Unisnfx 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive unisnfx review examines a relatively new forex broker that entered the market in November 2023. Unisnfx positions itself as a multi-asset trading platform offering access to forex, precious metals, cryptocurrencies, stocks, energy commodities, and CFDs through their proprietary FX6 trading platform. The broker targets traders interested in diversified asset classes. They provide educational support through video resources.

However, our analysis reveals significant concerns regarding regulatory transparency and the absence of detailed trading conditions. While the platform advertises zero spreads and claims 0ms trading speeds, the lack of comprehensive regulatory information and limited user feedback raises questions about the broker's credibility. The platform appears designed for traders seeking exposure to multiple asset classes. It particularly targets those new to trading who might benefit from educational resources, but potential clients should exercise caution due to insufficient regulatory disclosure and limited operational transparency.

Important Notice

This review is based on available information summaries and publicly accessible data about Unisnfx. Due to the broker's recent establishment and limited public information, some details regarding trading conditions, regulatory status, and operational procedures may be incomplete or subject to change. Potential traders are strongly advised to conduct independent verification of all claims and seek detailed information directly from the broker before making any investment decisions. The absence of clear regulatory information in available materials should be considered a significant factor in any trading decision.

Rating Framework

Broker Overview

Unisnfx emerged in the forex trading landscape on November 3, 2023. The company positions itself as a comprehensive financial derivatives trading service provider. Despite its recent establishment, the broker attempts to differentiate itself through a multi-asset approach, offering traders access to various financial instruments beyond traditional forex pairs. The company's business model centers on providing retail traders with access to global financial markets through their proprietary trading infrastructure. However, specific details about corporate structure and ownership remain unclear in available documentation.

The broker's primary offering revolves around the FX6 trading platform. This platform serves as the gateway for clients to access multiple asset classes including foreign exchange pairs, precious metals, cryptocurrencies, individual stocks, energy commodities, and contracts for difference. According to available information, Unisnfx emphasizes educational support through video content, suggesting a focus on attracting newer traders who may benefit from learning resources. However, the unisnfx review reveals concerning gaps in regulatory disclosure, with no clear mention of oversight from recognized financial authorities. This significantly impacts the broker's credibility in the competitive forex industry.

Regulatory Regions

Available information does not specify the regulatory jurisdictions under which Unisnfx operates. This absence of regulatory disclosure represents a significant concern for potential traders. Regulatory oversight is crucial for ensuring client protection and operational standards in forex trading.

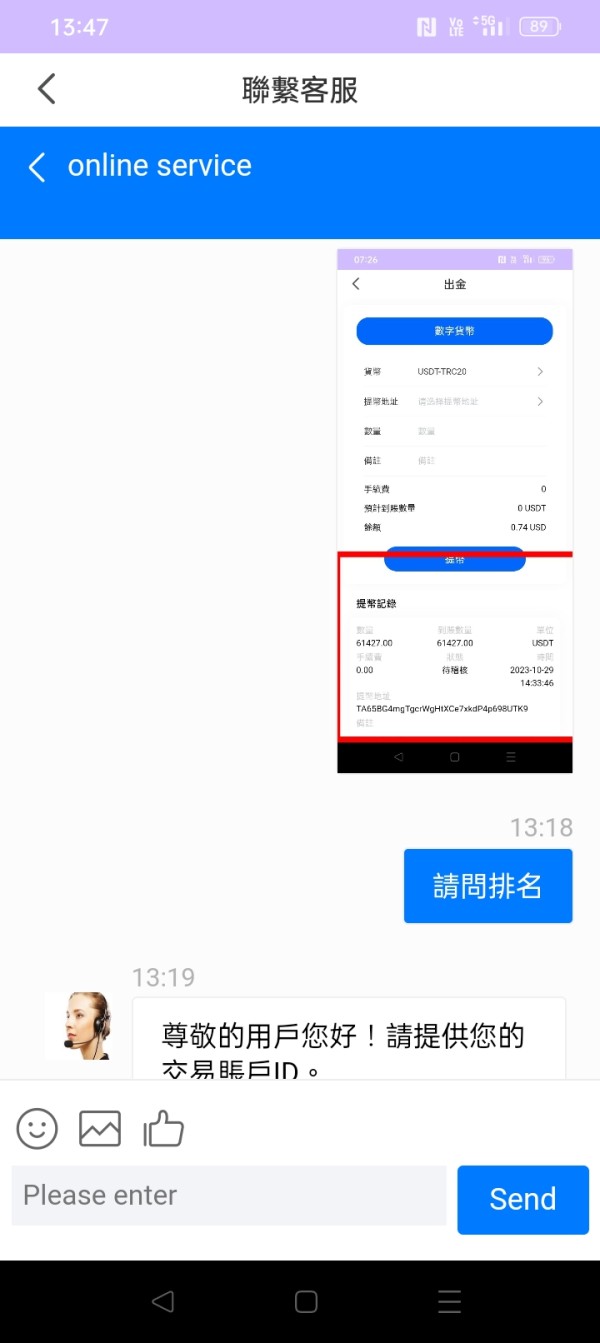

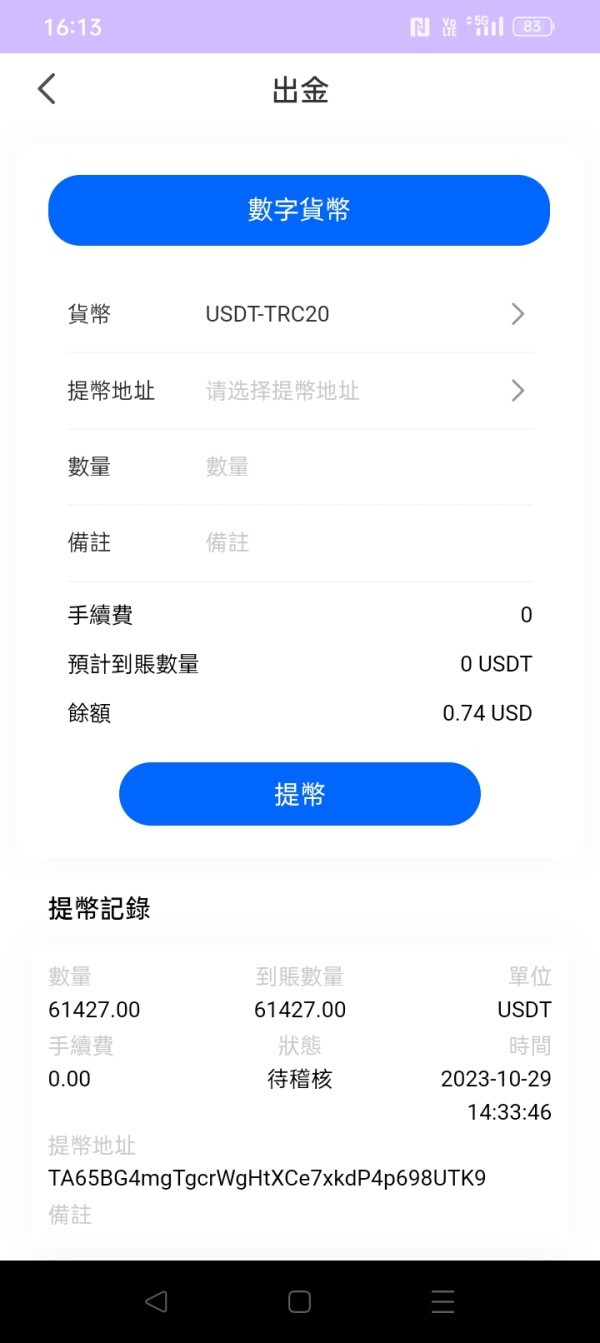

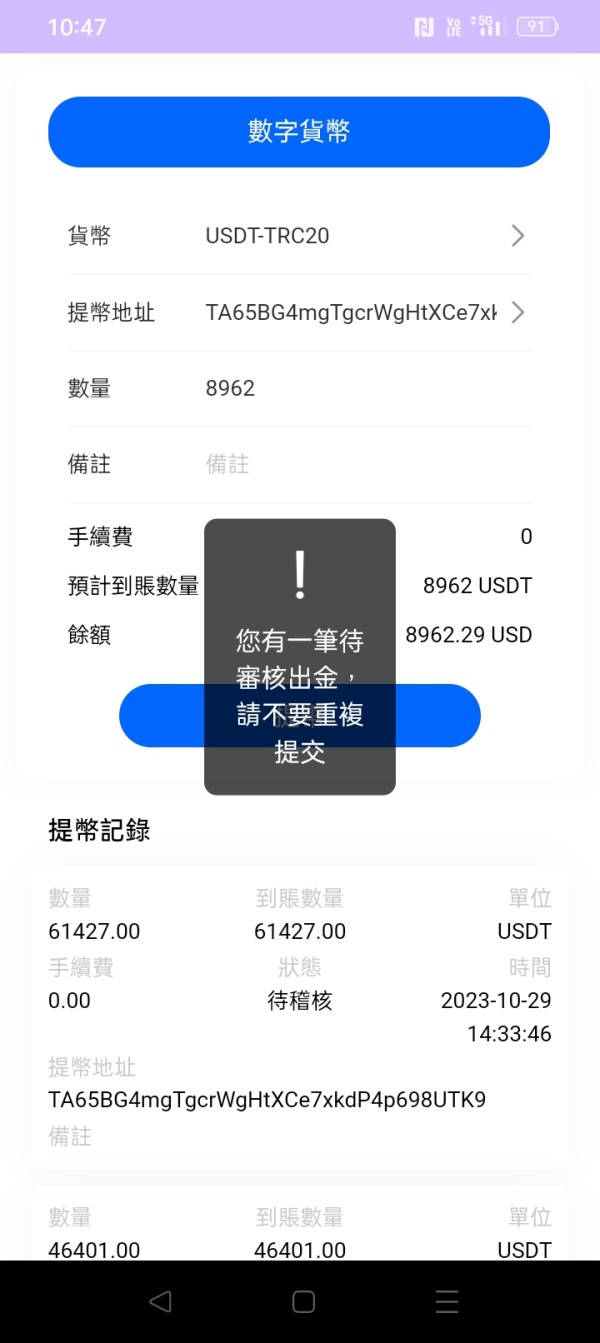

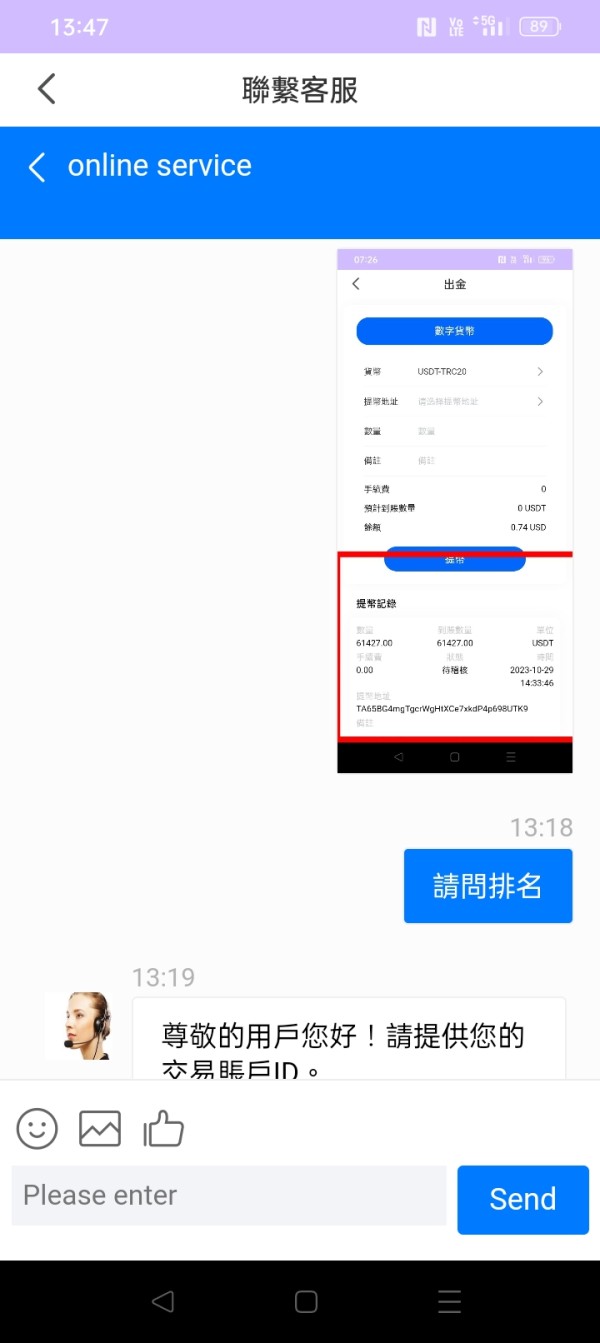

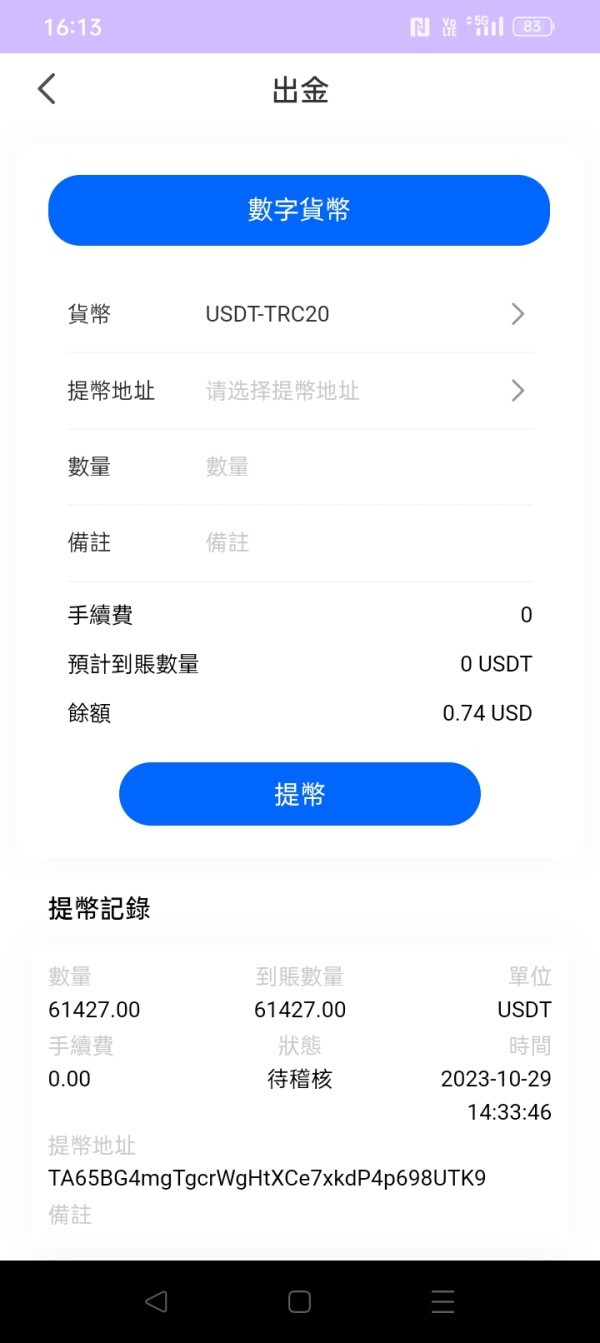

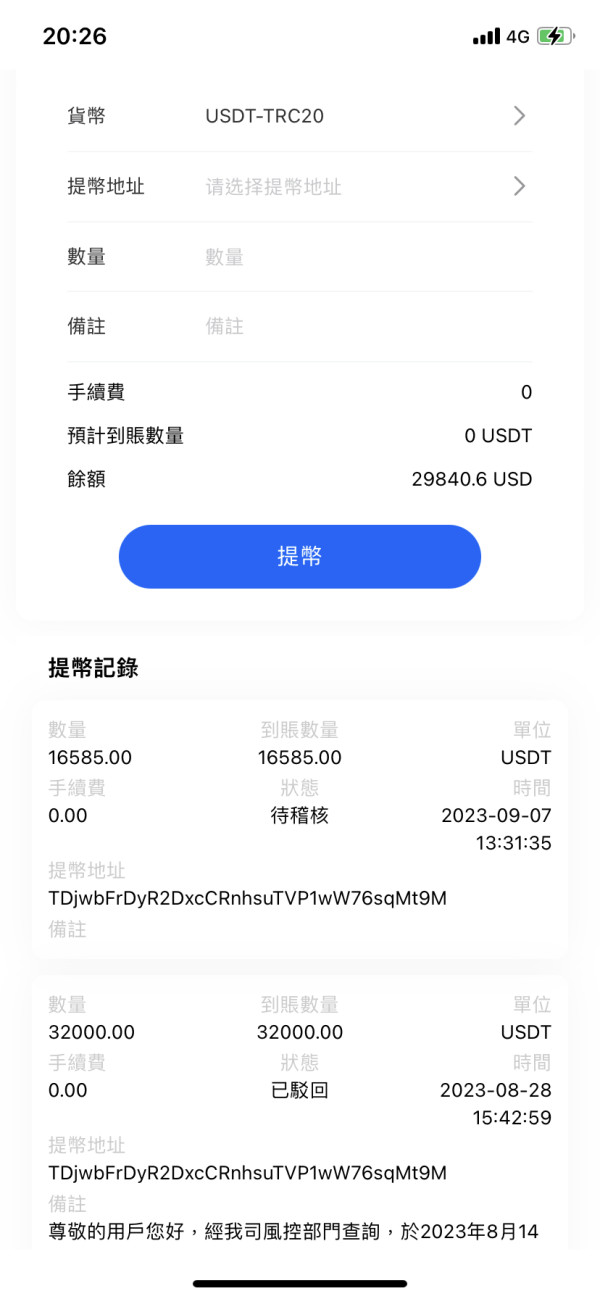

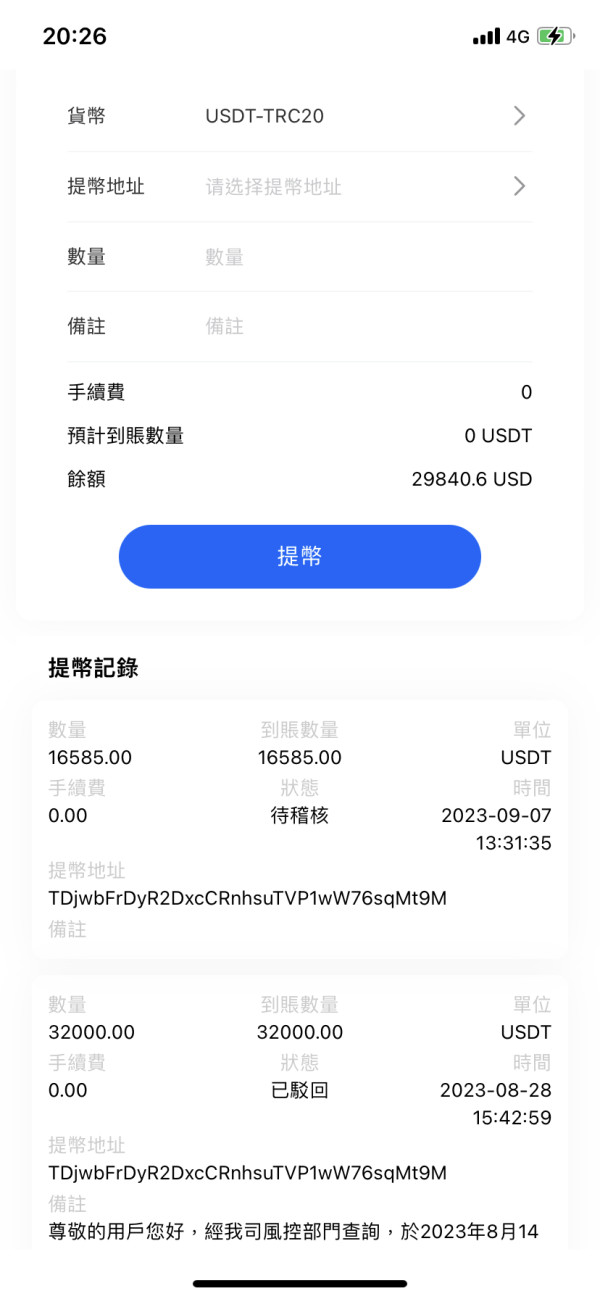

Deposit and Withdrawal Methods

Specific information regarding deposit and withdrawal methods is not mentioned in available documentation. The lack of transparency about funding options makes it difficult for potential clients to assess the convenience and security of financial transactions with this broker.

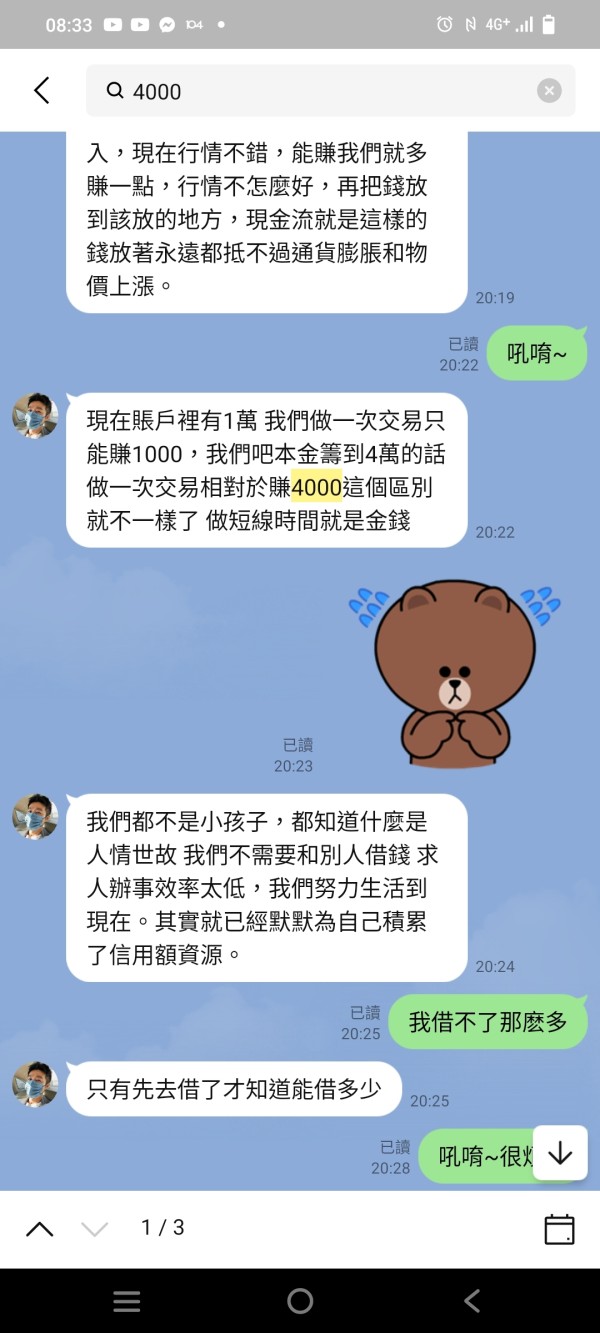

Minimum Deposit Requirements

Available sources do not provide details about minimum deposit requirements for opening trading accounts with Unisnfx. This information gap prevents potential traders from understanding the financial commitment required to begin trading.

No information about promotional offers, welcome bonuses, or ongoing incentives is available in current documentation. The absence of promotional details suggests either the broker does not offer such incentives or has not made this information publicly accessible.

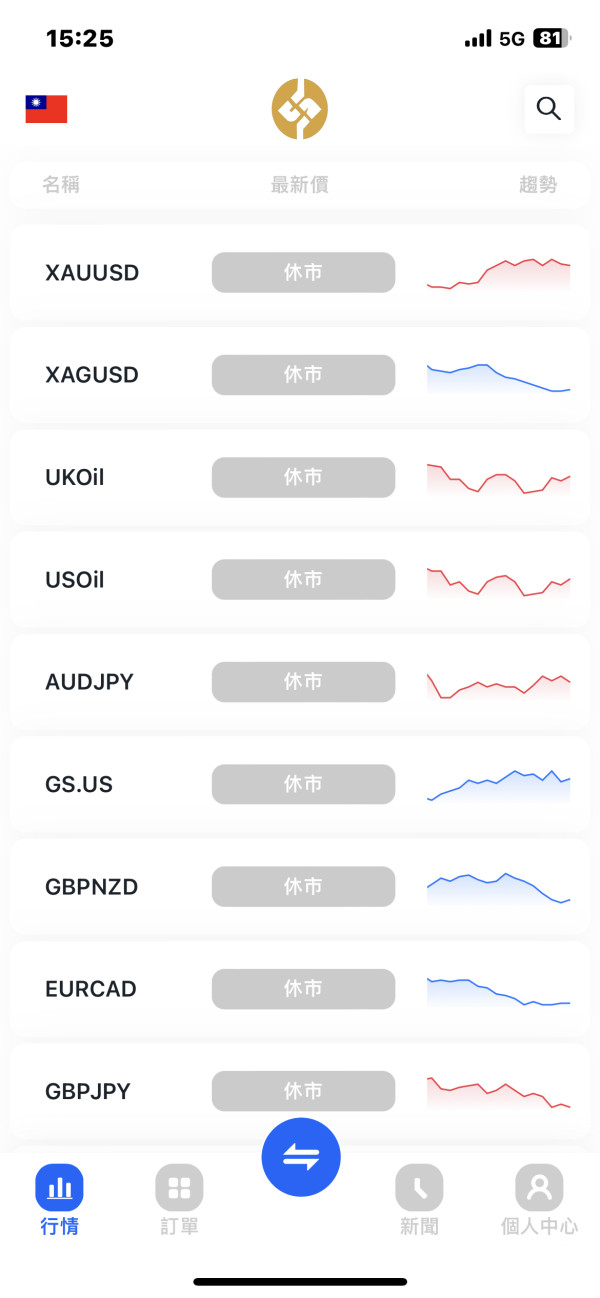

Tradeable Assets

Unisnfx offers access to six main asset categories. These include foreign exchange pairs, precious metals, cryptocurrencies, individual stocks, energy commodities, and CFDs across various underlying instruments. This diverse asset selection indicates the broker's attempt to serve traders with varied investment interests.

Cost Structure

The broker advertises zero spreads on trading, which would be highly competitive if accurate. However, this unisnfx review notes the absence of information regarding commission structures, swap rates, or other potential trading costs that could impact overall trading expenses.

Leverage Ratios

Information about maximum leverage ratios offered by Unisnfx is not specified in available documentation. This makes it impossible to assess the risk management parameters available to traders.

The broker exclusively offers the FX6 trading platform, which appears to be their proprietary trading solution. Limited information is available about the platform's features, capabilities, or technical specifications.

Geographic Restrictions

Available documentation does not specify which countries or regions may be restricted from accessing Unisnfx services.

Customer Support Languages

Information about supported languages for customer service is not mentioned in available sources.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions offered by Unisnfx receive a below-average rating primarily due to the significant lack of transparency regarding fundamental account features. Available information does not specify the types of trading accounts available. This makes it impossible for potential traders to understand what options might suit their trading style or experience level. The absence of minimum deposit requirements in public documentation creates uncertainty about accessibility for traders with different capital levels.

Furthermore, the account opening process is not detailed in available materials. This leaves questions about verification requirements, documentation needed, and timeline for account activation. Special account features such as Islamic accounts for Muslim traders, demo accounts for practice, or managed account options are not mentioned in accessible information. The unisnfx review reveals that while the broker advertises zero spreads, the lack of comprehensive account condition details significantly undermines the attractiveness of their offerings. Without clear information about account tiers, benefits, or restrictions, potential traders cannot make informed decisions about whether this broker meets their specific trading needs.

Unisnfx demonstrates a relatively strong commitment to trader education and platform functionality. This earns them a good rating in this category. The broker provides educational videos, which indicates recognition of the importance of trader development and market understanding. This educational approach suggests the platform may be particularly suitable for newer traders who benefit from structured learning resources.

The FX6 trading platform serves as the primary tool for market access. However, specific technical features and capabilities are not detailed in available documentation. The platform's proprietary nature could offer unique advantages, but without detailed specifications, it's difficult to assess its competitiveness against established platforms like MetaTrader 4 or 5. The broker's focus on multiple asset classes through a single platform interface potentially simplifies the trading experience for clients interested in diversified portfolios. However, the absence of information about research resources, market analysis tools, charting capabilities, or automated trading support limits the overall assessment of the tools and resources category.

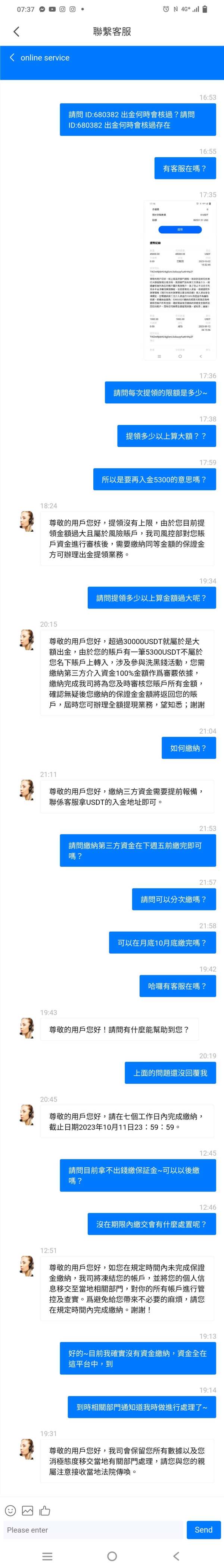

Customer Service and Support Analysis (5/10)

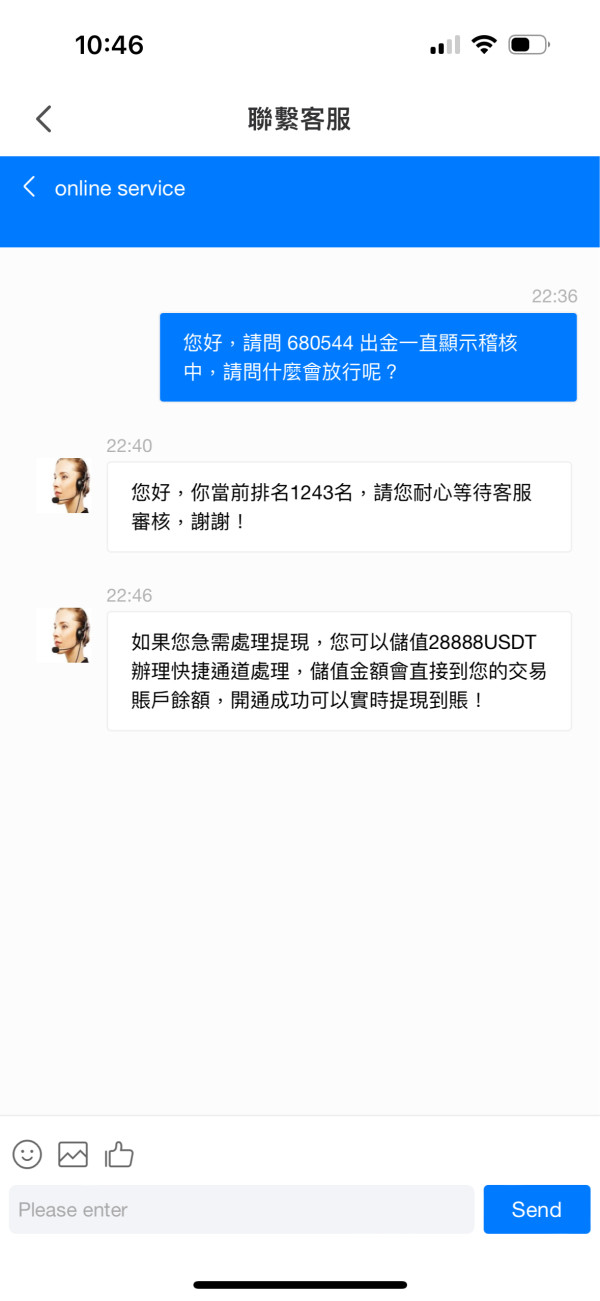

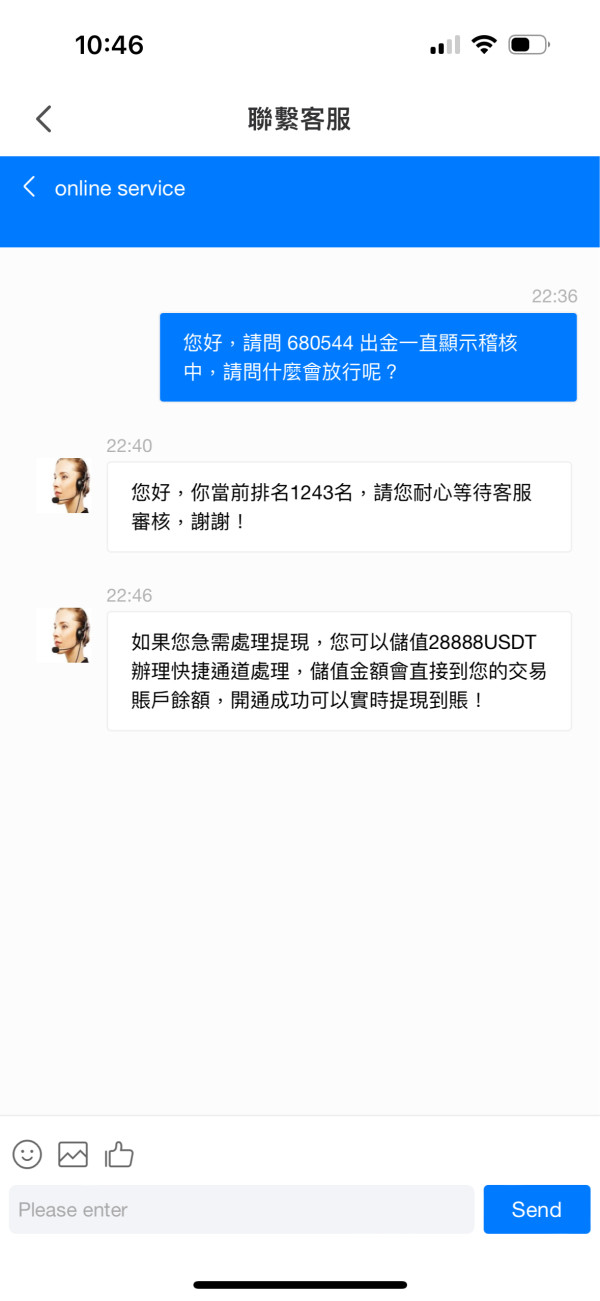

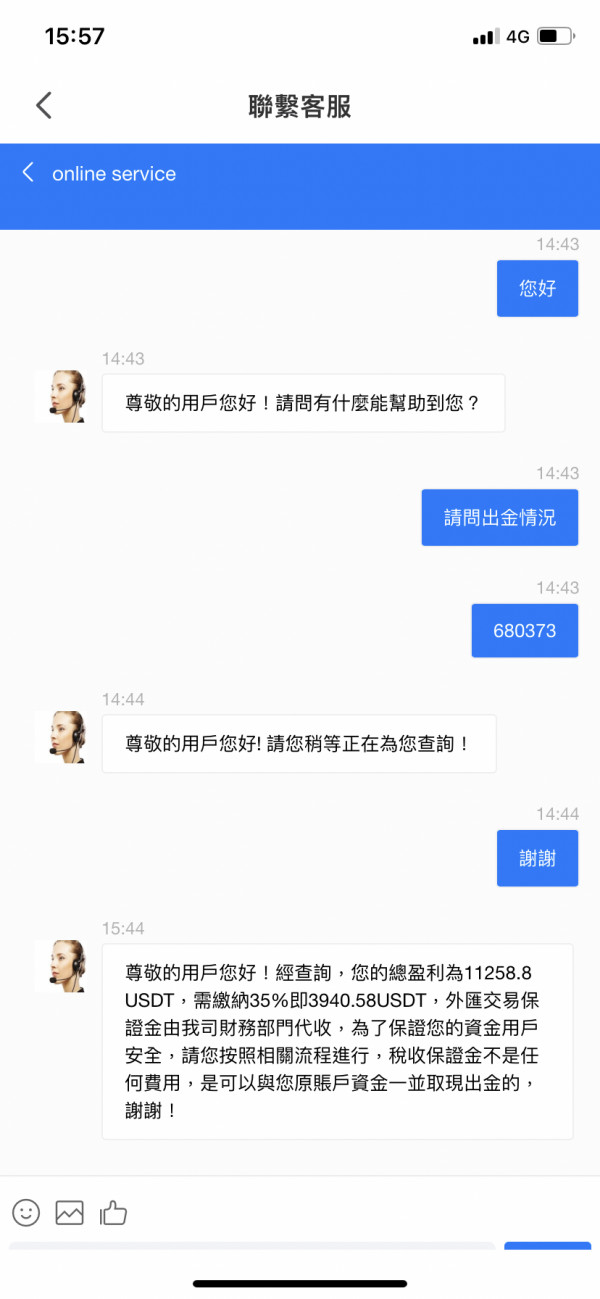

The customer service evaluation for Unisnfx receives a below-average rating due to the complete absence of information about support infrastructure in available documentation. Critical details such as available communication channels, customer service hours, and response time expectations are not specified. This makes it impossible to assess the quality or accessibility of client support.

The lack of information about multilingual support capabilities raises concerns for international traders who may require assistance in their native languages. Additionally, there are no details about the expertise level of support staff, whether specialized trading support is available, or how complex issues are escalated and resolved. Without user feedback or testimonials about service quality, potential traders cannot gauge the effectiveness of the broker's customer support. This information gap is particularly concerning for a financial services provider, where reliable customer support is essential for addressing account issues, technical problems, and trading-related inquiries promptly and effectively.

Trading Experience Analysis (6/10)

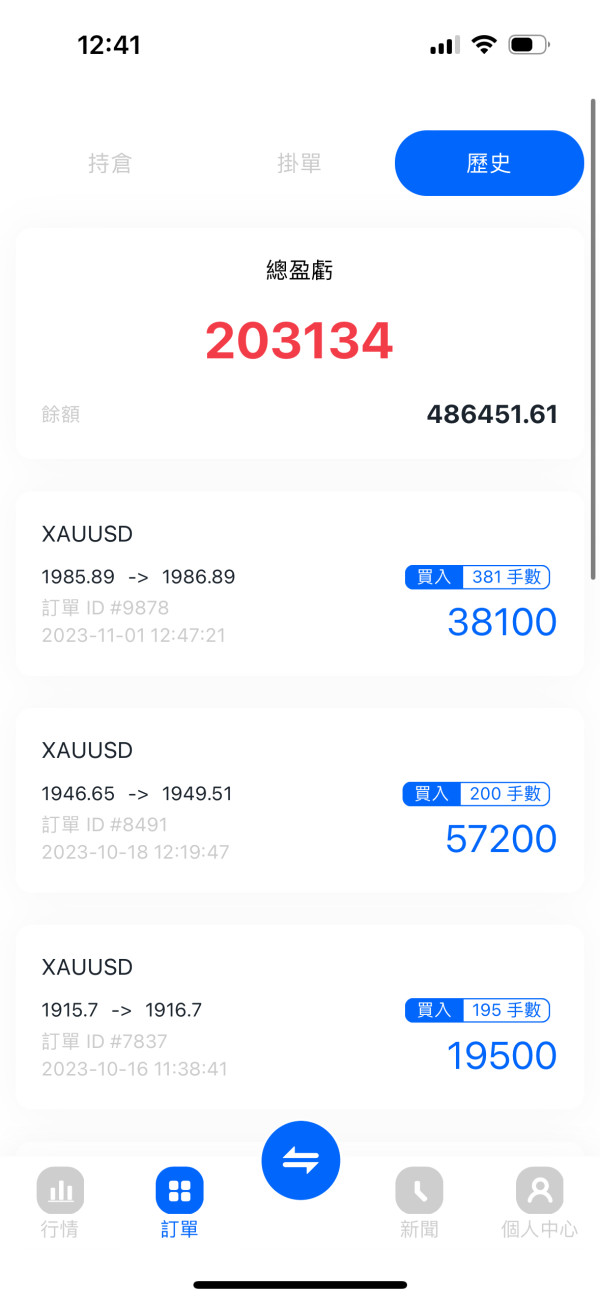

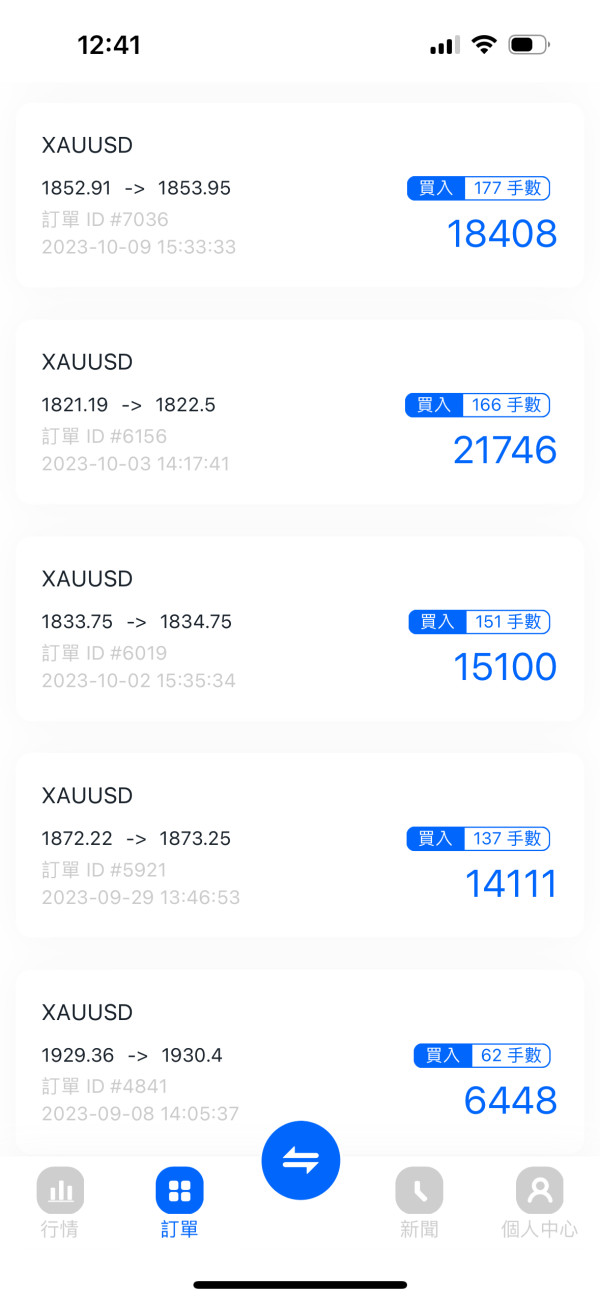

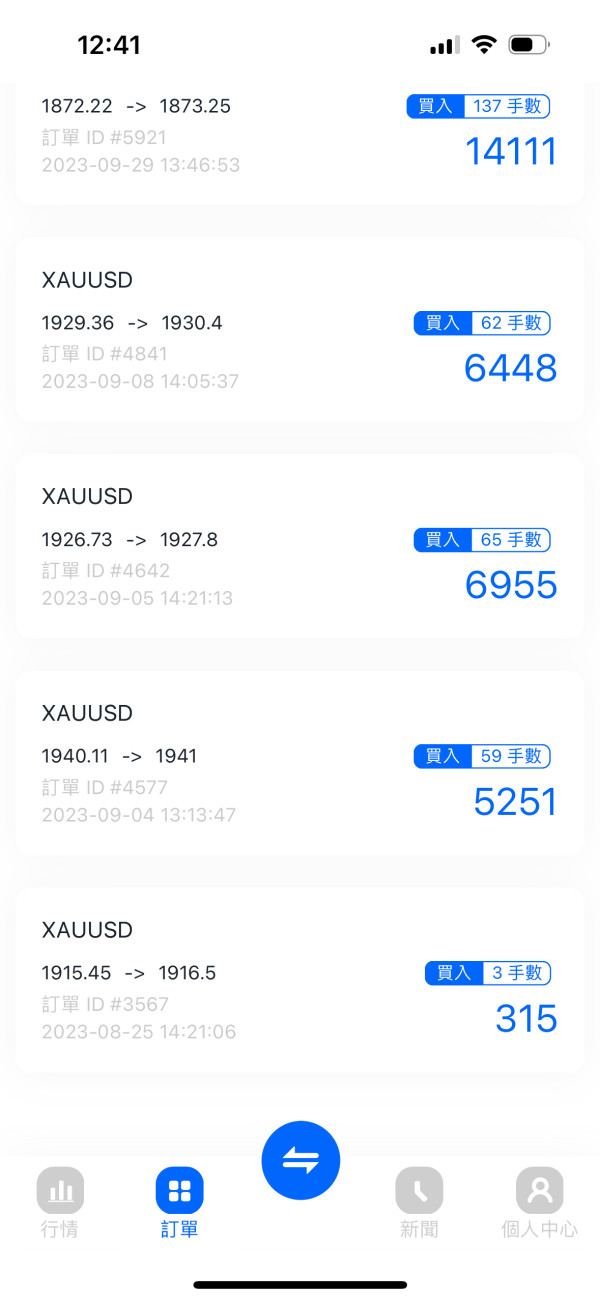

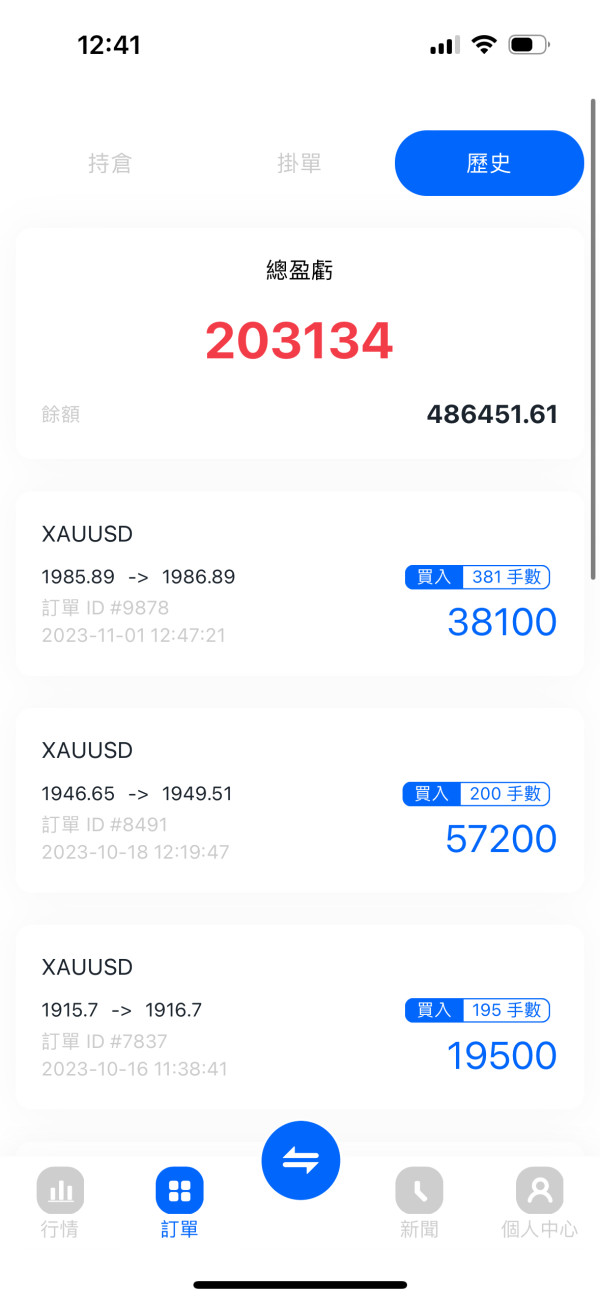

The trading experience with Unisnfx receives an average rating based on limited available information about platform performance and execution quality. The broker claims an average trading speed of 0ms, which, if accurate, would indicate excellent order execution capabilities. However, this unisnfx review notes the absence of crucial trading environment details such as slippage rates, requote frequency, and order execution policies during high volatility periods.

The advertised zero spreads could significantly enhance the trading experience by reducing transaction costs. However, without information about commission structures or other fees, the true cost of trading remains unclear. The FX6 platform's performance characteristics, including stability during market hours, functionality across different devices, and reliability during news events, are not documented in available sources. Mobile trading capabilities, which are essential for modern traders, are not specifically addressed. The diverse asset selection potentially enhances the trading experience for clients seeking portfolio diversification, but the lack of specific information about liquidity sources, market depth, and execution models limits the ability to fully assess the overall trading environment quality.

Trust and Regulation Analysis (4/10)

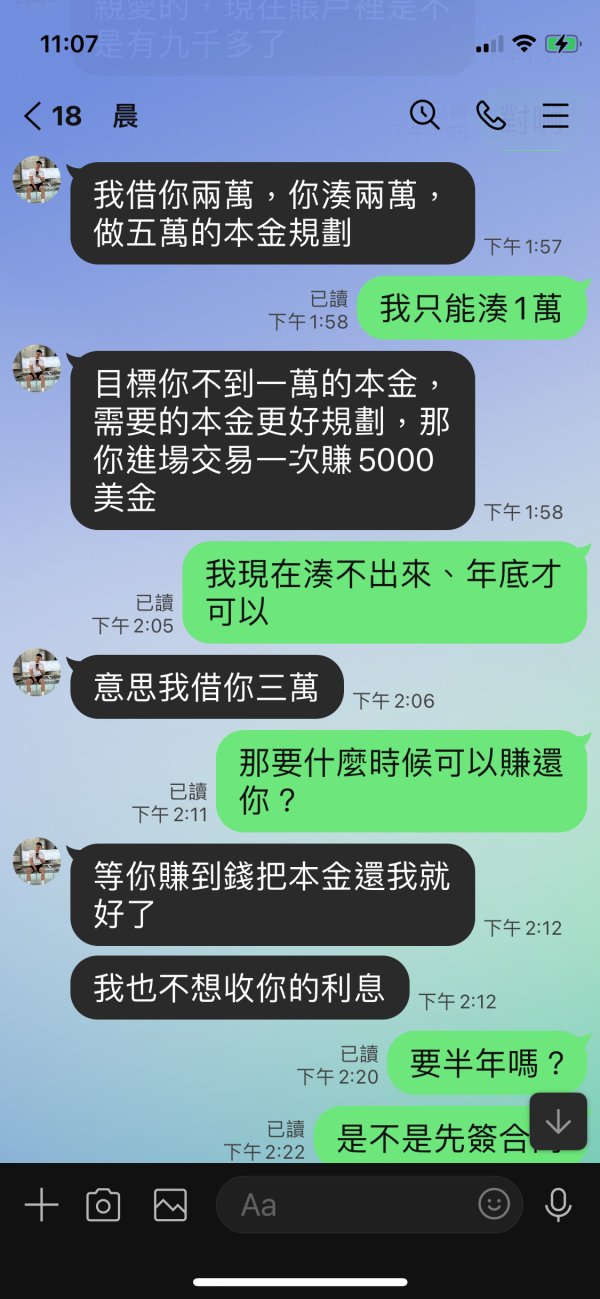

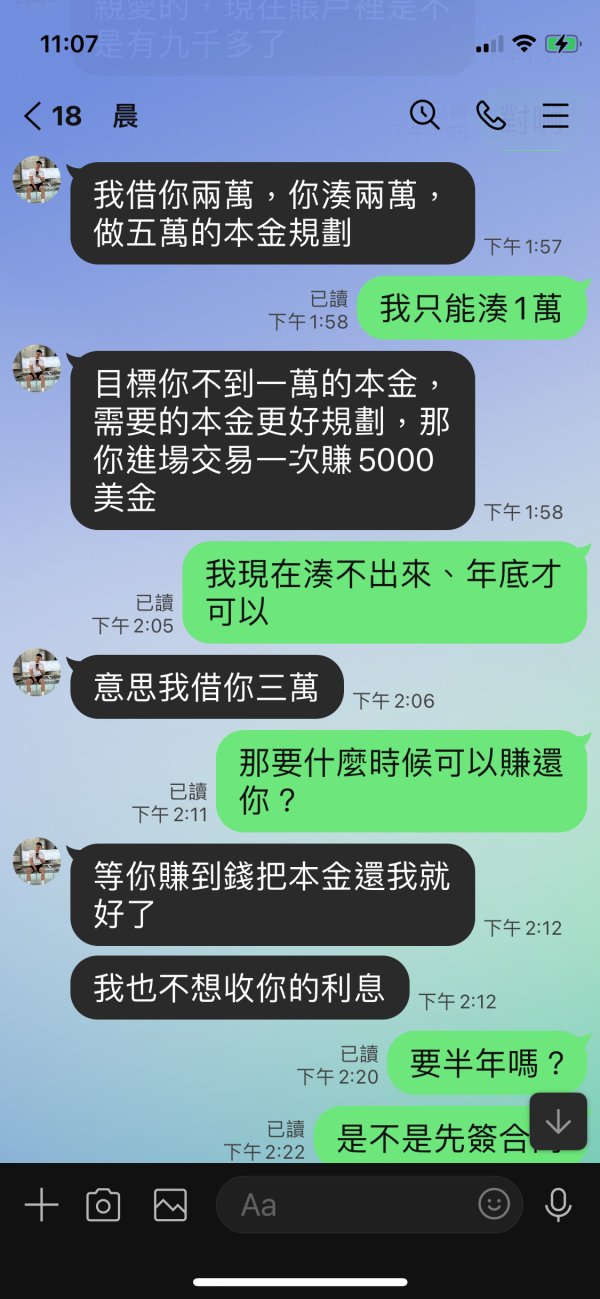

Unisnfx receives a poor rating in the trust and regulation category. This is primarily due to the absence of regulatory information in available documentation. The lack of disclosure about regulatory oversight from recognized financial authorities represents a significant red flag for potential traders. Regulatory compliance is fundamental to ensuring client fund protection, operational transparency, and adherence to industry standards.

Without clear regulatory status, questions arise about fund segregation practices, investor compensation schemes, and dispute resolution mechanisms. The broker's recent establishment in November 2023 means there is limited operational history to assess reliability and stability. Available information does not mention membership in regulatory bodies, compliance with international financial standards, or third-party auditing of operations. The absence of regulatory disclosure makes it difficult for traders to assess the safety of their investments and the recourse available in case of disputes. This lack of transparency significantly undermines confidence in the broker's legitimacy and operational integrity, making it a high-risk choice for traders prioritizing fund security and regulatory protection.

User Experience Analysis (6/10)

The user experience evaluation for Unisnfx receives an average rating. However, this assessment is limited by the absence of actual user feedback and detailed interface descriptions in available documentation. The broker's focus on educational videos suggests an awareness of user needs, particularly for less experienced traders who benefit from learning resources integrated into their trading experience.

The proprietary FX6 platform could potentially offer a streamlined user experience designed specifically for the broker's multi-asset approach. However, without detailed interface descriptions or user testimonials, it's difficult to assess usability, navigation efficiency, or overall design quality. The registration and account verification process is not described in available materials, leaving questions about the complexity and time requirements for new users. The absence of information about mobile app availability, cross-device synchronization, or platform customization options limits the assessment of modern user experience expectations. Additionally, the lack of user reviews or satisfaction surveys means there's no insight into common user complaints, appreciated features, or areas needing improvement from actual client perspectives.

Conclusion

This unisnfx review reveals a broker with both promising features and significant concerns that potential traders must carefully consider. While Unisnfx offers an interesting multi-asset approach through their FX6 platform and demonstrates commitment to trader education through video resources, the substantial lack of regulatory transparency and detailed trading conditions raises serious questions about the broker's suitability for most traders.

The broker appears most appropriate for traders interested in accessing multiple asset classes through a single platform and those who value educational support. However, the absence of regulatory disclosure, limited information about trading conditions, and lack of user feedback make this a high-risk choice. Potential clients should exercise extreme caution and seek comprehensive information directly from the broker before considering any investment. This is particularly important regarding regulatory status and fund protection measures.