Founded in 2022, USG operates as a forex brokerage with its headquarters located in Saint Vincent and the Grenadines. The company manages to portray itself as a legitimate trading option within the forex market. Nonetheless, its rapid establishment and lack of established history raise questions about its long-term credibility and reliability. USG positions itself primarily to attract beginner to intermediate traders looking for diverse account types and trading tools that promise automation and ease of use.

USG offers a variety of trading services primarily focused on forex trading, alongside contracts for difference (CFDs) on commodities and indices. It claims to provide access to over 30 forex currency pairs while utilizing well-regarded trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Currently, USG cites the Financial Conduct Authority (FCA) as one of its regulatory bodies, but users have reported suspicions regarding the legitimacy of these claims.

USG's legitimacy is clouded by inconsistent regulatory information. Sources indicate that while USG claims FCA regulation, it operates under the name of a different entity, United Strategic Group LLC, which lacks regulatory oversight. This discrepancy is alarming and suggests the broker may be a clone firm or otherwise engaged in misleading practices. This uncertainty raises risks for traders, particularly regarding the safety of their funds.

- Visit the FCA website: Go to the official FCA register at fca.org.uk.

- Search the broker's name: Enter “Union Standard International Group Limited” to verify the registration.

- Examine the registration number: Ensure that it matches USGs claims. If the domain does not match, proceed with caution.

- Check the NFA BASIC database: Go to nfa.futures.org and search for USG to confirm if there's any regulatory action against it.

- Look for complaints and reviews: Cross-reference feedback on platforms such as WikiFX or Forex Peace Army to find actual user experiences concerning safety.

Industry Reputation and Summary

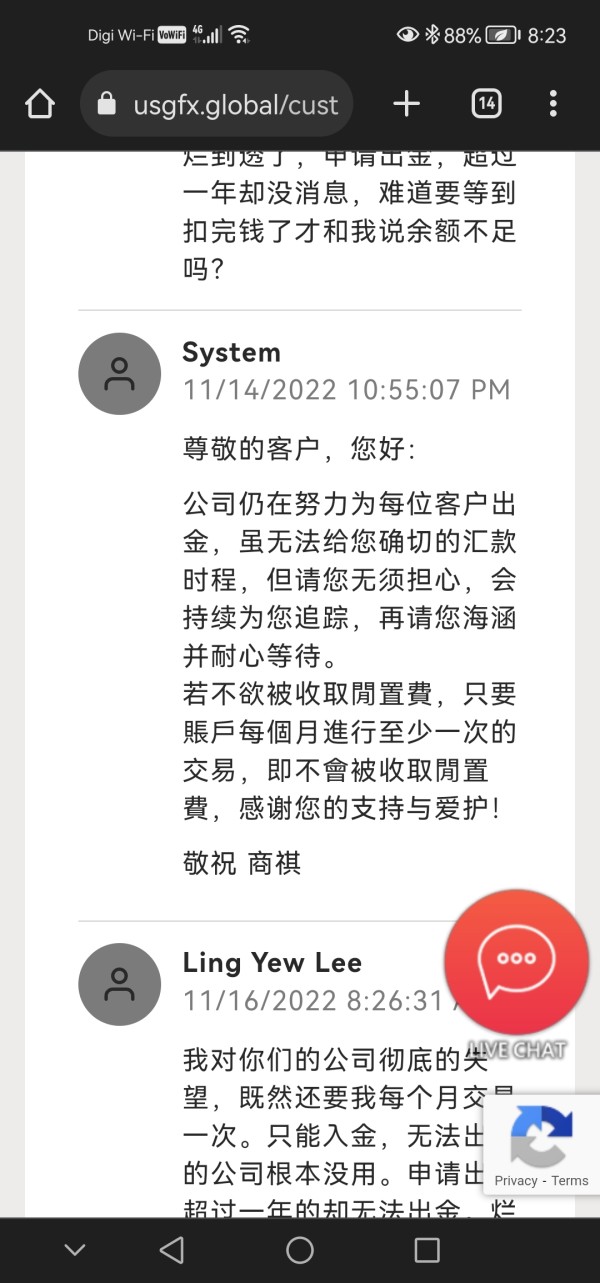

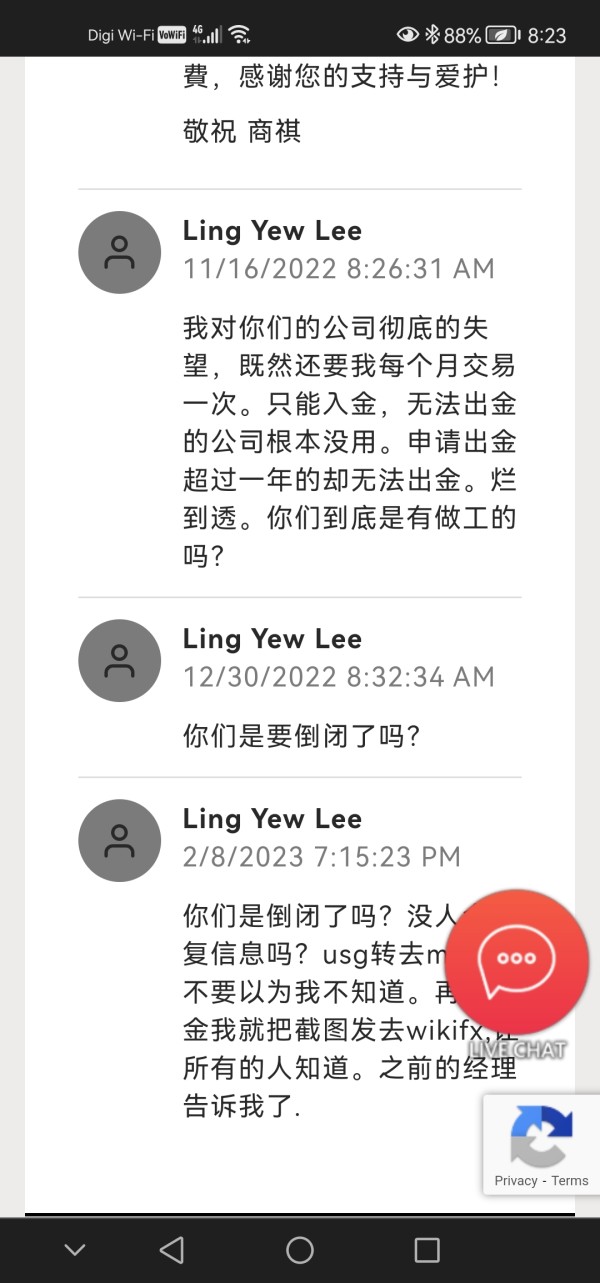

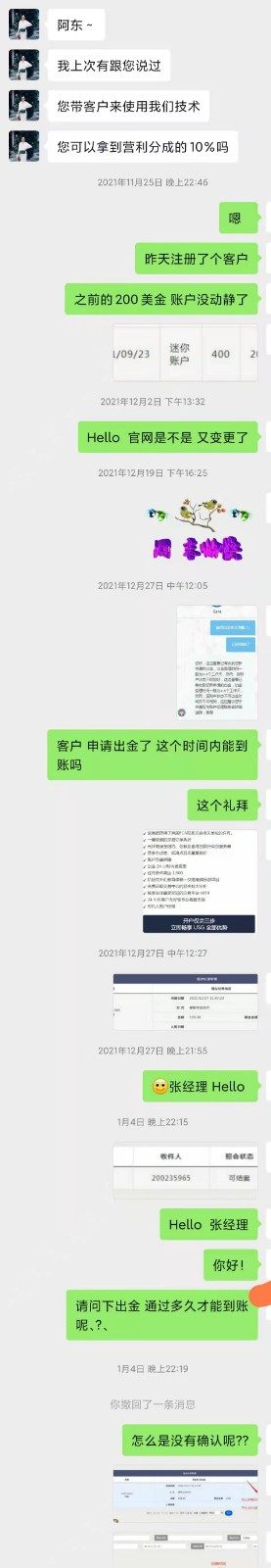

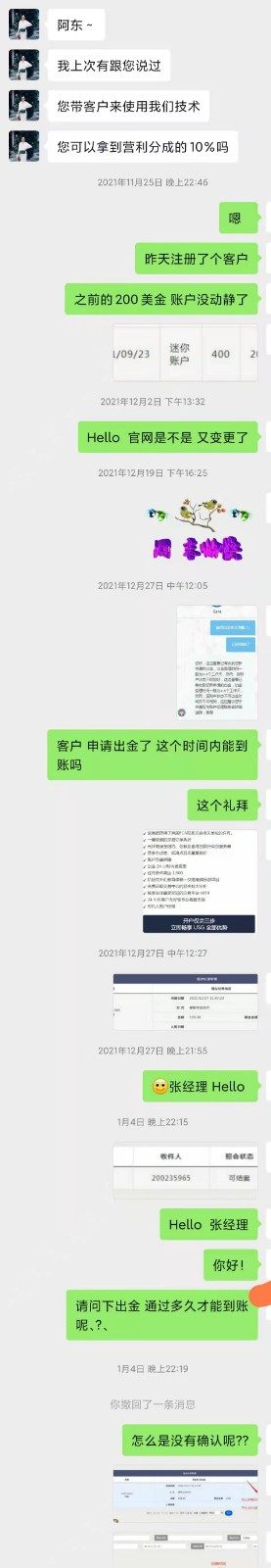

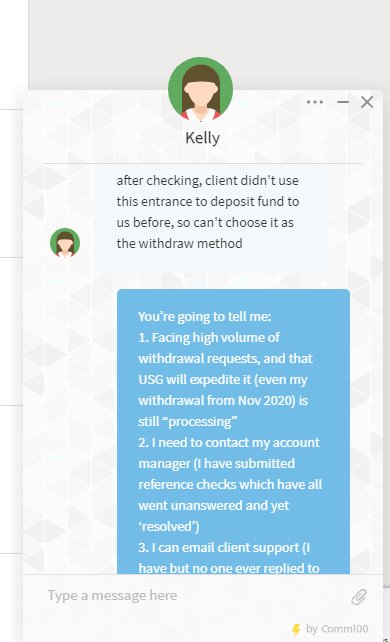

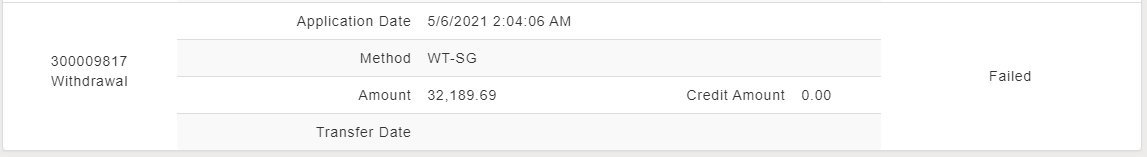

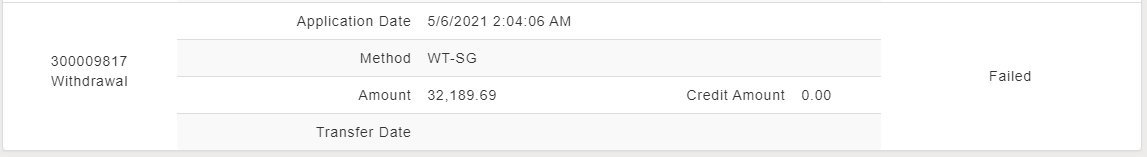

User feedback presents a concerning picture of fund safety, reinforcing the need for self-verification. A common sentiment among users is frustration:

“Its been a long time that I can't withdraw. Don't know when it can be solved. Liars.” — User Complaint.

This underlines the critical need for potential clients to conduct thorough research before engaging with USG.

Trading Costs Analysis

Advantages in Commissions

USG markets itself with a low-cost commission structure. Specific claims suggest competitive spreads, with many users attracted by the promise of low costs. For instance, the minimum spread for EUR/USD is reportedly 1.3 pips, which is competitive within the market.

The "Traps" of Non-Trading Fees

Despite attractive commission structures, users encounter significant hidden costs during the withdrawal process:

“Withdrawal fees are ludicrous; they charge $30 per withdrawal and claim its for processing.” — User Complaint.

Such non-trading costs could disproportionately impact traders, particularly those looking to withdraw smaller amounts frequently.

Cost Structure Summary

While the entry costs may be appealing, particularly for new traders, the hidden fees associated with withdrawals can erode profitability, potentially leading to severe financial setbacks. As such, scrutiny of the entire cost structure is imperative for anyone considering trading with USG.

USG provides its clients access to industry-standard platforms such as MT4 and MT5, both of which are renowned for their robustness. These platforms equip users with diverse trading tools for technical analysis, offering a conducive environment for both novice and experienced traders.

The availability of tools such as charting indicators and automated trading options enhances the trading experience. However, user feedback indicates mixed results regarding the quality and availability of educational resources, which are crucial for developing trader competency.

User experiences are generally positive about the trading platforms, but there are notable concerns:

“The platform can be slow and unresponsive at times, especially during high volatility.” — User Feedback.

User Experience Analysis

Account Opening Process

The account opening process is reported to be straightforward and digital. Users have indicated that signing up is generally hassle-free; however, they should remain cautious of what they agree to during this phase.

Trading Experience

Once accounts are active, users experience a mixed trading environment. Complaints about delays in order execution are common, with some users indicating dissatisfaction with the platform's performance during peak trading hours.

User Feedback Summary

While some traders express satisfaction with the basic functionalities, many echo a sentiment of frustration regarding the responsiveness and execution speed:

“I cant close the position, no reply to email.” — User Complaint.

Customer Support Analysis

Availability and Channels

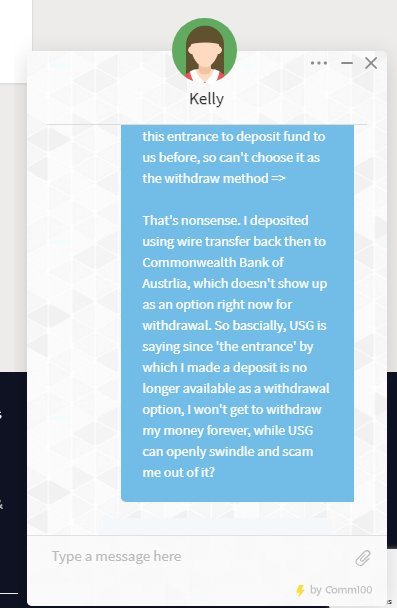

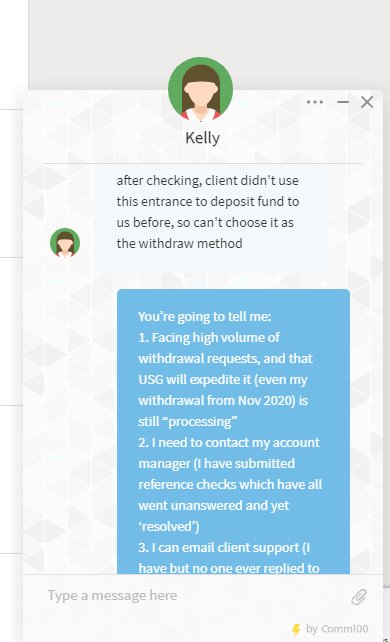

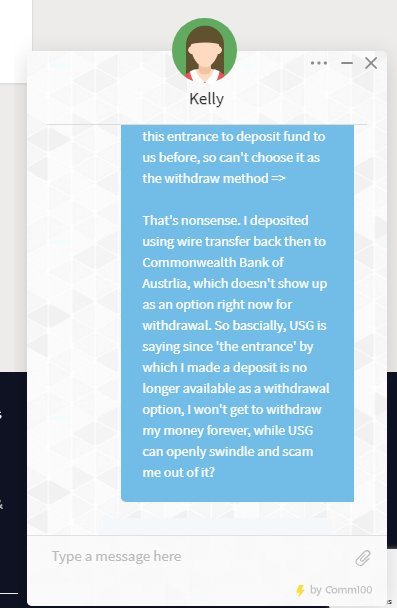

USG offers customer support via email, live chat, and phone. However, many users report that attempts to reach out result in long wait times or no response at all.

Response Times and Quality

Feedback regarding the effectiveness of customer service is predominantly negative, with users pointing out that their issues remain unresolved for extended periods.

Summary of Support Experience

Overall, users feel neglected by the customer support system, which significantly affects their trading experience.

Account Conditions Analysis

Account Types Offered

USG caters to diverse trader needs with several account types: mini, standard, pro-ECN, and VIP. However, the high minimum deposit required for some accounts discourages many potential clients.

Minimum Deposits and Leverage

Users can start trading with a minimum deposit of $100, but may find disinterest due to the stipulated high deposits in some account charts. The maximum leverage of up to 500:1 is enticing but comes with its respective risks.

Account Conditions Summary

The myriad of accounts provides flexibility but also reflects a disparity based on deposit levels, often alienating prospective traders who fall below the threshold.

In summary, USG presents an intriguing yet risky proposition for budding forex traders. Their promise of low costs and diverse account options stands in stark contrast to troubling evidence regarding regulatory compliance and user experiences. Therefore, potential clients are advised to perform due diligence before engaging with this broker.