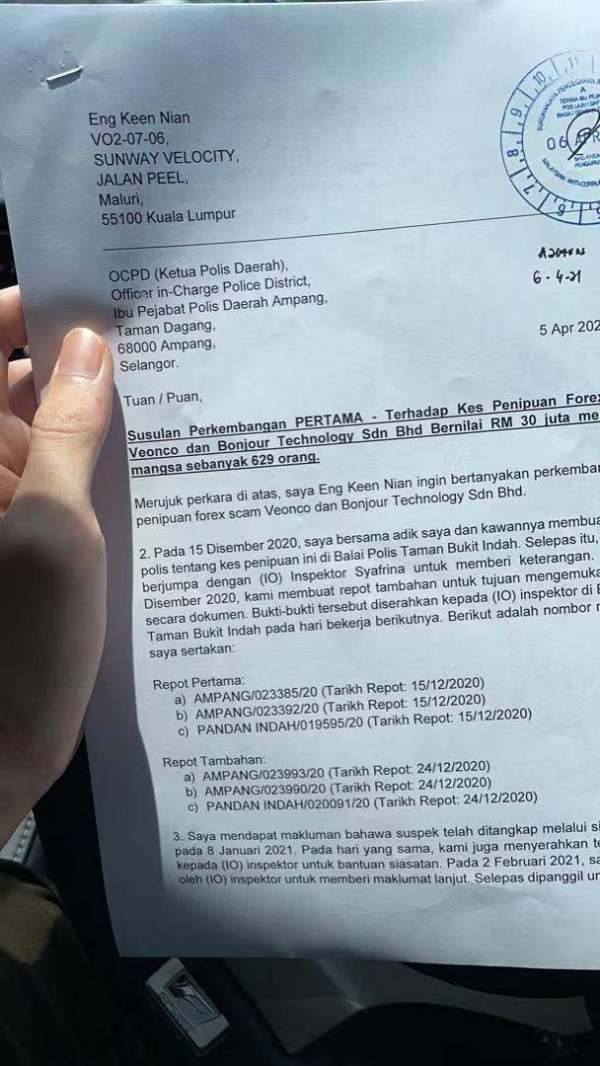

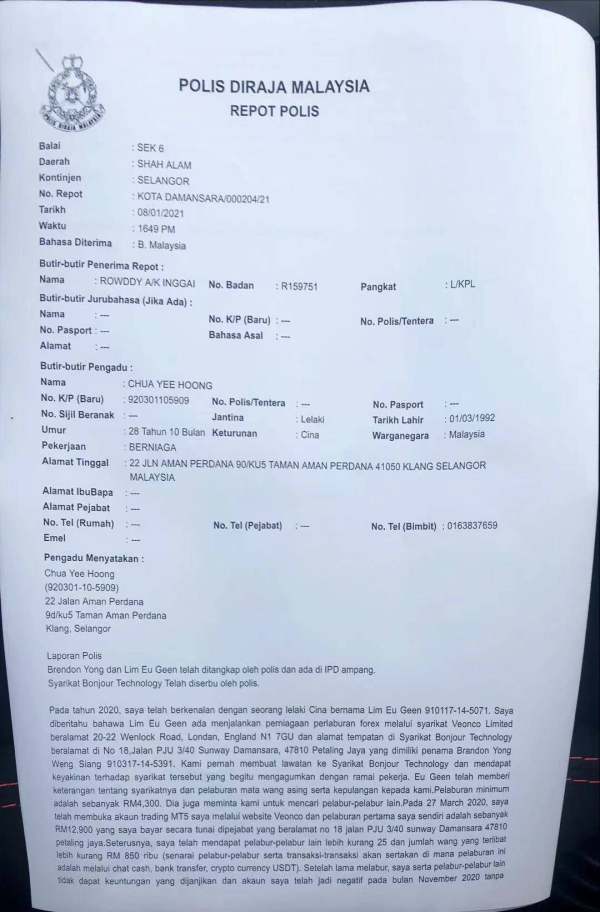

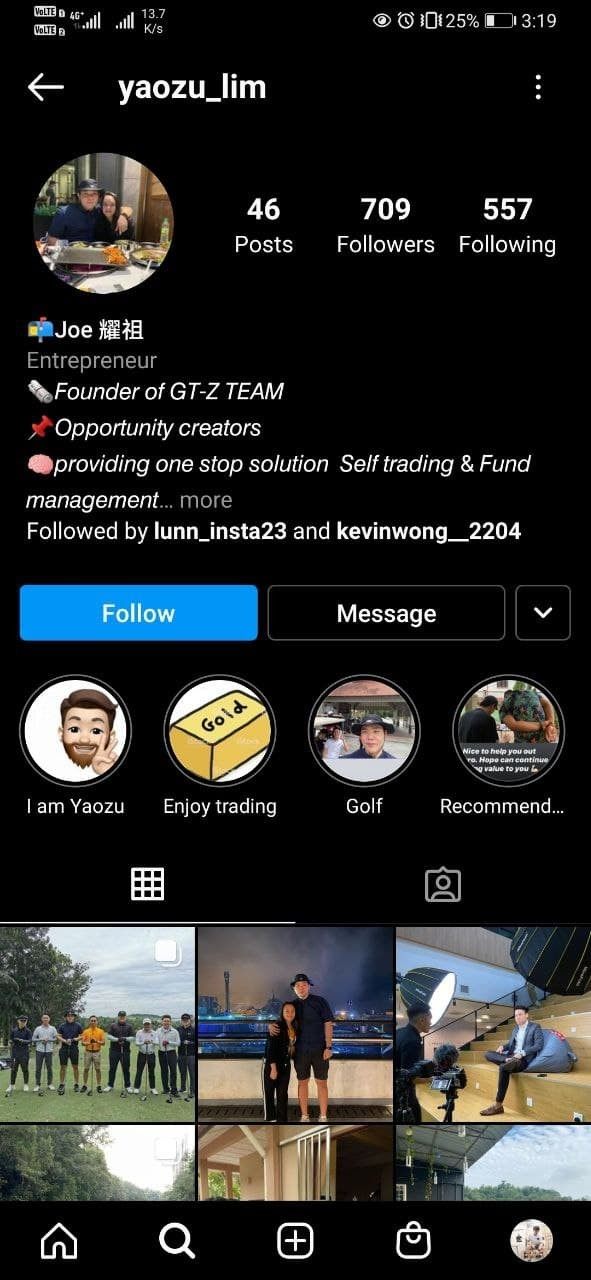

Veonco does not appear to be regulated by any recognized financial authority. This absence of oversight is alarming, as it leaves traders vulnerable to potential fraud and mismanagement of funds. Most user reviews highlight their concerns regarding the lack of transparency and accountability from the broker. According to WikiFX, the broker operates anonymously, which is a significant risk factor for traders.

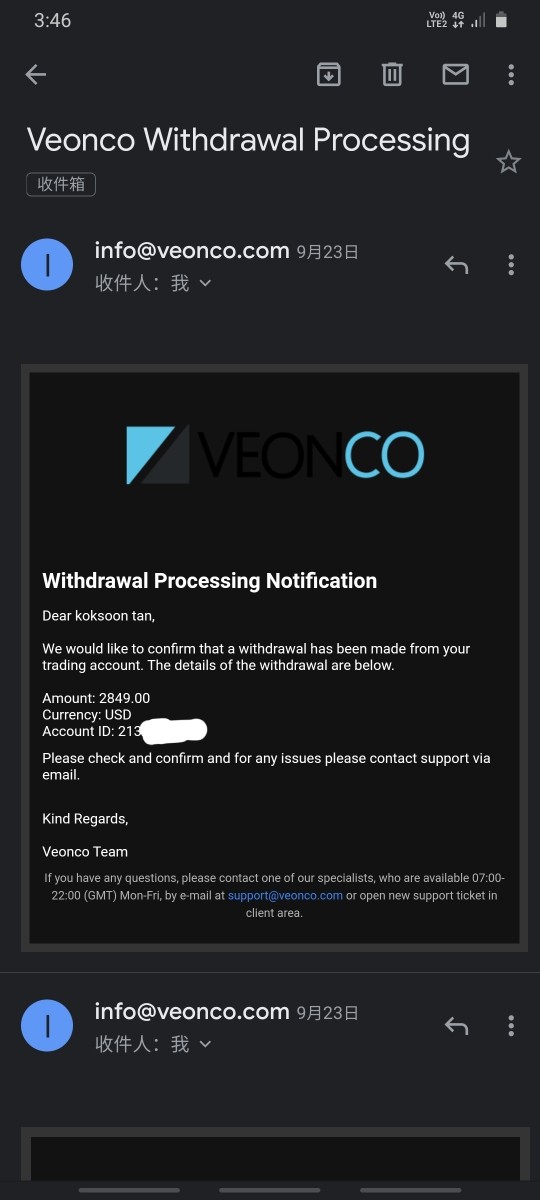

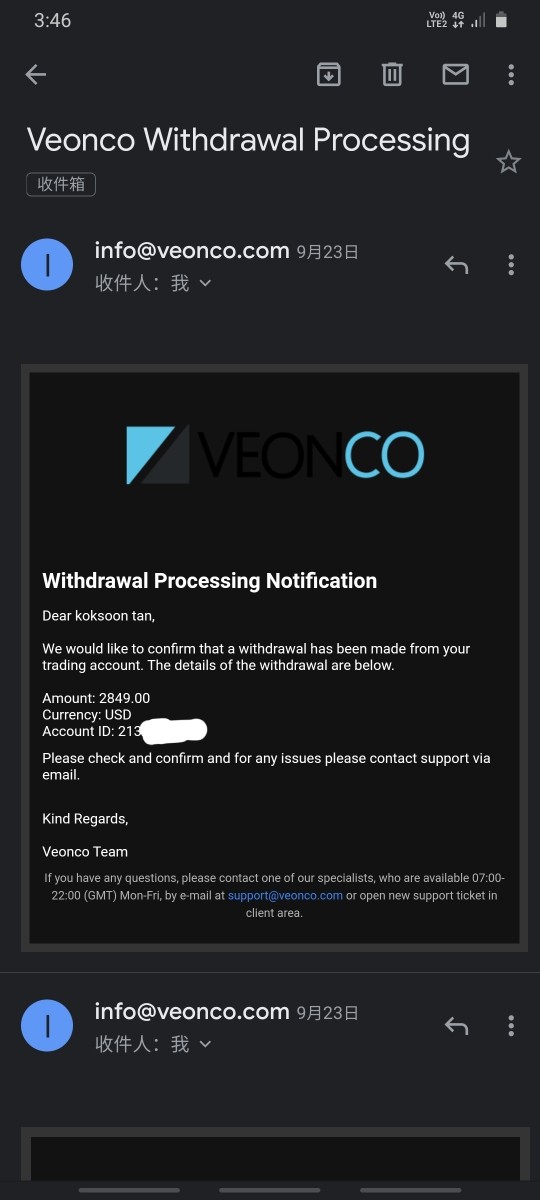

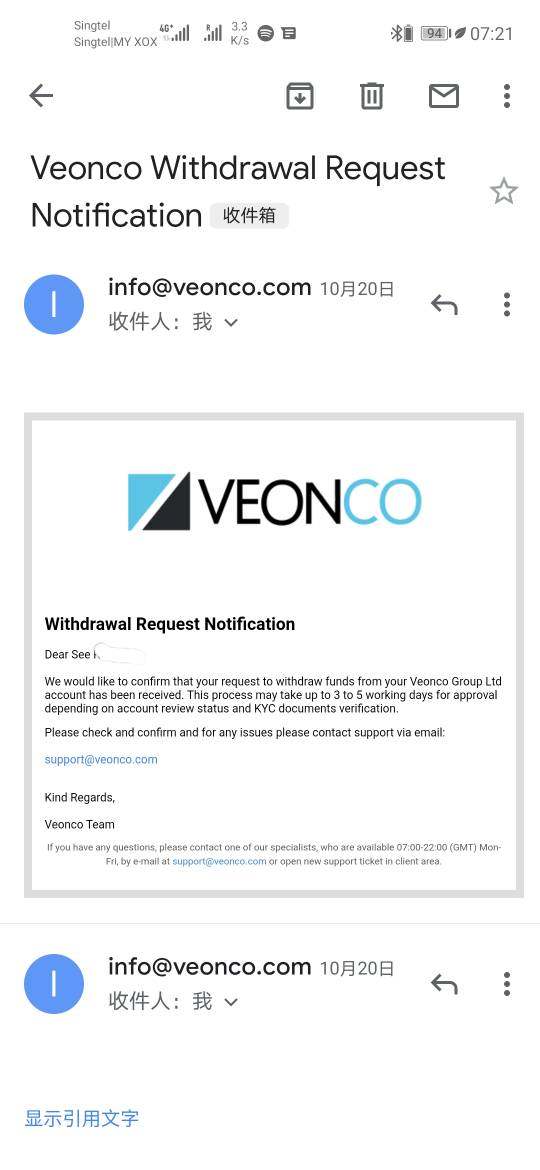

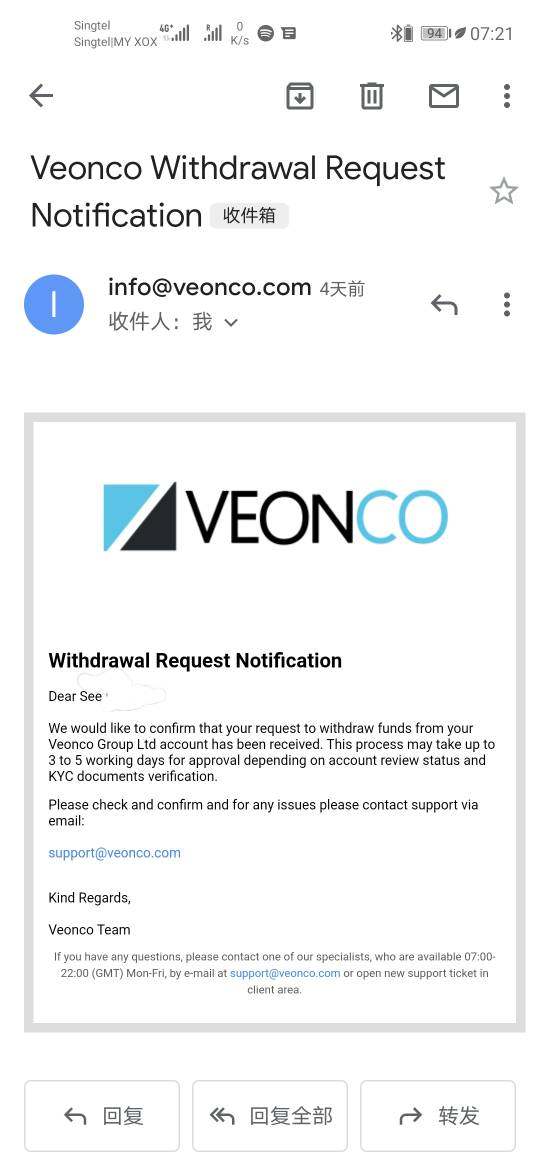

Deposit and Withdrawal Options

Veonco allows deposits via various methods, including credit/debit cards and e-wallets. However, user experiences regarding withdrawals are overwhelmingly negative. Many users report difficulties in accessing their funds, with some claiming they have been unable to withdraw for extended periods. This aligns with findings from Valforex, which indicate that no user has successfully withdrawn funds from the platform.

Minimum Deposit and Bonuses

The minimum deposit to open an account with Veonco is reported to be $100. While this is relatively low compared to other brokers, the lack of clarity regarding bonuses and promotions raises questions about the broker's integrity. Many users have expressed skepticism about the promotional offers, suggesting they may be tactics to entice traders into depositing more funds without any real benefit.

Trading Costs

Veonco advertises spreads starting at 1 pip; however, user testing has shown that actual trading costs can be significantly higher, with spreads on major pairs sometimes reaching 3 pips or more. This discrepancy highlights a lack of transparency in the broker's pricing structure, which is concerning for potential traders.

Leverage and Account Types

The broker offers leverage up to 1:200, which can appeal to traders looking to maximize their positions. However, high leverage also increases the risk of substantial losses. Veonco provides several account types, including Classic, Standard, Premium, and Tailored accounts, but the specific benefits and conditions of each account type remain unclear, according to Binary Today.

Restricted Regions

Veonco does not clearly specify any restricted regions on its website, but the lack of regulatory oversight suggests that it may not be suitable for traders from jurisdictions requiring licensed brokers. This ambiguity can lead to complications for traders attempting to operate legally in their respective regions.

Customer Support Languages

Customer service is reportedly limited and often ineffective, with many users citing long response times and unhelpful support. The primary language of support appears to be English, but the lack of live chat options is a significant drawback, as noted by multiple sources.

Repeated Ratings Overview

Detailed Breakdown

-

Account Conditions (3/10): While the minimum deposit is low, the lack of clarity regarding account types and conditions raises concerns.

Tools and Resources (4/10): The MT5 platform offers advanced features, but user experiences suggest it may not perform consistently.

Customer Service and Support (2/10): Users report significant delays and ineffective responses from customer support, which is a major concern for potential traders.

Trading Experience (3/10): The trading conditions advertised are often not met in practice, leading to dissatisfaction among users.

Trustworthiness (1/10): The absence of regulation and numerous complaints about withdrawal issues severely undermine the trustworthiness of Veonco.

User Experience (4/10): While the platform is customizable, the overall user experience is marred by withdrawal issues and a lack of transparency.

In conclusion, the Veonco review reveals a broker that operates with significant red flags. The absence of regulation, coupled with negative user experiences regarding withdrawals and customer service, makes it a risky choice for traders. Potential users are strongly advised to consider these factors carefully before engaging with Veonco.