Elite Traders 2025 Review: Everything You Need to Know

Summary: The overall assessment of Elite Traders reveals significant concerns regarding its legitimacy and regulatory status. Most sources indicate that this broker operates without proper regulation, raising serious red flags for potential investors. Key findings include the lack of protection for user funds and numerous negative user experiences.

Note: It is crucial to consider that various regional entities may operate under similar names, which can lead to confusion. This review is based on a thorough analysis of available information to ensure fairness and accuracy.

Ratings Overview

How We Rate Brokers: Our ratings are based on a comprehensive review of user feedback, expert opinions, and factual data regarding the broker's offerings and regulatory compliance.

Broker Overview

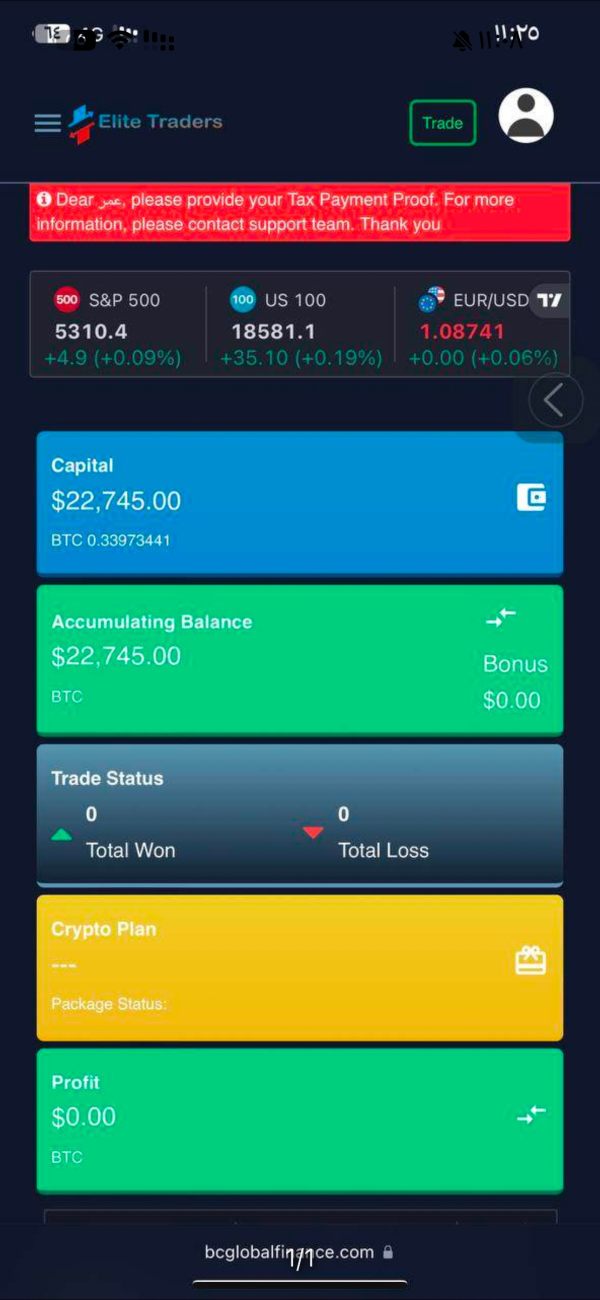

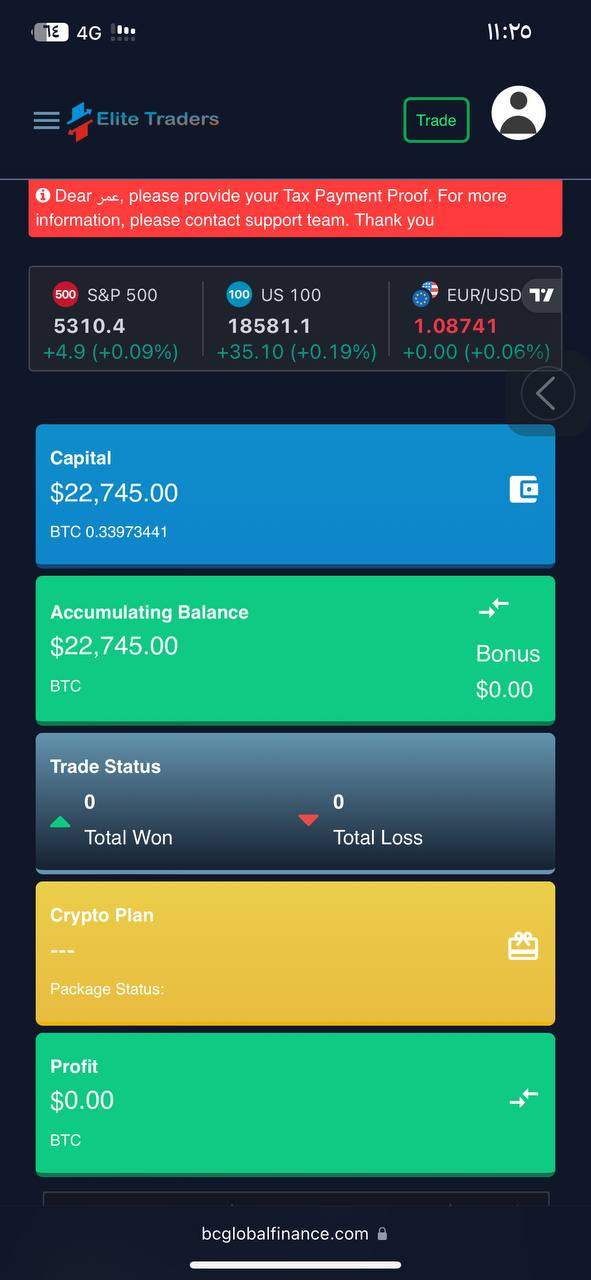

Elite Traders, reportedly established in 2023, operates as an offshore broker, primarily targeting clients in various regions without the necessary regulatory oversight. The broker claims to provide access to a generic web-based trading platform, which lacks the sophistication of industry-standard platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Users can trade a variety of assets, including forex, commodities, stocks, and cryptocurrencies. However, the absence of a valid regulatory license raises serious concerns about the safety of clients' funds.

Detailed Review

Regulatory Regions:

Elite Traders operates without valid regulation, which is a significant concern for potential clients. The Financial Conduct Authority (FCA) in the UK does not recognize Elite Traders, and there have been warnings issued by the Autorité des marchés financiers (AMF) in France regarding its unregulated status. This lack of oversight means that investors may have little recourse in the event of disputes or fund mismanagement.

Deposit/Withdrawal Methods:

The broker primarily deals in fiat currencies and cryptocurrencies, but the specifics of deposit and withdrawal methods are not clearly outlined on its website. This lack of transparency can be alarming for potential investors. The minimum deposit to open a standard account is set at $250, which is relatively standard in the industry.

Bonuses/Promotions:

There is no substantial information regarding bonuses or promotional offers available for new clients. This lack of incentives may deter potential traders from engaging with the platform.

Tradeable Asset Classes:

Elite Traders claims to offer a wide range of trading instruments, including forex pairs, commodities, stocks, and cryptocurrencies. However, the reliability of these claims is questionable given the broker's overall lack of transparency and regulatory compliance.

Costs (Spreads, Fees, Commissions):

The broker advertises competitive spreads, such as 0.1 pips on major currency pairs. However, many reviews caution that these figures should be approached with skepticism due to the perceived unreliability of the trading platform. Additionally, there are numerous complaints about hidden fees and withdrawal challenges, which are common red flags for unregulated brokers.

Leverage:

Elite Traders offers high leverage options, reportedly up to 500:1 on forex trades. While high leverage can amplify profits, it also significantly increases the risk of substantial losses, particularly for inexperienced traders.

Allowed Trading Platforms:

The only trading platform mentioned is a basic web-based interface, which has been criticized for lacking essential trading functionalities. There is no support for popular platforms like MT4 or MT5, which are preferred by many traders for their advanced features and customizability.

Restricted Regions:

While specific restrictions are not detailed, the unregulated nature of Elite Traders suggests that it may not be a suitable option for traders in jurisdictions with strict regulatory requirements.

Available Customer Service Languages:

Customer support appears limited, with no clear indication of the languages offered for assistance. This can pose challenges for non-English speaking clients who may need help navigating the platform.

Repeat Ratings Overview

Detailed Breakdown

Account Conditions:

The account conditions at Elite Traders are subpar, with a minimum deposit requirement of $250. However, the lack of regulatory oversight and transparency regarding withdrawal processes raises concerns about the safety of client funds.

Tools and Resources:

The broker does not provide adequate trading tools or educational resources, which can hinder users, particularly those new to trading. The absence of a robust trading platform further diminishes the user experience.

Customer Service and Support:

Reviews indicate that customer service is lacking, with many users reporting difficulties in receiving timely assistance. This is a significant drawback for any trading platform.

Trading Setup (Experience):

While the trading experience can vary, the generic web-based platform does not meet the expectations of traders accustomed to more sophisticated trading environments. The lack of advanced features can be a deterrent for serious traders.

Trustworthiness:

Elite Traders has been flagged by several regulatory bodies and user reviews for its lack of transparency and potential scams. This significantly impacts its trustworthiness and overall reputation in the trading community.

User Experience:

Overall user experiences have been negative, with many complaints regarding withdrawal issues and the platform's reliability. This is a crucial consideration for anyone contemplating trading with Elite Traders.

In conclusion, the Elite Traders review indicates that potential clients should exercise extreme caution before engaging with this broker, given the numerous red flags and lack of regulatory oversight. It is advisable to consider more reputable and regulated brokers to ensure the safety of your investments.