Is Elite Traders safe?

Pros

Cons

Is Elite Traders Safe or Scam?

Introduction

In the world of forex trading, brokers play a crucial role in facilitating transactions and offering trading platforms. One such broker is Elite Traders, which has positioned itself as a provider of forex and CFD trading services. However, as with any financial service, it is essential for traders to conduct thorough evaluations before committing their funds. The forex market is rife with unregulated brokers and potential scams, making it imperative for traders to assess the legitimacy and safety of their chosen broker. In this article, we will explore the safety and legitimacy of Elite Traders through a comprehensive analysis of its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Our investigation is based on a review of multiple sources, including user testimonials, regulatory databases, and expert analyses. By synthesizing this information, we aim to provide a balanced view of whether Elite Traders is safe or a potential scam.

Regulation and Legitimacy

A broker's regulatory status is one of the most critical factors in determining its legitimacy and safety. Regulation ensures that brokers adhere to specific standards and practices, safeguarding traders' interests. Unfortunately, our research indicates that Elite Traders operates without proper regulation from recognized financial authorities.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a regulatory license raises significant concerns about the safety of funds and the overall trustworthiness of Elite Traders. Regulatory bodies such as the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and others provide a layer of security for traders. Without such oversight, traders may find it challenging to recover their funds in the event of a dispute.

Moreover, the lack of regulation often correlates with a higher risk of fraudulent activities. Elite Traders has been flagged by several scam reporting websites, indicating a pattern of complaints and negative reviews from former clients. This lack of regulatory oversight and the presence of red flags suggest that traders should exercise extreme caution when considering this broker.

Company Background Investigation

Understanding a broker's company background is essential for assessing its legitimacy. Elite Traders claims to operate from offshore jurisdictions, specifically Seychelles and Saint Vincent and the Grenadines. These locations are known for having lax regulatory environments, which can attract unregulated brokers seeking to evade stringent oversight.

The ownership structure of Elite Traders is not clearly disclosed, which raises transparency concerns. A credible broker typically provides detailed information about its management team and ownership. However, Elite Traders has not made such information readily available, making it difficult for potential clients to assess the qualifications and experience of the individuals behind the broker.

Furthermore, the company's website lacks comprehensive disclosures regarding its operations, trading policies, and client protections. This opacity is a common trait among brokers that may not have the best interests of their clients at heart. In summary, the ambiguous company background of Elite Traders further complicates the question of whether it is safe or a potential scam.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions, including fees and spreads, is vital. Elite Traders offers various account types, each with different minimum deposit requirements. However, the overall fee structure appears to be less competitive compared to established brokers.

| Fee Type | Elite Traders | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 0.5 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | Not specified | 0.5% - 2% |

The spreads offered by Elite Traders may initially seem attractive, but the lack of transparency regarding commissions and overnight interest raises concerns. Traders should be wary of hidden fees that could significantly impact their profitability. Moreover, the absence of clearly defined withdrawal policies could lead to complications when attempting to access funds.

The potential for unexpected fees or unfavorable trading conditions is a significant red flag for traders considering Elite Traders. In a market where transparency is critical, the lack of clarity surrounding fees and costs can be indicative of a broker that may not prioritize its clients' interests.

Client Funds Safety

The safety of client funds is paramount when choosing a forex broker. Elite Traders' approach to safeguarding client funds is concerning, as it lacks the necessary investor protection measures typically offered by regulated brokers. The absence of segregated accounts, which separate client funds from the broker's operational funds, poses a significant risk.

Many reputable brokers ensure that client funds are held in segregated accounts, providing an additional layer of security. However, Elite Traders does not appear to offer this level of protection, leaving clients vulnerable in the event of financial instability or insolvency.

Additionally, the absence of negative balance protection means that traders could potentially lose more than their initial investment. This lack of safety measures raises serious questions about whether Elite Traders is safe for traders looking to invest their hard-earned money.

Customer Experience and Complaints

Customer feedback is a crucial aspect of evaluating a broker's reliability and service quality. A review of user experiences with Elite Traders reveals a pattern of dissatisfaction, with many clients reporting difficulties in withdrawing their funds and poor customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Quality | Medium | Inconsistent |

| Transparency Concerns | High | Lacking |

Common complaints include delays in processing withdrawals and a lack of responsiveness from customer support. Many users have expressed frustration over their inability to access funds, which is a significant concern for any trader. These issues not only reflect poorly on Elite Traders but also highlight the potential risks associated with trading with an unregulated broker.

In particular, anecdotal evidence suggests that some clients have experienced significant delays in fund recovery, leading to financial distress. Such patterns of complaints indicate that Elite Traders may not provide the level of service and support that traders expect from a reputable broker.

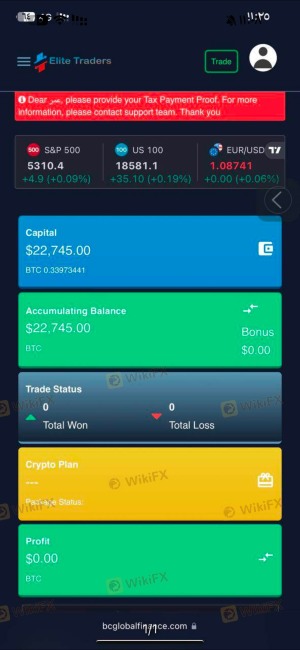

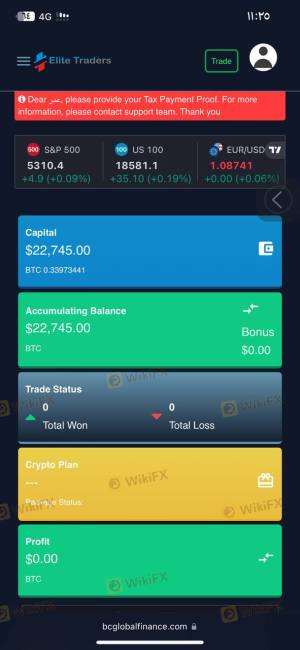

Platform and Execution

The trading platform offered by Elite Traders is another critical aspect to consider. While the broker claims to provide a user-friendly trading experience, reviews suggest that the platform may not perform reliably under all conditions. Issues such as slippage, order rejections, and execution delays have been reported by users.

A stable and efficient trading platform is essential for traders, as even minor execution issues can lead to significant financial losses. The lack of transparency regarding the platform's operational capabilities raises questions about whether Elite Traders can deliver a satisfactory trading experience.

Furthermore, the potential for platform manipulation, often associated with unregulated brokers, adds an additional layer of risk for traders. Without regulatory oversight, there are no guarantees that the trading environment is fair and transparent.

Risk Assessment

When considering whether Elite Traders is safe or a scam, it is essential to evaluate the overall risk associated with trading through this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Financial Risk | High | Lack of fund protection measures. |

| Operational Risk | Medium | Platform performance issues reported. |

| Customer Service Risk | High | Poor response to complaints and issues. |

The high levels of regulatory and financial risks, coupled with operational and customer service concerns, suggest that trading with Elite Traders may not be advisable. Traders should carefully consider these risks and explore alternative brokers that offer greater security and reliability.

Conclusion and Recommendations

In conclusion, the evidence suggests that Elite Traders raises several red flags that indicate it may not be a safe option for traders. The lack of regulation, questionable company background, unclear trading conditions, and numerous customer complaints all contribute to the conclusion that Elite Traders may be operating as a scam.

Traders are strongly advised to exercise caution and consider alternative, well-regulated brokers that prioritize client safety and transparency. Some reputable alternatives include brokers regulated by the FCA or ASIC, which offer the necessary protections and support for traders.

In summary, while Elite Traders may present itself as a viable option for forex trading, the risks associated with this broker far outweigh any potential benefits. It is crucial for traders to prioritize their financial security and choose brokers that are transparent, regulated, and committed to their clients' success.

Is Elite Traders a scam, or is it legit?

The latest exposure and evaluation content of Elite Traders brokers.

Elite Traders Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Elite Traders latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.